Justin Fabo from Antipodean Macro published intriguing charts showing the sharp decline in consumer inflation expectations.

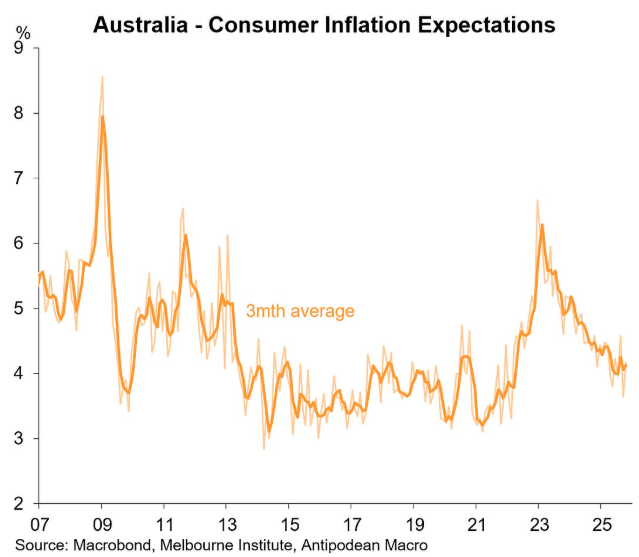

The following chart shows that the long-running monthly Melbourne Institute measure of consumer inflation expectations has fallen to the long-run (1995–2019) average on a quarterly basis.

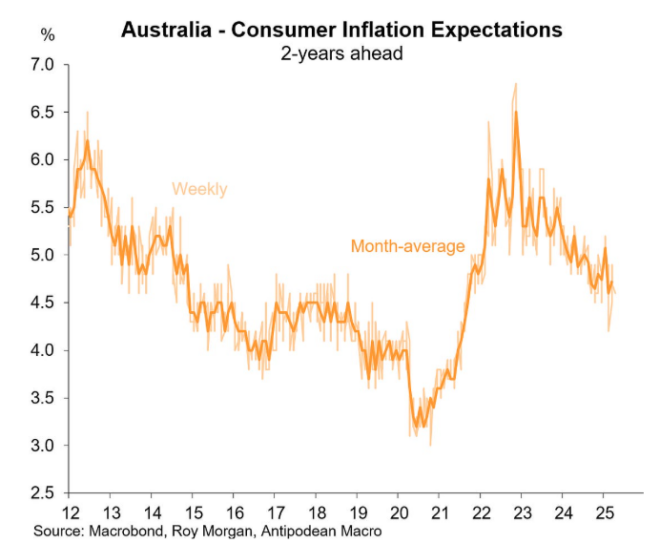

The same holds for consumer inflation expectations two years from now.

Justin Fabo notes that “decline in consumer inflation expectations – and falling job turnover – is likely to have kept downward pressure on wages growth into 2025”:

Workers’ wage growth expectations have also rolled over:

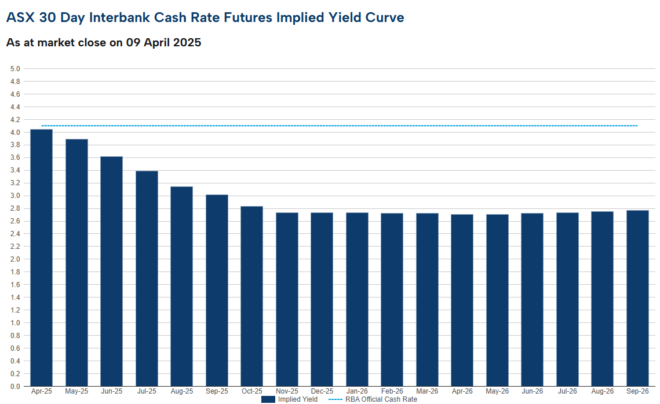

Amid the Trump administration’s trade shenanigans and market volatility, financial markets are tipping five more rate cuts this calendar year, which would lower the official cash rate to only 2.85% at year’s end.

The sharp decline in consumer inflation and wage growth expectations would give the Reserve Bank of Australia (RBA) more confidence that inflation is under control, permitting lower interest rates.

On Wednesday, the Trump administration increased tariffs on Chinese imports to 125% in response to China’s retaliatory 84% tariff rate on US goods.

These higher tariffs on Chinese goods should be deflationary for Australia because China will sell less into the US—the world’s largest consumer market— and will, therefore, dump surplus goods into Australia (and elsewhere).

As a result, the inflation of imported goods should fall, helping to pull trimmed mean inflation back to within the RBA’s 2% to 3% target.