It’s amazing how two economists can see the macroeconomy so differently.

Judo Bank chief economist Warren Hogan has penned an article in The AFR arguing that “it increasingly looks like we will need to get rates up closer to 5%” to stay on the RBA’s “narrow path”.

Hogan’s central argument is that Australia’s economy is already running hot and will get a further kick along in the second half when various government stimulus, such as Stage 3 tax cuts, take effect.

Hogan described the “strength in employment growth” as “startling”:

“Not only is employment growth accelerating in 2024, but a big part of the increase is in full-time jobs. Trend employment growth is now running at 40,000 a month, according to the ABS”.

“In the latest RBA forecasts, employment growth was projected to increase by about 10,000 a month in the June quarter. Over April and May, job creation is running at four times that pace”…

“Not only is employment growth running four times what the RBA had expected just six weeks ago, it is more than double the 20-year average gain prior to the pandemic”…

“The job vacancy data does not lie – the excess demand for labour in the Australian economy is like nothing we have seen, at least not since the vacancy series commenced in 1979”.

It is true that Australia’s employment growth is strong, running at more than double the 20-year average gain.

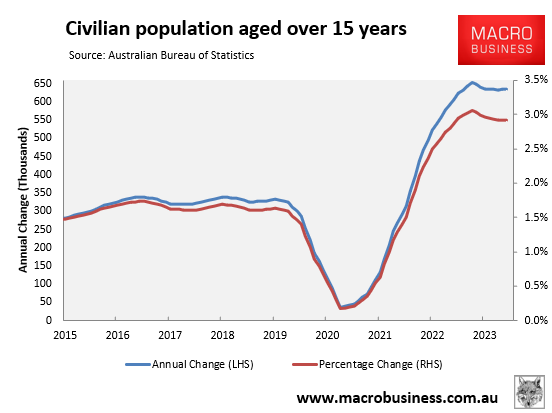

However, this employment growth reflects the record net overseas migration, which is running at well over double the 20-year average gain:

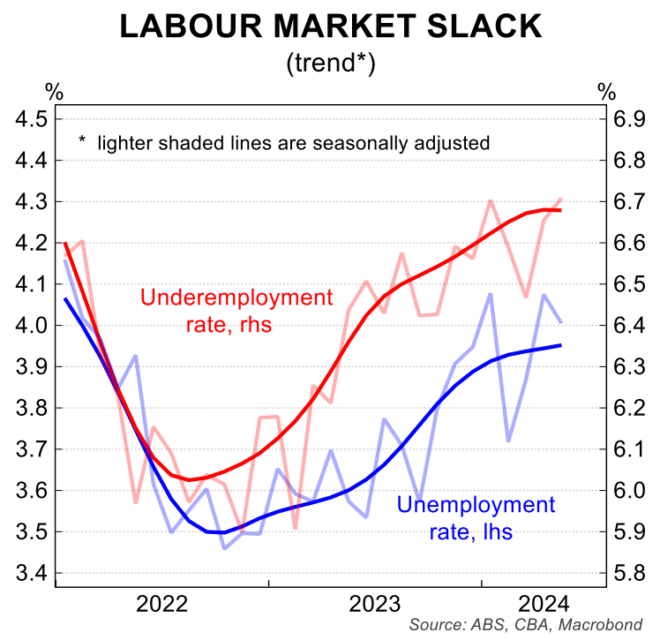

Australia’s labour market isn’t creating enough jobs to soak up the additional workers. Hence, both unemployment and underemployment rates are rising:

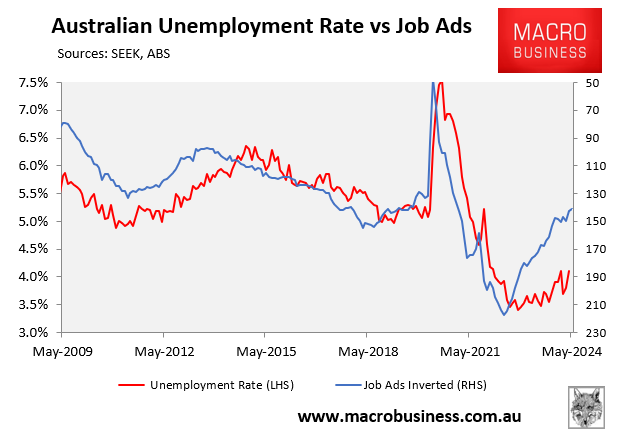

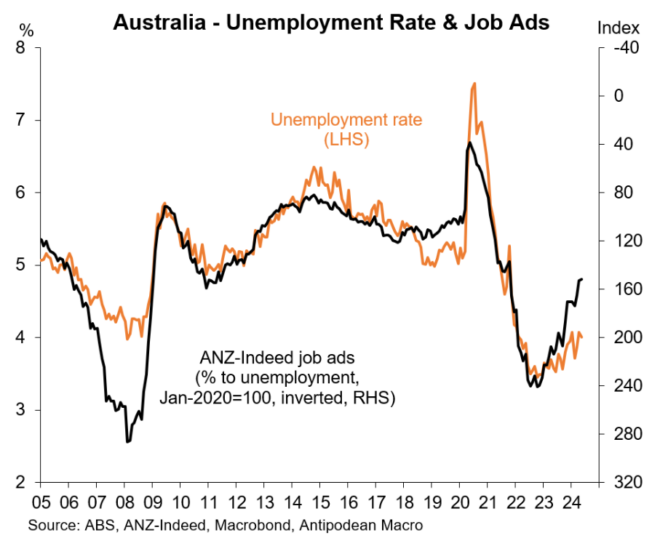

Job advertisements are also falling, which points to rising unemployment.

Here is SEEK’s measure:

And here is ANZ-Indeed’s measure:

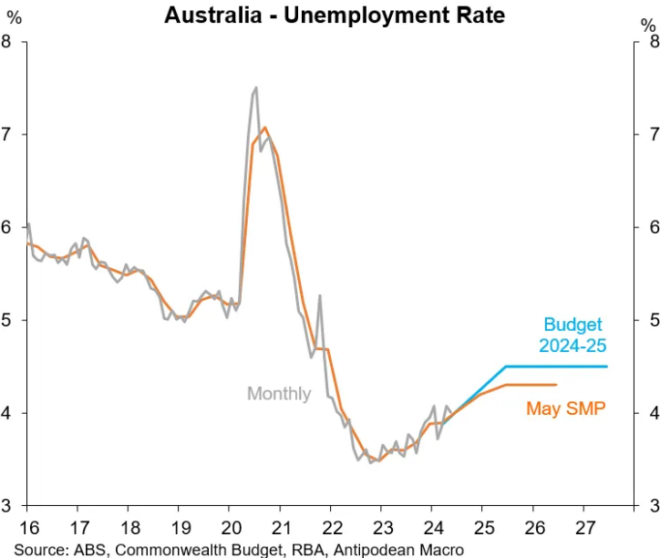

Besides, Australia’s unemployment rate is tracking in line with the RBA’s forecasts:

Next, Hogan claims that the strong job market and the “chronic shortage of Labour” is “supporting household income growth”.

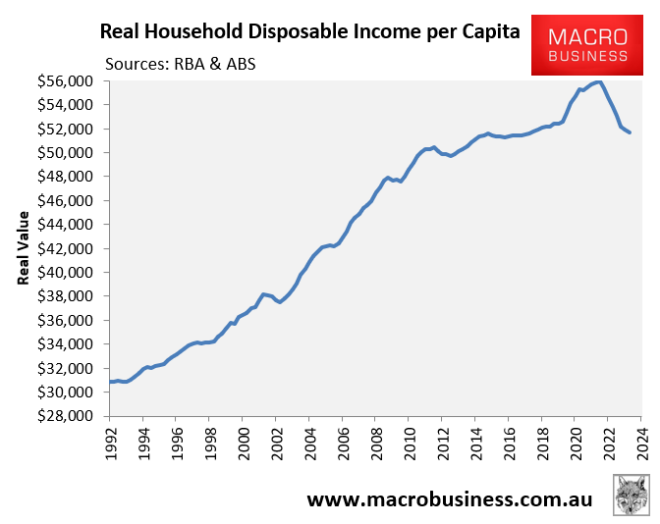

However, real per capita household disposable income fell heavily in the past year:

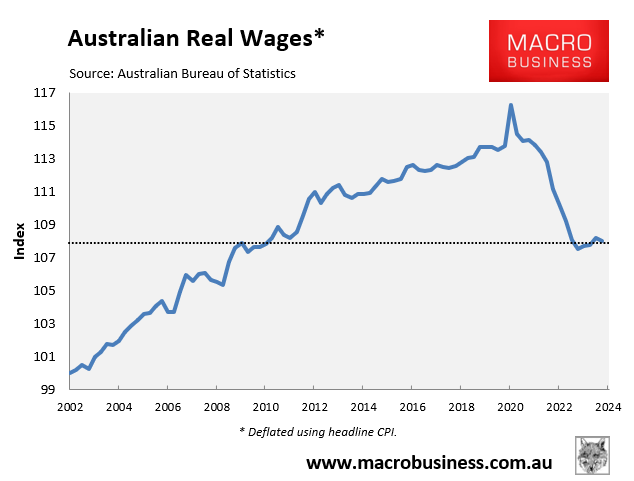

Real wages also commenced falling in Q1 2024:

Hogan then argues that Australia’s low productivity will put upward pressure on interest rates:

“Last week’s strong employment numbers also highlight Australia’s productivity problem. Employment growth this year is rising at around a 3 per cent annualised pace, but real economic growth is up just 1 per cent. The latest national accounts showed productivity was flat in Q1. The employment outcomes in April and May suggest it got worse in Q2”.

“In the absence of productivity growth, cost pressures in the economy end up as inflation. Cost pressures remain elevated, and it is more than just wages growth. Non-wage labour costs, insurance, energy and raw materials are all part of the mix”.

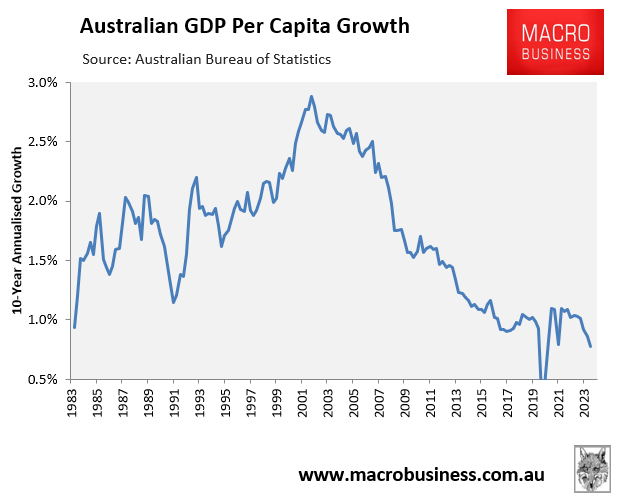

It is true that Australia’s productivity growth is woeful. However, it has been that case for around 20 years, as reflected in Australia’s falling per capita GDP growth:

Poor productivity growth never stopped the RBA from cutting interest rates, leading into the pandemic. So why would it force the RBA to lift rates now, especially when the labour market is weakening and the economy is suffering a sharp per capita recession?

Canada’s productivity growth is even worse than Australia’s and the Bank of Canada just commenced an easing cycle.

Finally, Hogan argues that the imbalance between demand and supply is about to worsen:

“It is not a lack of demand that is keeping Australian economic growth at 1%, it is the supply side of the economy that is the constraint. Trying to put demand into an economy operating at its capacity simply doesn’t work. It will create inflation”…

“The forces holding the economy back over the past two years will ease over the coming financial year as Australian governments inject tens of billions of dollars into household disposable incomes with tax cuts and cost of living relief”.

“Household real disposable incomes are about to jump sharply higher in 2024/25″…

It is true that the Stage 3 tax cuts will inject disposable incomes into household budget, which could put moderate upward pressure on inflation.

However, the cost-of-living relief will mechanically lower inflation at the margin (although the impact will be small). The labour market and wage growth will also continue to weaken.

My view has always been that the next move in interest rates is down, and I am sticking with this view.

What has changed is the likelihood that rate cuts will arrive in the second half, which is looking increasingly unlikely.

I may end up being wrong and having egg on my face. Maybe the RBA will hike again. Only time will tell.