Tom Elliott from Radio 3AW outlined multiple reasons why he believes Australian home prices will boom amid the fallout from the Trump administration’s trade war.

First, Elliott argued that the share market rout is likely to see a flight to the perceived safe haven of property.

“When the share market gets the wobbles as it has in the past few weeks thanks to Donald Trump’s tariffs, people pull their money out of shares and go “Oh they’re too risky. I don’t like the volatility. What’s safe?” And they go to “bricks and mortar”, Elliott said.

Second, Eliott notes that deep interest rate cuts are now expected, which will turbocharge demand for property.

“Well, I can guarantee this: if interest rates go down that much, and they probably will, that will turbocharge the property market”, Elliott said.

Elliott also noted that there are “other factors”, including “immigration remaining high”, that will keep pressure on housing demand.

“Hence, if the population keeps going up, which thanks to immigration it does, the pressure on the housing market is just immense”, Elliott said.

Elliott said that he has “never seen so many things come together at the same time, which will make property prices go up”.

He added that this is “bad news if you’re a first home buyer yet to get into the market”.

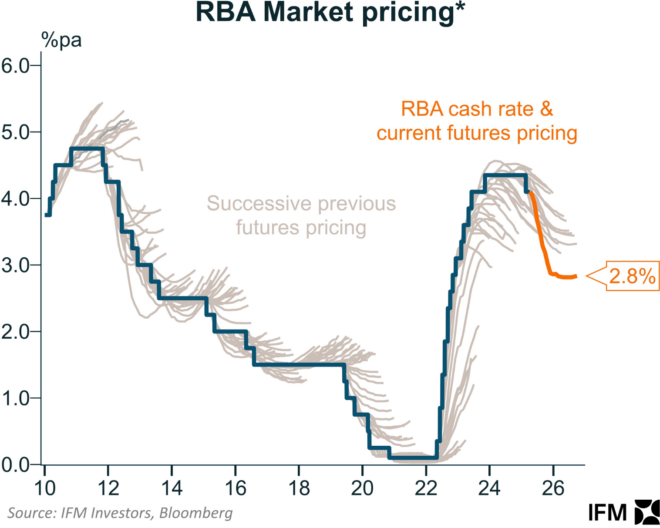

I agree with Tom Elliott’s sentiment. Financial markets are tipping another 100 basis points of rate cuts this year and more in 2026.

There is also the risk that the trade war escalates, financial markets crash, and the global economy enters recession, in which case rate cuts will be even deeper.

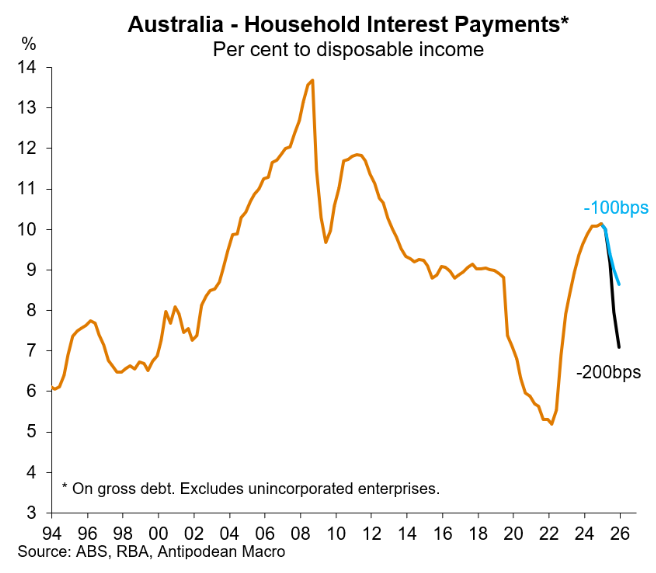

Justin Fabo from Antipodean Macro estimated that 100 basis points of easing would reduce the average interest paid on household loans in Australia by around 1.5% of disposable income, whereas a 200 basis point reduction in rates would reduce the average interest paid by 3%.

The combination of such interest rate cuts and an investor flight to property would significantly boost Australian house prices.

As a father with two teenage children, this is not what I want to see. Australian housing is already far too expensive.