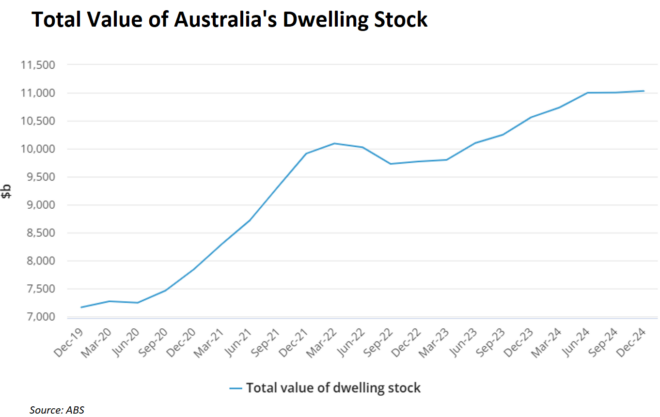

Data released this month by the Australian Bureau of Statistics (ABS) showed that the total value of Australia’s dwelling stock hit a record high of $11,032.2 billion at the end of 2024, with the average dwelling valued at $976,800.

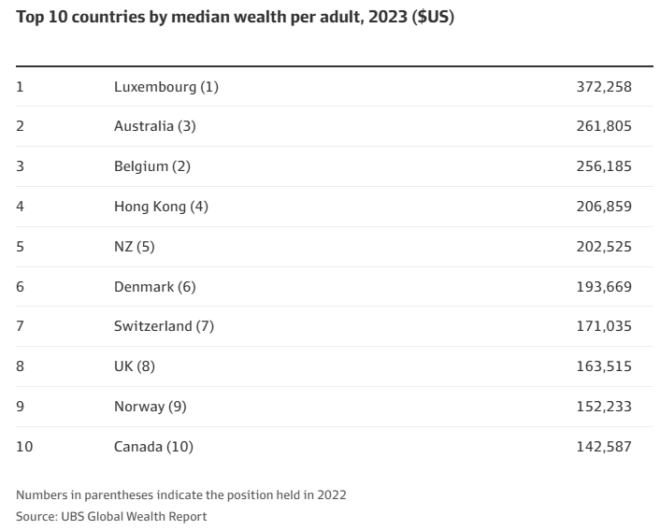

The hyperinflation of home values helps to explain why Australian households are ranked among the wealthiest in the world.

The average home value of nearly one million dollars has created a nation of paper millionaires.

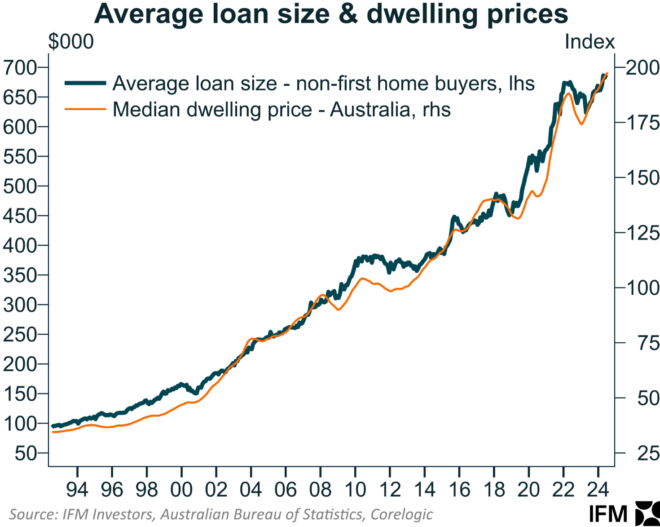

Meanwhile, Australians have buried themselves in mortgage debt, with the average mortgage size chasing prices higher:

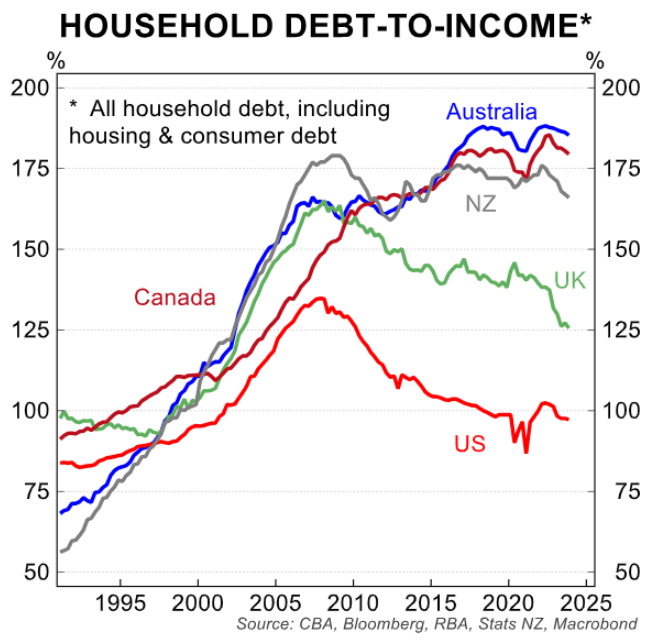

As a result, Australians have the world’s highest debt loads:

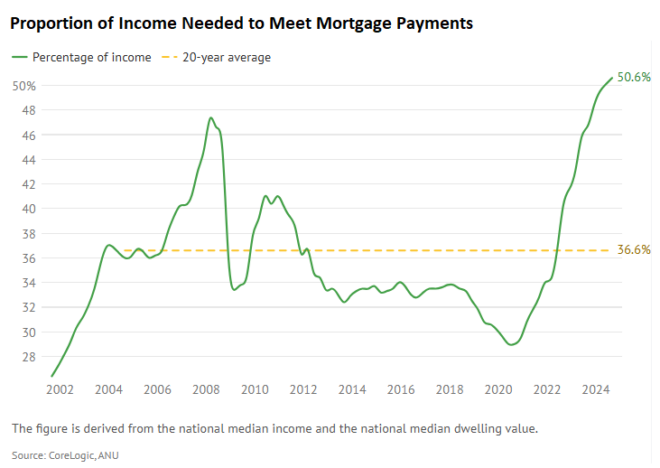

New housing entrants are also expected to dedicate a record share of their incomes to mortgage lending:

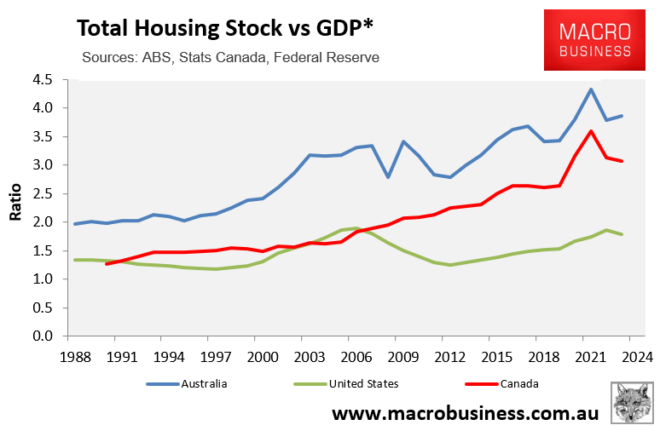

It is fair to say that housing has engulfed the Australian economy, comprising a far higher share of GDP than peer economies:

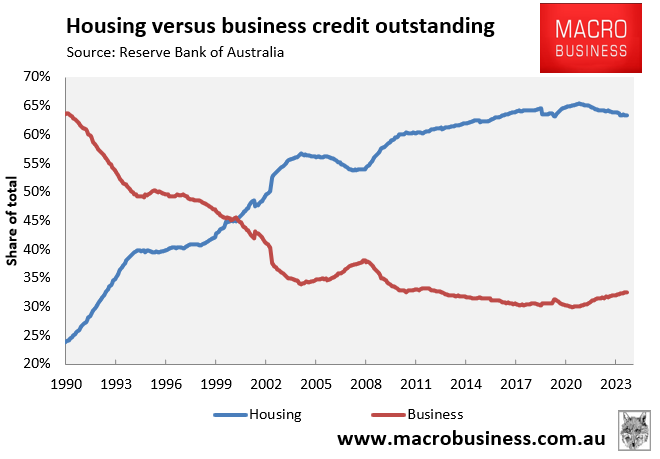

Australia’s banks have also starved the provision of credit to productive businesses in favour of mortgage lending.

In 1990, nearly two-thirds of bank lending was for businesses, whereas only around one-quarter went to mortgage lending.

As of early 2025, the shares have flipped. Nearly two-thirds of bank lending is for mortgages versus only one-third for businesses.

Earlier this month, AustralianSuper chief executive Paul Schroder told the 2025 AFR Business Summit that the housing crisis is a huge drain on the nation’s productivity:

Below are the key extracts from Schroder’s sermon:

“I think the big, burning productivity and cost of living problem is housing. I think we keep underestimating how worrying housing is”.

“You could buy a house in 1970 for two times a family’s income. In 1990, you could buy a house for three times a family’s income. And now it’s six and a half times. And Sydney it’s nine times”.

“If you can’t find safe and secure housing, you can’t be optimistic, positive, and energetic, and everything feels like a drag”.

“This is the crisis that is facing Australia”…

“In the United States, the total housing stock is $50 trillion against an economy of $29 trillion. So, not even twice [GDP]”.

“In Australia, because we have ploughed so much money into houses – they’re still the same house, it’s just worth so much more – housing is worth $11 trillion here against a GDP of $3 trillion”.

“So, there’s [the USA’s] is twice [GDP] ours is four times [GDP]”.

“So, all we’ve done is pour all of this money into houses, which has deprived the economy of heaps and heaps of productive capital”.

“We’ve got all this money in domestic houses and we’re not backing business, we’re not creating new things, we’re not driving productivity”.

“So, to me, all of our pants should be on fire about housing. Because, if our kids can’t live safely and securely, how can you be freed up to think positively about productivity or future, if you don’t know where to live”?

Brilliantly said.

The reality is that Australians would be “wealthier” if our homes had never increased in value so rapidly, the average price was $488,000 instead of $977,000, and Australia’s household debt was 90% rather than 180% of income.

Younger and future Australian homebuyers would not face a lifetime of debt servitude or be locked in the rental market.

Australia’s economy would also be more productive if our financial resources were directed into the real economy rather than the housing Ponzi scheme.

Tags:

Articles

March 28, 2025