How to exclude securities in countries like Russia from your portfolio

The western world has not engaged in war with Russia in a traditional sense yet, but it is waging financial war through economic sanctions and the divestment of Russian securities. Nucleus Wealth wants to reassure you that we do not hold any Russian investments across any of our portfolios. It is well publicised in the media that many other super funds and investment managers are ditching their Russian stocks in an attempt to punish Russia’s aggressive actions. Nucleus Wealth is different though. Whilst we would never invest in any Russian companies, we also allow you to customise your portfolio through our ethical and sector screens to align to your ethical values and beliefs. This differs from other fund managers in the ESG investing space, where you have to prescribe to their ethical philosophy whether or not it aligns with yours.

If you do not agree with the way Russia is behaving and want to ensure that you would never invest in a country that may behave similarly you can screen out these types of countries and securities with Nucleus Wealth. We have 48 ethical, sector and asset class screens that allow you to remove securities from your portfolio based on your values and beliefs, plus the ability to create specific custom screens. Specific to the Russian invasion of Ukraine you can screen out undemocratic countries, morally repressed countries or economically repressed countries. By utilising these ethical screens it will ensure that you will never support one of these regimes by investing in a company of their country.

We offer five different ethical country screens:

No Morally Repressed Countries (Any)

This screen removes companies from countries that score below "High Moral Freedom" on the World Index of Moral Freedom. Note this category removes countries like Japan, Singapore, South Korea and China. This also removes companies where more than 20% of the company is owned by a government organization from a country that rates poorly.

No Morally Repressed Countries (Worst Offenders)

This category removes companies from countries that rate "Insufficient Moral Freedom" or below as assessed by the World Index of Moral Freedom. Note this category removes countries like Singapore, South Korea or China. This also removes companies where more than 20% of the company is owned by a government organization from a country that has low or very low moral freedom. Religious freedom, bioethical freedom, drugs freedom, sexual freedom, and family and gender freedom are also assessed. "

No Undemocratic Countries

This screen removes companies from countries that score below 7 on the Democracy Index (from the Economist Intelligence Unit). Note this category removes some countries that are rated as Flawed Democracies like Singapore, Hong Kong or Brazil. This also removes companies where more than 20% of the company is owned by a government organization from a country that rates below 7.

No Economically Repressed Countries (Any)

This screen removes companies from countries that are not either "Free" or "Mostly Free" as assessed by the Index of Economic Freedom (Wall Street Journal and the Heritage Foundation). Note that this category removes many European Countries like Spain or France. However, the "worst offenders" version does not. This also removes companies where more than 20% of the company is owned by a government organization from a country that is not free or mostly free"

No Economically Repressed Countries (Worst Offenders)

This category removes companies from countries that rate either "Repressed" or "Mostly Unfree" as assessed by the Index of Economic Freedom (Wall Street Journal and the Heritage Foundation). This also removes companies where more than 20% of the company is owned by a government organization from a country that is repressed or mostly unfree

We have several other human rights screens that you can choose not to invest in if that is important to you. These are;

- No Immigration Detention

- No Jails

- Lack of Gender Diversity

- Lack of Gender Diversity (Worst Offenders)

Please log into our onboarding portal to see more detailed information about each of our screens

Asset Class and Sector Screens

Our screening functionality also gives you the ability to screen out stocks by asset class and sectors. For example, you can screen out Government bonds, International shares, Australian shares or foreign cash via the asset class screen. An example of how you could use this is; if you are particularly bearish on an asset class or want to bolster holdings in the other asset classes you can screen that asset class out. Within the sector screens, you can choose from 14 different sectors to screen out. Examples include; screening out Australian banks, limiting Australian Housing Exposure or removing consumer Staples (GICS Sector 30) to name a few.

You can use any combination of our 48 different screens to customize your portfolio so it is the perfect fit for you.

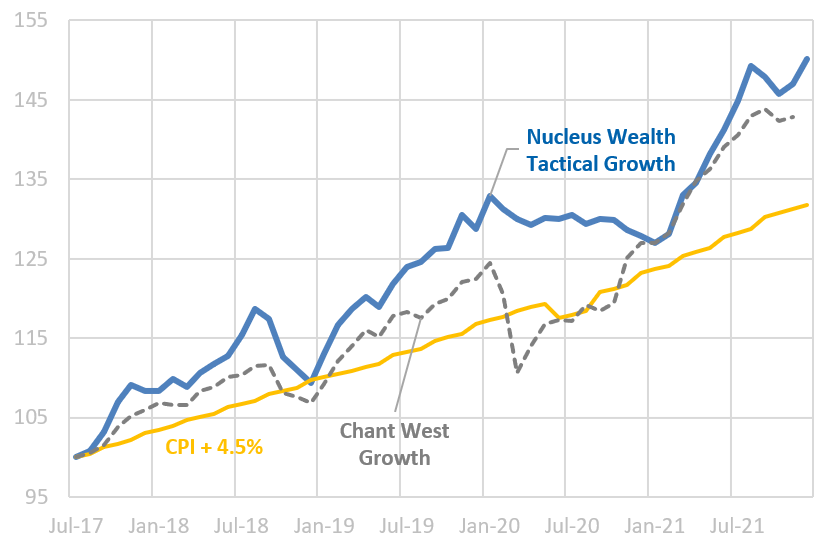

Our screens can be utilised across all of our active and passive portfolios. This is unique and a market-leading innovation particularly for our passive portfolios. They are like an ETF in that they track a large-cap index but you can customize it to fit your ethical values and beliefs by screening out certain stocks that you do not like. You do not have this flexibility or customization with a traditional ETF. Please see the link here to our portfolios page so you can view all our different portfolios that you can apply the different screens to.

If you would like to discuss ethical investing, are looking for an ethical investment adviser or just want to understand your options please book a call with me and I would be happy to chat and explain things in more detail.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Nucleus Wealth Management is a Corporate Authorised Representative of Nucleus Advice Pty Ltd - AFSL 515796.