CBA head of Australian economics, Gareth Aird, has explained why he believes the Reserve Bank of Australia (RBA) will cut the official cash rate at its May monetary meeting.

Aird noted that “the recent run of domestic data has on balance been a little softer than the RBA forecasts imply”.

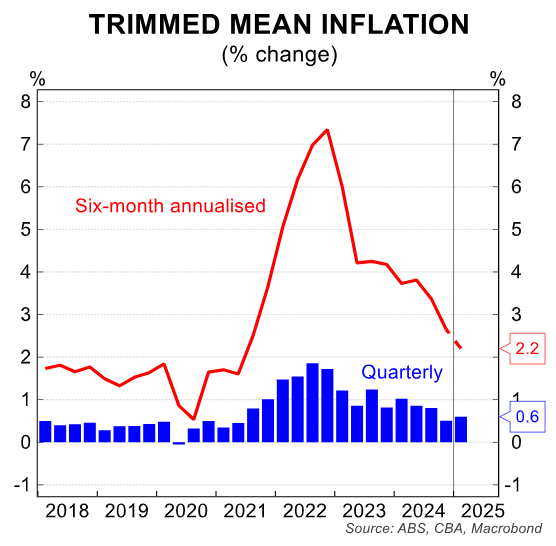

The softer readings include the February monthly CPI indicator, which has led the CBA to lower its Q1 25 trimmed mean forecast to 0.6%, below the RBA’s 0.25% forecast.

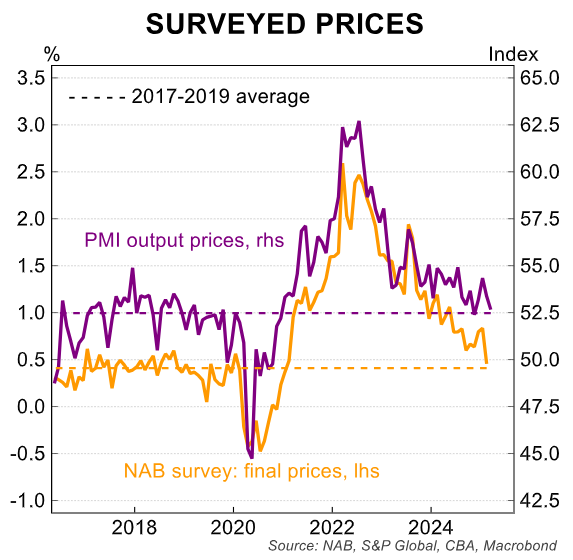

Aird noted that private surveys that capture price changes are also continuing to move in the desired direction.

The latest consumer price gauges in the NAB business survey (February) and the S&P PMIs (March) all confirmed the disinflation process is continuing.

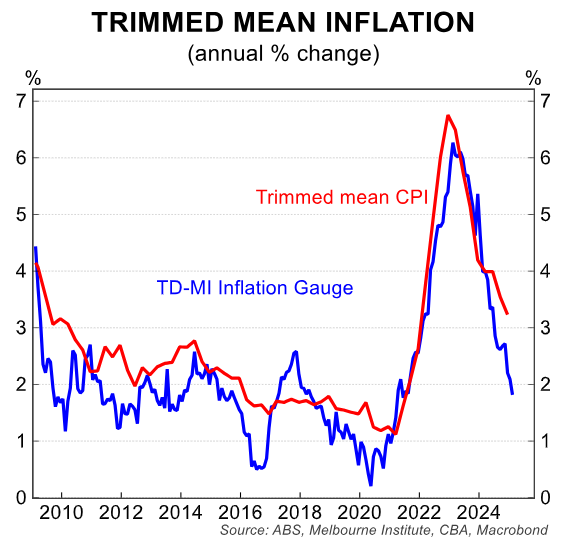

In addition, the Melbourne Institute trimmed mean inflation gauge fell by 0.1% in February to take the annual rate to only 1.8%.

“The RBA will be keeping a close eye on these surveys”, Aird said.

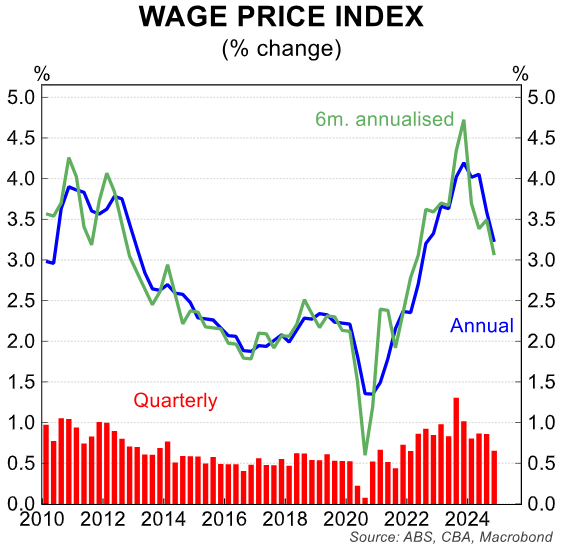

Aird also noted that recent wage data is consistent with ongoing disinflation.

The Q4 24 Wage Price Index (WPI) was softer than market and RBA expectations at 0.65% for the quarter, the weakest quarterly growth outcome since Q1 22.

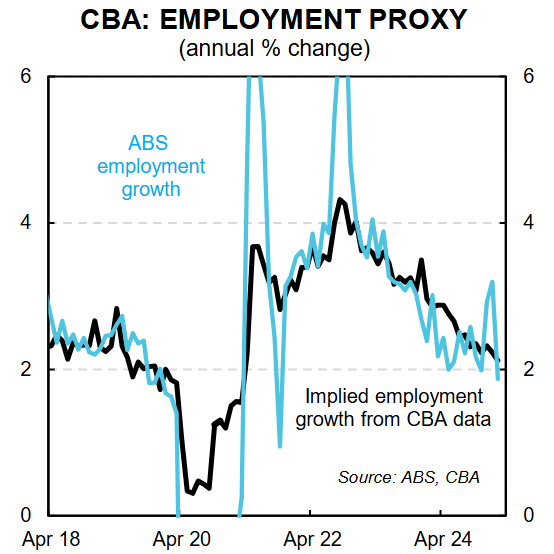

Aird also noted that “the big decline in employment in February meant the jobs report was ‘soft’”.

Moreover, “second tier data related to the labour market also indicatesthat the labour market is gradually loosening rather than tightening”.

“The Internet Vacancy Index (IVI) was down by 5.9%/mth in February and 15.0%/yr. It was the largest monthly decrease in job advertisements since late 2022”.

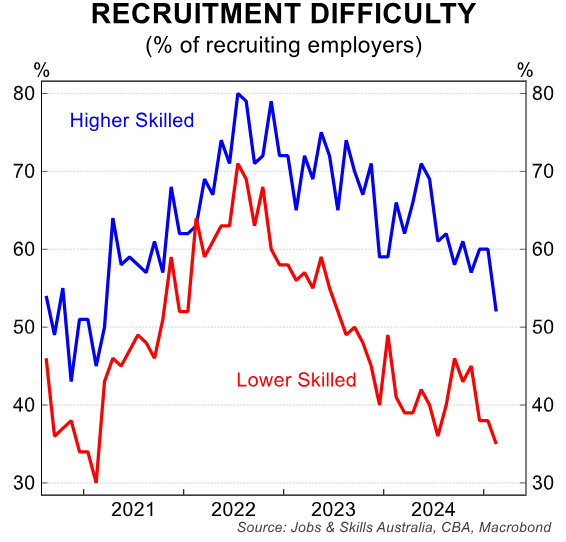

“Some further signs of labour market loosening were reported by the Jobs and Skills Australia department”.

“The recruitment difficulty rate decreased by 8ppts to 43% of recruiting employers in February, which is the lowest reported recruitment difficulty rate since February 2021”, Aird said.

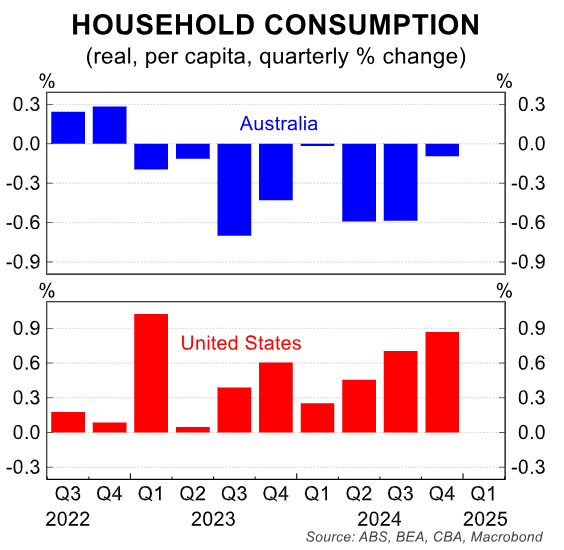

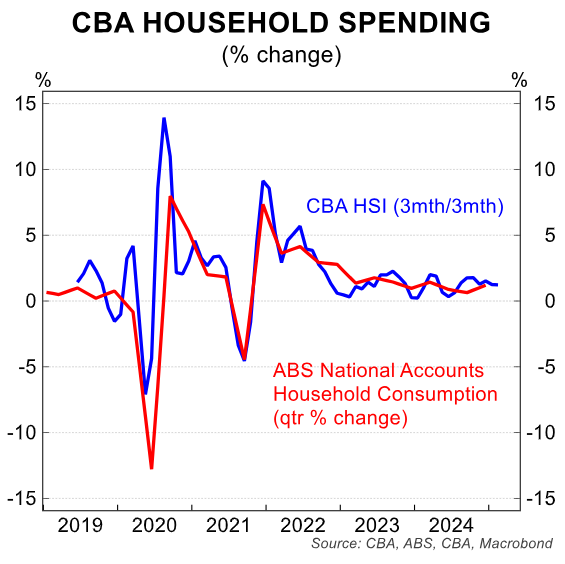

Finally, Aird notes that the consumer pulse “hasn’t picked up much”.

Real per capita household consumption has declined for eight consecutive quarters.

CBA’s internal data to February suggests that consumer spending remains soft.

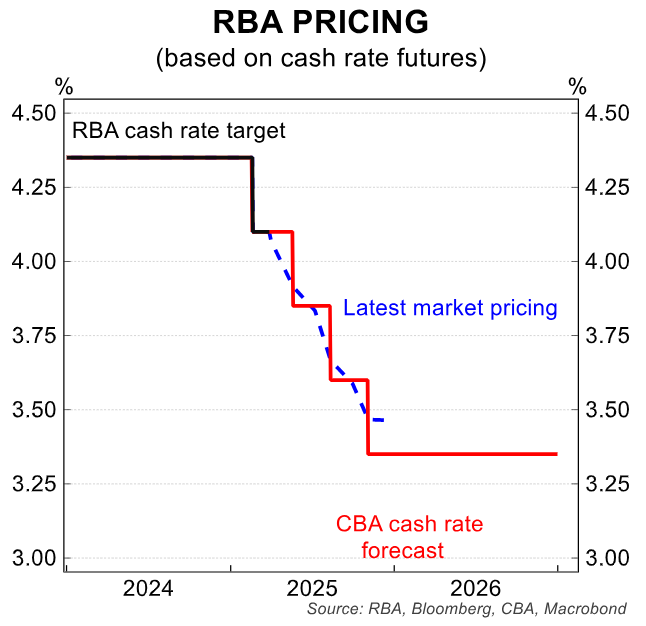

The upshot is that the RBA is highly likely to cut again at the May board meeting after the Q1 CPI has been released.