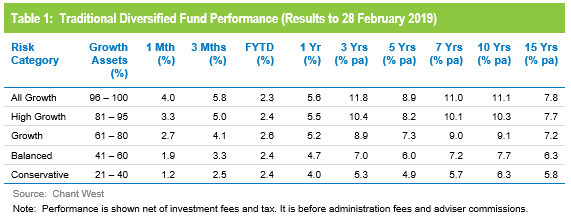

Strong start to 2019 for most super funds

Chant West has the latest performance stats:

Super funds have kept up their strong start to 2019, with the median growth fund (61 to 80% in growth assets) gaining 2.7% in February on the back of the ongoing rally in share markets.

“World share markets have traded in a V-shaped pattern over the past few months and that holds some lessons for super fund members. No-one wants to see the value of their savings fall, but when you see an abrupt sell-off followed by an equally sharp gain it should act as a reminder not to react to short-term volatility. The worst thing to do after the December quarter falls would have been to switch into a more conservative option with a lower exposure to shares. Not only would you have locked in the losses, but you would also have missed out on the January and February rebound. As always, the message is to choose an appropriate option and stick with it.

Maybe.

My take is that usually you should choose an appropriate option and stick with it - but "usually" is not "always" as Chant West suggests. When markets are particularly overvalued or undervalued there can be a case to be tactical. Sometimes there is a case for pulling the sails in and battening down the hatches. In particular, I'm not a supporter of sailing into a housing crash while loaded up on expensive Australian equities while the RBA continues to focus on the most lagging of indicators, unemployment.

The Nucleus Tactical Funds have outperformed since inception, although the outperformance was not as much in February as our portfolios have been selling into the rallies: