Over the last few weeks, financial markets have recently adjusted expectations to reflect a victory for Trump. However, there are a significant number of inconsistencies and risks.

The meme stock’s reaction

Trump Media best reflects the change in view. Over the last month, the stock has surged by over 100%. Betting odds have shifted from 45% to around 60% :

However, there are also some interesting nuances. The biggest is options trading. Traders greatly favour options expiring November 15th rather than the 8th, which is three days after the election. What does this tell us? That option traders are willing to pay extra for another week. Which would indicate an expectation of post-election uncertainties or legal challenges rather than the run-away victory that the price suggests.

What is a Trump trade?

If something has gone up in the past few weeks, you can probably find someone calling it a Trump trade:

- Broad agreement: Long Trump Media, crypto, the US dollar, stocks. Within stocks: small caps & healthcare. Short bonds (higher inflation), short renewables, short Europe exporters, short Mexico.

- Question marks: short China (but not Aust?). Tech? Energy? Banks? Traditionally, Republican wins are better for defense stocks, but maybe not this time.

- Weird: Gold (and other precious metals). They are hitting new records, but typically US dollar strength = gold weakness. And, higher real interest rates are usually negative for gold. In both cases the opposite has happened.

Reduced Regulation

The sector winners from the Trump trade are mostly from reduced regulation expectations. Small caps, banks, and energy sectors are considered key winners.

Healthcare is one of the few to buck the trend – expectations are that regulation would be less favourable under a Democrat President.

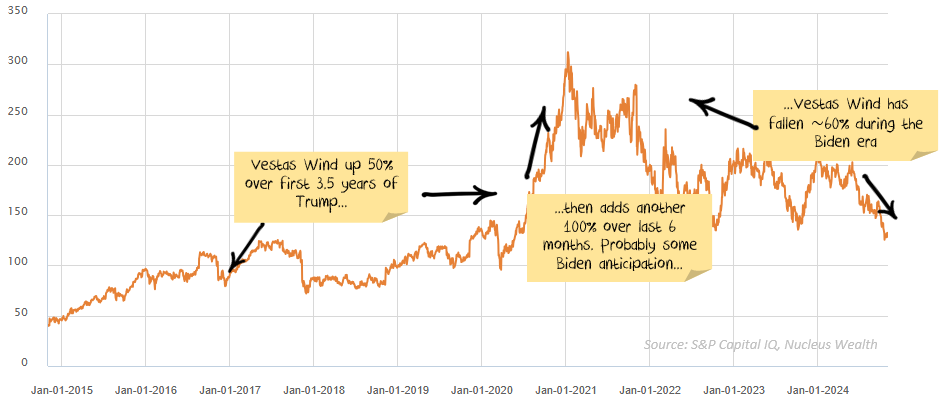

This is definitely creating opportunities for stock pickers. In many cases, the expected winners may not be actual winners. In others, markets have simply got carried away as to the extent of the benefit. Vestas Wind is a great example.

Vestas Wind is one of the world’s largest manufacturers of wind turbines. With Trump being anti-renewables, and Biden pro, you might have thought that Vestas did badly under Trump and well under Biden. The opposite was true. Up 150% under Trump, up another 100% in anticipation of Biden, down 70% from Biden’s inauguration:

We sold out of Vestas as it ran up into a Biden presidency. It is probably too early to trade against these themes. But Vestas is exactly the type of stock that we are starting to buy and have on our watchlist for mispricing to take advantage of.

US Dollar inconsistency

Expectations of higher interest rates have fueled the strength of the US dollar. Under Trump, higher debt, higher inflation, and thus higher interest rates are expected. However, Trump has suggested pursuing the opposite: weaker dollar to drive exports.

Energy paradox

“Drill baby drill” has been the mantra. Add in easing of Russian sanctions and there is probably a lot more oil coming. Into an already weak market. Will the additional debt and tax cuts be enough to prop up the oil market? Probably not. In my view, a Trump presidency would see lower oil prices and lower profits for energy companies.

Tech stock uncertainty

Tech stocks have underperformed on a relative basis. Higher growth is good for these stocks, but higher interest rates negate a lot of the benefit. Of more concern to investors is the perception that some will face selective regulatory scrutiny due to perceived political support. It is a real risk. But the fundamentals look pretty good given the valuations.

Renewable paradox

The conventional wisdom is that if you are optimistic about Harris, buy renewable stocks and vice versa. I spoke about Vestas Wind above turning that on its head. However, it does go further.

China’s government support for renewable energy like solar and wind heavily influences market dynamics. The massive tariffs from Trump on Chinese imports will benefit renewable energy players in the US and Europe. These players won’t face the same competition focused on high-volume production from China.

So, total renewable energy rollout is probably slower under Trump than Harris, and that is a bad thing for climate change. However, for listed companies in the renewable space Trump may well be better for profitability.

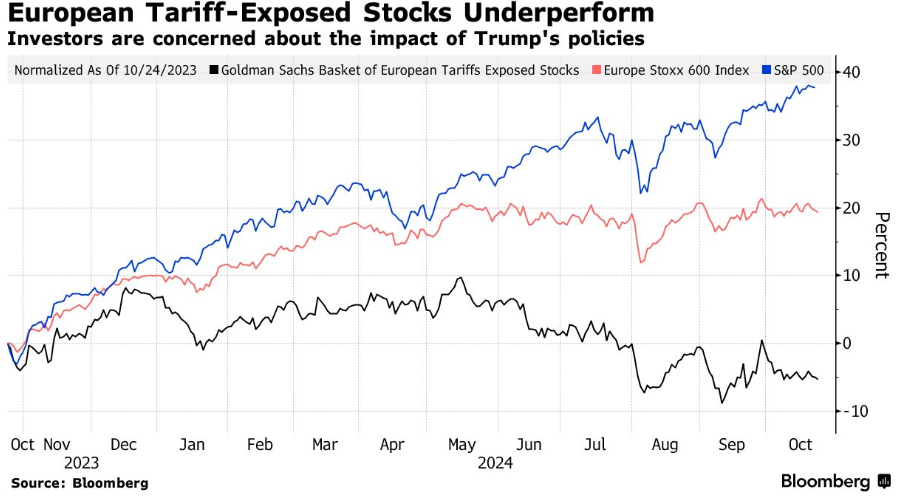

European Stocks

Shorting European exporters, especially from Italy and Germany, is another area of focus. European countries might face challenges with the US if the relationship isn’t as strong under a Trump administration as it might be under a Harris administration. Shorting Mexico is also gaining attention.

Traditionally, Republican wins favour defence stocks due to increased spending, but this might not hold true this time. It’s possible that Trump’s policies could lead to less spending in the US. However, this might actually benefit European defence stocks. Trump is likely to sharply curtail support to the Ukraine, and Europe will likely step up production. If Trump ushers in the fall of Ukraine to Russia, defence spending in Europe is likely to increase even more.

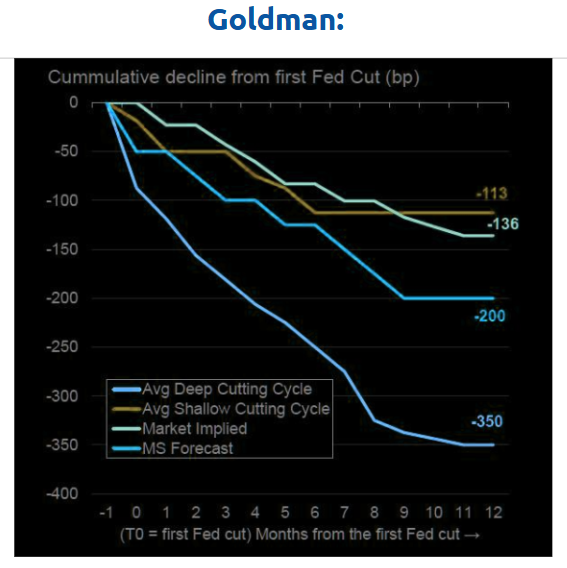

Pricing in bonds

Bonds are another area where markets may have priced in the full effects already. This chart from shows the market is pricing in a typical “shallow” cutting cycle. Which may be the case, but the risk is that bonds will rise if it is even slightly deeper.

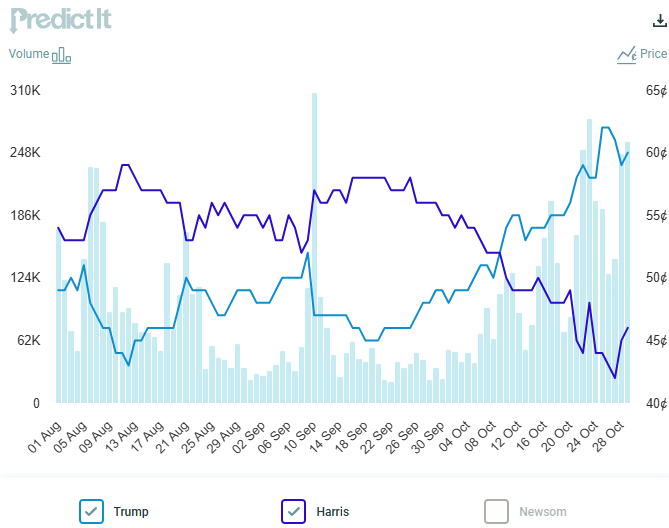

Betting Markets agree

Turning to betting markets, there have been significant shifts towards a Trump win. The same trends are evident. The betting markets like Polymarket which be influenced by a few large bettors tend to show better odds for Trump.

Predictor markets are intriguing as they often involve academics who may naturally lean Democratic, potentially skewing results. However, individual influence is minimized, preventing significant sway by any single participant. They are saying the same thing.

Polling does not

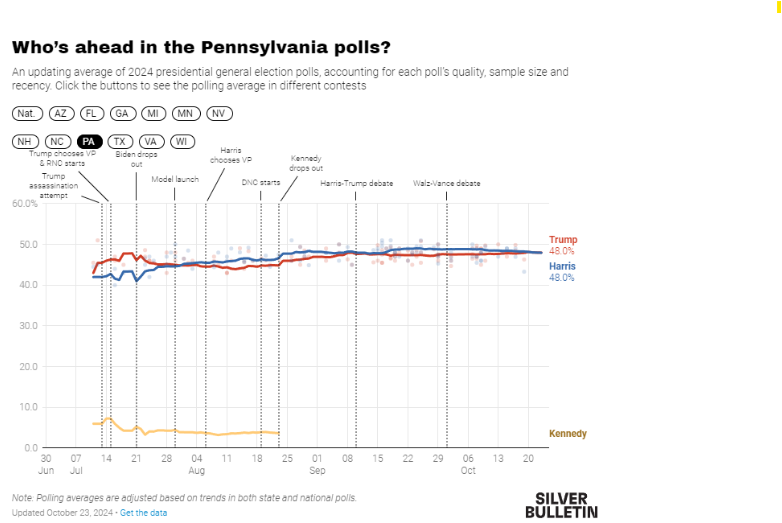

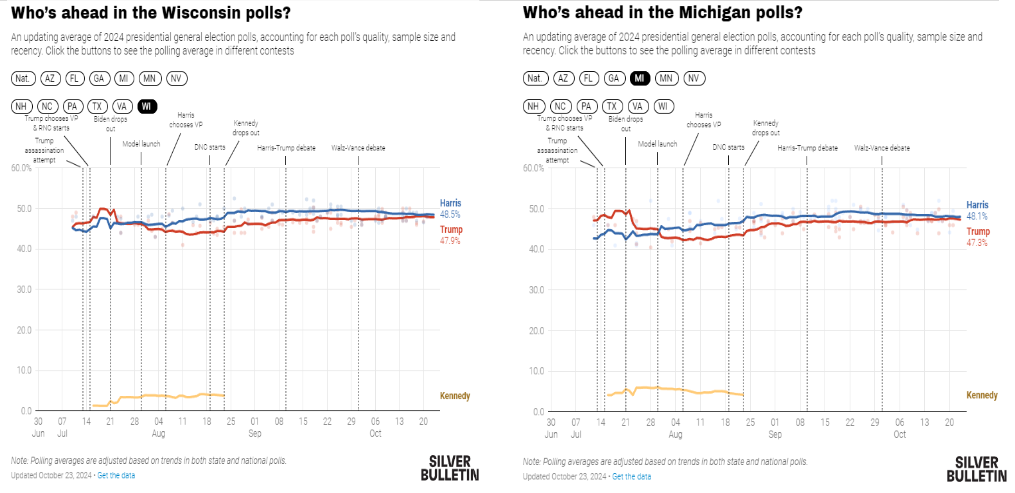

Polling has been drifting towards Trump in recent weeks. But to call it anything other than a complete toss-up is wrong. If you run through the three main states that Harris will need to win to get power, all are neck and neck:

What stands out most in the context of these markets are the pivotal roles of Pennsylvania, Wisconsin, and Michigan. The states form a cluster in the Rust Belt and share similar demographics. This geographical and cultural proximity suggests they could sway in the same direction in an election. If one state swings, there’s a likelihood that the others will follow. If Harris secures these three states, it could be decisive without needing further surprises.

Currently, betting markets reflect a narrow margin, suggesting outcomes like 45-55 or 60-40 in Trump’s favour. But the polls say different. Even with tightened race dynamics, Wisconsin and Michigan show marginal support for Harris. Pennsylvania has polls in a deadlock. The electoral race here has been 50-50, demonstrating a consistent lack of clear separation between the candidates for several months.

So, are stock markets and betting markets presciently calling the election early? Or are they simply carried away with extending recent trends to infinity?

There have been notable instances where betting markets have failed. The Brexit vote and the Trump-Clinton election are high-profile examples. This inconsistency introduces a dilemma from an investment perspective. Investment markets often price outcomes heavily influenced by such betting predictions. This can lead to misconceptions about the likelihood of certain events.

The real question for investors is whether they are prepared for potential disappointment. Are the markets overpricing outcomes as near-certainties when they are not? For instance, a scenario may be priced as if it has an 80% likelihood, when in reality, it’s only 60%. It’s crucial to determine whether the expected returns align with these potentially skewed odds.

How are earnings?

I could write a lot more – maybe click through to our recent podcast if you are interested in the detail. The short version: pretty good. Earnings look like being 5%ish and only minor downgrades to bullish forecasts.

What about valuations?

Expensive.

We’re approaching post-pandemic valuation highs but remain significantly above the 80th percentile in terms of pricing.

INSERT CHART

Having said that, there are two ways to fix high valuations:

- falling prices

- steady prices and rising earnings

Sometimes when markets seem expensive, it is simply a signal of better-than-expected growth coming. Currently, earnings are relatively strong compared to a few years or even eight months ago when there were negative earnings. Continued earnings strength can’t be ruled out.

Outlook

The investment outlook is nuanced. Markets have certainly priced in many positives.

If you’re examining individual sectors, they appear to be anticipating a Trump win. The question arises: if you believe Trump will win, should you rush to buy from these sectors, or are most gains already captured? For me, it feels like a “buy the rumor, sell the fact” scenario. If Trump wins, there could be slight reversals. If Harris wins there could be meaningful reversals.

On the other hand, market movements differ from what polls suggest. Polls suggest a coin toss. While markets and betting odds often predict outcomes accurately, they aren’t always right. Hence, you need to be discerning with asset purchases, especially given current uncertainties.

We’ve maintained significant equity holdings throughout the rally. It appears more likely to end in a soft landing, regardless of the election outcome. If Harris wins, opportunities to increase equity positions may arise.

There are inconsistencies in the “Trump trade“. Some assets are rising, not aligning with his policies, while others don’t align. Look to take advantage of these inconsistencies.

The uncertainty depends on who wins, and we see it as an opportunity to acquire assets in the volatility. We have a shopping list of assets that interest us if prices fall.