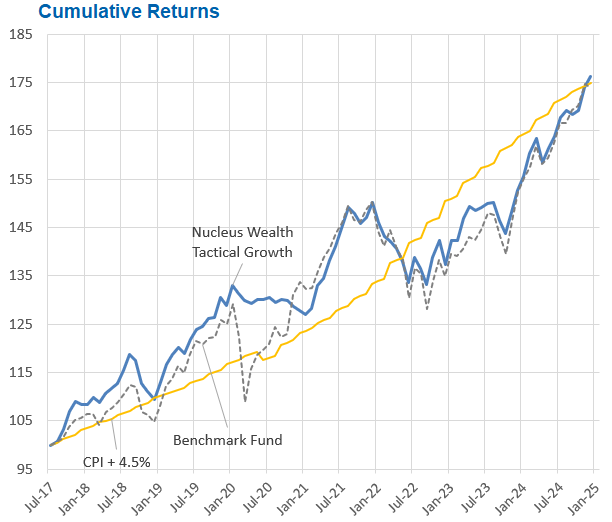

For the 12 months to Dec 31 it was a cracking year for stocks. To be more specific, it was a cracking year for NVIDIA, and to a lesser extent the other big 6 US technology stocks. So, as long as you had lots of NVIDIA, your portfolio did well. Our global leaders portfolio, a concentrated exposure to the top 40, had the most exposure to these stocks and so led the charge, finishing the year up 43%. In comparison, the broader MSCI world with 1,500 stocks was up around 30%, about 10% of that coming from the falling Australian dollar. Our tactical growth fund finished up over 15%, well in front of the Australian market which rose around 11%.

December saw the Santa Rally reversed mid-month as higher bond yields took some wind out of the stock market’s sails. The Australian market finished down almost 2%, but a rapidly weakening Australian dollar meant that international stocks finished up over 2%.

Will Trump break markets, or will markets break Trump?

OK. Let me get this out of the way up front: Trump will declare victory either way.

However, it seems increasingly likely that markets will change Trump’s policies. There have already been signs, such as potentially staging tariffs, reductions in government expense cuts, and debate (more accurately, a Musk vs. Bannon media war) over immigration. This suggests a flexibility in approach, not a complete reversal of plans. Trump often uses stock market performance as a gauge of success, making him susceptible to changes that favour market stability.

Bond Yield blow-out

Recently, we’ve seen significant rises in bond yields. In the Australian market, the 10-year bond is up to 4.5%, while 20- or 30-year bonds are around 5%. In the US, the 10-year bond is about 4.6%, and the longer-term bonds are slightly higher at 4.8%. The UK market is similar to the US.

Stock markets responded by selling off.

China presents a different picture. Interest rates are headed in the opposite direction. 10-year bonds have fallen to 1.6% and longer-term bonds to 2%.

Push comes to shove?

The big question is whether rising yields and falling stock prices will constrain Trump’s policies. Or will yields rise until Trump’s policies crash stock markets?

There are effectively five elements behind rising bond yields: future economic growth, current economic growth, inflation, the term premium, and the reaction of the US central bank.

1. Future Economic Growth

Trump’s policies are likely to favour growth over fiscal responsibility. While many Republican politicians are concerned about debt, Trump is not.

If well-targeted, higher government deficits lead to more economic growth in the long term. The well-targeted element of Trump’s plans has room for debate.

But in the short term, there is no debate. Higher deficits will lead to more growth regardless of how well targeted. Higher government deficits (in the short term) simply transfer money from the government to consumers and businesses.

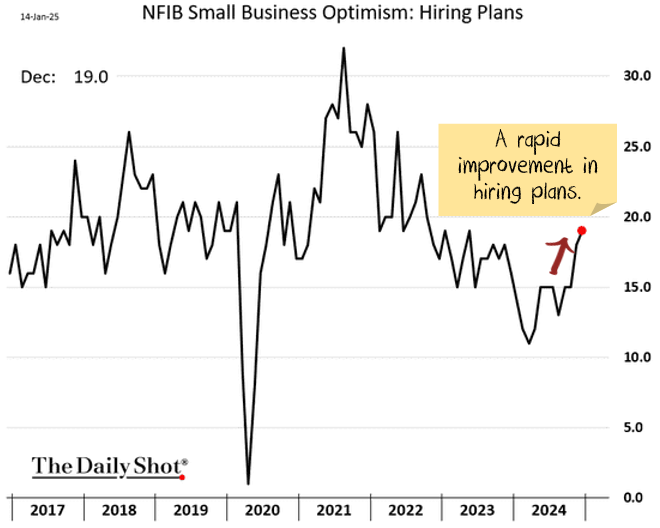

Additionally, there is a degree of reflexivity. As long as businesses believe growth will be higher, they will invest. And businesses do believe future economic growth will be better:

Republican voters often comprise small business owners and entrepreneurs. They may hesitate to expand or invest under a government they perceive as inefficient. However, when their preferred party is in power, they might increase spending and push economic activity forward.

Bottom line: at least some of the rise in interest rates is related to higher expected growth.

2. Current Economic Growth

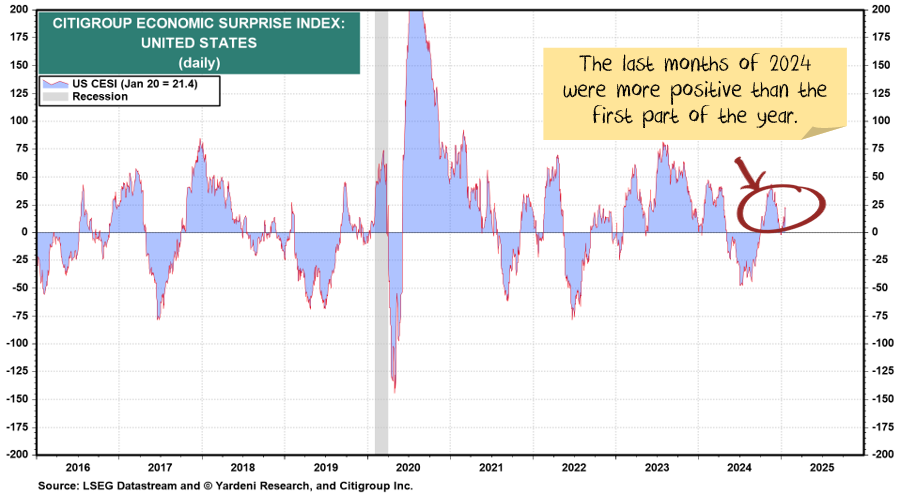

Recent economic stats have been a lot more positive than mid-2024.

Some of this is genuine. Some of this might be a “bring-forward” where companies are trying to beat tariffs and spend money before they take effect. Either way, the economy appears strong.

Bottom line: Trump is inheriting an economy that (at least) appears stronger than many thought last year.

3. Inflation

There are two issues with inflation.

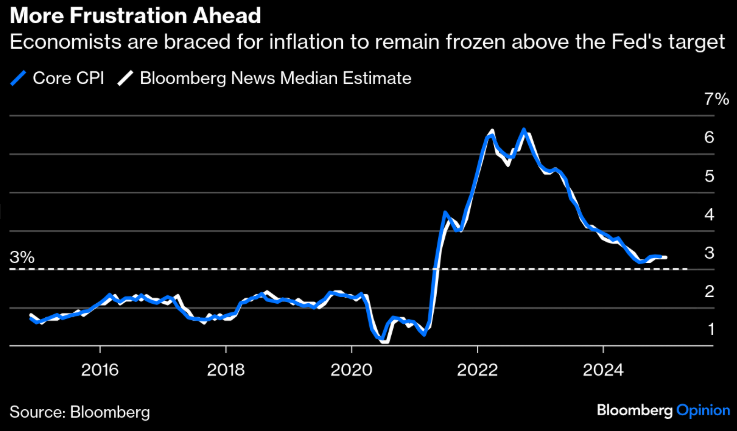

First, getting inflation from 3%ish to below 2% is proving to be more difficult than expected.

Will this embed higher inflation expectations, which will become self-fulfilling? Maybe. Financial markets have increased their expectation to 2.5% inflation:

The second issue is that many of Trump’s signature election promises are likely to be inflationary.

Tariffs? Short term, yes. If they are disruptively high (e.g. 60% for China, 20% for Canada and Mexico), supply chains will need to change significantly, which will also be inflationary in the medium term.

Lower immigration = inflationary. But is there the potential for a bait-and-switch? A John Howard-esque crackdown on illegal immigration while vastly expanding legal immigration? Steve Bannon thinks so, which is why he is rallying the MAGA base against Elon Musk.

Trump is going to front a much less aggressive Federal Trade Commission. Companies will have more scope to charge higher prices.

Bottom line: recent inflationary trends are necessarily bad. But they aren’t showing the improvements many expected. And many Trump policies will be inflationary.

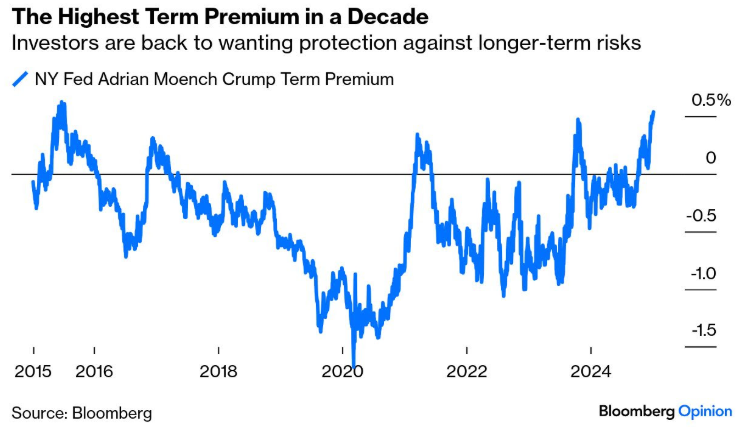

4. Term Premium / Risk

A key concept is the term premium. It’s a theoretical idea suggesting that the return on a bond increases with its maturity. For example, if you buy a one-year government bond, you expect a certain yield, say 4%. But a five-year bond carries more risk of things changing, warranting a higher yield of (say) 4.3%. This pattern continues, with longer maturities demanding higher returns due to greater uncertainty.

In recent years, as negative term premiums have become the norm, there has been debate about their existence and significance.

Another way to look at this is as a risk gauge. Politicians who disrupt norms and make bold policy moves can increase perceived risks. Suppose they advocate for massive tax cuts or radical policy changes. In that case, investors will demand a higher risk premium on government bonds.

During Trump’s campaign, a proposition was made to eliminate income taxes and rely solely on tariffs for revenue. It went no further, but it is just one example of mooted radical change.

Bottom Line: Trump is considerably more unpredictable than other politicians. Bond markets will demand a premium for risk.

5. US Central Bank reactions

The final factor is how the US central bank has been reacting. In late 2024, it came out strongly with multiple interest rate cuts despite higher inflation. It was responding to slowing jobs and sending the message that it thought job growth was more important than stamping out the final embers of inflation.

Taken in that context, investors should expect higher interest rates. The market concern was that the US would go through a typical cycle. The central bank waits until a downturn is solidly underway, then cuts rates—too late to prevent a recession. This means rates need to go even lower to create an economic recovery.

The early actions suggest that interest rates won’t need to go as low. You can think about long-term bonds as the average of expected interest rates. Suppose markets expect the Fed to continue forward-acting to prevent downturns. In that case, you can slice off the lowest interest rate outcomes. Which makes the average higher.

Bottom line: The actions of the US central bank suggest an increase in average interest rates over time.

What should investors be watching?

The Musk-Bannon debate highlights the key issue. Elon Musk advocates for increased immigration, particularly in the tech sector, to bring in highly skilled workers. Conversely, Steve Bannon emphasizes training US workers to fill these roles. The outcome of this debate will indicate how pragmatic Trump will be.

If Musk prevails, expect lower wage growth and, thus, lower long-term inflation. If Bannon wins, higher inflation is on the horizon.

Tariffs are another key data point. A gradual implementation will be a nod to markets.

A significant unknown is Musk and the government’s efficiency department. The targeted savings have already halved from $2t to $1t. Will the changes be all marketing and spin? Or will there be a drastic plan to downsize parts of the US government? The former is another suggestion that markets have the upper hand.

Wrap up

Our base thesis is that markets are more likely to rein in Trump’s excesses than any outcry from the press. Public criticism won’t deter him; Trump will likely double down. However, if Trump continues this approach and markets drop significantly, we believe that will be enough to check his excesses.

With that view, opportunities await those willing to buy the dips. However, if Trump decides to disrupt markets, we must pivot quickly.

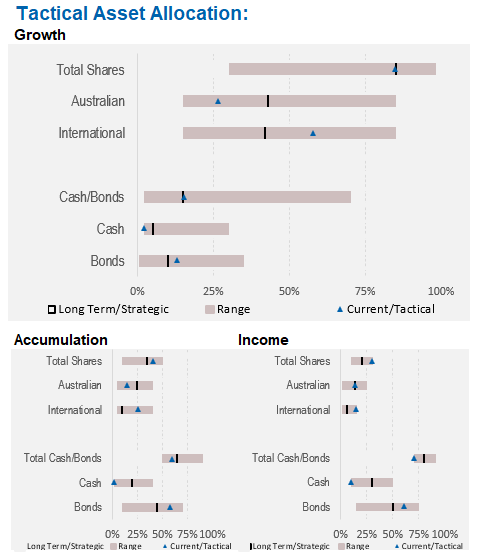

Asset allocation

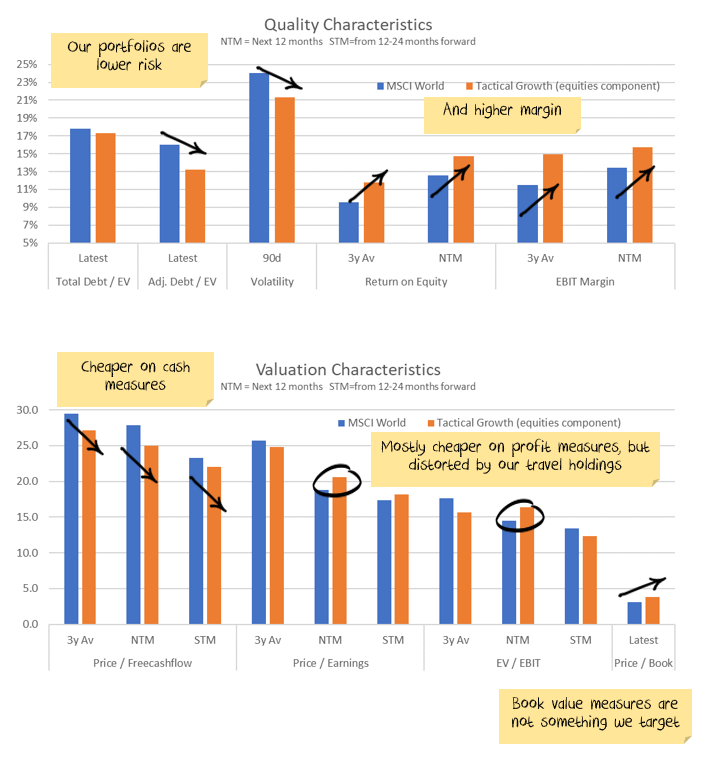

Earnings growth looks to have turned positive. When you add corporate tax cuts and some margin expansion through lighter regulation and a quite expensive US market becomes merely expensive.

We are underweight Australian shares, significantly overweight international shares, with the view that the Australian market is more affected by interest rates and less affected by an AI boom:

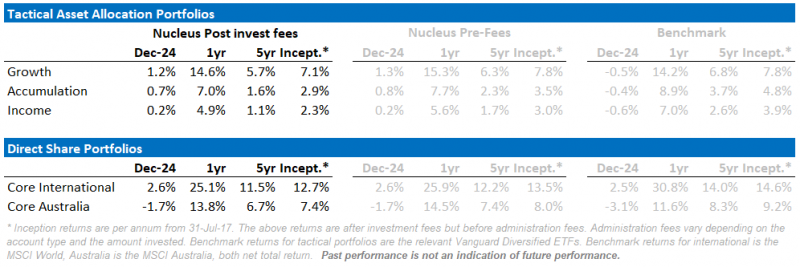

Performance Detail

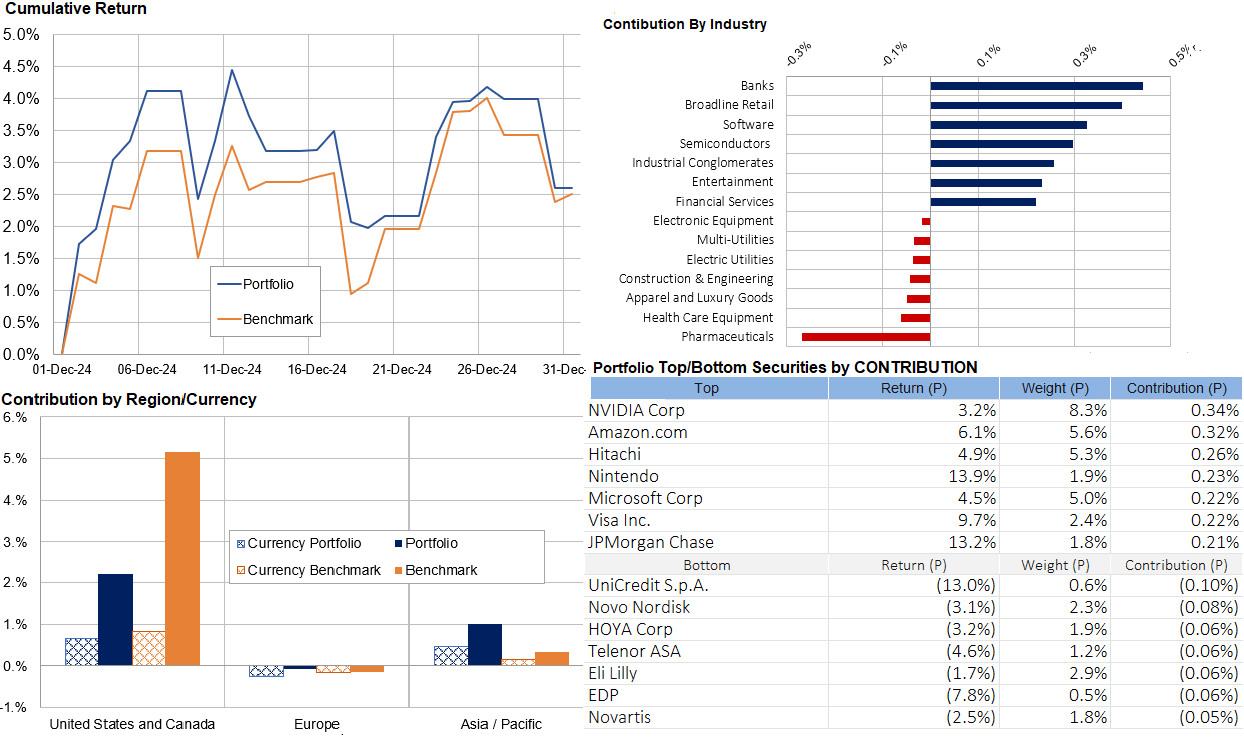

Core International Performance

The Santa Rally petered out mid-December, only the weak AUD saved the overall equity performance. Interactive Media was the stand out sector with Google and Amazon putting on double digit gains over the month. Currency was the primary reason for the strong gains this month as the AUD weakened breaching 2022 lows on China worries and USD strength.

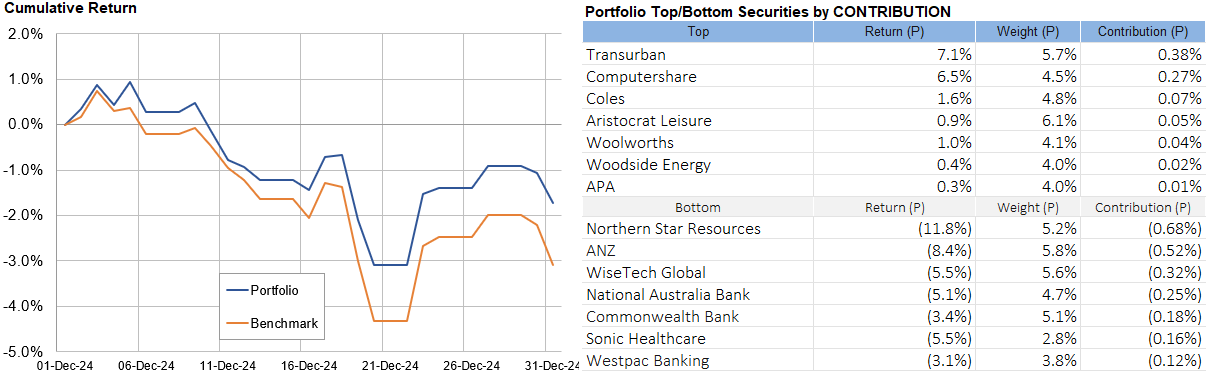

Core Australia Performance

Australian equities mirrored the global slump mid-month with defensive stocks the best performers.