Markets were slightly weak in February, but then turned nastily down in March. We sold down stocks at the start of March – more detail below.

More market mayhem

Two weeks ago, we lightened up substantially on stocks. I want to explain why we made these decisions and discuss the prevailing uncertainty in the market.

First, markets rarely move in a straight line. They typically oscillate with pullbacks and bounce-backs. Don’t get too caught up in day-to-day movements. There are fear and greed indexes that try to measure investor sentiment. They shifted from outright greed a few weeks ago to abject fear now. Leverage and options trading have also moved from bullish to bearish. Typically, this overreaction suggests markets might soon rebound.

A month has been a long time.

The primary focus today is the uncertainty affecting corporations in real time. When Trump was elected in November, we retained higher weights in the stock market due to his corporate-friendly policies. These included deregulation and tax cuts, which boosted corporate earnings. For the stock market, policies benefiting companies, even at consumers’ expense, often lead to market gains.

The pressing question now is: what has changed? The answer is execution risk.

The Trump (Bessent?) plan

In a broad sense, Trump’s approach emphasizes corporate-led economic growth with minimal government intervention. He believes US corporations should be free to innovate and drive productivity. By cutting back on government spending, reducing taxes, and reducing regulation, Trump expects the private sector to thrive.

This strategy could have many benefits, but successful execution is crucial. Recent chaotic developments are creating economic strain.

Capital Expenditure Uncertainty

Tariffs will likely increase costs for US-made goods, especially cars and create a raft of supply chain disruptions.

The plan is to get companies to build factories in the US. While this vision has merit, flip-flopping on timing is not helping. Say you are a company building a factory:

- If you build in Mexico, costs will be (say) 20% lower. If you knew tariffs would remain 25%, you would build in the US.

- But, if you build in the US and then Trump drops the tariffs, now you are 20% more expensive than Mexican competitors.

And none of this is short term. Land acquisition, permitting, new suppliers are likely to take years. Net effect: you do nothing, and wait for clarity.

Consumer Uncertainty

Consumer confidence is notably declining, suggesting consumers are wary about spending.

Elon Musk’s actions have an impact. Confidence isn’t boosted when nuclear scientists are laid off, only to be rehired when their importance is recognized. Sending a mass email to a significant portion of the US workforce to justify their employment or firing those on probation, only to rehire them, sends mixed signals. These actions contribute to a climate of uncertainty and caution.

The economic landscape is marked by uncertainty, particularly for individuals employed by the government, which comprises about one-fifth (at all levels of government, plus contractors and grants) of the US workforce. Many of these workers are likely delaying major purchases such as vacations, home renovations, or new cars due to job insecurity.

Inflation dangers

Even before the Trump administration, inflation was ticking up. Tariffs’ direct effect will exacerbate inflation concerns. Second-order effects are likely, as companies use tariffs to justify price increases.

And that is not even the biggest risk. Significant supply chain disruptions were at the heart of the lion’s share of pandemic inflation. The US looks to be about to re-test its resilience as companies shift supply chains to avoid tariffs.

Interest rate uncertainty

The Federal Reserve is now caught between conflicting signals. Initially planning to cut rates, the Fed faces complications due to inflation pressures from tariffs. It is difficult to disaggregate the direct impacts (which they will ignore) from supply chain issues and corporate profiteering (which they won’t).

Employment Uncertainty

Immigration policy is another critical factor. The crackdown may lead to wage growth for US citizens, but it also risks leaving many lower-paid jobs unfilled. This situation could curb corporate expansion if companies struggle to find workers or face higher labor costs.

Legal Uncertainty

The Department of Justice is experiencing considerable turnover. Many officials are being fired, and there’s a noticeable change in focus. Selective prosecution and retaliatory actions against critics are occurring. There’s a shortage of experienced lawyers to deal with lawsuits and support executive orders. Courts are already pushing back, questioning the legitimacy of executive decisions and actions.

Additionally, a number of Trump’s actions seem legally worse than what he was impeached for last time (although there is no chance of impeachment this time). Paying foreign bribes may soon be legal.

None of these changes encourage companies to take more risks and spend more.

Other Uncertainty

Beyond supply chains, we haven’t even discussed Ukraine and military spending, raising questions. Will Russia re-enter the global market, particularly in commodities?

It’s uncertain whether Trump will follow through on his statements. One day, Zelensky is a dictator, and a week later, Trump can’t remember saying that. Knowing the big-picture government strategy might make it easier to accept ongoing changes. That doesn’t appear likely.

Investment Outlook

Markets are expensive, down from very expensive. About the 80th percentile. If there are corporate tax cuts (which seem likely) then 75th percentile.

The US fundamentals are getting worse, there is a chance they get much worse. China fundamentals are looking like struggling for years. Europe is showing signs of life.

There are productivity gains from AI, stalling obesity rates and automation which underpin a broadly positive economic outlook over the next decade.

We see three probable outcomes:

- Stagflation—weak growth and high inflation due to tariffs and other factors. The Fed might hesitate to cut rates to control inflation, which could worsen the growth situation.

- Recession – if growth is weak enough, you won’t need to be worried about inflation because a recession would stop that in its tracks.

- US exceptionism. The US economy has been strong and resilient. It might avoid major setbacks, maintaining manageable inflation levels. The Fed could provide a safety net, akin to a “Fed put.” Trump might introduce significant fiscal stimulus, creating a “Trump put.”

Under scenario 3, the market would likely rally. Under the other two scenarios it won’t.

This dip might present a buying opportunity if the fundamentals support an exceptionism scenario—where conditions aren’t dire, and safety nets, like government and central bank interventions, are in place.

Our strategy is to take some stocks off the table now, creating a cash cushion to leverage future opportunities. We’ve adjusted our sector allocations accordingly.

Timing is fraught. The Trump put could be 20 minutes away or 20 months away. The Fed put is at least six months away, unless fundamentals get dramatically worse more quickly (in which case you don’t want to be invested anyway).

In our tactical funds we have reduced stocks and raised cash. We will look to re-enter when we see these puts emerge, or if markets fall far enough.

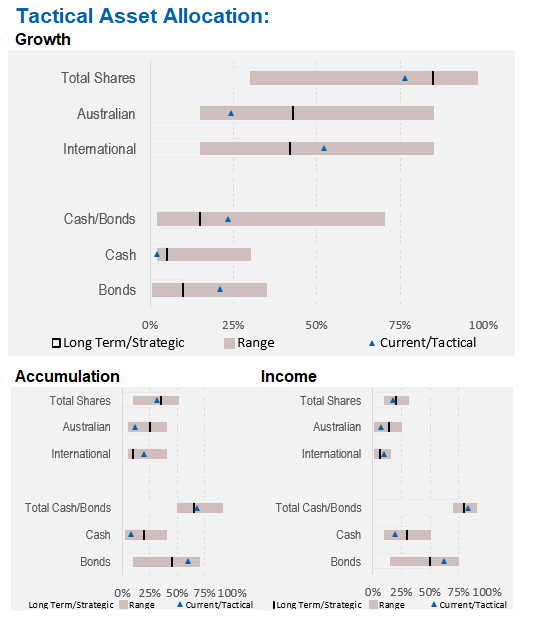

Asset allocation

We are underweight shares overall, significantly underweight Australian shares. We are mildly overweight bonds, and with lots of foreign cash:

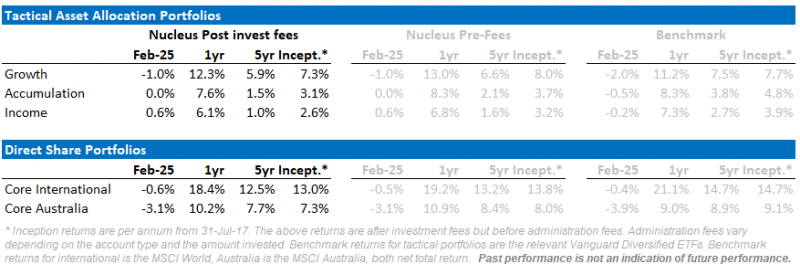

Performance Detail

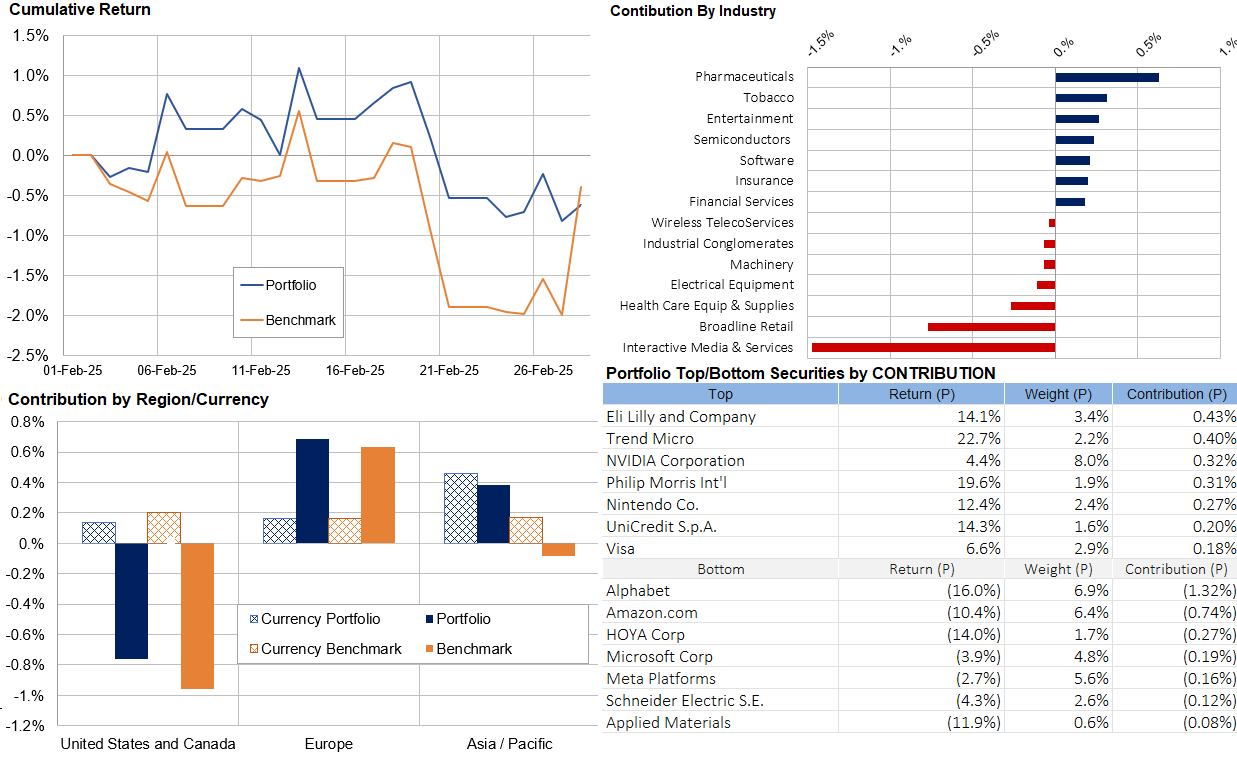

Core International Performance

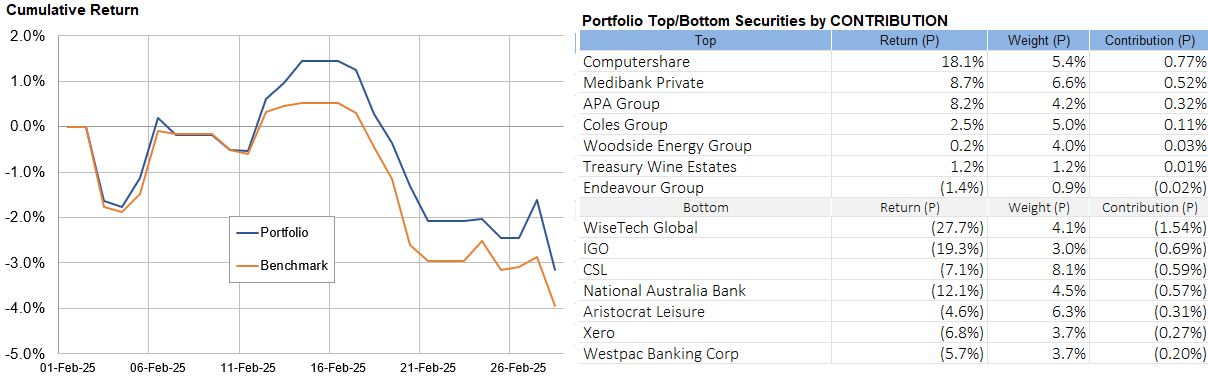

February saw the bull market stall with our portfolio outperforming until month end. Currency was an offset this month as the AUD weakened across the board. We made no major changes over the month.

.

Core Australia Performance

Australian equities pulled back this month with growth stocks and banks particularly hard hit.