January 2023 Performance

Stock markets continued their on/off mode in January. This time it was on. The ASX 200 rose 6.2%. International stocks rose a similar amount, but the higher Australian dollar meant they only rose 3.0% in Australian dollar terms. Bond prices rose 3%, but most of that change was simply the reversal of the December reaction to changes by the Bank of Japan.

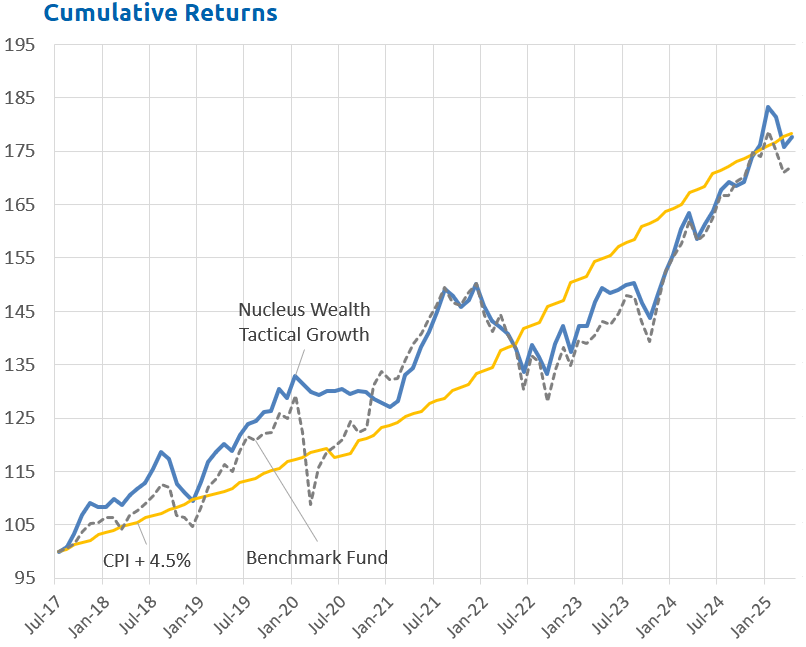

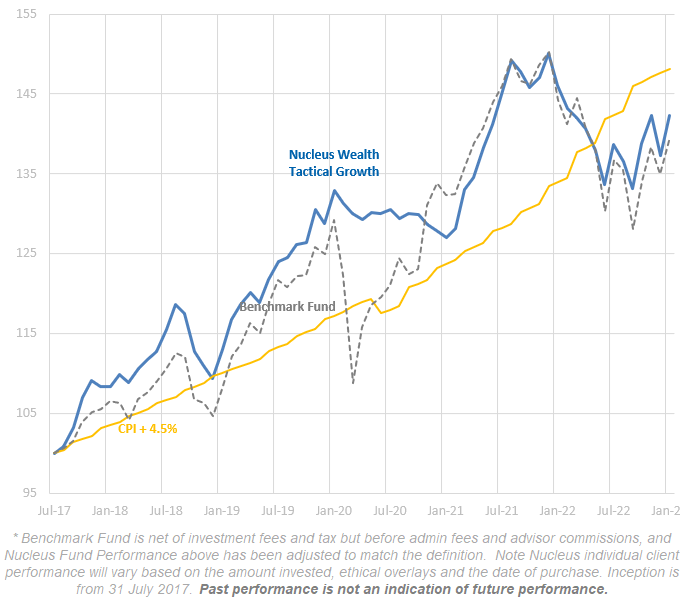

Our portfolios outperformed benchmarks:

We expect weak stock markets as the central banks raise rates to slow demand, shrinking company profits. With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability. The reporting season in the US showed some signs of weakening earnings, but not enough to confirm our thesis yet.

Investment Scenarios

Over the past 20 years, developed market economies have become financialised. Both housing and stock markets make up an ever greater proportion of consumer wealth and the increase (or decrease) in value leads to consumers spending more (or less). Arguably, central banks have become bubble managers, responsible for injecting confidence into markets. With the feedback loop between asset markets and consumer spending, it becomes reflexive: rising confidence increases asset prices which therefore increases consumer spending, justifying the prior rise in asset prices. The key central bank responsibility? Making sure the system doesn't go into reverse.

There is an elevated level of uncertainty at the moment. Investors, economists, central banks, consumers, and corporates are all struggling to come to terms with how to interpret the economy:

- Central banks are trying to guide to higher rates for longer. Markets have been, to a certain extent, ignoring what central banks are saying. The US central bank releases a "dot plot" showing that they expect rates to be over 5% by the end of 2023. In contrast, markets are pricing in rate cuts in the second half of the year.

- Economists are mostly expecting a recession for developed markets. Strategists are calling for earnings to fall 10% or more. Individual stock analysts are largely ignoring both. They are still expecting positive earnings growth from companies.

- The US central bank GDP forecast confidence interval ranges between a recessionary -1% and a booming 3%+ growth.

- Forward indicators from business surveys are at recessionary levels, suggesting a tough ride ahead. In contrast, companies are still hiring. Unemployment rates are at generational lows in a number of countries.

- December looked bad for consumer spending, a sign that higher interest rates were beginning to bite. But early results from January suggest consumers are back. So was a weak December the anomaly, or is it a strong January we should be discounting?

It is no wonder that markets are confused, oscillating between fear and elation.

Any investment is an exercise in probabilities. As part of the process, it is prudent to look at the various outcomes and consider the likelihood of different scenarios occurring.

Scenario 1: Central banks fold quickly in the face of weaker growth

This scenario would be the most positive for equities. It involves the economy weakening and central banks folding quickly, cutting rates to support growth.

It is the least likely in my view, but we have seen it play before. When Powell first became the US central bank chairperson he explained that he wasn't there to backstop equity markets. A plunge in equity markets culminated on Christmas and Powell essentially reversed that position.

This scenario is a bet on a replay of the above.

Effect on markets

This scenario has a number of legs to it. At first, bond yields would tumble. Stocks would go into a wild "risk-on" rally, growth and cyclical stocks in particular would pace the market. The US dollar would be hit hard, emerging markets and commodities would fly as global growth picks up. The party would be in full swing.

Then comes the hangover. We are likely looking at yields rebounding as inflation bounces back, freaking out markets. Best case, government spending is constrained and we get a replay of the 2010s: OK growth, deflation and central banks continually trying to push growth. Worst case, government spending is not constrained and inflation takes hold requiring an extended period of high interest rates.

What to invest in

Maybe there is a bond play at the start of this scenario, but you would need to get out of it quickly and into the stockmarket. Within stocks, growth stocks and cyclical stocks will boom the most. Avoid defensives.

Likelihood

Low to very low.

Scenario 2: Central banks pause soon, start cutting in the second half of the year

This scenario is largely what markets have priced. A looming recession (albeit mild), weak economic growth and falling corporate earnings lead central banks into starting to reverse interest rates.

Effect on markets

Again, bond yields would fall. Corporate profits fall modestly on big margin squeeze but multiple expansion lifts stocks (a little) anyway. The US dollar falls a little. Emerging market stocks continue to increase. Commodities struggle.

What to invest in

Both stocks and bonds give low returns under this scenario, and returns would probably be similar. Within stocks, quality stocks will perform better. You want stocks that can maintain their margins, as earnings will be under pressure. At the same time, markets will be rewarding earnings growth with multiple expansion.

Likelihood

Either this scenario or the next seems the most likely in my view.

Scenario 3: Central banks pause toward the middle of the year, starts cutting late in the year

This scenario is about the mid point between what markets are pricing and what central banks are saying they are going to do. It would eventuate if inflation is stickier than expected, or if central banks are more resistant to market pressure than they have been in the past. Either way, corporate earnings will be hit harder under this scenario.

Effect on markets

First, bond yields plateau. Then they fall considerably once the recessionary effects emerge. Corporate profits are down moderately on a big margin squeeze. The multiple expansion is delayed and so stocks fall. The US dollar remains firm. The emerging market stock rally peters out, commodities fall. Quality stocks and defensive stocks give the best returns within equities.

What to invest in

Bonds give the best returns under this scenario. Stocks would fall, but not significantly. Within stocks, a mix of quality stocks and defensives will give the best performance. A shallower recession will favour quality stocks, a deeper recession will favour defensives. Buy both.

Likelihood

This scenario and the last seem most likely. Probably two in three odds at the moment.

Scenario 4: Central banks raise rates until mid-year, then remain on hold for the rest of 2023

This scenario is central banks doing what they are saying they are going to do. It would eventuate if inflation is significantly stickier than expected, there are more supply chain disruptions or central banks are much more resistant to market pressure than they have been in the past. In any event, we are looking at very weak economic growth and considerably lower corporate earnings.

Effect on markets

Bond yields rise initially then crash into 2024. Government bond returns boom. Corporate profits are down significantly on both falling sales and falling margins. Significant bankruptcies emerge. Valuation multiples fall. The US dollar is strong. Emerging market stocks tumble, along with commodities. Defensive stocks give the best returns within equities.

What to invest in

Bonds give the best returns under this scenario. Stocks tumble. Within stocks, defensives are one of the few havens. Growth stocks and cyclicals are hammered.

Likelihood

This scenario is possible, but not probable.

Net Effect

Investing is always a trade-off between economic outlook and price. Prices look expensive, the economic outlook is troubled.

Have we seen this all before?

- Globalised supply chains reversing into more local production due to geopolitical tensions

- A pandemic disrupting supply chains

- A surge in inflation due to supply issues

- Central banks hiking rates into a supply-side shock

Yes, we have. Following World War I, all of the above factors were in place.

By 1920, inflation in the US was running at 15%. The US central bank hiked rates from 3.5% to 5.6% to curb demand. By 1921 the US was in a depression, with inflation of -10%.

The analogy is not exactly the same. But, trying to use interest rates to solve supply chain problems is at the core. There are more similarities than there are differences.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren't in the long term. However, the short-term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short-term effect was commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic. In China, rolling lockdowns have finally finished.

- The geopolitical energy crisis in Europe has eased on the back of much warmer weather. Australian energy price caps have pushed down energy prices. There will be a rush to alternative energy sources in the mid-term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock into 2023. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian-induced energy issues and supply chain-induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. The latest changes are not a bailout... but they may morph into one. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. In the short term, commodities have been booming. If China doesn't continue to roll out new measures, the commodity market will deflate again.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for a recession this is a buying opportunity. In the short term is that the narrative "high inflation, central banks raising rates = sell bonds" seems to be coming to an end. Although there may be another last hurrah as the US central bank looks to rein in the stock market optimism.

And the mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We are invested for bond yields to reverse.

Asset allocation

After being very expensive for a number of years, stock markets are now flirting with fair value. Debt levels are extremely high. Earnings growth had been really strong but has come to a halt. There are signs it is starting to reverse.

Markets are supported to a great degree by central banks and governments. Policy error is every investor's number one risk.

But, any number of other factors could force this off course and see unexpected inflation. COVID mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

Performance Detail

Core International Performance

January saw "risk on" as all major share indices moved higher. High beta sectors like Media and Luxury goods bounced hard while pharmaceutical stocks were sold down after their strong run over 2022. Regionally the US was strongest but Europe too had a good month. Currency overall was a detractor as the AUD strengthened over the period. No portfolio changes were undertaken during the month.

Core Australia Performance

Australian indices bounced hard in January led by the resource stocks and a bounce in the oversold technology sector. Financials and Energy were the laggards but eked out gains nonetheless. We bought some more gold exposure early in the month which proved timely.