March was a shocker for the ASX with the ASX200 down over 4%. Investors in our tactical funds did much better, led by our income and accumulation funds increasing +0.4% and +0.3% respectively. International shares performed much better than Australian shares (helped by a falling Australian dollar) finishing down 1.1%.

In particular, our March performance was driven by our defensive investments. Government bonds increased, Thales (France/defense contractor +11%), Unilever (consumer products +10%), Meiji (Japan/confectionary +7%), UPM-Kymmene (Finland/forestry +9%) and Swedish Match (Tobacco) were the standout performers.

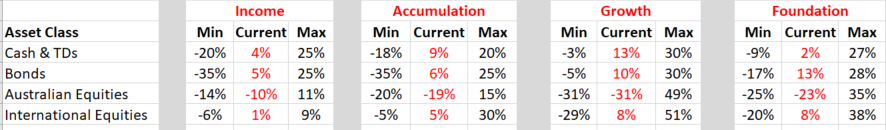

We are sitting on a considerable cash balance in all of our Tactical portfolios – our Tactical Growth fund targets a 10% exposure to cash and bonds, our weight is currently 34%. We have even more cash in the more conservative funds.

Investment Outlook

The fundamentals for shares look good, valuations don’t.

Which, despite all of the ups and downs of the last few months is largely where we have been for the past year.

There are two ways to “cure” high valuations: higher profits or lower stock prices.

Our tactical asset allocation continues to be based on getting as much exposure as we dare to over-valued equities that continue to get even more over-valued while maintaining protection in case it all unravels.

To be clear, we don’t think that we have reached the end of the current investment cycle, especially so as the long-awaited Trump tax cuts are on the verge of triggering a late-cycle US boom.

Can this be derailed by a trade war? Yes. We are treating Trump’s trade war as mainly posturing, but there are clear dangers if it becomes something more.

March Performance

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees.

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees.

The Way Forward

As a reminder, we look at the key themes facing our portfolios as being:

- China: Rebalancing is occurring, the question is how fast Chinese authorities allow it to occur.

- Trump: Taxes are through as we expected. Our base case has been that trade wars will be more hot air than follow through, but events of recent days are putting that assumption under some pressure.

- Europe: Grinding recovery. We are not expecting great things, but note the political risks have reduced. We also note that the high Euro is weighing on the economy and economic statistics have turned down. The major long-term issue is still the significant imbalances between Germany and most of the rest of the Eurozone.

US

Our core position is that Trump is trying to engineer a boom. It will not be sustainable and will likely be followed by a bust that leaves the US economy in a worse position but that is a future problem – positioning the portfolio for the boom is the current issue.

The proposed tax cuts are badly targeted by giving most of the benefit to the rich and to companies, trickle down is unlikely to work, the tax cuts are unsustainable, and they are only a short-term “sugar hit” for the US economy. But it is going to be such a huge stimulus that you don’t want to stand in the way of it as an investor.

So, we want to play the boom, keeping a sharp eye on the bust. Our portfolio positioning on this basis remains:

- overweight international stocks from an asset allocation perspective

- overweight stocks with US exposures – subject to valuation. The practical implementation of this has been buying non-US stocks that are exposed to the US.

China

In China data continues to weaken, suggesting that the rebalancing is occurring. A cut in the reserve rate this week might seem to some as a sign that the authorities want to return to debt-driven growth. Our view is that the reserve rate is more about managing the downward glide path.

Over the medium term:

- the shift to consumption-led growth rather than investment-led growth will require a greater shift than many recognize. This shift will be a significant negative for commodities/the Australian dollar

- current growth rates are unsustainably high, inflated by rapidly increasing Chinese debt. The increase in debt has been required in order to hit the growth targets, so removing the growth targets will help refocus local party officials to more sustainable policies

- activity still seems to be slowing, although the last few months have been difficult to get an accurate read on economic activity due to winter pollution shutting down of a considerable amount of industrial manufacturing, in particular, steel production. We would expect that some of the strength in commodity prices in July/August reflected the bringing forward of production in front of the shut down. Then, the weakness in Q7 2017 represents the shutdown. Finally, there is likely to be a bounce in Q1 2018 due to “catch-up” production. So, the true trajectory is going to be difficult to ascertain accurately until we are through this period.

- the Chinese housing market appears headed into a soft landing thanks to macroprudential tightening so a possible path ahead for rebalancing is a muted not busting housing cycle that supports consumption while weighing on investment;

- we are probably 2-6 months away from being able to see whether the removal of growth targets makes a big difference or not – they have the potential to foreshadow a seismic shift to a more sustainable growth model. I suspect the outcome will be that with the Communist Party Conference done now the impetus will switch to slowing the economy as much as possible, but with any sign of unrest the debt taps will be turned back on.

Our expectation is that China is going to continue to “glide” lower to try to normalize the capital expenditure to consumption in-balance that we discussed in our recent webinar.

It is our view that the Chinese economy will continue to slow over the coming years – Japanese style lost decades, and low inflation/deflation remain more likely than a dramatic bust, which means a grind lower for commodities and the Australian dollar.

Our portfolio positioning on this basis remains:

- considerably underweight Australian stocks from an asset allocation perspective

- underweight resource stocks within equity portfolios

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 12 months was to ride the Trump Boom, switch into Europe in March / April as the US became overvalued and then switch back into the US as the Euro rallied and the USD fell.

We have been using rallies in stock markets to reduce our holdings.

In March the Income fund increased by 0.4%, the Accumulation by 0.3% and the Growth fell by 1%. We remain underweight shares in aggregate, overweight international shares and significantly underweight Australian shares.

Over / Underweight positions by portfolio

Tactical Foundation Portfolio

Our tactical foundation portfolio is designed for investors with lower balances, it uses exchange-traded funds for its international exposure rather than direct shares. The reason for this is parcel sizes, you can’t buy half a Google (Alphabet) share directly and so we use exchange-traded funds which buy baskets of stocks instead. The tactical portfolio is a balanced fund, not as aggressive in its holdings as the growth fund nor as conservative as our income fund.

In February this fund decreased by 1.3%. The fund continues to be underweight Australian stocks.

Equities

Our biggest call is underweight energy. In particular oil producers. This has not been a good call over the last six months, and our outperformance has been despite the underweight to oil rather than because of it.

We have been doing a lot of soul-searching on this call over the month. The broad overview is:

- Oil demand remains strong, and with (relatively) synchronized global growth we expect this to continue.

- The supply side is stronger. US production continues to reach new highs, Libya and Nigeria’s production recovered from interruptions. The lone negative is Venezuela continuing to decline. The ability of US shale oil to react quickly to higher prices means that supply is much more responsive than its been in the past. The US has now become an exporter of oil.

- On the political side is where we see most of the action. OPEC and Russia are withholding supply to keep the price high, and US bombing in Syria plus Trump threats raise the spectre of sanctions returning to Iranian production.

- On the trading side, speculators hold record balances. This can be read two ways: (1) everyone else is going long, the oil price is going higher (2) the oil price has been pushed to current levels by speculators and will fall when they unwind their positions.

So, the question from here is whether we hedge our risk to political events by buying oil stocks in the face of fundamentals that suggest the oil price should be materially lower. If the risk were greater or the oil price lower, I would probably hedge. Given the current situation and current prices, we are going to stay underweight oil. But the debate rages on.

Our sole holding in the energy sector, Neste Energy is up around 50% over the past few months, which has shielded up a little from the rising oil price. Neste is a Finnish oil refiner, making a significant investment in green technologies and is well regarded by a number of sustainable rating firms including being in the Global 100 most sustainable companies, the Dow Jones Sustainability index and CDP.

We are underweight financials – mainly as we can’t find US financials that are cheap enough to justify purchasing. We have been trawling the European banks for value. Insurance continues to be a sore spot, but we made some gains over the month with Everest Re and Direct Line. We are looking to continue to build holdings in the sector with the view that after such severe losses in 2017 that insurance premiums will rise significantly.

We have a reasonable tech / IT exposure. There are a number of smaller tech stocks that we own, in particular, a range of semiconductor stocks where we like the growth outlook. It is worth noting that part of the reason for Apple increasing the price of its latest phone is an increase in memory and components. This is a positive for semi-conductor stocks more generally, especially if a “feature war” breaks out in the smartphone space. We current hold a range of stocks that should be helped by this trend (Lam, Applied Materials, Skyworks, and to a lesser extent Cisco).

Performance to date

Portfolio performance can be cut a number of different ways. At its most basic level, you should care about the total return. At the next level, you should care about the total return relative to some sort of benchmark.

As you dig deeper, you should also be interested how the return was achieved – for example if your fund manager is taking lots of risk but only performing slightly better than the market then you should be concerned. Similarly, if you can get market returns but at a much lower risk then that may be an appropriate trade-off.

Our portfolios to date have been both out-performing benchmarks, and taking less risk. The disclaimer is that they have only been running for eight months, and that is not enough time to make definitive judgements.

For the sake of comparability, we have used the Vanguard MSCI World ETF (ASX:VGS) to compare to our international portfolio – VGS is an index fund investing in the same stocks that we do.

Epilogue

In summary, our view continues to be that Australian investors are better off holding international investments at this point in the cycle.

We retain relatively large cash balances to hedge against volatility and to look for a cheaper entry point. If markets continue to be weak then we will look to buy more equities. We are concerned about the potential for trade wars, which will be a key focus for us over the next few months.

Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We usually find that big picture macro themes take a long time to resolve themselves in financial markets, but when macro theme resolve themselves they do so quickly – usually too quickly to reposition your portfolio if you are not already invested.

Register your interest now (if you haven’t already):

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.