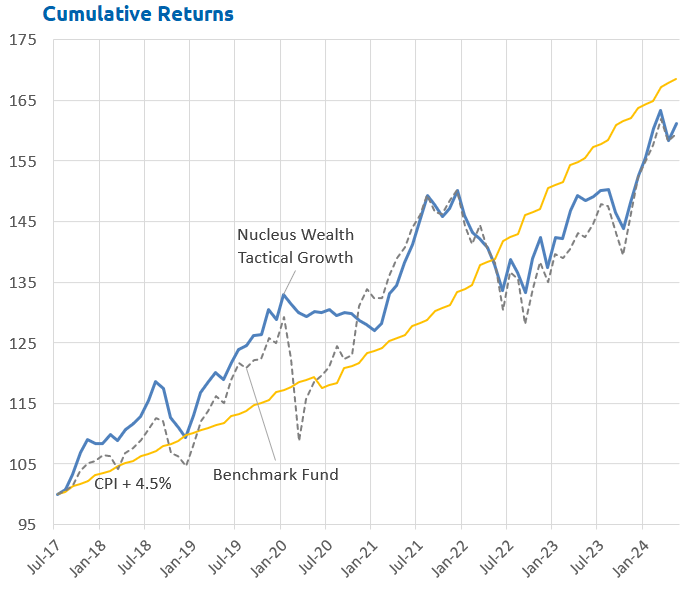

In May, the AI stocks continued to lead the charge, pushing stock markets higher. Our international portfolio outperformed given our exposure to those themes, our tactical portfolios outperformed as international stocks rose considerably more than Australia stocks.

Are we headed for Tech Boom 2.0?

There are considerable parallels between the tech boom in the early 2000s and the AI boom of the last year.

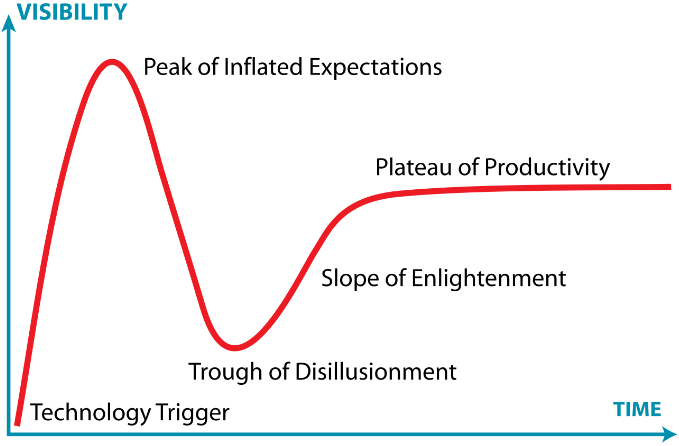

The hype cycle

The Gartner Hype Cycle (above) is a model often used to describe new technological changes. It starts with a ‘Technology Trigger,’ leading to a ‘Peak of Inflated Expectations.’ At this stage, everyone believes the new tech will be revolutionary. At some point, the peak falls, followed by the ‘Trough of Disillusionment,’ where reality falls short of expectations. Finally, it progresses to the ‘Slope of Enlightenment,’ with genuine productivity gains.

The internet followed the hype cycle

Consider the early internet boom. I’ll use online banking as an example. Initial excitement surrounded the first browsers and the ability to share images and text easily. This led to a huge boom. Online banking services expanded rapidly. However, the expected productivity gains weren’t immediate – consumers took time to trust online banking. Features often didn’t work, leading you to go to a bank and speak to a teller. It took time to connect via a dial-up modem, which operated slowly. Banks, in many instances, were adding IT staff to write the new programs but couldn’t yet meaningfully cut back on branches. Disillusionment. Finally, as online banking became mainstream over time, the actual benefits became apparent. Tasks like banking that once required a physical presence could now be done online, saving time and effort.

And share prices followed a similar path.

Artificial Intelligence will likely also follow the hype cycle

There is a reasonable case to be made that we are still climbing the first peak. There is a potential for disillusionment, but it is probably some time away.

AI has significant potential but isn’t fully meeting its intended purposes now. You can see progress. In certain areas, AI achieves 80-90% efficiency. Humans can easily accomplish the remaining tasks, yielding productivity gains in fields like marketing or legal work.

However, reaching the final 10-20% is critical for full functionality. Self-driving cars, for instance, show great promise but require near-perfect performance before production use.

For the internet, it took time to build the tools.

In the early days of the internet, capital expenditures focused on connectivity, browsers, and infrastructure. These building blocks were needed to create the next leg of growth.

Waiting for an image to load line by line on a dial-up modem was frustrating. Building faster internet connections on their own didn’t create productivity gains. It was the application of faster internet to replace offline tasks that drove the productivity gains.

For AI, the tools are still being built.

So, what does this mean for AI and technology? We see huge potential but limited current benefits, similar to the internet in 1999. Increased capital expenditure is aimed at enabling the next growth phase.

In the AI space, the emphasis is on computational power. Data centres are proliferating globally.

For both, the productivity gains were/are broad-based

The internet delivered widespread productivity gains across almost every sector. It reduced communication costs and friction, enabling efficiency.

Similarly, AI promises benefits across various industries. AI can reduce staff, minimise errors, and uncover patterns in data. The full impact of AI will unfold gradually. Emergent properties will develop over time rather than providing instant benefits. Every industry will find unique applications, leading to widespread, long-term advantages.

However, for many companies, initially, it will likely be a cost and a negative impact on profitability. Eventually, they will reap the benefits.

The government impact will be greater this time

Government spending did increase but did not lead the business side in the internet boom. This time will be different. Militaries are acutely aware of AI’s potential. Speculation surrounds AI-driven operations, from drones to other advanced weapons. There’s a pressing need not to fall behind strategic competitors. This urgency pushes investment in AI capabilities. They may not know exactly what they need, but they are recognising the importance of being prepared.

This fear of missing out propels both companies and governments toward significant AI spending. They might start with data centers, anticipating the need for computing power even before defining specific applications. Yet more fuel for a boom.

Stock winners and losers

From a stock market perspective, simply mentioning the internet spiked share prices. AI is already showing signs of doing the same.

There will be companies that are just leveraging the AI buzz without substantial value. Many of these companies will see their share prices soar and then crash, much like we saw during the tech boom. If you want to invest in this high-risk space, be prepared for volatility. When the music stops, these investments can fall apart quickly.

There is a clear divide between the new economy and the old economy. During the tech boom, old economy stocks experienced poor price gains, particularly in Australia, which has many old economy stocks. In contrast, new economy stocks saw significant valuation increases. This creates a market of “Haves” and “Have Nots,” with highly valued stocks and those that are not.

Funding similarities

We may be witnessing an equity-based boom rather than a debt-based boom. These booms tend to be a healthier type of business cycle. If we are to have booms and busts, it’s far less damaging for the economy if the boom is equity-based rather than a debt-based like the 2007 financial crisis. More on the macro another time.

Job losses

While there are concerns that AI could lead to job losses in the long term, there is a preliminary phase where job creation from capital expenditure exceeds job losses. For example, supermarkets investing in automated scanners will reduce the need for cashiers in the future. However, they are still in the phase of implementing these technologies. The tech is close, but not quite ready. Cameras, technology, and programming improvements are needed.

This is similar to the internet boom.

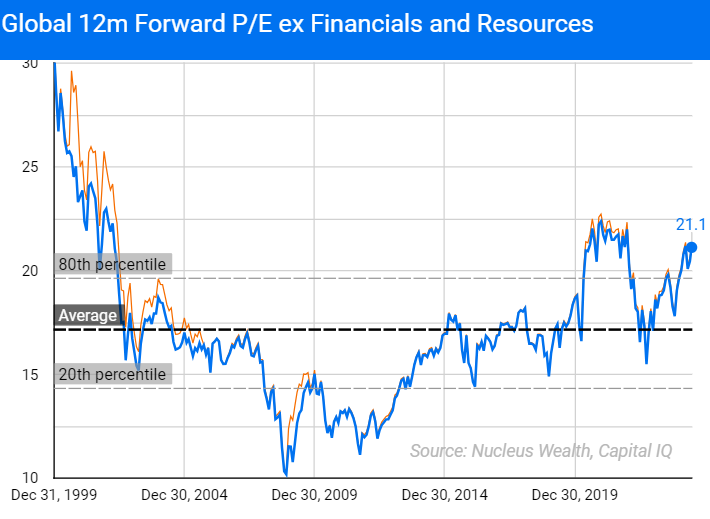

Valuations: how high can they go

The 1999-2000 Tech boom witnessed extreme valuation increases, unlike anything before. When considering whether valuations could reach those same levels again, it’s important to note the extremity of that period.

If markets went to similar valuations there is roughly a 50% upside purely from valuations. If we see more earnings growth, and we haven’t seen much in recent years, you can add another 20-50%.

In the internet boom, pricing got really, really crazy. But even if valuations went halfway to those historic levels, there’s lots of room to run on the valuation front.

Behavioural investing

Now, what does this mean for investors? Imagine you’re in 1999 with foresight, but not perfect foresight. You can’t time the market perfectly, but you have a broad view that there will be a boom and bust. Should you sit out the entire boom, expecting prices to drop in a few years, or try to navigate the edges?

If you are going to invest, don’t let initial wins get you overly excited to invest significantly more at the wrong point in the cycle. Plenty of investors in bubbles see $1 turn into $10 and then add another $40. The market only has to fall 20% to wipe out all the earlier profits.

If you are considering making a bet on this, remember to act early. Don’t expect to exit at the market peak. If there is a bubble, as profits accrue, strategically pull out your money throughout.

Investment outlook

Is a boom guaranteed? No, but the setup is promising. The macroeconomic and technological environments are similar to the late 1990s tech boom. Current stock market actions resemble that period, and there is room for valuations to grow.

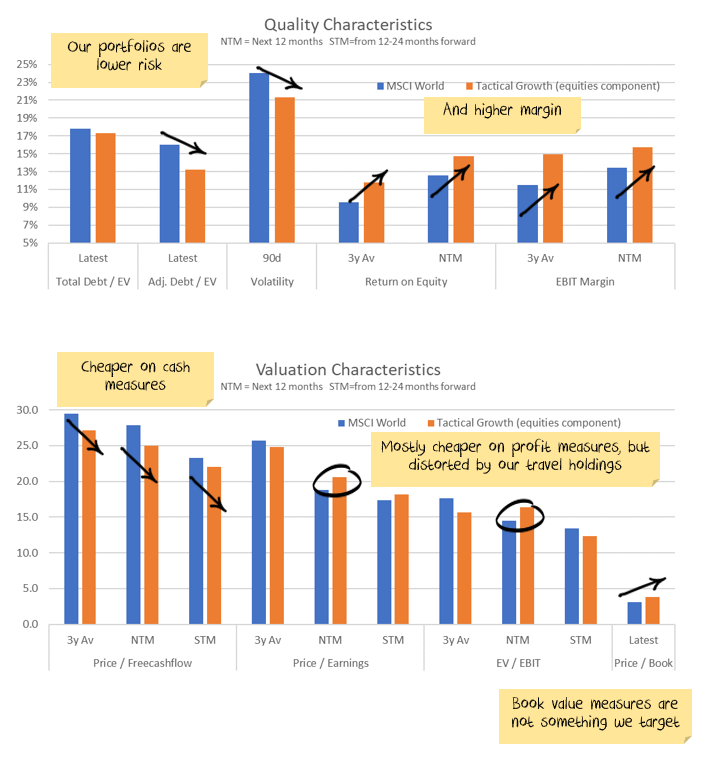

We still believe maintaining a reasonable equity exposure is important. Specifically, consider international markets versus Australian markets. We’re focused on themes already present in our portfolio but aim to gain more exposure over time.

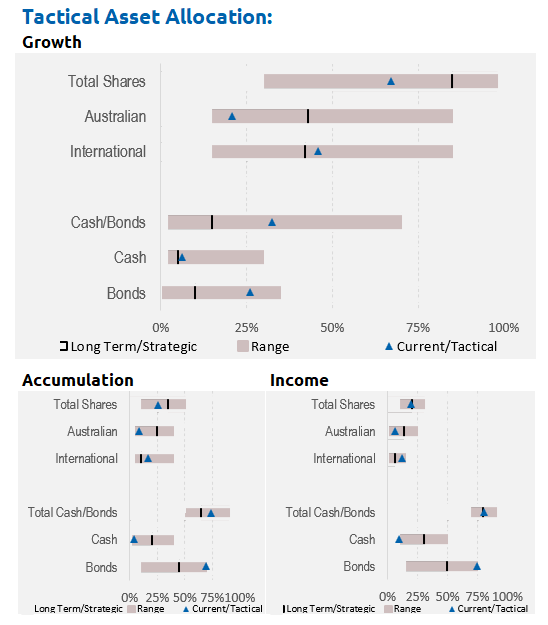

Asset allocation

After being very expensive for a number of years, stock markets briefly touched off average value before becoming expensive again. However, debt levels are extremely high. Earnings have been going backwards, and seem overly optimistic in 2024.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Energy prices could jump higher, increasing inflation. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might decide again to supercharge property investment.

We are underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more affected by interest rates and less affected by an AI boom:

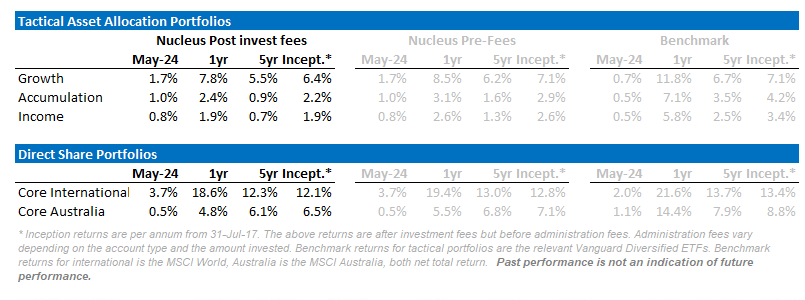

Performance Detail

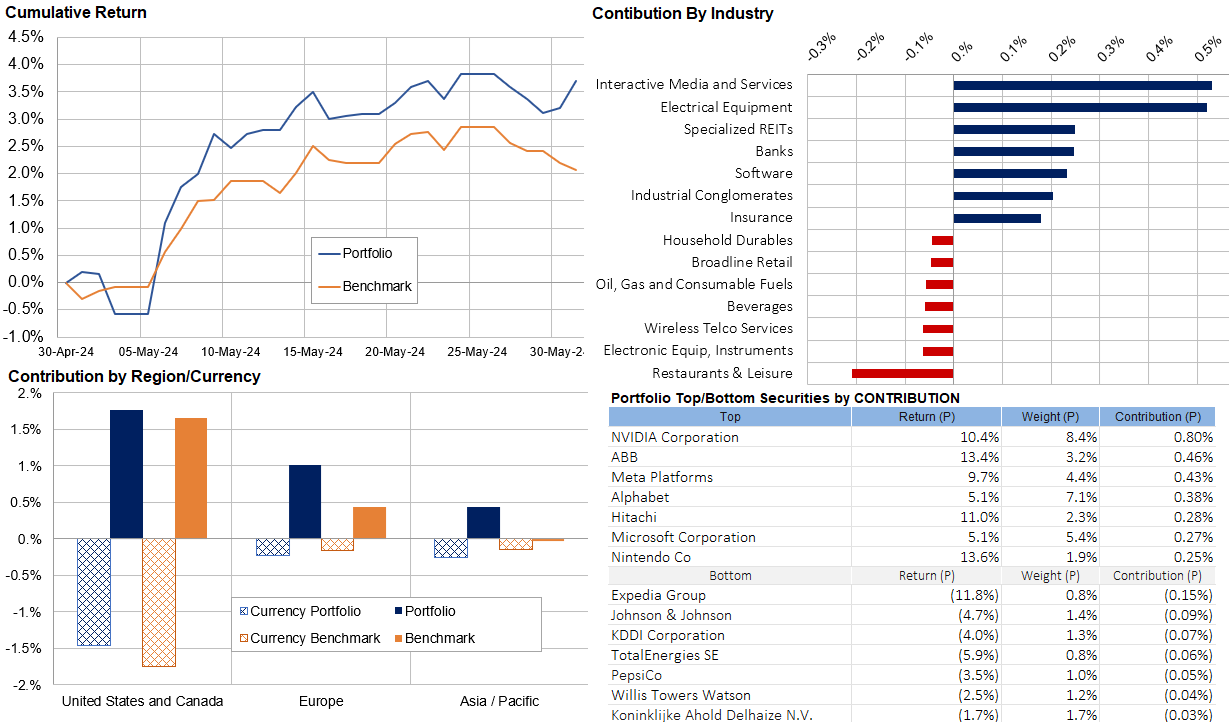

Core International Performance

The rally was back on in May with Internet and electronic stocks surging as defensive exposures fell back after their month in the sun. Our European stocks outperformed their benchmarks while our US portfolio got a boost from our new Nvidia exposure. Overall currency proved a minor drag across all markets.

.

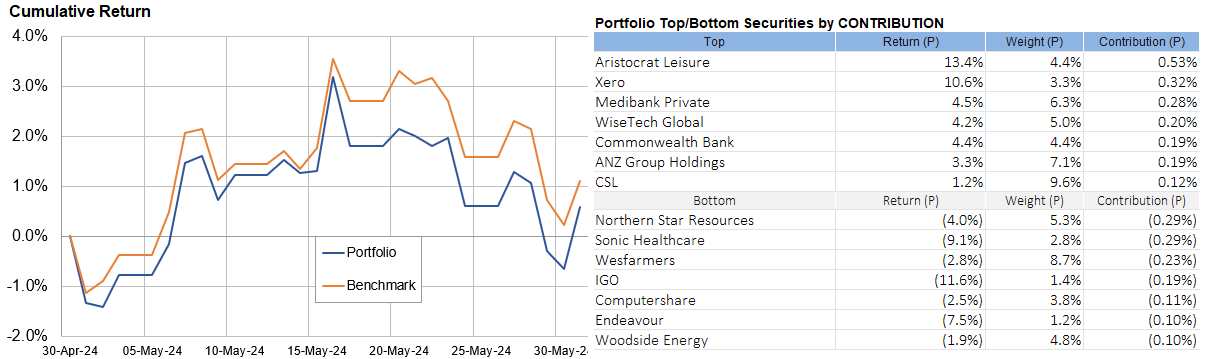

Core Australia Performance

Australian equities staged a more modest rally over May with Technology gains offset by weakness in the Mining and Energy stocks. We upweighted our Bank stocks at the expense of gold stocks toward the end of the month.

Portfolio Yields

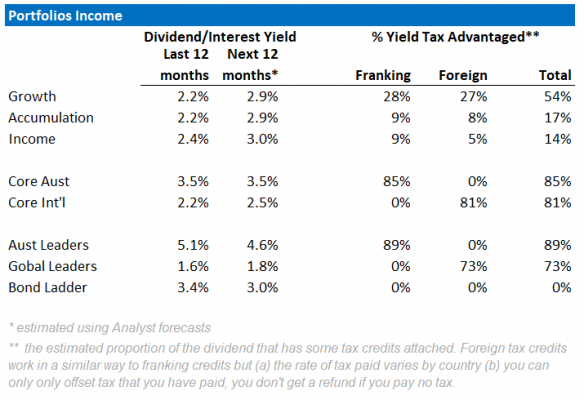

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.