October saw investment returns for equity markets higher yet again, the bigger story was a reversal in the bond market. Our tactical investment funds have performed better than most superannuation and investment funds over the year. In October the funds gave back some of the lead we have built up. Outperformance in our international fund helped to pare bond losses.

In our portfolios, we are positioned for adverse outcomes, which means we tend to lag the market on strong up months and then make back the returns in weaker months:

Assets are priced for perfection, and we are expecting conditions to be far from perfect:

- corporate earnings are weak globally,

- inflation is almost nonexistent,

- central banks know that they are out of ammunition and are begging governments to borrow,

- largely governments are ignoring these central banks.

Buy high, sell higher?

Perversely, sometimes buying stocks on an expensive valuation is a good strategy. I am going to argue that this is not one of those times.

The price/earnings ratio is a commonly used valuation metric which compares expected earnings to the price. Simplistically, when this number is high, the market is expensive, when this number is low, it is cheap. In the US, the price/earnings ratio has averaged a little over 15x over the last 15 years.

You would think a profitable strategy would be to:

- Buy the US market when the price/earnings ratio was below average (i.e. cheap)

- Sell when it was above 15x (i.e. expensive)

But that has not been the case.

The reason why is that earnings growth is a great leveller of valuations. Say you bought the US market at 19x earnings (i.e. looking very expensive) in 2003. Two years later prices had increased to be up a further 14%. But, buoyed by a housing boom, the denominator of the price/earnings equation had boomed: 40%+ higher. The US price/earnings ratio was back to its average.

Rational Optimism or Irrational Exuberance?

While the above chart looks like the market always gets it right, you don’t have to stray too far to find counterexamples. Five years earlier, during the tech boom, buying on a high price/earnings multiple was a surefire way to lose money.

With the price/earnings ratio back above 18x, is this:

- Investors bidding prices up in front of another earnings boom?

- Or is it a sign prices have run in front of fundamentals?

In 2003 the US was recovering from the tech wreck, spurred on by loose monetary policy and a nascent housing boom. In 2009 the market was recovering from the financial crisis, just about to post a 30%+ increase in profits. In 2017 Trump tax cuts were just about to turbo-charge profits.

It is much harder now to find the reason for profits to boom from here. Most investors arguing for rational optimism point to:

1. Trade war resolution

Some say a trade war resolution will spur earnings growth. I would argue:

- resolution is uncertain

- the deal that is being currently negotiated is only a preliminary version with little meaningful changes

- the preliminary agreement has little that will spur earnings

- given the problems getting a preliminary deal over the line, the larger deal is a long (long) way away from being resolved

2. Central bank support

The other core argument is central banks have moved from tightening to loosening, which will turn economic conditions positive.

I have sympathy for this argument eventually, but not yet. In the meantime:

- each successive round of easing has less and less of an effect on the economy

- the amount of central bank loosening is still relatively limited

- it is likely economies will need to get worse before central banks act more decisively

For my part, it is too early to invest based on central bank support.

3. The goldilocks zone

A different argument notes that stocks are in a goldilocks zone – enough growth to keep profit strong, not so much growth that central banks need to raise rates.

Inflation, in particular, wage inflation, remains low. This means costs will remain constrained, which is good for profit margins.

There is plenty of truth in this argument. The more important question is how much do you want to pay for stocks in the goldilocks zone given:

- being in the goldilocks zone helps keep profits grinding high, but it isn’t a reason for earnings to rocket higher

- there is a risk that stocks leave the goldilocks zone

I’m arguing that stocks in the goldilocks zone are attractive – just not so attractive that I’m prepared to pay the same price the market usually pays just before a massive earnings boom.

So where does an asset allocator turn?

If the increase in valuations is a rational response by markets to improved economic conditions, then we should be buying stocks. We don’t think it is.

Another argument is that there is no alternative. Stocks are expensive, but so is everything else. This is partly true. Bonds are expensive, but cash is always fair value. We are also of the view that Australian bonds have room to become more expensive.

Stagnant growth is going to be on the menu until we see governments spending money. And probably “helicopter” money. Given the current state of economics, that will probably take a sizeable economic crisis. Until then, we expect more of the same – slow growth and a grind lower.

The low yields present an asset allocation quandary. I was hoping that by this stage, we would have seen more reasonable equity prices, allowing us to switch out of our bonds and into equities. But equities are looking expensive. Not irrationally expensive, but certainly more costly than we would have thought given the uncertain and low growth outlook. So we are now holding lots of cash, looking for the right opportunity.

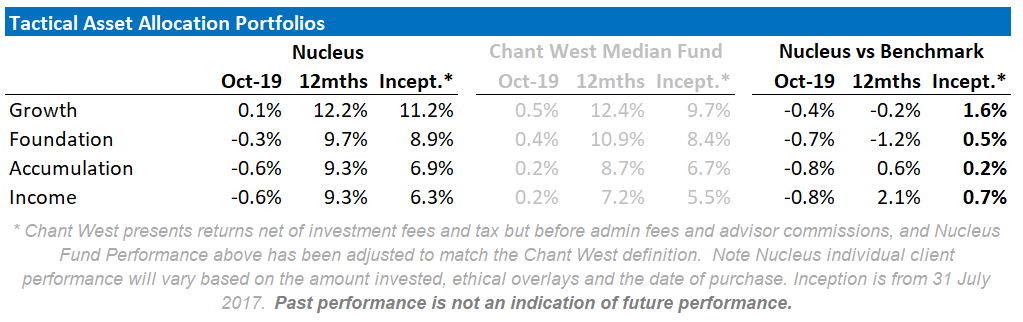

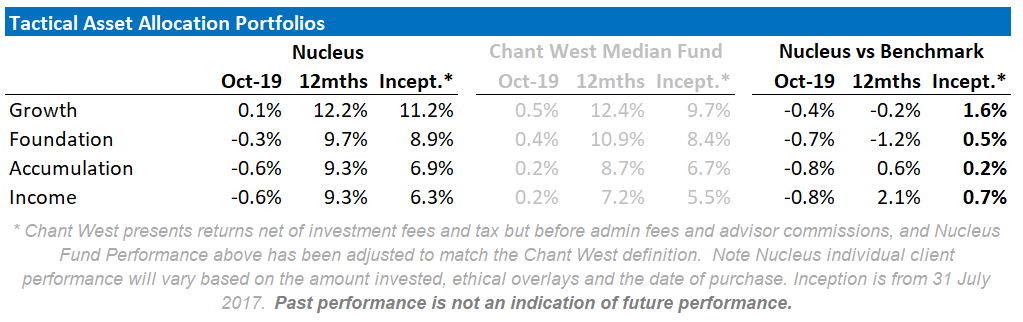

October Performance

We are comfortable with the view that the defensive position is warranted. If markets shoot higher, then we will underperform, but we think the trade-off is justified. Downside protection is more important at this point in the cycle than chasing stock markets higher.

Investment Outlook

Australian shares are still considerably more expensive than most international comparisons with weaker growth expected. We retain large cash and bond balances to hedge against volatility and with the expectation capital protection will be necessary for the next few months.

Our key focus is on:

- Chinese growth, gauging the extent of the slow down and the policy response to the trade war

- Trying to work out how sustainable the effect of the Australian election will be on house prices

- Gauging the damage that a Boris Johnson led Brexit might cause