In October, global markets continued to add to their performance, aided now by a falling Australian dollar. The Australian market finished down 1.5%.

Following the US election, we look at the key elements and impacts of Trump’s agenda.

Key Policies of Trump 2.0

Tax cuts, tighter border control, deregulation and tariffs. It’s clear why this agenda appeals to Americans. Protecting industries and providing tax cuts sounds attractive.

Many policies will be economically favourable in the short term. However, they will likely have negative long-term consequences. Stock markets will worry about the long-term later. Bond markets are starting to show concern.

Dancing close to the cliff

Experimentation, or breaking norms and conventions, can be a good thing. The danger with Trump is that he likes to push things as far as possible. The rule of law is the key concern.

A secondary concern is crony capitalism. Markets are already showing signs of favouritism in the US. Companies with good relationships with Trump, like Tesla, are expected to receive government support and tax cuts. Meanwhile, companies that have censored or criticised Trump, such as Meta or Amazon, may see targeted lawsuits, legislation or anti-trust actions. This might limit growth a little at the margin. Pushed too far, and the danger snowballs. Hong Kong used to be the premier financial market in Asia. Earlier this year, the Hang Seng Index was lower than when it was handed over to China in 1997. There are consequences for pushing too far.

Inflation bifurcation

Stronger US inflation will meet a wave of deflation from China. Notably, inflation in services will contend with deflation in goods.

US inflation pressures arise from tariffs and a tighter labour market as immigration is reduced. Add to that increased company profits, larger deficits, and more tax cuts. The one saving grace? Mostly, these benefit the richest and thus contribute less to demand than a broader-based tax cut would.

On the deflation front, China is already undergoing deflation. With increased US tariffs, China’s response to US tariffs is likely to include a currency devaluation. Chinese goods exports will see a one-off jump from tariffs in the US and then will return to deflation. The rest of the world (without tariffs) will only see goods deflation out of China.

Non-US markets can expect China to try to divert more exports, probably using lower prices. Add to that falling energy and commodity prices, driven by:

- weaker economic growth in China.

- increased US energy production.

- the potential lifting of Russian oil export bans.

China

China is already facing immense challenges with over-investment leading to deflationary pressures. Tariffs are not going to help. Trump’s cabinet looks to be full of China hawks.

The Chinese government may adopt aggressive measures, such as large interest rate cuts, to oppose this downturn. The currency is likely to decline. Additionally, China’s strategies might include geopolitical maneuvering. Given the new legal allowances for foreign gifts, this could influence President Trump through questionable means. However, that is a risk case rather than a base case.

China’s internal economic efforts currently are inflating asset prices instead of real growth. A potential $1 trillion stimulus that might marginally address structural issues is speculated.

Commodity prices keep trying to rally, effectively assuming that things are so bad that they are good. For example, China will be forced to try to re-ignite a property building boom. We continue to think this is unlikely.

Deregulation

Regulation is a common good that imposes costs on companies and, eventually, consumers. In return, safety for employees, customers or environmental benefits accrue to society. Finding the right balance is important; under-regulation is dangerous, and over-regulation creates unnecessary costs.

The pendulum is about to swing to deregulation. Voters will decide if the social trade-off between costs and safety is appropriate. But, it will be positive for company profits.

Geopolitics

Russia/Ukraine: Peace looks to be the base case, despite questions about what will be given up. With peace, Russian commodities re-enter world markets. This will drive energy prices down.

China/Taiwan: China may be looking to distract its population from weak economic growth. Trump is probably more likely to do a deal on Taiwan than any future US president. This is a key yet unlikely risk to monitor.

China Tariff Retaliation: Probably limited. Last time, China crafted retaliatory tariffs to target Trump’s rural and manufacturing political base. Europe’s economy, already fragile, faces heightened competition from Chinese electric vehicles. This threatens Europe’s automotive industry—a cornerstone of its economic structure. Could this escalate into competing tariffs? Maybe. Competitive currency devaluation and rate cuts across major economies are more likely.

Australian impact

The outlook for the Australian dollar is grim. It’s likely to drop significantly due to factors like a strong US dollar and growth, as well as yield spreads. The Reserve Bank of Australia might be forced to implement rate cuts as China continues to struggle. Bulk commodities are oversupplied. All they need is a push, likely coming in 2025. Even with a short-term boost from China, it won’t last. If China faces economic turmoil and moves towards Taiwan, the impact on Australia could be severe.

Higher inflation forever?

Politicians love to imitate success. Will we see “domestic first” policies emerge elsewhere? Will we see rising tariffs, fiscal spending, and government deficits globally?

The balance between China’s deflationary forces and inflation from increased spending may temper inflation expectations temporarily. Yet, this might encourage governments elsewhere to spend until it becomes unsustainable.

Populism’s global rise might pose significant implications. Have populist fiscal policies driven us to the early stages of 1970s-style inflation? It is too early to be sure but not too early to be wary.

Are asset markets the limiting factor?

It is possible that asset markets will be the only meaningful regulator of Trump’s policies. A rising US dollar and interest rates are more likely to temper Trump’s instincts than political checks and balances.

Are we looking at a blow-off boom in equities into an interest rate shock? Quite probably.

Sector impacts

- Technology faces potential setbacks due to regulatory threats. Higher interest rates will also impact valuations.

- The energy sector risks price declines due to factors like Russia’s market re-entry and increased drilling.

- Healthcare remains robust, but stabilising US obesity rates might alter profitability dynamics.

- The military sector anticipates growth, driven by increased defense budgets. This is likely both in a Europe that can no longer rely on NATO and in the US.

- Interest-sensitive sectors, such as utilities, might struggle with inflation and rising rates.

- Consumer discretionary spending could rise due to tax cuts, despite tariffs complicating the outlook.

- Renewable energy stocks were hit hard. Thanks to favourable valuations, there are some investment opportunities. Additionally, tariffs will hit Chinese competitors.

Outlook

Tax reforms that reduce corporate taxes will enhance profits and drive stock market growth. If you add, say 10% to profits from tax cuts and another 10% from stimulus demand and less regulation, then the market no longer looks that expensive.

The key to watch will be rising interest rates, which will slow other sectors, such as housing.

The net effect is that Trump’s agenda will likely boost the US economy in the short term through tax cuts, government spending, deregulation and investment. Trade wars, crony capitalism and geopolitical tensions will have long-term negative effects.

Stock markets won’t care. The key question is how much bond markets will care.

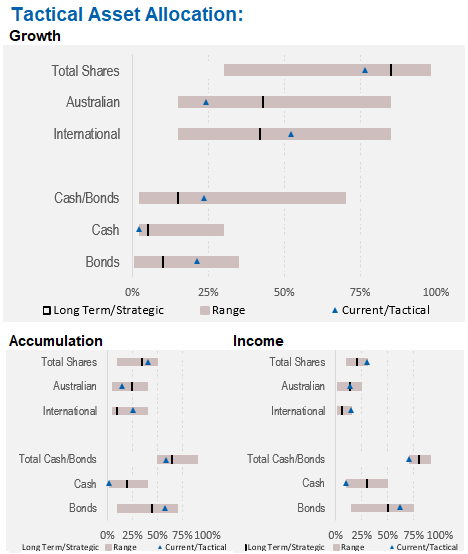

Asset allocation

Earnings growth looks to have turned positive. When you add corporate tax cuts and some margin expansion through lighter regulation and a quite expensive US market becomes merely expensive.

We are underweight Australian shares, significantly overweight international shares, with the view that the Australian market is more affected by interest rates and less affected by an AI boom:

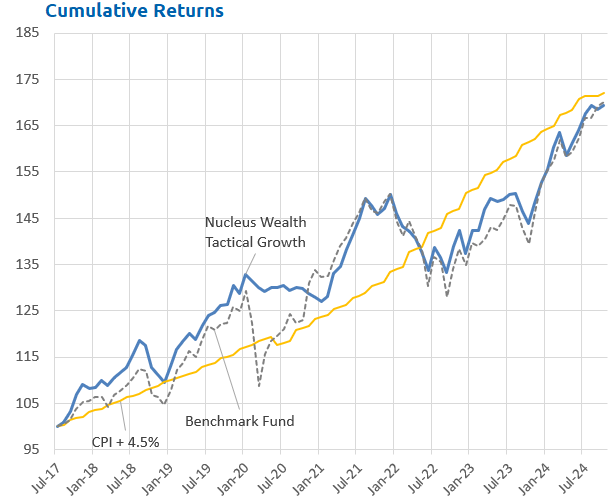

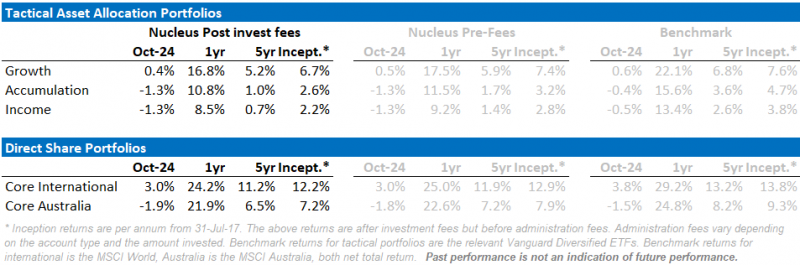

Performance Detail

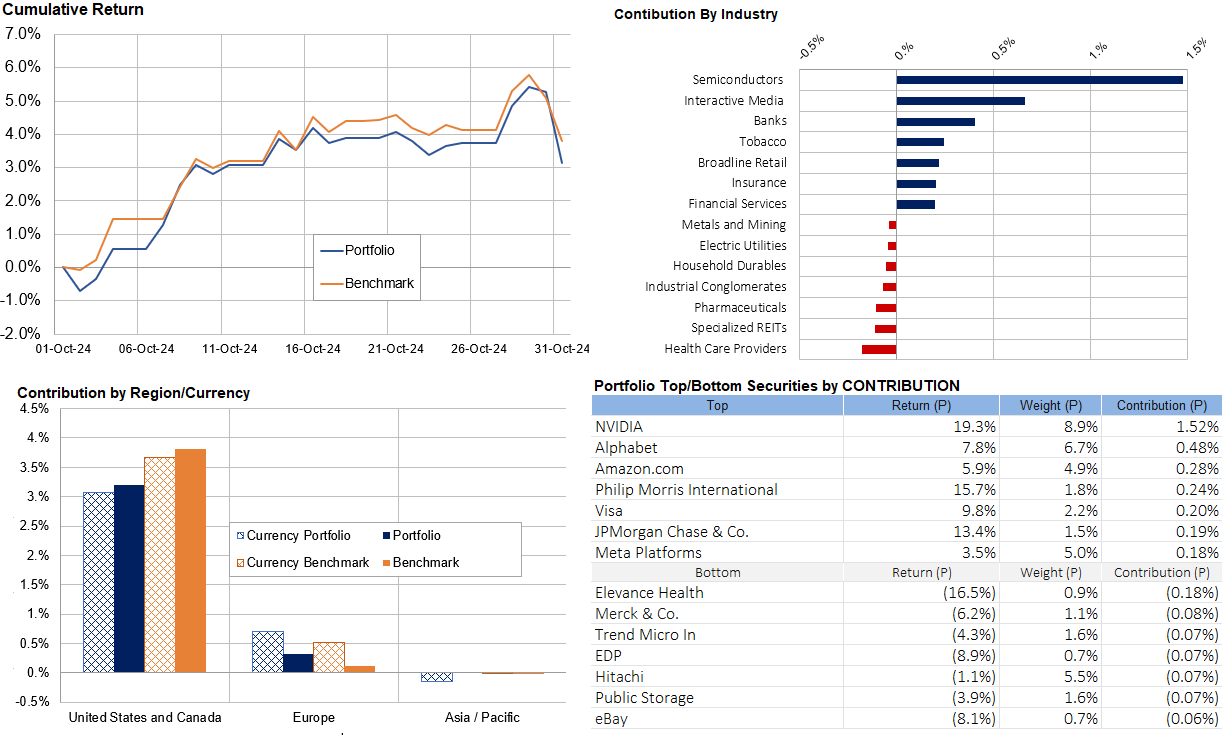

Core International Performance

October seems to show a return of the equities bull market, however in USD terms global markets were actually down. Tech continues to recover with financials also doing well, health while defensives suffered. Regionally, we outperformed in Europe but underperformed in the US. Currency proved a significant boost as the AUD deflated from last month’s surge up to 0.69. We made no major changed leading into the US elections.

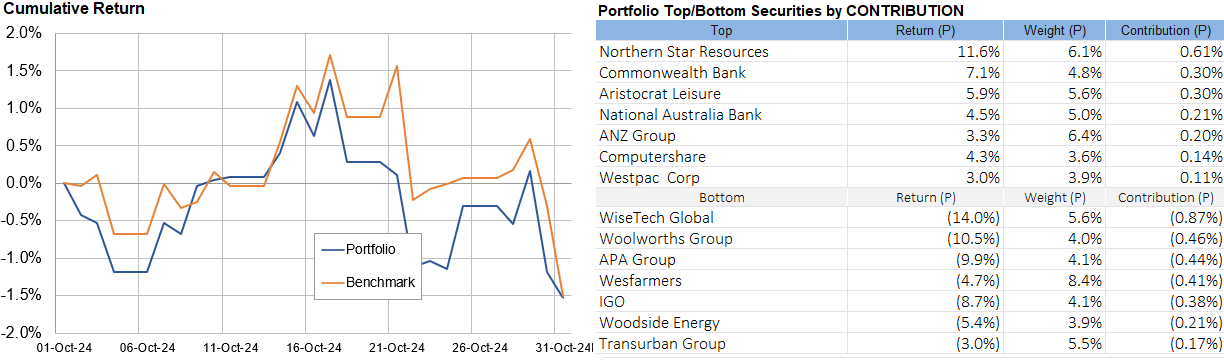

Core Australia Performance

Australian equities similarly underperformed toward the end of the month as sector rotation into commodities and away from Defensive stocks negatively affected the portfolio.

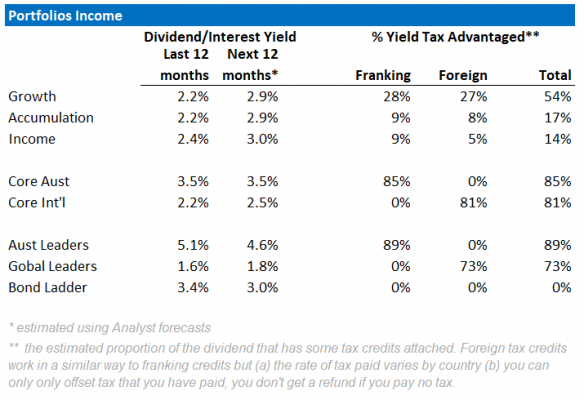

Portfolio Yields

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.