Chant West is out with its latest super fund returns:

Chant West senior investment research manager Mano Mohankumar says: “Despite a disappointing October, growth funds still have a good chance of finishing in positive territory for the seventh consecutive calendar year. However, this year’s return is certain to be well below the 10% average of the previous six years. But members need to remember that an average of 10% is not normal. Growth funds are typically constructed to beat inflation by 3.5%, which translates to about 6% per annum over the long term.

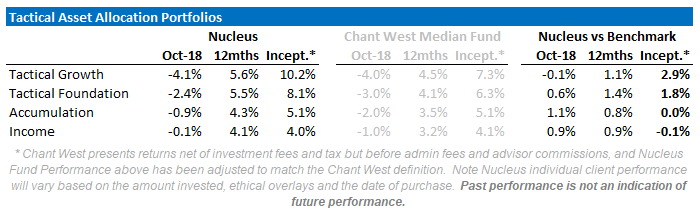

Our funds continue to stack up well against the median fund with our Flagship Tactical Growth outperforming by almost 3% since inception:

While we don’t know the current asset allocation of most of these funds as they are not transparent, we believe that currently we are significantly more overweight bonds and international shares than the typical fund.

Our take is that the average fund is too overweight Australian shares, too ready to believe that the RBA will be raising rates next year into a housing crash, and has too little exposure to a falling Australian dollar.

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.