1.2 Outline briefly the key dates and events in relation to the “corporate” history of your investment management organisation (i.e. date founded, changes in capital structure, mergers/acquisitions, etc.) using a time-line format.

- Nov 2016 – Established funds management business

- July 2017 – First client funds invested

- July 2019 – Began operating under own AFSL (formerly corporate authorised representative of Integrity Private Wealth)

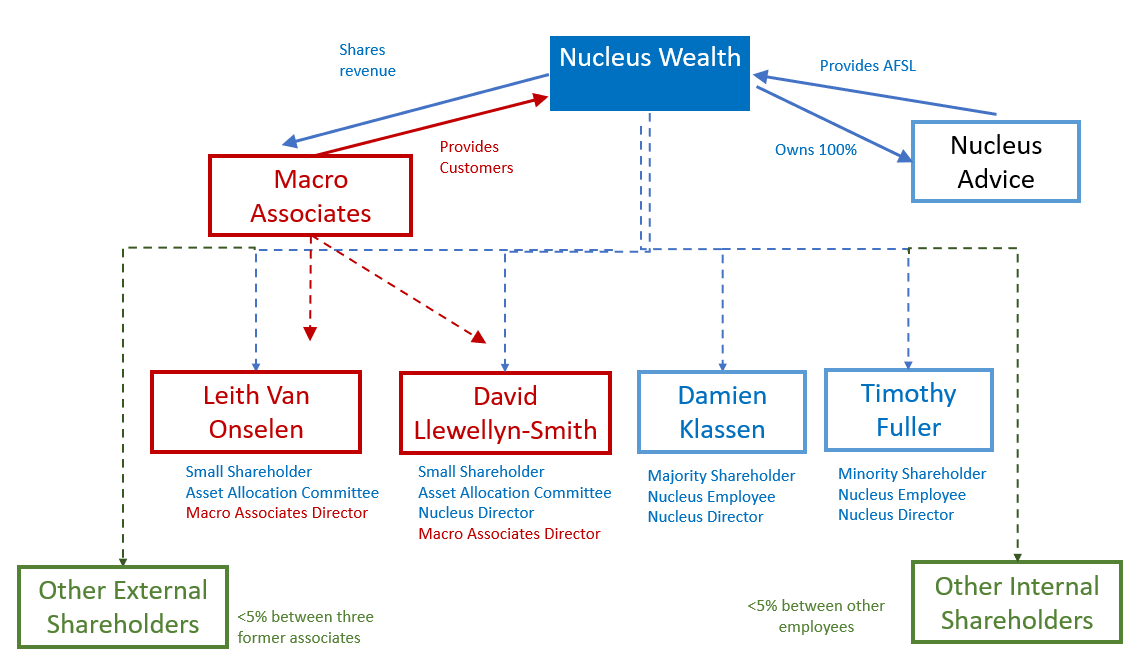

1.3 Provide an organisation chart showing the ownership structure of the investment management organisation and subsidiaries of the parent company. Also show the proportion (%) owned by principals of the company, other financial organisations (include names) and outside individual shareholders.

Nucleus is majority owned by Damien Klassen.

Macro Associates was the initial source of customers. Two principals of Macro Associates sit on the asset allocation committee, are equity holders, and David Llewellyn-Smith is a director of Nucleus.

Principles own 96% of Nucleus.

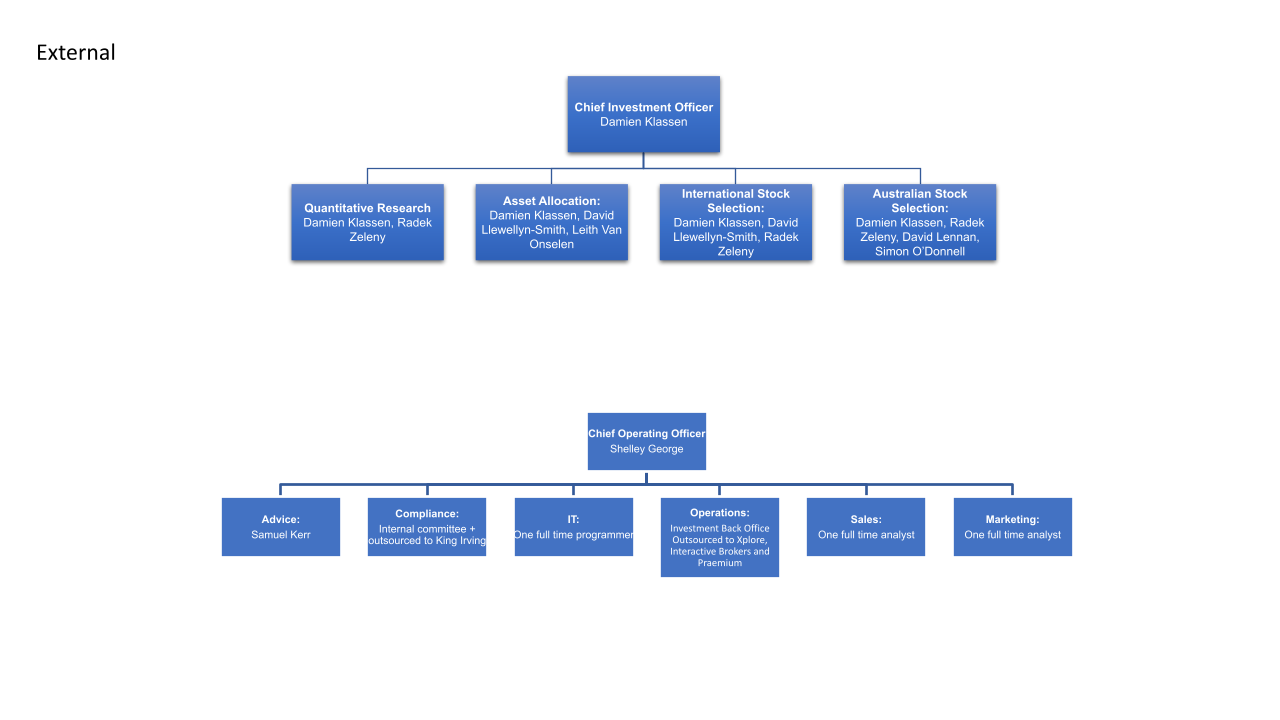

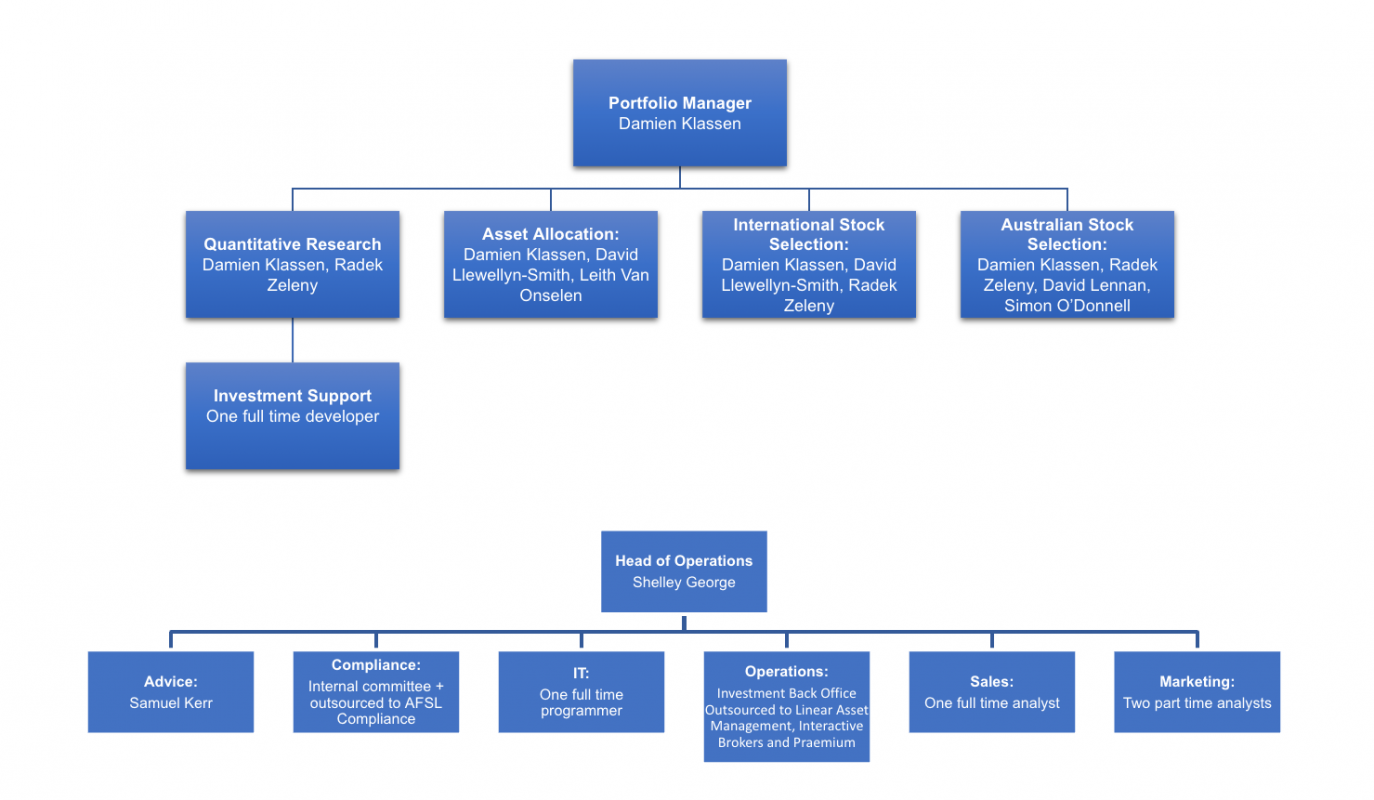

1.4 Please state the number of staff and how many are investment professionals.

Nucleus employs twelve staff members directly. Four are investment professionals, two are data scientists / software engineers who help with the quantitative aspects. In addition, there are two investment professionals from Integrity who sit on stock selection committees.

1.5 Please outline any key staff turnover in the past 2 years of both senior executive and senior investment staff.

In August 2021, Timothy Fuller left the business.

1.6 List any companies shown in the above organisation chart that have been rated by a debt-rating agency. Specify the rating achieved and the name of the rating issuer.

N/A.

1.7 State the business targets that are set for the investment management organisation and briefly describe the strategies that will be used to achieve those targets.

Nucleus Wealth is looking to grow through three different channels:

- Direct: These are investors who invest directly with us using nucleuswealth.com. We derive customers from blogging, podcasts and direct online marketing. Nucleus has over 600 direct investors with accounts. This is our primary source of growth.

- Intermediary: These are investors who invest with us via a financial advisor or accountant. We have a small number of these who have invested already, and a wider range of these customers ready to invest subject to being added to an approved product list. We expect these clients to provide an increasing amount of our FUM over the medium term.

- Institutional: These are large funds investing directly or after advice from asset consultants.

1.8 What support does the Parent provide in terms of financial, technical, systems integration or personnel?

None.

1.9 If applicable, outline any Parent guarantees or limited liability agreements with the Manager.

None

1.10 Approximately what proportion of your Parent company’s revenue is generated by your investment management organisation?

N/A

1.11 List any organisations with which you have formal affiliations and provide a brief overview of the nature of each affiliation.

Nucleus pays Macro Associates to be the exclusive portfolio provider on macrobusiness.com.au and has employed two principles of Macro Associates as part of its asset allocation committee. David Llewellyn-Smith from Macro Associates is a director of Nucleus.

1.12 List any investment and investment related service providers (e.g. custody, settlement, IT, compliance, administration, customer service) to the organisation and provide a brief overview of each service.

S&P Capital IQ is the key data provider. Data is received electronically and loaded into Nucleus web servers. Amazon Web Services provides hosting for Nucleus web servers. Google and Hubspot provide customer service software. Praemium, Interactive Brokers and XploreWealth provide the investment platform.

1.13 List any products that are closed to new business. Where possible, it would be helpful if you could also list those products that may be closed over the next year.

N/A

1.14 Which investor groups does your company primarily target?

Retail and superannuation investors.

1.15 What are the major factors affecting the change in your market share over the past five years?

N/A.

1.16 What are your capacity targets as a funds management business? Please state for each key strategy offered.

All of our asset allocation funds invest in a broad portfolio of large capitalisation stocks and government bonds, and so there are no capacity constraints in the foreseeable future. Generally, each stock is less than 1% of the portfolio and greater than $20b in market cap. Even if the fund were $50b in size, it is unlikely to own more than 5% of any individual stock. For our Australian large cap strategy we estimate the capacity to be more than $10b.

1.17 Please outline your approach to taxation management and the reporting and provision of after tax returns, if applicable.

As the model portfolios are implemented in a transparent tax environment (an absolute entitlement trust) we would not generally manage individual tax positions as all clients would have different tax positions dependant on when their portfolio shares was purchased.

Portfolio Manager Buy/Sell decisions may be influenced by the unrealised tax liability/asset for our model portfolio for a typical Australian investor provided that this influence does not create additional risks, while being mindful that any trading may affect different clients differently. For example a trade may be delayed if the trade is not urgent and the delay would result in typical Australian investor receiving a capital gains discount. Individual client positions will differ.

1.18 Provide a complete organisational chart for your investment management business (including investment management, sales/marketing, administration and compliance) and give a brief description of the “key” reporting lines. Include reference to overseas investment management offices and staff.

1.18 Please supply biographies for each of the investment personnel in word format as an Appendix.

See appendix

1.19 How is performance of members of the investment team assessed? Please explain the remuneration scheme for key people, particularly the bonus structure and the manager’s share of the performance fee. Please provide detail on equity ownership of senior key staff.

Performance of the investment committees and the portfolio manager is assessed with reference to the underlying indices.

Stock investment performance is assessed based on the performance of stocks selected relative to the stocks in the universe. Consideration is taken of sector and thematic issues which are hard to forecast or beyond the control of the analyst – for example oil & gas stocks are assessed on stock selection and identification of high quality stocks within the oil and gas sector, not on movements of the oil price.

As we are in start-up phase, key staff are being rewarded with a mix of equity and salary.

All senior staff are equity holders.

1.20 Outline your Board compensation policies.

In the start-up phase, the board of Nucleus is rewarded through shareholding incentive schemes

1.21 Outline your approach to succession planning in regards to the Board and the investment team. Indicate the back-up person for key business and investment management positions.

Damien Klassen is backed up by a combination of David Llewellyn-Smith, and Radek Zeleny. The quant basis of the portfolio also lends itself to a smooth continuity of business should a disruption occur with respect to Damien.

Shelley George’s back up is a mix of Damien Klassen, and Aileen Chong.

Section 2.20 contains the backup information for key investment management positions.

1.22 Please supply, as an attachment, your Parent’s and your firm’s most recent Annual Report.

See attached.

2.2 Does the company have a dedicated compliance officer?

No. See section 2.3 below.

2.3 How is compliance structured within your organisation?

Nucleus manages internal compliance through its own board and in association with external parties. This arrangement includes support from external experts King Irving, who oversees the process.

2.4 Is there a written Compliance Manual?

Yes

2.5 Provide details of your license(s) to manage funds under the Corporations Law. This should include details of how you will operate under MIA (e.g. independent directors, Compliance Committee, Custody, Capital, Capital Adequacy, Professional Indemnity Cover, Bank Guarantees, Fidelity Insurance, external audit etc.) and the nature of your membership of the Sydney Futures and Australian Stock Exchanges. If applicable, provide details of licenses held by any affiliate group in your overall organisational structure.

Nucleus Wealth is a corporate authorised representative under Nucleus Advice (AFSL 515796) who hold an AFSL.

2.6 Please list the Directors and whether they are independent: what is their relationship to the company and how often do they meet?

Damien Klassen (Chief Investment Officer at Nucleus Wealth), Shelley George (Chief Operating Officer at Nucleus Wealth), David Llewellyn-Smith (Chief Strategist at Nucleus Wealth).

2.7 Do you currently hold insurance for the Directors or Key Personnel or others?

Yes

2.8 Please state the composition of the compliance committee(s) and list the dedicated compliance personnel.

Damien Klassen, Shelley George, Radek Zeleny (Senior Investment Analyst at Nucleus Wealth) and Samuel Kerr (Senior Financial Adviser at Nucleus Wealth).

2.9 Outline your compliance policies and reporting procedures (including the process for dealing with compliance breaches). List all incidents over the last year where, as a result of a mandate compliance breach, a loss or a potential loss to a client occurred.

On becoming aware of an actual or potential breach or other significant event, the Compliance Committee member must ensure that the Compliance Committee and the Board are immediately informed of all matters that are potentially reportable to the Regulator and/or require the attention of the Compliance Committee and Board, including but not limited to:

- Any actual or suspected significant adverse event(s)

- An incident that has had, or is likely to have, individually or collectively with other breaches, a material adverse effect on members’ interests or a material effect on the operations of the Licensee (ASIC Regulatory Guide 104).

The responsible officer in charge of the function where the significant event has occurred completes an event report on the Register. The Register is provided to the Compliance Committee who monitors progress and keeps the Board informed.

The Compliance Committee ensures the matter is recorded in the Register.

Notification to Fund Members

The company has a duty of care to maintain continuous disclosure to members and to notify them of any material changes or significant events that may adversely affect their interests in the fund and/or affect their investment decisions.

Notification may precede an investigation and confirmation of the event. The Compliance Committee will be responsible for investigating all reported adverse events (including potential breaches of the law).

The company has a duty to notify fund investors of material changes or significant events. It is possible that a material change or significant event will not be a breach of the financial services laws and therefore not be covered by the general obligation to report breaches to ASIC.

Significant events that are not otherwise breaches of the law that need to be reported to investors might include:

- Appointment of a receiver, manager, liquidator or administrator

- An event or change which could have a definitive effect on the future prospects of market values

- A major decrease or increase in the value of scheme property

- A change in control of the Responsible Entity

- An acquisition of significant assets

- A large asset re-evaluation

- Some systemic issues (i.e. identification of poor disclosure or communications, administrative or technical errors, product flaws and improper interpretation or application of standard terms might adversely affect members’ interests)

- Major changes in the prospects of the company

There are no incidents over the last year where, as a result of a mandate compliance breach, a loss or a potential loss to a client occurred

2.10 Detail the process for external audit/compliance reviews (e.g. unit pricing, valuation, allocation of trades).

Our external compliance resource oversees our investment activities including monitoring the models for compliance with investment and trading parameters

2.11 Outline your risk management approach or philosophy. Describe how risk is managed within your organisation; include your approach to legal, operational, reputational and business risks.

Nucleus has taken a decision to outsource most of the back-office functions to professional third parties where possible and then to monitor those relationships.

The most significant is the outsourcing of the managed account platform to Praemium Managed Accounts. Nucleus have built a system to manage client portfolios and allocate trades and use this to check any trades and account balances for clients.

Portfolio maximum/minimum asset allocation limits are monitored by two internal systems to verify asset allocation, first limitation on pre-trade instructions, and secondly a follow-up check on client portfolios.

Investment risk systems have been created internally to monitor a range of factors. See 2.15 quantitative risk management below for more. These internal systems are cross-checked with analysis run by S&P Capital IQ on our portfolios.

The Nucleus board undertakes annual reviews of all outsourced relationships.

2.12 Please provide a Derivative Risk Statement if available.

N/A

2.13 Does the firm use quantitative risk management tools? Please describe.

Yes. Nucleus uses quantitative screens to:

- Identify stocks for investment

- Track analyst recommendations and effectiveness

- Identify portfolio exposures to ensure that we are not exposed to unintended factors including:

- by country

- Sector

- Industry

- Business model (manufacturing vs intermediary vs service vs landlord)

- Brand exposure (commodity products vs high volume vs premium branding)

- Currency exposure: focussed on underlying business model and currency mismatches

- Quality factors (return on capital, margins, cash conversion, stability)

- Value factors (Earnings, cashflow, balance sheet, returns)

- In the creation of the portfolio we examine tracking error, active share and portfolio correlation.

- We have a model to suggest minimum volatility portfolio weights, but use this as a suggestion rather than the default weights.

2.14 Please describe your approach to managing liquidity.

Nucleus invests in stocks that are in the MSCI World Index.

All of the stocks in that index are large and liquid, and Nucleus runs a large portfolio so until Nucleus has USD10 billion or more we cannot see any liquidity issues arising.

Clients that decide to leave Nucleus do not have to sell and can simply take the stock.

2.15 Please describe how you manage hedging risk if applicable.

In our quantitative screens we identify companies that have a currency mismatch – for example exporters or commodity producers.

Based on the exposure to particular currencies we evaluate whether hedging is appropriate or if we are over-exposed to currency movements.

2.16 Detail the back office and front office separation policy. Are they independent?

Yes. Back office is outsourced which provides separation and independence.

2.17 Does the Board approve and review the operational risk management framework?

Yes

2.18 Who is responsible for implementing the operational risk management framework? What are the lines of responsibility across senior staff?

The portfolio manager implements the operational risk management framework in respect of investment decisions. Separately, Shelley George oversees the operational risk, and Tim Fuller the regulatory risk.

Independently, the RE and the administrator of the Praemium Managed Accounts each have separate operational risk management frameworks within which the model portfolios must operate.

2.19 Please describe your Disaster Recovery Plan with regards to computer systems, key staff, backup systems, physical presence.

Risk

|

Response

|

|

Power outage

|

Nucleus operate with cloud based systems with multiple redundancies.

Cloud partners are tier 1 operators, primarily Amazon and Google who have multiple data centres.

Nucleus staff can operate from home or alternative premises with minimal loss of productivity.

|

| Computers are stolen or erased |

Nucleus operate with cloud based systems with multiple redundancies.

All information and systems are backed up daily.

Laptops and PCs used on a daily basis have no custom software and so can be easily replaced. A register of installed software for each PC is stored in the cloud.

|

|

Disruption that incapacitates the Nucleus Office

|

Given the cloud based nature of the databases Nucleus staff can operate from home or alternative premises with minimal loss of productivity.

|

|

Damien Klassen incapacitated

|

There are a range of investment staff across the business who can (in combination) perform his role in the short term, see section 1.22.

|

|

Tim Fuller incapacitated

|

Clients can be serviced by internal Nucleus staff, see section 1.22.

|

|

Succession planning

|

The Nucleus portfolio consists of large liquid assets which have been assessed for quality and does not have high turnover

It can be managed in the short term on a static basis by internal staff until a replacement fund manager can be found.

See also, section 1.22.

|

2.20 How do you analyse and monitor counterparty risk?

Counterparty risk is considered in the context of the contracting parties with which Nucleus engage to provide services as part of our outsourcing procedures. As the provider of investment models, Nucleus does not assume any counterparty risk in respect of transactions taken on model portfolios, nor do we believe there is any counterparty risk to members over and above the RE of the Praemium Managed Accounts

2.21 What due diligence processes does the company perform prior to the appointment of a contracted service provider?

We assess (including, but not limited to): the provider’s ability to execute and deliver the service they provide, the number of years they have been in business, their financial stability, their other key clients and how long they have been with the service provider, talk to industry sources about the provider, assess key staff and personnel, perform ASIC checks, insurance checks on them

2.22 How does the company manage and monitor service level agreements for service providers if they are in place?

Annual review at board meeting

2.23 How does the company manage conflicts of interest?

Nucleus maintain a conflict of interest register, which is reviewed by the compliance committee.

2.24 Are there Anti-money Laundering (AML) procedures in place? Please provide a brief description of these.

Yes, Nucleus have outsourced the AML procedure to GreenID verification at initial client onboarding.

Praemium also have AML procedures

3.2 Explain how assets are held by your organisation. Explain the arrangements for the custody of assets.

All assets are held through either a Separately Managed Account or Managed Discretionary Account structure with the custody controlled by the Separately Managed Account or Managed Discretionary Account provider.

3.3 If assets are held in the name of a nominee company, please state the nature of the security arrangements including name of the custodian, details of any indemnities and details of audit arrangements. What indemnities are given by your organisation concerning the safe keeping of securities?

N/A

3.4 Detail the insurance carried covering securities held on a client’s behalf (e.g. cover, in particular the insurer, type and amount of insurance cover, excess applicable to each event, limitations on amount or frequency of claims and any other relevant aspects of the insurance cover).

The RE carries compulsory insurance as required under the terms of the AFSL. Nucleus also has $2.5 million PI insurance.

3.5 Do you lend securities? If so, what arrangements do you have for fee sharing with clients?

No.

3.6 What custody arrangements would normally be used where a new client does not express a preference for a particular arrangement?

All assets are held through either a Separately Managed Account or Managed Discretionary Account structure with the custody controlled by the Separately Managed Account or Managed Discretionary Account provider.

3.7 Outline your company’s policy with respect to in specie transfers into and out of pooled products.

In specie transfers are permitted for all clients. However there are limitations for superannuation clients under our current RE.

3.8 Should a client wish to terminate an agreement, what restrictions apply? Are you prepared to pass over physical securities rather than cash and what is the time delay involved? If necessary, comment separately for the various products and asset classes in your range.

There are no restrictions, in specie transfers are permitted for clients upon request.

Cash withdrawals are dependent upon normal exchange trading rules. In Australia that is T+2 days, other exchanges vary. We note that public holidays around the world may delay settlement. Typically an entire sell down for a global portfolio will be available within 1 week.

For multi-asset portfolios there is typically a cash balance which can be accessed more quickly.

3.9 What due diligence checks are performed on the custodian or any other service provider for your funds management business?

This is the responsibility of the RE. At present some of the custodians our REs use are JP Morgan Chase Bank, HSBC, ANZ Bank, Bank of NY, Northern Trust and State Street Bank.

4.2 Is any aspect of your registry, unit pricing, custody and other back office operations outsourced? If so, please state the organisations involved and the scope of the outsourcing arrangement(s).

The administrators, Praemium Managed Accounts and Interactive Brokers, are subject to the outsourcing requirements of the Responsible Entity.

4.3 Have there been any changes to service providers in the last 5 years? Please provide a brief explanation.

Our initial offering was through Linear Managed Accounts (Now Xplore Wealth) in July 2017. Following the introduction of personal superannuation accounts through Praemium Managed Accounts in September 2018, we moved all account types to Praemium in June 2019. In January 2023 we began offering investments through Managed Discretionary Accounts on Interactive Brokers for their fractional shares.

4.4 What is the frequency of pooled fund unit price calculations? If it varies from fund to fund, break down this information by fund group.

NA. Direct investment models.

4.5 Are the systems for administration developed in-house or are standard industry products used?

Nucleus uses proprietary software for the administration of investment research and client investment management. For client administration we use Hubspot in conjunction with Aircall telephony and call recording.

4.6 Describe the systems in place to measure price, monitor and report derivative exposures.

NA we are not using derivatives

4.7 Please provide an organisational diagram of the Customer Service Department.

Customer service is managed by Shelley George.

4.8 How are customers defined? Are different levels of service provided to different customer categories?

Customer service is defined as follows:

- Limited Robo advice – these clients have progressed through the online application process and needs have been addressed automatically using the system generated SOA

- Limited Personal advice – these clients have gone through the process above but opted to pay the fixed initial only fee to speak to an adviser and potentially had current cost and benefit comparisons etc. Note that this advice only extends to recommending suitable Nucleus products. For clients looking for a comparison of Nucleus products with other investments, we suggest using an independent financial advisor.

4.9 What forward planning is carried out to handle targeted growth in client numbers?

The initial client onboarding process has been designed principally to accommodate a large scale of clients – through using the efficiencies of online onboarding, AML checking and account creation we do not foresee any problems on this side.

Once the appetite for personal financial advice has been ascertained, Nucleus will create additional roles to accommodate the day to day client needs through the hiring of additional phone based general and limited personal financial advisers.

Nucleus has grown the team by 4 FTE roles in 2020 to assist with the growth of the business and to help meet client service expectations.

4.10 What technology is used to assist the customer service function? (e.g. automated call analysis, automated logging of times, document imaging and workflow systems, integrated account management systems.)

The AgileCRM system provides the ability for a client to email to contact@nucleuswealth.com which in turn is recorded against their client file, and an issue ticket is created for action by the Client Service Admin team.

Additionally, the team is available through a phone based system. All phone calls are recorded and lodged against client files.

Any additional tasks are created by the client service manager in the same system used above for tracking and completion purposes.

4.11 What is your client reporting policy including frequency and timeliness?

An annual tax report is created by the RE and administrator and accessible online generally within 3 months of the completion of the tax year.

Additionally, the RE client system will be able to create tax, trading and performance reports on command by the client at all times.

This system will be available online through the client portal, or can be requested through contact@nucleuswealth.com or on 1300 623 863.

4.12 How do you communicate with clients?

Primary communication is electronic. We run weekly webinars/podcasts and blog on our website multiple times per week.

Personal contact with customers is via email or phone.

All personal email is all initiated through our CRM which logs each email against the client record for compliance and customer service reasons.

All phone calls are recorded.

4.13 What are your standards regarding the following:

|

Process

|

Days

|

|

Number of days to process applications

|

2 days

|

|

Number of days to process redemptions

|

1 week

|

|

Number of days to respond verbally to queries or complaints

|

2 days

|

|

Number of days to provide a written response to queries or complaints

|

1 week

|

4.14 Please provide brief details of how client services personnel are provided with a required level of product and investment knowledge (i.e. induction and training programs, manuals, etc.).

All support staff are inducted by Tim Fuller and will work under his direct supervision.

There is an ‘escalation’ action within the CRM which allows support staff to direct queries and issues directly to management.

4.15 What training do customer service personnel undertake prior to the launch of a new product?

Support staff have a 1 week induction process in which all aspects of the Nucleus Wealth product suite will be demonstrated to ensure that they are competent in the role they are to perform before becoming active.

4.16 What information is provided to clients (e.g. technical, economic, investment, performance, and asset allocation)?

Nucleus prides itself in having an open investment architecture which allows clients to see exactly what they are invested in at all times.

This includes asset allocation and performance metrics, available both in report format or on screen at any time.

Additionally, for every stock in the portfolio an investment report is available from the Nucleus site showing why it is in the portfolio.

4.17 In terms of service and administration standards:

-

How does your organisation benchmark itself?

Nucleus aims to provide the highest level of service available to the online and robo advice space. Samuel Kerr is a Certified Financial Planner and ensures that all client operations conform with the FPA’s Code of Practice.

-

How are the service standards formulated and implemented?

Nucleus will set the service expectations firmly at the beginning of any client relationship. It will then adhere to these expectations.

-

How is the achievement of service standards monitored?

Services are measured to agreed processes and updated with client consultation and market requirements.

Note that all of the above relate to Nucleus client service and administration. Most of the investment administration is outsourced to Praemium.

4.18 Briefly describe your procedures for dealing with complaints.

If you wish to discuss any aspect of the Fund or wish to lodge a complaint please contact us and we will endeavour to resolve your concerns quickly and fairly. Please send your complaint in writing to the Compliance Manager at Nucleus Wealth, Level 9, 401 Collins Street Melbourne 3000. We will confirm receipt of your complaint within 7 Business Days.

If you have not received a satisfactory response or 45 days have elapsed, you may refer the matter to the Australian Financial Complaints Authority :Telephone 1800 931 678 (free call from Australia), or by email at info@afca.org.au or in writing to Australian Financial Complaints Authority, GPO Box 3, Melbourne, VIC 3001, Australia.

4.19 What level of interaction exists between customer service and the investment management team?

The Product Managers are in daily interaction with the portfolio management team and liaises daily with the customer service team.

The investment team meet regularly, and there are dedicated Slack channels used as a method of keeping the customer service staff informed. All staff, including customer service, have access to these communication channels.

5.2 Describe your broad investment philosophy. This should not limit the statement to different philosophies or sub-philosophies which may be driving any individual product, as articulated in a later section of this document. What evidence do you have to support this philosophy? Please be concise and do not use any marketing embellishment.

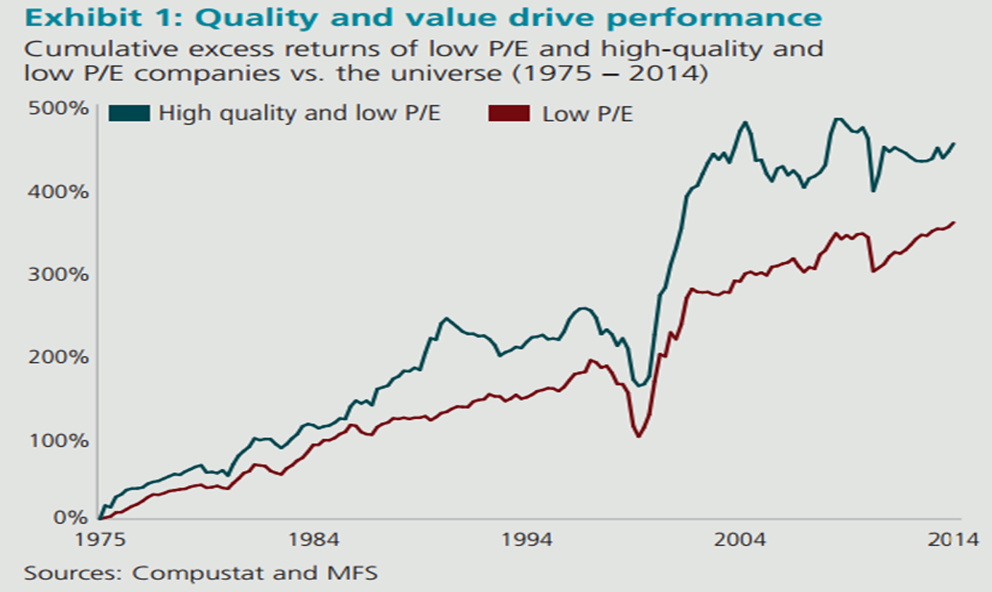

Our Investment philosophy is that high quality assets at reasonable prices provide the best investment outcomes for investors.

Not only do studies show that these assets provide higher returns over time, but the path is also much smoother as the lowest quality and most expensive assets will often rise the most during bull markets and then fall the most during bear markets.

While we use quantitative methods extensively, we also note that quantitative methods often suggest investments in value-traps, and that analyst oversight adds value to the investment outcome by screening these stocks from the process. i.e the philosophy of choosing high quality assets at reasonable prices can largely be performed quantitatively, but analyst input can ensure that the quality and value characteristics are real and not statistical anomalies.

5.3 Please describe your approach to tax management. Do you report after tax returns?

Assets are held within an SMA structure, the platforms manage tax parcels for stocks to reduce the tax liability for individual clients.

Fund Manager Buy/Sell decisions are influenced by the unrealised tax liability/asset for our model portfolio for a typical Australian investor provided that this influence does not create additional risks.

For example a trade may be delayed if the trade is not urgent and the delay would result in typical Australian investor receiving a capital gains discount. Individual client positions will differ.

5.4 Have you committed to formalising the integration of ESG considerations in your investment process either by becoming a signatory to the UNPRI or developing a publically available responsible investment/ESG policy?

We take a two pronged approach to ESG:

- We incorporate a number of ESG factors into our quantitative screens for stocks – we invest in quality stocks and consider good corporate governance to be a quality factor.

- We encourage investors to incorporate environmental and social exclusions into the portfolios that we provide. We offer a range of ethical exclusions such as uranium, tobacco, carbon and alcohol. Investors choose exclusions on a portfolio by portfolio basis.

5.5 Do you report on your progress in integrating ESG considerations publically or to clients?

While we don’t disclose the exact weights of ESG in our quantitative model, we do disclose the factors. The screens that clients can choose from are publicly available.

7.2 Please describe how the investment team responsible for this asset class is structured. Please include a reference to back-up procedures and ultimate investment responsibility.

The investment team is split into five functions:

- Quantitative Screening and Analysis. The first stage of both the stock selection process and the asset allocation process is the generation of suggestions from quantitative models. This is performed primarily by Damien Klassen. Radek Zeleny and Denise O’Sullivan are the key quantitative backups if Damien is unavailable.

- Fundamental Analysis. There are analysts (see appendix 1 for details), whose role it is to analyse the stocks and sectors generated by the quantitative screens and provide advice to the investment committee.

- Stock Selection Investment committee. This meets regularly (usually fortnightly but more frequently when required), with the purpose being to create a list of “acceptable stocks” that can be invested in and broad sector investment parameters for the portfolio manager. The details of the members are included in Appendix 1.

- Asset Allocation Investment committee. This meets regularly (at least monthly but more frequently when required), with the purpose being to create broad tactical asset allocation parameters for the portfolio manager. The details of the members are included in Appendix 1.

- Risk Management/portfolio construction. The portfolio manager, Damien Klassen manages the portfolio construction based on stocks from the stock selection investment committee. Note that the stocks from that committee are a broad list and he has some flexibility to choose stocks. Changes can be based on a number of factors like:

- valuation, i.e. if a stock rises significantly then it might no longer be a candidate to buy

- market events. E.g. takeover offers or profit warnings

- in order to achieve a portfolio or risk outcome. For example the stock selection committee may treat Boeing and Airbus as acceptable with a preference for Boeing. He may choose to invest in Airbus instead to increase the portfolio exposure to Europe or to Euro costs.

David Llewellyn-Smith is the key asset allocation backup if Damien is unavailable. Radek Zeleny is the key stock selection backup if Damien is unavailable.

7.3 Describe the investment philosophy that underlies this particular product including references to market inefficiencies you aim to exploit. What evidence do you have to support this approach to investing? Please be concise and do not use any marketing embellishment.

Home-country bias and independent economic drivers between countries and region give rise to mispricing and investment opportunities globally.

We use a top-down global macro strategy that seeks to identify and exploit inefficiencies between markets, regions, countries, and sectors.

We use a fundamentally-driven discretionary approach supported by quantitative tools to seek to capture these mispricings. Our quantitative tools focus on finding an appropriate mix of quality and value.

We take the view that a mix of tactical asset allocation and stock selection through a transparent low cost structure give individual investors a core investment that can be efficiently mixed with other client assets or strategies to deliver optimum returns for the risk.

7.4 State briefly the competitive advantage that underlies this strategy.

We are looking to use three factors as our competitive advantage:

(1) Experience of Damien Klassen and David Llewellyn-Smith providing tactical asset allocation

(2) low cost, transparent, customisable structure enabling investors to use the strategy as a core investment, while still allowing customisation of portfolios

(3) both stock selection and bond selection working in concert with the tactical allocation to ensure that different parts of the portfolio are not working at cross-purposes

7.5 Please complete the following information for your flagship product in this strategy:

|

Product name

|

Benchmark

|

Inception date

|

Excess/absolute return objective

|

Target TE (& other relevant risk targets e.g. volatility) range

|

FUM (Aug 2020)

|

Timeframe

|

Performance calculated gross or net

|

|

Tactical Growth

|

Australian Inflation (CPI) + 4.5%

|

31 Jul 2017

|

Absolute

|

Annual volatility less than 15%

|

$62m

|

Rolling five year periods

|

Gross

|

|

Tactical Income

|

Australian Inflation (CPI) + 2.5%

|

31 Jul 2017

|

Absolute

|

Annual volatility less than 10%

|

$13m

|

Rolling three year periods

|

Gross

|

|

Tactical Accumulation

|

Australian Inflation (CPI) + 2.5%

|

31 Jul 2017

|

Absolute

|

Annual volatility less than 10%

|

$13m

|

Rolling four year periods

|

Gross

|

|

Foundation

|

Australian Inflation (CPI) + 3.5%

|

31 Jul 2017

|

Absolute

|

Annual volatility less than 15%

|

$27m

|

Rolling four year periods

|

Gross

|

| |

|

|

|

|

|

|

|

|

|

7.6 Use a diagram to help explain your process including references to the market inefficiencies you aim to exploit and your buy/sell disciplines.

7.7 Describe any enhancements that have been made to your process over the last year.

The major change to processes in the past year has been a temporary de-weighting of current and one year forward measures in our investment assessment process due to the impact of coronavirus shutdowns.

We are now looking in more detail at two-year forward numbers, although we are cognisant that analyst forecasts have a poor track history this far forward. We also look in detail at five year average numbers, adjusted for purchasing power parity.

7.8 Do you offer a separate AAA overlay product or is AAA only offered as part of a multi-sector product?

Only as part of a multi-sector product

7.9 Who is responsible for tactical asset allocation?

Asset Allocation investment committee, see Appendix 1 for details.

7.10 Explain your AAA processes including references to decision making, typical bet sizes, frequency of position changes, re-balancing policy, whether decisions are implemented via physical and/or derivatives.

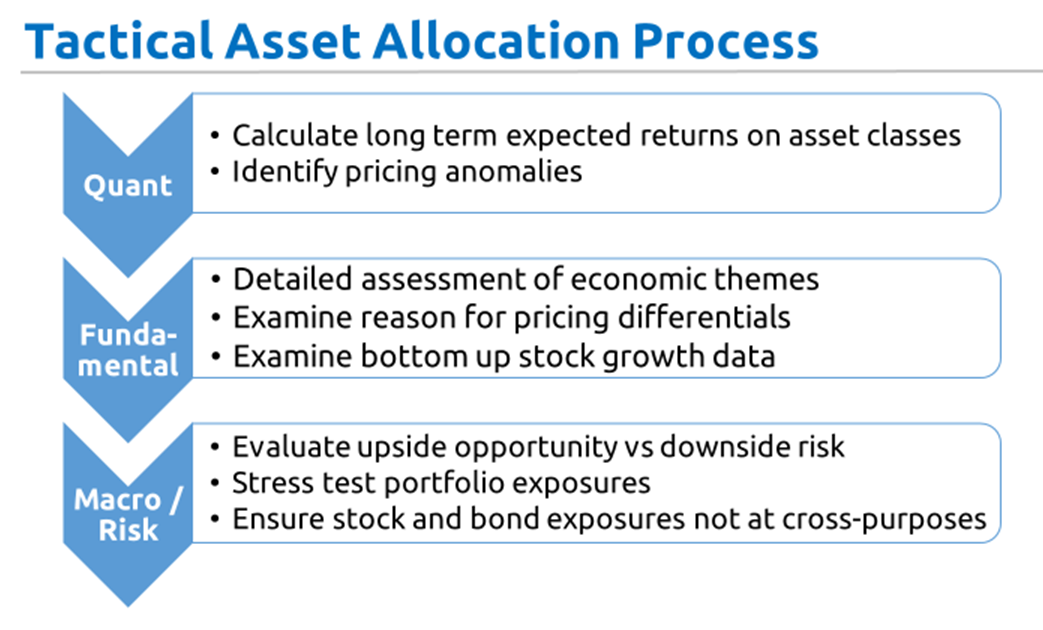

The TAA process begins with the calculation of long term expected returns on asset classes based on a reversion to long term average prices, margins, and growth rates. These returns are used as an anchor to our asset allocation decisions.

For example government bond rates are currently well below long term averages, and so the expected returns are low which suggests an underweight position. However, reversion to long term averages could take a considerable period of time, and so we may choose to over-ride this weighting – however the “burden of proof” is considerably higher when we are taking a position at odds to the long term returns.

Next we look for pricing anomalies. Sectors, commodities, countries or assets where the valuation statistics are at odds with prior experience. Once identified, we then look to identify the catalyst for pricing to normalize – again with the view that it may take many years to normalize. If, for example, we are considering investing in a particularly cheap sector but we cannot see any catalyst for a number of years, we may choose to wait – but again the burden of proof is higher when looking to take a position (i.e. to not buy) at odds with the model.

We undertake a detailed assessment of economic themes, look at pricing differentials and examine bottom-up stock growth data to come up with an assessment of world conditions. This assessment is the basis with which the asset allocation committee may choose to override the model.

Finally, in the portfolio construction phase we examine the upside opportunity from tactical positions vs the downside risk if our economic assessment is incorrect. We stress-test portfolio exposures to adverse events and monitor the likelihood of those events. Part of the construction process involves examining the stocks and bonds position to make sure that they are not working at cross-purposes. For example, if we are expecting worse economic conditions we can choose to either invest in more defensive stocks and/or we can choose to overweight bonds and/or we can choose to invest in longer dated bonds. Part of the process is to ensure that the net position we have chosen is not too extreme.

Below we have the benchmarks and the maximum/minimum positions for each of the tactical asset allocation positions.

| |

Income

|

|

Accumulation

|

|

Asset Class

|

Min

|

Benchmark

|

Max

|

|

Min

|

Benchmark

|

Max

|

|

Cash & TDs

|

10%

|

30%

|

50%

|

|

2%

|

20%

|

40%

|

|

Bonds

|

15%

|

50%

|

75%

|

|

10%

|

45%

|

70%

|

|

Australian Equities

|

0%

|

14%

|

25%

|

|

5%

|

25%

|

40%

|

|

International Equities

|

0%

|

6%

|

15%

|

|

5%

|

10%

|

40%

|

| |

|

|

|

|

|

|

|

|

Total Cash & Bonds

|

75%

|

80%

|

90%

|

|

50%

|

65%

|

95%

|

|

Total Equities

|

10%

|

20%

|

25%

|

|

5%

|

35%

|

50%

|

| |

Growth

|

|

Foundation

|

|

Asset Class

|

Min

|

Benchmark

|

Max

|

|

Min

|

Benchmark

|

Max

|

|

Cash & TDs

|

2%

|

10%

|

30%

|

|

4%

|

17%

|

36%

|

|

Bonds

|

0%

|

5%

|

35%

|

|

5%

|

23%

|

50%

|

|

Australian Equities

|

20%

|

43%

|

85%

|

|

13%

|

33%

|

70%

|

|

International Equities

|

15%

|

42%

|

80%

|

|

10%

|

27%

|

68%

|

| |

|

|

|

|

|

|

|

|

Total Cash & Bonds

|

0%

|

15%

|

85%

|

|

27%

|

40%

|

88%

|

|

Total Equities

|

15%

|

85%

|

100%

|

|

12%

|

60%

|

73%

|

|

|

|

|

|

|

|

|

|

All positions are currently implemented through physical investments. Rebalancing is considered at least monthly by the asset allocation committee. The committee often takes a longer term view on assets and will choose to gradually build positions with dividends/excess capital rather than actively trading where ever possible.

7.11 Detail any in-house or third party software or models used in the asset allocation decision process (including analysis of risk) and the extent to which they are used.

Nucleus have developed several in-house tools and use S&P CapitalIQ. The key models used are:

· Nucleus Long Term Expected Returns model. This is a reversion model to estimate asset returns.

· Nucleus Sector Analytics. This is a standard set of analytics allowing the analysts to look at sectors from a bottom up perspective and drill-down into growth rates, various valuation metrics, analyst upgrades and downgrades.

· Nucleus Portfolio Analytics. This is a standard set of portfolio analytics that allow us various views on the portfolio.

7.12 What impact does your view within an asset class (e.g. bullish on interest rates, hence long duration within Australian bonds) have on the relative weighting to that asset class within your flagship balanced fund?

The view within an asset class has an effect on both the exposure within the asset class and the overall weight of the asset class. As noted above, we examine the portfolio in total as well to ensure that our views within different asset classes are not working at cross purposes (e.g. the gain in bonds discuss above being cancelled by being underweight REITs and Utilities within the equities portfolio) or increasing the risk beyond what is reasonable.

7.13 What control procedure/systems ensure adherence to asset allocation guidelines and decisions?

These are controlled at three levels:

- The internal system for changing Asset allocation positions highlights any positions that are outside of the bands

- We run individual client analytics to check holdings are maintained with in the tolerances for each model

- We run individual client analytics which highlight if the portfolio is out of sync

7.14 Explain how the magnitude of AAA positions varies between your capital stable, balanced and growth funds.

The growth portfolio can see the widest band of changes. The income and accumulation funds are relatively limited in terms of the magnitude of AAA positions.

7.15 What is your re-balancing policy, what triggers a re-balance and how is it implemented?

We look to rebalance only when our fundamental views change or market movements carry the funds too far away from the original positions.

We examine the position at least monthly, more frequently if markets have moved.

Implementation occurs through changing the target weights with RE

7.16 Is it permissible for a portfolio to go outside its asset allocation ranges? If so, please provide full details.

Only for short periods if carried by market movements. At the next rebalance portfolios must be brought back inside its range.

7.17 What are your sources of value add? Please use the table below to illustrate where out-performance is expected to come from.

|

Source of Value Add

|

%

|

|

Quant Screening

|

25%

|

|

Analyst modelling/reviews

|

25%

|

|

Sector/Asset Allocation

|

25%

|

|

Investment Experience

|

25%

|

|

|

|

|

Total

|

100%

|

7.18 How do you ensure AAA is implemented consistently across all multi-sector mandates/portfolios? What steps are taken to ensure clients with similar mandates have similar rates of return?

Note that our small balance foundation fund is a combination of three units of our Growth fund, one unit of our Conservative Income fund and one unit of our Conservative Accumulation fund.

All funds are run through managed accounts, it is the RE and administrator’s responsibility to keep the portfolios aligned at a client level. Nucleus separately run checks on models to ensure that clients are correctly allocated.

7.19 Please describe how you integrate your consideration of ESG issues in your investment decision making: please include information on ESG research and its role in the investment process.

We take a two pronged approach to ESG:

- We incorporate a number of ESG factors into our quantitative screens – we invest in quality stocks and consider good corporate governance to be a quality factor.

- We encourage investors to incorporate environmental and social exclusions into the portfolios that we provide. We offer a range of ethical exclusions such as uranium, tobacco, carbon and alcohol. Investors choose exclusions on a portfolio by portfolio basis.

7.20 Do responsible investment practices form any part of investment managers’ goals/incentives/remuneration? If yes, please provide a brief explanation.

No. Responsible investment practices form part of our investment process but are not specifically part of our incentives for managers.

7.21 Do you have any additional resources outside the investment team with specific ESG related responsibilities or incentives? If yes, please provide brief details.

We use S&P CapitalIQ research to help identify and score issues.

S&P CapitalIQ provides structured and standardized research data.

The data is gathered from publicly available information sources and is manually collected to ensure that the information is standardized, comparable and reliable. All of the ESG data collected is quality controlled and verified by analysts and automated checks.

7.22 Do you identify and prioritise ESG issues and set engagement objectives for a particular company and, if so, how?

Yes. We have a number of qualitative screens based on ESG issues that go into our quality score. We do not invest in companies with poor quality scores.

While our analysts do speak to companies and may mention ESG issues, we do not specifically engage with companies about ESG.

15.2 Please describe how the investment team responsible for this asset class is structured. Please include a reference to back-up procedures and ultimate investment responsibility.

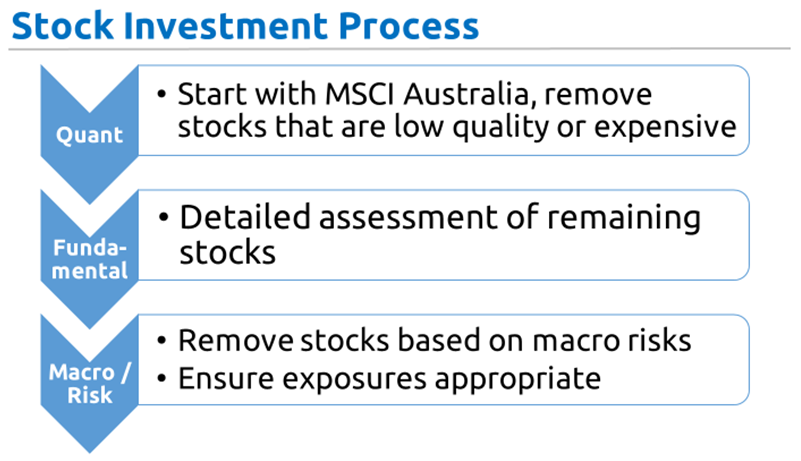

The investment team is split into four functions:

· Quantitative Screening and Analysis. The first stage of both the stock selection process and the asset allocation process is the generation of suggestions from quantitative models. This is performed primarily by Damien Klassen. Radek Zeleny is the key quantitative backup if Damien is unavailable.

· Fundamental Analysis. There is a team of analysts (see appendix 1 for details), whose role it is to analyse the stocks and sectors generated by the quantitative screens and provide advice to the investment committee. Each analyst has a backup if they are unavailable.

· Stock Selection Investment committee. This meets regularly (usually fortnightly but more frequently when required), with the purpose being to create a list of “acceptable stocks” that can be invested in and broad sector investment parameters for the portfolio manager. The details of the members are included in Appendix 1.

· Risk Management/portfolio construction. The portfolio manager Damien Klassen manages the portfolio construction based on stocks from the stock selection investment committee. Note that the stocks from that committee are a broad list and he has some flexibility to choose stocks. These changes can be based on a number of factors like:

o valuation, i.e. if a stock rises significantly then it might no longer be a candidate to buy

o market events. E.g. takeover offers or profit warnings

o in order to achieve a portfolio or risk outcome. For example the stock selection committee may treat Computershare and ASX as acceptable with a preference for ASX. He may choose to invest in Computershare instead to increase the portfolio exposure to non-Australian companies.

Radek Zeleny is the key stock selection backup if Damien is unavailable.

15.3 Describe the investment philosophy that underlies this particular product including references to market inefficiencies you aim to exploit. What evidence do you have to support this approach to investing? Please be concise and do not use any marketing embellishment.

Our Investment philosophy is that high quality assets at reasonable prices provide the best investment outcomes for investors.

Not only do studies show that these assets provide higher returns over time, but the path is also much smoother as the lowest quality and most expensive assets will often rise the most during bull markets and then fall the most during bear markets.

While we use quantitative methods extensively, we also note that quantitative methods often suggest investments in value-traps, and that analyst oversight adds value to the investment outcome by screening these stocks from the process. i.e the philosophy of choosing high quality assets at reasonable prices can largely be performed quantitatively, but analyst input can ensure that the quality and value characteristics are real and not statistical anomalies.

15.4 State briefly the competitive advantage that underlies this strategy.

Both Quality and Value screens have been shown to generate excess returns over the long term. The combination of the two strategies tends to result in a lower risk portfolio with considerable downside protection.

We have a considerably more practical view of quantitative metrics relative to other quantitative funds. Accounting standards have changed considerably over the past 20 years, and many strategies have not adjusted for the changes. We particularly note the changes to the calculation of shareholders equity as distorting a number of key metrics.

We have considerably more focus on return on re-invested capital than most other quantitative funds. This is a difficult calculation, not easily standardised. However, the focus on this important measure we believe uncovers important insights into companies.

One of the key issues with purely quantitative screens is the propensity for “value traps” to appear in screens. We use fundamental analysts to analyse each stock in the portfolio in depth to minimise the risk of investing in value traps.

15.5 Please complete the following information for your flagship product(s) in this strategy:

|

Product name

|

Benchmark

|

Inception date

|

Excess/absolute return objective

|

Target TE (& other relevant risk targets e.g. volatility) range

|

FUM

|

Timeframe

|

Performance calculated gross or net

|

|

Nucleus Core Australia

|

MSCI Australia

|

April 2017

|

1% p.a. over the MSCI Australia Index

|

Volatility below MSCI Australia Index

|

$15m

|

Rolling 3 year periods

|

Gross

|

15.6 Describe briefly your investment style (passive/growth/garp/value etc.). Is the nature of your investment approach fundamental or quantitative? Please be concise and do not use any marketing embellishment.

The investment style is a mix of quality and value.

Quantitative methods are used to select the stocks in the portfolio, fundamental analysis is employed to ensure that the stocks are not value traps or are of low quality.

Stock selection is bottom up, and then top down analytics is applied to the resulting portfolios to ensure that net portfolio weights are appropriate.

15.7 Has your investment style changed in the last five years? If it has, describe all changes and the reasons for these changes. (Note this question relates to style. It should not include reference to changes/enhancements to the investment process per se.)

N/A

15.8 Explain your investment process (use a diagram if appropriate).

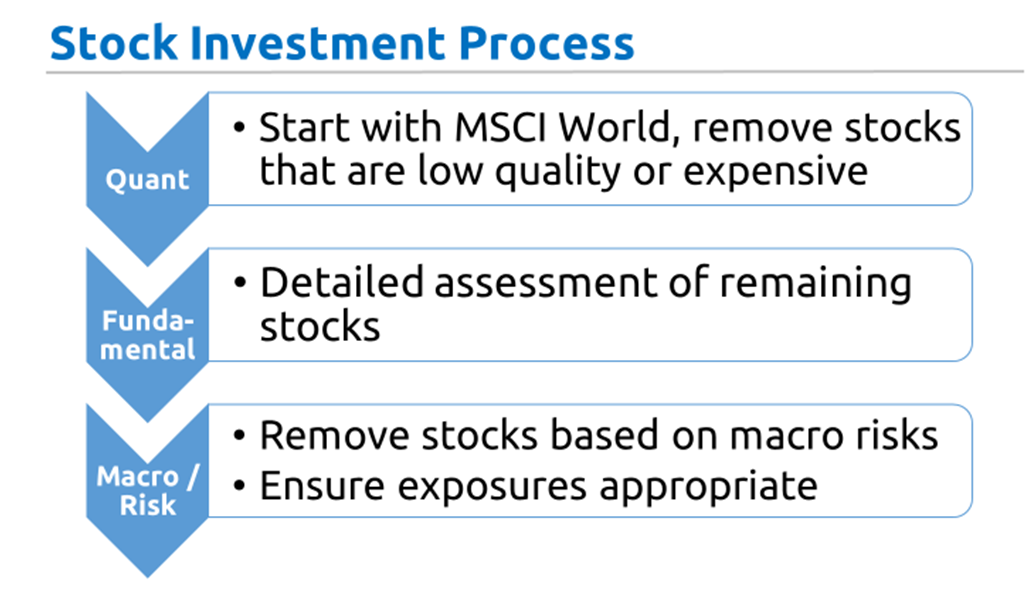

Step1: Quant Screen

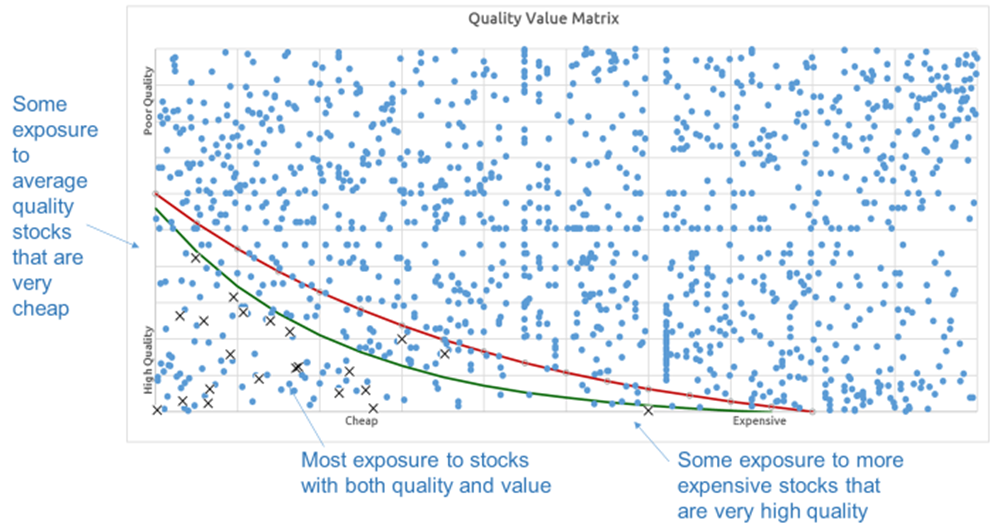

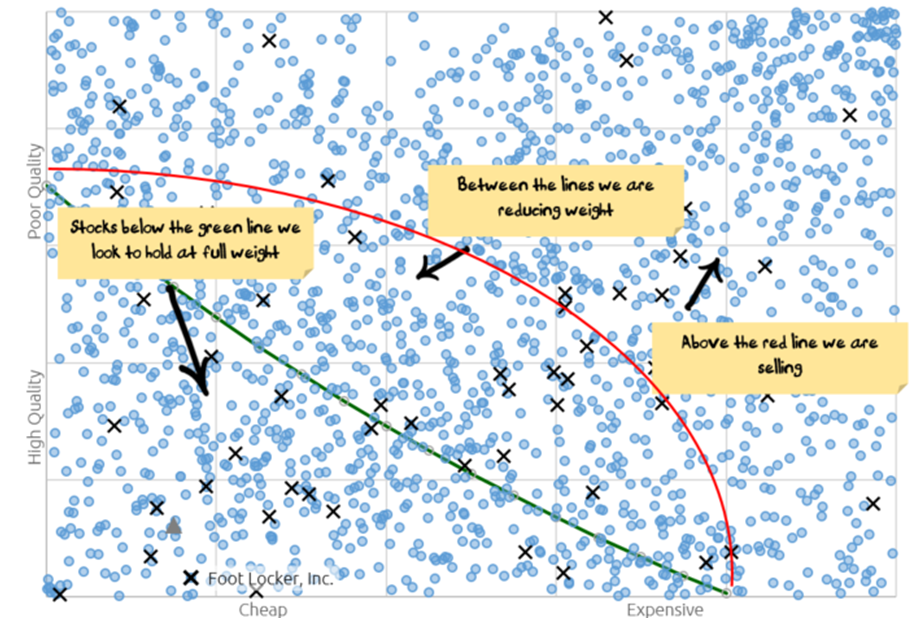

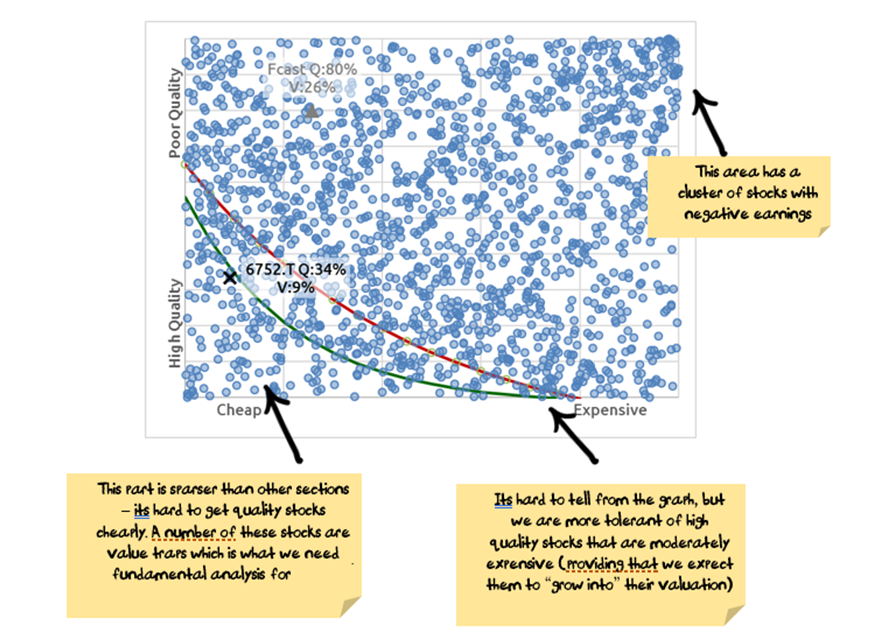

We use quality and value screens as our first cut. The idea is that we only buy stocks in the bottom left-hand quadrant of this graph (the black crosses are Australian stocks, the blue dots are all stocks globally):

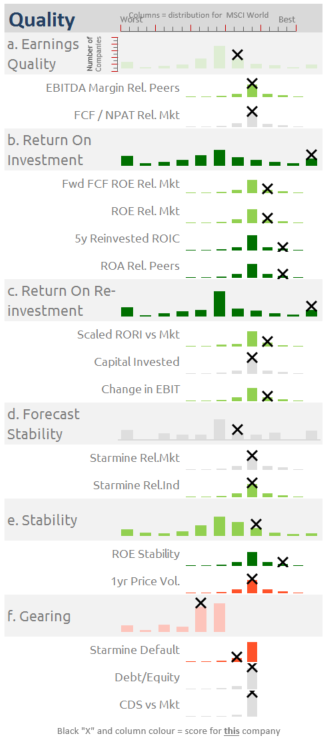

For the Quality score, we use a broad range of factors including:

- Economic Moat: High margins, high returns, high proportion of earnings converted to cashflow

- Economic Trajectory: High marginal returns, above average EPS growth, sustainability of economic moat

- Stability: Earnings, cashflow, dividends, share price

- Financial: Appropriate gearing, interest cover

For the Value score, we use a broad range of factors including:

- Cashflow: Free cashflow, Operating Cashflow

- Earnings: Range of earnings measures, pre and post abnormals, EV/EBIT, P/E

- Balance Sheet: Asset backing, replacement value

- Returns: Dividends, sustainable dividends, buy backs, capital returns

All factors are measured over varying time frames:

- Long term value and quality: Inflation adjusted earnings / cashflow over 5-10 years – identifying cyclical industries and companies

- Current value and quality: What are the latest accounts telling us

- Potential value and quality: How much hinges on forecast earnings

Factors are also compared across different universes. For example when looking at EBITDA margins, it is inappropriate to compare a service company (with very low levels of depreciation) with a capital intensive manufacturer. Some of the most common universe splits we look at are:

- Global value and quality: comparing every company

- Industry value and quality: comparing with companies in the same sector – are there features of the Industry that are inappropriate to compare

- Country value and quality: comparing with companies in the same country – are there country factors at play

- Business Model value and quality: Service companies have much lower depreciation rates than manufacturers – are there business model factors that are affecting results

Step2: Fundamental Analysis

After we have screened stocks, we then hand them over to fundamental analysts to put stocks into five categories:

- Best Ideas: Stocks that the analyst recommend owning in our portfolio. Stocks that have both quality and value characteristics, and in the best cases an element of growth. These stocks we are more tolerant of when they move just outside our investment bands.

- Deep Value/Turnaround:Stocks that the analyst thinks have potential but no catalyst. These are stocks that are very cheap, likely beaten down in price, might be cyclical (close to the bottom of the cycle) and have limited downside. The analyst may not be able to see a catalyst for the price increasing over the next year, but in our larger portfolios they are happy for us to own the stock with the view that there is limited downside. We would expect these stocks to provide stability if the market sells off. These stocks we are less tolerant of when they move just outside our investment bands, and we look to limit the number of these stocks in our portfolio.

- At the right price: Stocks that the analyst would recommend owning in our portfolio if the price were lower. Stocks that have quality characteristics, and in the best cases an element of growth, but are currently too expensive. These stocks are the ones that we may own in our international portfolio if they fit a diversification or risk purpose. We are likely to own these stocks in our Australian portfolio as the universe of investment opportunities is lower.

- In Reserve: Stocks that aren’t in the above categories, but are coming up in or just outside our screens. These stocks are the ones that the analyst is maintaining a lower level of coverage. They are stocks that we are likely to own in the future subject to catalysts, improved earnings or lower share prices.

- Value Traps: Stocks that consistently appear in our quant screens but the analyst recommends avoiding. These stocks that show up on quant screens but are fundamentally flawed. For example it may be a resource stock with a short mine life or an industrial whose profits are elevated due to a government grant which is about to end.

Analysts complete a company model, a valuation, a company profile and investment thesis for each stock in our portfolio. For many stocks this also involves speaking to management and competitors.

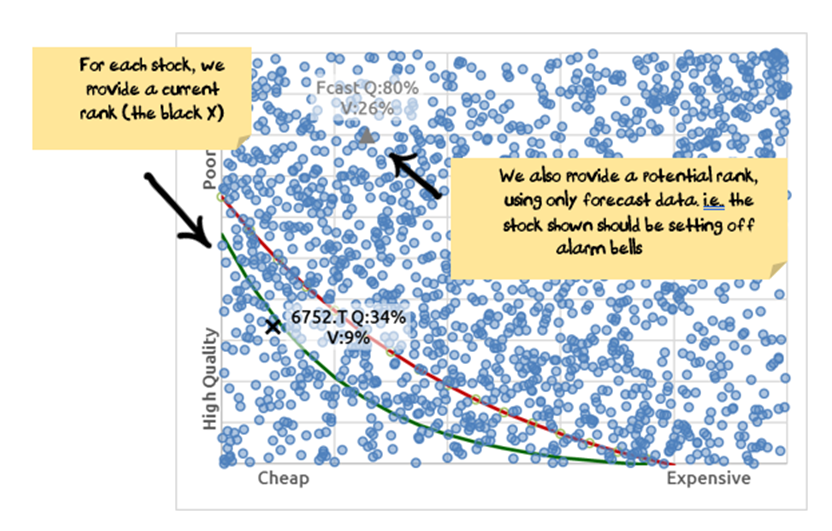

To aid with the analysis, a detailed quantitative report is produced which highlights key reasons for our quantitative model liking the stock and any potential concerns. For example, the company below is rated highly on both return on investment and return on re-investment, however there are some debt concerns:

The stock selection committee then reviews each stock and confirms its rating.

Step 3: Thematic Portfolio Construction

The portfolio manager decides which stocks to enter into each portfolio.

When putting together portfolios, the portfolio manager is looking for a mix of sectors, a mix of countries, a mix of business types (i.e. services, manufacturing, intermediaries), a mix of risk and a mix of quality and value (i.e. some high quality/moderately expensive, some moderate quality/cheap, some both). We also look at thematic themes and other risks. For example, an analyst might have Boeing in their “best ideas” and Airbus in their “at the right price” category but find that we buy Airbus because we need more European exposure.

Step 4: Trading considerations

We have a trading score as well as a quality and value one. It is based on a number of factors, share price momentum rates highly. It also includes factors like short selling, option pricing, analyst recommendations and other short term factors.

We use this score to influence the timing and highlight stocks that may have issues.

analysts can expect more questions for stocks with poor trading scores and greater scrutiny than ones with a good trading score. For stocks already in the portfolio with poor trading scores the analyst may be asked to go and perform further analysis.

For example for a stock in our portfolio where we see short selling increase, put options getting expensive and poor share price momentum we go back to the analyst to get more information to see if there are any major issues that we may be missing.

Step 5: Portfolio Optimisation

Based on the size of the company, the risk parameters, the valuation and the expected price characteristics (volatility, correlation, beta, liquidity etc) we may increase/decrease the weights of stocks within the portfolio.

15.9 Describe any enhancements that have been made to your process over the last year.

We have been focussed on return on reinvestment over different timeframes and the effect of using P&L vs cashflow on investment returns.

The major change to processes in the past year has been a temporary de-weighting of current and one year forward measures in our investment assessment process due to the impact of coronavirus shutdowns.

We are now looking in more detail at two-year forward numbers, although we on cognisant that analyst forecasts have a poor track history this far forward. We also look in detail at five year average numbers, adjusted for purchasing power parity.

15.10 Define the authorised universe of investable securities for your flagship fund and the sub-universe of securities that are actively researched. What is your investment approach to securities not included in the index?

We are able to invest in stocks in the MSCI Australia Index.

We actively research Australian stocks that meet our quality and value metrics. Broadly this involves not being in the bottom 25% of stocks on either metric.

For stocks that have dropped out of the index that we already own, we are able to hold the stock for up to 13 months.

15.11 Describe briefly your stock selection process including your ‘research effort’ (e.g. reliance on internal versus external research, company visits, type of analysis carried out and key criteria targeted in the research process).

See section 15.8 (above) for stock selection process.

The research is a mix of internal and external research.

Companies in our quantitative screen use data from Thomson Reuters, S&P CapitalIQ, consensus forecasts and our own models. There is ongoing effort to improve the quant process based on external quantitative research, internal quantitative research and based on feedback from analysts where companies that are not quality or value appear in our screens.

Fundamental analysts have a range of requirements depending upon the classification of the stock. For the highest rated stocks, analysts need:

· a financial model and a valuation

· Assessment of a range of other valuation metrics (P/Book, P/E, EV/EBITDA etc)

· A written investment thesis, including a response to any quantitative factors where the company rates poorly

· To take part in investor conference calls

· Meet management where required

Key factors analysts consider in modelling include:

· Appropriate levels of capex for the business over long term

· Return on re-invested capital

· Where mid-cycle earnings is and how low cycles are in its industry

The analyst also performs a detailed business model assessment:

- Sector / Industry

We use a mix of GICs and our own custom sectors to create a comparable industry.

- Business Model

- Commodity Extraction

- Commodity Refining (take one commodity, turn it into another)

- Manufacturing (take a range of commodities and turn them into a physical product)

- Intermediary (take a product from one person and sell to another without significantly altering the product)

- Services

- Landlord (included Financial Landlords, Physical Landlords, Intellectual Property Landlords)

- Content / IP producer

- Customer Type

- Consumers

- Businesses

- Intermediaries / resellers

- Government

- Sales Type

- Transactional

- Short term contract (<3 years)

- Long Term contracts

- Customer Purchase frequency

- Regular (daily / weekly / monthly)

- Semi-regular (1-4 times a year)

- Irregular

- Target market (relative to industry)

- commodity products (little to no difference between final product)

- high volume, low margin (compete mainly on price)

- premium brand (compete on quality or perception of quality)

- exclusive (restrict volume to increase price eg Ferrari, LMVH)

- Currency Exposure

- Almost None: Creates and sells in same country, mainly domestic competitors (currency not an issue)

- Import Competition: Creates and sells in same country, competes with both domestic competitors and importers (currency somewhat an issue)

- Mismatch: Costs mainly in one currency, revenues in a different currency (Export to other countries)

- International Profits: Produce and sell in multiple countries, main currency issue is translating profits back to head office currency

15.12 What are your sources of value add? Please use the table below to illustrate where out-performance is expected to come from.

| Source of Value Add |

%

|

|

Quant Screening

|

50%

|

|

Analyst modelling/reviews

|

20%

|

|

Sector Allocation

|

30%

|

|

Total

|

100%

|

15.13 Describe your portfolio construction process covering tools/techniques, buy/sell disciplines, number of stocks held, stock weightings relative to index, determination of large/medium/small cap exposure, sectorial bias, securities that are not in the index and the cash allocation decision.

The cash balance is kept to a minimum in this portfolio, targeted between 1% and 5%. This portfolio forms part of the tactical asset allocation portfolios and so no asset allocation decisions are made at the Australian portfolio level.

The portfolio targets 25-35 stocks.

Stocks entering the portfolio are considered at index weight, and then scaled lower or higher for the following factors:

· Quality score

· Value score

· Trading score

· Analyst view

· Sector view

· Portfolio characteristics (i.e. is there a positive or negative risk benefit from adding the stock to the portfolio

All stocks in the investable universe are large or mid cap. We do not specifically target company size in the portfolio construction.

Buy / sell decisions are based on the company’s quality or value rank as shown on the diagram below:

It is important to note that the sell line for the Australia fund is much higher than for the International fund as the Australia fund represents a broader exposure to the Australian market.

Stock weights can be higher than shown on the chart in a few circumstances:

· The expected “future quality” or “future value” score is attractive enough to warrant inclusion in the portfolio. This is more likely to be a stock that is already owned rather than a new stock in the portfolio, in order to minimise turnover.

· For portfolio construction or diversification benefits.

For stocks that drop out of the index, the fund has thirteen months to sell the stock.

15.14 Does the strategy allow shorting? How are short ideas sourced and managed (including strategies employed) in the portfolio (if relevant, contrast this process with the management of long ideas). What is the typical % of the portfolio in short positions? Describe the distinctive risk management approach used for short positions. Are there any particular analyst incentive practises in place with regards to shorting?

No

15.15 How are trades allocated across portfolios? What processes are in place to ensure portfolios are structured consistently and excess cash is not held?

Nucleus has outsourced the management of the Separately Managed Accounts to Praemium, whose role it is to allocate trades and ensure portfolios are structured consistently and excess cash is not held.

Additionally, Nucleus has internal systems to monitor portfolio construction and check that clients hold the correct weights.

Due to the nature of Separately Managed Accounts, there will invariably be portfolio differences between clients. We also note that unlike in a unit trust, excess cash from one investor does not represent a “drag” for all clients as the cash for each client is managed independently.

15.16 Describe what steps you take to monitor and minimise transaction costs. What is the typical rate of annual turnover for the portfolio?

Trading is conducted by Praemium on a net daily basis. This allows trades for Nucleus Wealth’s portfolios to be netted off against opposing trades from all of Praemium’s other portfolios. So while brokerage is set at 5.5 bps for domestic trades and 15 bps for international, the realised rates are closer to 3 bps and 12 bps respectively.

All transactions are performed by Praemium for a fixed fee and the Nucleus board will re-examine the fees annually with a view to reducing the fee as funds under management increase.

Portfolio turnover is targeted to be around 33%, however in times of volatility it may be higher.

15.17 In what way is the after tax return for each stock considered prior to each transaction? Are systems in place to manage individual tax lots in portfolios? Are portfolios managed to an after tax benchmark(s)? Is performance measured and reported on an after tax basis? Are portfolio managers incentivised in relation to pre and/or post tax performance?

Our portfolio manager considers trades on an after tax basis, examined from the view of a typical Australian investor who can take advantage of franking credits and benefit from reduced capital gains on stocks held longer than a year.

Individual clients or their adviser have capability to manage tax parcels

Given the broad array of investors and tax positions, Nucleus manage to a pre-tax benchmark.

15.18 In the case of pooled vehicles, is acceptance of an off market buy-back at the discretion of the portfolio manager? What has been the typical decision made in relation to accepting buy-backs with regard to pooled vehicles in recent years?

N/A

15.19 Summarise in table format your risk management techniques (e.g. stock/sector limits, ex-ante tracking error, quality filters, constraints on derivatives, etc.). Please define these limits as either hard or soft in nature.

|

Risk

|

Limit

|

|

Max stock overweight* on purchase

|

4%

|

|

Max stock overweight*

|

6%

|

|

Max holding of a company’s issued capital

|

5%

|

|

Maximum sector overweight/underweight*

|

+/-15%

|

|

Max allocation to cash

|

5%

|

* Relative to MSCI Australia Index

15.20 Please explain how you use derivatives. Who is responsible for managing and implementing derivative strategies?

N/A

15.21 To what extent do you participate in transactions such as underwriting issues etc. originated by another division of your firm?

N/A

15.22 Outline your soft-dollar policy.

No soft dollar brokerage is paid

15.23 What market condition(s) are typically conducive to the out-performance of this strategy? In what market or economic circumstances would this strategy typically under-perform?

Typically, a blend of Quality and Value strategies performs in line with rising markets and then outperforms in a falling market. In a rapidly rising market where valuation is less important (eg. Tech boom in 2000) the strategy would be likely to under-perform.

15.24 Provide an estimate of your capacity for the strategy. Do you regularly conduct formal capacity studies (include the date of the most recent study)?

Generally each stock is less than 5% of the portfolio and greater than $10b in market cap. Even if the fund were $10b in size, it is unlikely to own more than 5% of any individual stock.

We have not conducted any formal capacity study. We will conduct a formal capacity study when this strategy reaches $500m.

15.25 What factors do you consider when determining your capacity constraints in the management of this strategy? (e.g. metrics utilised, regularity of formal review, is the strategy’s capacity considered in isolation to other strategies managed by your organisation in this asset class or in the aggregate etc?) Please explain your soft and hard closing policy/discipline.

We have undertaken basic liquidity and ownership screens to determine that our capacity far exceeds our expected funds for the next two years.

15.26 Please describe the trading process (e.g. responsibilities of the portfolio manager versus dedicated traders, utilising programme trades, algorithms, and Direct Market Access) and outline your broker selection and allocation process.

All transactions are performed by RE for a fee. RE allocates these trades to brokers.

We note that all securities are very large and very liquid relative to the amount that Nucleus is investing

15.27 Describe the procedures used to ensure consistency of performance across portfolios with similar objectives.

Where Nucleus manage similar strategies, we look to hold the same stocks whenever possible. This helps reduce trade costs, tax issues for customers with multiple Nucleus products, analyst effort and helps the consistency of performance.

Nucleus has outsourced the management of the Managed Accounts to RE, whose role it is to allocate trades and ensure portfolios are structured consistently.

Additionally, Nucleus has internal systems to monitor portfolio construction and check that clients hold the correct weights.

Due to the nature of Separately Managed Accounts, there will invariably be portfolio differences between clients.

15.28 Please describe how you integrate your consideration of ESG issues in your investment decision making: please include information on ESG research and its role in the investment process.

We take a two pronged approach to ESG:

- We incorporate a number of ESG factors into our quantitative screens for stocks – we invest in quality stocks and consider good corporate governance to be a quality factor.

- We encourage investors to incorporate environmental and social exclusions into the portfolios that we provide. We offer a range of ethical exclusions such as uranium, tobacco, carbon and alcohol. Investors choose exclusions on a portfolio by portfolio basis.

15.29 Do responsible investment practices form any part of investment managers’ goals/incentives/remuneration? If yes, please provide brief details.