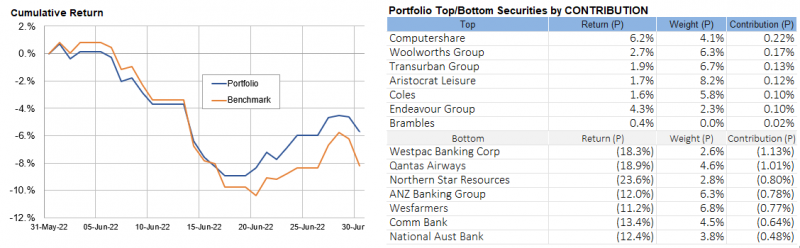

June was the month that what we have been saying since the start of the year finally hit home, the ASX fell over 8%. International stock markets fell almost 5%, cushioned, for Australian investors, by the falling Australian dollar. Our equities portfolios are set for this environment and so our tactical portfolios performed much better than the median balanced fund, which fell around 5%. Finally, the bond market is coming around to our view as well, providing a significant hedge in the second half of June.

Maybe that will be the end of the equity bear market. Valuations have returned to a more normal range, high inflation implies a strong economy and company earnings estimates remain strong. Many are making that argument. I think they are wrong.

After huge government transfers over the last 2 years, companies and consumers are being asked to stand on their own. Can they? Skyrocketing energy and housing prices are a drain on budgets, not a sign of an economic boom. There is a risk of a significant reversal in inflation, and I wouldn’t rule out deflation in 2023/24 if central banks follow through on their current path.

Our concern is that central banks are suggesting that they will solve inflation problems, which are largely a result of supply chain issues, by restricting demand. This is not an attractive setup for markets.

We expect international equities to provide some protection from a growth slowdown. While the Aussie dollar is likely to rise if the energy crisis worsens, it is more likely to fall over the medium term. This will hedge the downside under the worst scenarios, whilst still providing some upside in the better ones.

The US and Australian central banks do not agree with us

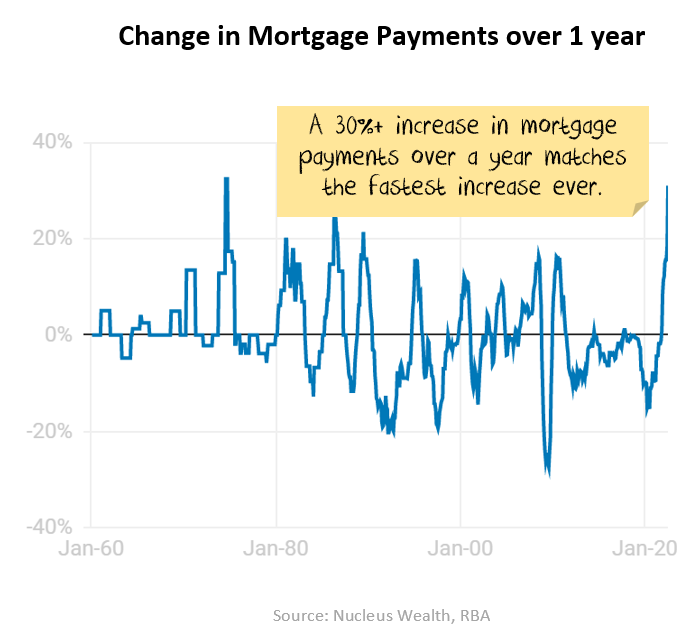

The RBA has commenced a record round of interest rate rises to bring down inflation. The US central bank has now raised rates at three consecutive meetings and is looking likely for a fourth. Around the world, except in Japan, and to a lesser extent Europe, central banks are marching interest rates higher. Already, in Australia mortgage payments are up 30%+ vs last year, and if the market pricing is right, then mortgage payments will be closer to 60% higher than 2021 levels by March next year.

Last year the RBA promised:

- to not raise rates until 2024.

- to not rely on forecasts and to focus on actual wage growth.

It broke both promises as the economy changed. I think you will find the RBA will struggle to fulfil its current outlook for the same reason. The economy will change.

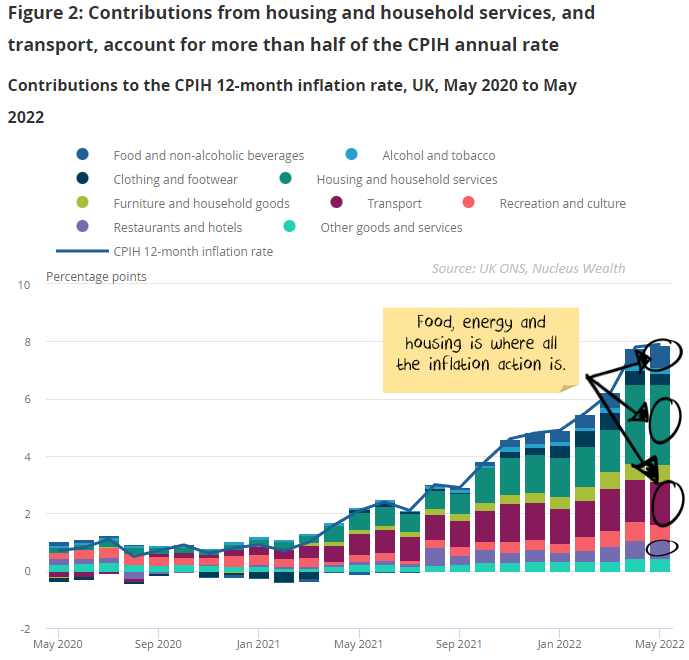

The biggest contributors to inflation in most economies are food, energy and housing:

The first two the central banks have little to no control over. The last one, housing, central banks have already done a fair bit. In a highly financialised world the danger is doing too much:

Food

Central banks worldwide explicitly strip food from the inflation statistics. Why?

On the supply side, higher interest rates won’t improve the weather for farmers. Higher interest rates won’t bring down the price of fertilizer.

On the demand side, the actual cost of the agricultural commodity in developed countries like Australia is very low – most of the cost is in the services to deliver the food (packaging, supply chain, rent etc). For example, the cost of coffee beans in your $5 latte is usually sub 30c. The cost of wheat in a loaf of bread is similar.

Higher interest rates might see some people switch from a $5 cafe coffee to an office cuppa, or from an expensive artisan loaf of bread to a supermarket equivalent. But the amount of coffee/wheat consumed is broadly the same. It is the service sector that is affected by the changing consumption, not the farmers.

So, food costs in developed countries are mostly independent of economic conditions – neither supply nor demand are meaningfully affected.

Developing markets are a different story. The danger there is political upheaval – as we are seeing in Sri Lanka.

Energy

Central banks worldwide also strip energy from the inflation statistics. Why? Higher interest rates won’t affect the global price of energy unless you are a major, major consumer. And Australia isn’t.

Higher energy prices are only just now crashing into Australian consumers. There are three sources of pain:

- Oil: shadow bans on Russian oil and sanctions have extended supply chains and pushed global prices higher.

- Gas: Last year, fluctuations in Russian gas to Europe led to rapidly rising gas prices. Then, the Ukraine attack created a sudden European desire to exit Russian gas as much as possible. Gas prices around the world boomed higher. It seems that if global gas prices fall, Europe may well expedite its transition away from Russian gas, which will send global prices back up.

- Coal: As a substitute for gas, the demand for thermal coal has also skyrocketed. This is of particular concern to Queensland and NSW, which rely heavily on coal-fired electricity.

None of the above is in the control of the Australian central bank. Australia could launch itself into a major economic depression and still not affect the global price of oil, gas or coal in any meaningful way.

Globally, central banks can slow energy markets by raising rates. Historically, it has taken a recession to achieve that outcome. Odds are that a recession will be needed this time, particularly given Russian sanctions.

Also, electricity prices come with a lag. And so central banks (and consumers) will be seeing inflation from electricity long after prices have peaked.

Housing

This is an interesting one. Rents are rising quickly. But house prices are falling. And with interest rates much higher than last year, the house price falls are set to continue.

The increase in mortgage payments over one year is already the highest on record, up 31% on a 25yr mortgage in Australia. Similar in the US and UK. Markets suggest within another eight months, in Australia mortgage payments will be 60% higher. For the country with the second largest debt burden in the world. And a greater exposure to variable mortgages than just about any other country.

Count me in the “house prices will fall, likely significantly” camp.

Some think rents will be different. Here, we end up in a philosophical debate about what causes rents to rise: supply, demand or investors. My view is that supply and demand affect the longer-term price but short-term prices are economic. Using Australia as a microcosm:

- Australia builds around 100-200k houses per year

- There are about 11m houses, 11% of those are unoccupied (holiday homes, second residences, overseas owners, money laundering etc.)

- There are about 2.7 people per occupied household.

Say we change only the second decimal place, i.e. increase to 2.74 or decrease to 2.66. This creates or destroys demand for 150k houses. A full year’s worth of building.

How does this happen? A few kids move out earlier or later. Some people get an extra flatmate or lose one. Households buy or sell a holiday home.

My contention is that if the economy continues to grow strongly, the number of people per household will shrink and rents will keep rising. But I don’t think that likely. In my view, the largest increase in mortgages ever will be enough to slow the economy, reduce jobs, increase the number of people per household and therefore rent growth will stall.

But, the way housing is included in inflation indexes, the inflation effect will be delayed. i.e. housing will keep contributing to inflation indexes long after the effects have peaked.

Central banks get caught

This leaves central banks with relatively high inflation that they have promised to stamp out:

- including inflation from food that they can’t control.

- energy costs at the moment look like adding about 3% to inflation over the next year in Australia – a huge impact. But higher interest rates will do very little to change – it is the global price of coal and gas that are doing the damage.

- while house prices will be falling, they will likely still add to inflation statistics due to the base effects and methodology for some time.

- given global growth, the Australian dollar could continue to fall, further increasing inflation.

The way inflation is reported, inflation will stay high on energy and house prices even after they peak. Which may well leave central banks tightening too much.

On the flip side, we could be seeing commodity prices crater due to lack of Chinese demand. Services cratering as higher interest rates smash local spending. Unemployment rising – albeit from low levels. And a slowing US at the same time. Europe crippled by high energy prices as it tries to decouple from Russia. Plus the end of the problems in supply chains as a mix of reduced demand and record investment combine to remove the issues.

Will central banks hold higher interest rates in the face of the notionally high inflation despite a weak economy? My expectation is yes.

Add in a dour China outlook

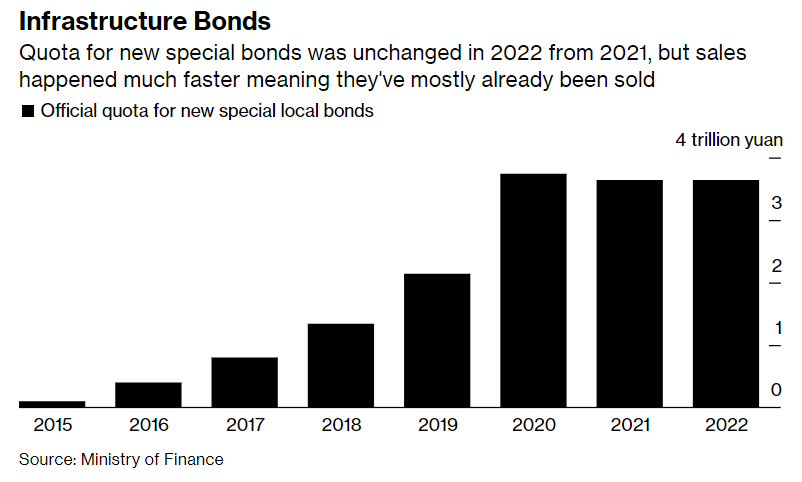

There are two ways to read the most recent China data showing a massive expansion in debt. Local governments are bringing forward next year’s debt quotas into this year.

.

- The boom times are back! The commodity super cycle is back on, infrastructure will boom, commodities will be in demand. Buy, buy, buy. This was certainly the market’s first impression as commodities rallied.

- Or, look out below! Local government revenues are crashing. For a 10%ish expansion in infrastructure this year, China has needed to double its lending. i.e. the actual infrastructure being built has not really changed that much. But that local government revenue has crashed so hard that they can no longer afford the infrastructure and are having to go with the begging bowl to Beijing for more debt.

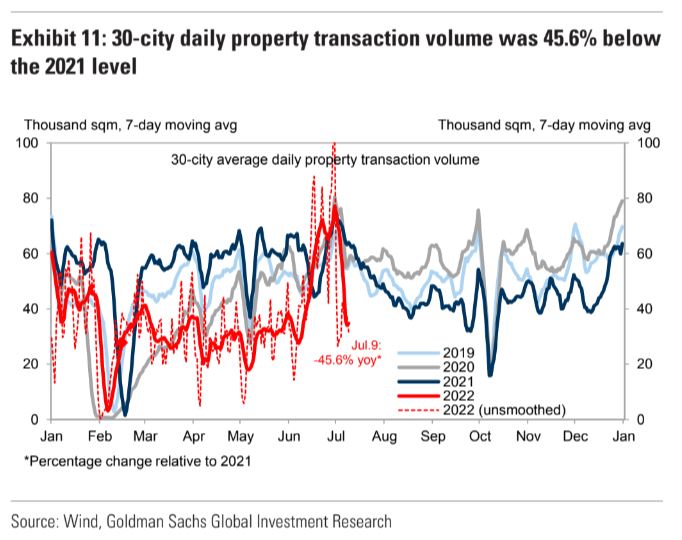

I’m going with the second interpretation. And I’m noting that infrastructure does not use that much iron ore or copper. Buildings do, and new floor space started continues to decline. Chinese property developers continue to default on debts.

The property market does not look good. The brief few weeks of hope as China came out of lockdowns has faded and property sales remain well below prior years.

Stocks

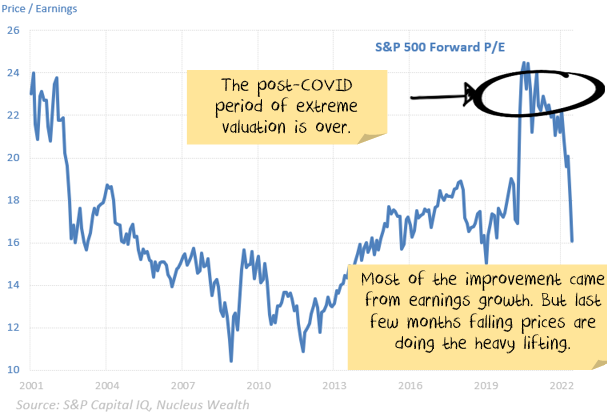

Stock valuations are back to reasonable levels.

Valuation does matter. But earnings growth matters more. In a good year, earnings can easily grow 20% or more, making an expensive market fair value. The danger is that earnings can also fall quite precipitously. And today, in my assessment, that is where the danger is.

At an aggregate level, earnings growth still looks OK. But most of the growth in the last reporting season came from energy and resources. And, effectively, central banks have promised to kill commodity prices to bring down inflation.

Earnings forecasts are still for another 20% combined growth over 2022 and 2023. In the face of a recession, that is heroic. Even if there is not an economic recession, I’m expecting a sharp slow down in profits.

Earnings are more likely to be flat over two years, with risks to the downside. On that basis, stocks would still be at the more expensive end of historical ranges. Heading into a potential recession, that is not where you want valuations to be.

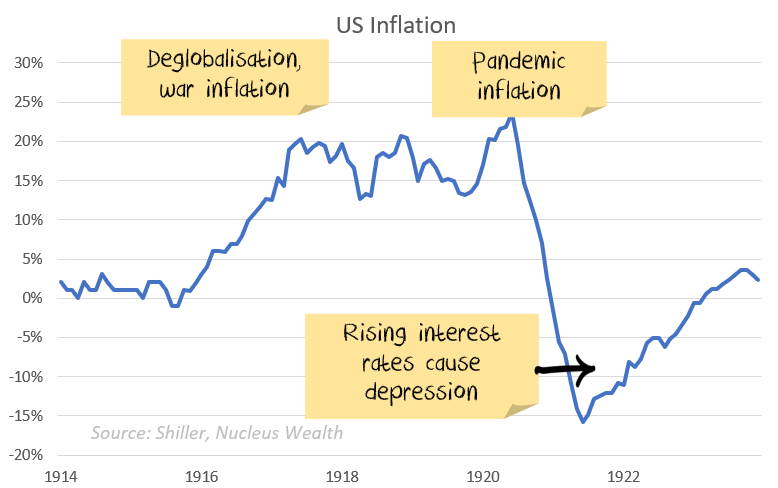

Have we seen this all before?

- Globalised supply chains reversing into more local production due to geopolitical tensions

- A pandemic disrupting supply chains

- A surge in inflation due to supply issues

- Central banks hiking rates into a supply-side shock

Yes, we have. Following World War I, all of the above factors were in place.

By 1920, inflation in the US was running at 15%. The US central bank hiked rates from 3.5% to 5.6% to curb demand. By 1921 the US was in a depression, with inflation of -10%.

The analogy is not exactly the same. But, trying to use interest rates to solve supply chain problems is at the core. There are more similarities than there are differences.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short term effect is probably commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic. In China, however, rolling lockdowns will likely continue for the rest of the year.

- The geopolitical energy crisis in Europe has turned acute and infected Australia. This will subtract from European and Australian growth in the short term, there will be a rush to alternative energy sources in the long term.

- Supply chains continue to improve.

- Demand is challenging to read and distorted by Omicron. Demand held up far better than prior virus waves.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock in 2022. The question is whether the private economy will be strong enough to withstand it.

- Central banks have made it clear that they will try to solve the Russian induced energy issues and supply chain induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. But China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. Unless they change, this will deflate the commodity market.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for recession this is a buying opportunity. The problem in the short term is that the narrative “high inflation, central banks raising rates = sell bonds” is surging still.

And the mix of higher volatility, leading to deleveraging of risk parity trades, and momentum means yields could yet go higher. We are starting to invest for bond yields to reverse.

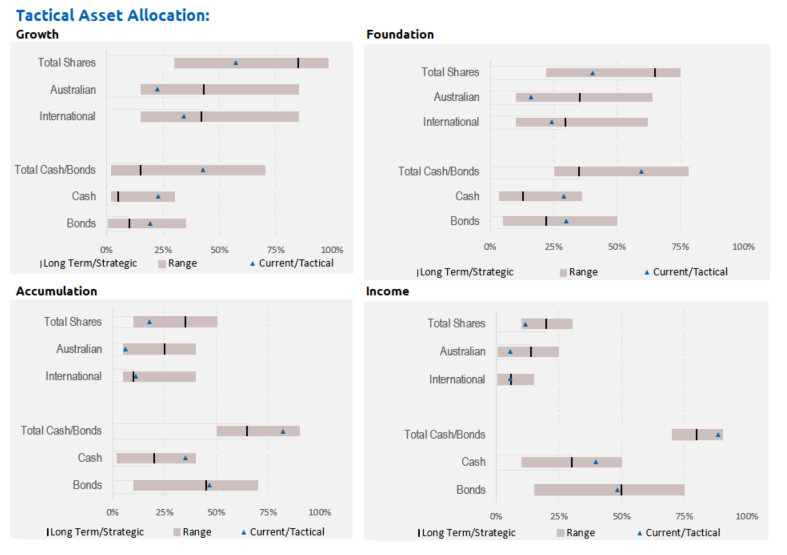

Asset allocation

Stock markets are expensive, but becoming less so. Debt levels are extremely high. Government/central bank support continues but is slowing. Earnings growth had been really strong but has come to a halt. There are signs it is starting to reverse.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, with the view that the Australian market will be the one most affected by a slowdown in China and a global recession:

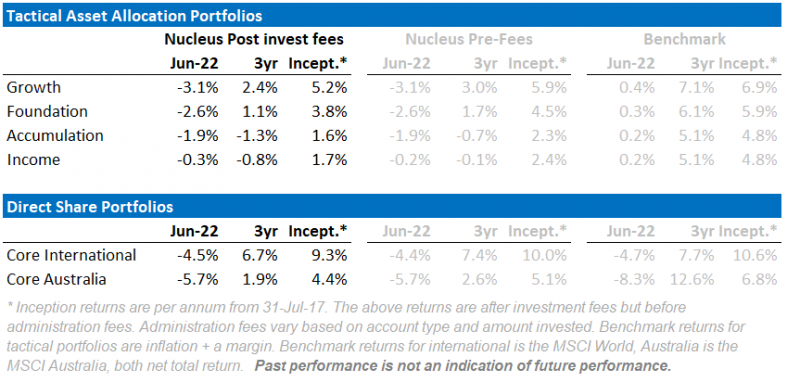

Performance Detail

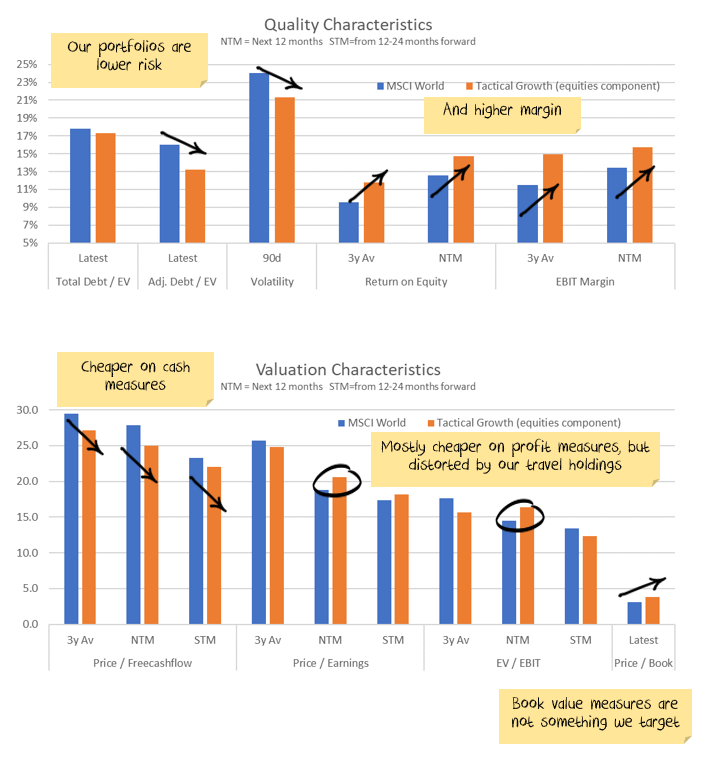

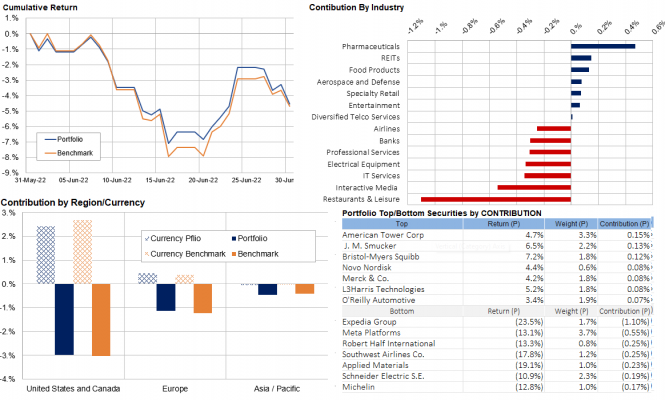

Core International Performance

June saw Markets decline to year lows with US indexes breaking the 20% decline. Our portfolio closely tracked the index as the declines were widespread The losses this month would have been worse but the rising USD meant it cushioned AUD-denominated returns. Given the large downward movements, we took the opportunity to reposition. We reduced some of our travel exposures (Expedia) given a weaker economic outlook, and exited recession-vulnerable stocks Illinois Tools, Fleetcorp and Daito. We took profits in our Bridgestone and NetApp holdings. While we are trying to limit exposure to discretionary names, we did open small positions in LVMH Moet Hennesy Louis Vuitton, Volkswagen and General Motors based on valuations being low enough to justify a longer-term holding. We will likely add to these positions if we are right and stock prices fall further. We also added defensive pharmaceutical companies Novartis and Eli Lilly.

Core Australia Performance

June was a dismal month for domestic equities, especially the Financials and Resource stocks. Our portfolio performed considerably better than the index due to our higher weight in defensives. Coles, Woolworths and Endeavour eked out gains for us but these were more than offset by losses in the banks. Our underweight in banks and resources stocks meant we significantly outperformed our Benchmark this month. With six-month lows we decided to exit Brambles fearing it may suffer should the US recession eventuate. Additionally, we lightened our Westpac (most vulnerable of the banks to mortgage stress) and moved into a more defensive Medibank Private health insurance provider to de-Beta the portfolio. We remain underweight resources despite the recent sell-off, given our bearish China views.