For the last six years, I have had a relatively consistent view on Australian asset allocation. The Australian economy was at the tail end of a commodity boom; investors needed international equities and Australian bonds while winding back exposure to Australian equities – click here for an example of the kind of research from five years ago that I wrote for WilsonHTM and Houses & Holes would re-publish.

It all seemed so simple (although there were many naysayers at the time): (1) stay overweight international shares, overweight government bonds until the Aussie dollar bottomed in the low 60c / high 50c range, and then (2) switch back into Australian equities. It’s been a boring investment philosophy – we are still in stage 1 five years later. And it worked. And then Trump gets elected, and the outlook is a lot more clouded.

But, I am going to make you wait before we get to the conclusion because first I want to describe the way I look at investment.

There are a number of big, long-term trends that investors need to be mindful of – like the demographic progression of the baby boomers. None of them are “drop everything and buy/sell” themes in the short term, but the effects are relentless, and these are the themes that will drive the decade-long trends.

Then we need to overlay medium term trends, like the tech boom, the US housing boom/bust, or the Chinese capex boom that have major investment consequences over 3-5 years.

Next, there are the short-term trends that will drive 6-12 months of performance – these are much harder to evaluate.

Finally, we need to look at what is (or isn’t) priced into markets.

Today’s post is about the long term trends.

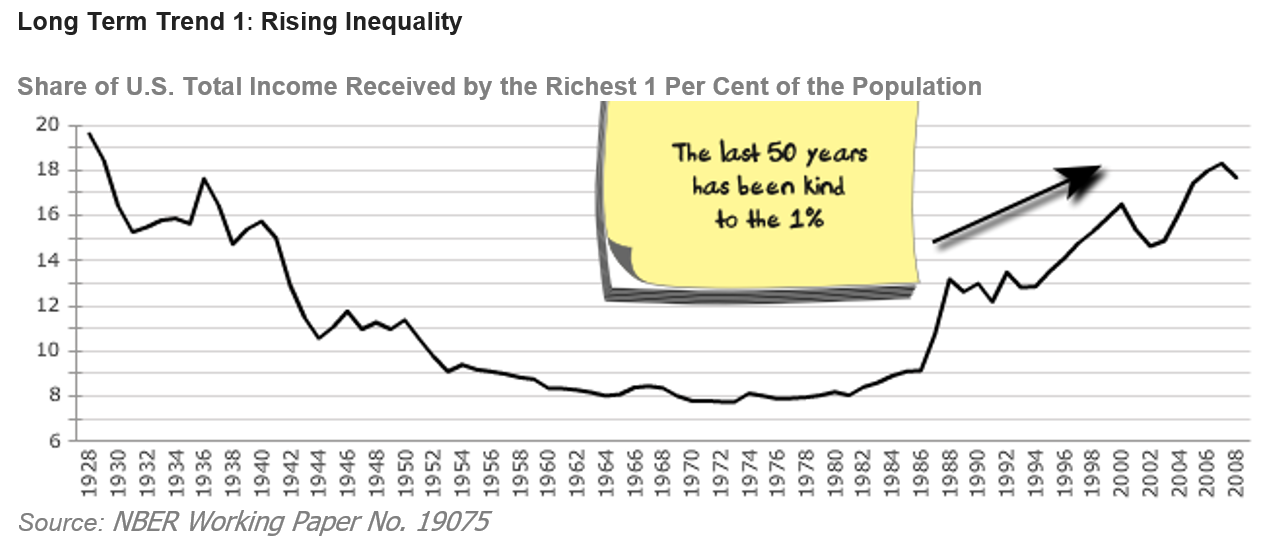

Long Term Trend 1: Rising Inequality

Rising inequality is an issue. And with Trump’s proposed tax cuts it’s about to become an even bigger issue as the 1% take an even larger slice of US income.

To confuse matters, global inequality has been falling as median incomes in places like China and India have narrowed the gap with developed countries. However, within countries the same trend is apparent – i.e. the 1% in China have done a lot better than the average Chinese citizen.

How does inequality manifest itself? In lots of ways, for the investor the two biggest issues are political instability and lack of demand.

Lack of demand is at the core of most of the world’s current growth problem. Inequality is not the only culprit, but it is a big one – give poor people more money and they spend it, give rich people more money and it is usually saved. It’s hard to see any reversal in inequality in the short term, quite possibly things will need to get worse before they get better. This lack of demand can be hidden by letting the 99% gear up, which has been the case for the last 40-50 years as well, but there is a limit to debt.

Political instability has been a feature of most elections over the last few years. Voters know something is wrong and that change is needed – they are just not sure what is wrong and that leaves them vulnerable to con men and demagogues. I’m thinking this is going to get worse before it gets better.

I suspect the rise of communism in the 50s-70s meant that capitalist countries worked hard to keep inequality from getting too extreme. The fall of communism since then has meant that its open slather on inequality – unfortunately the fact that capitalism won over communism has also been equated (in my view erroneously) with the view that we should let the 1% accrue as much as they can.

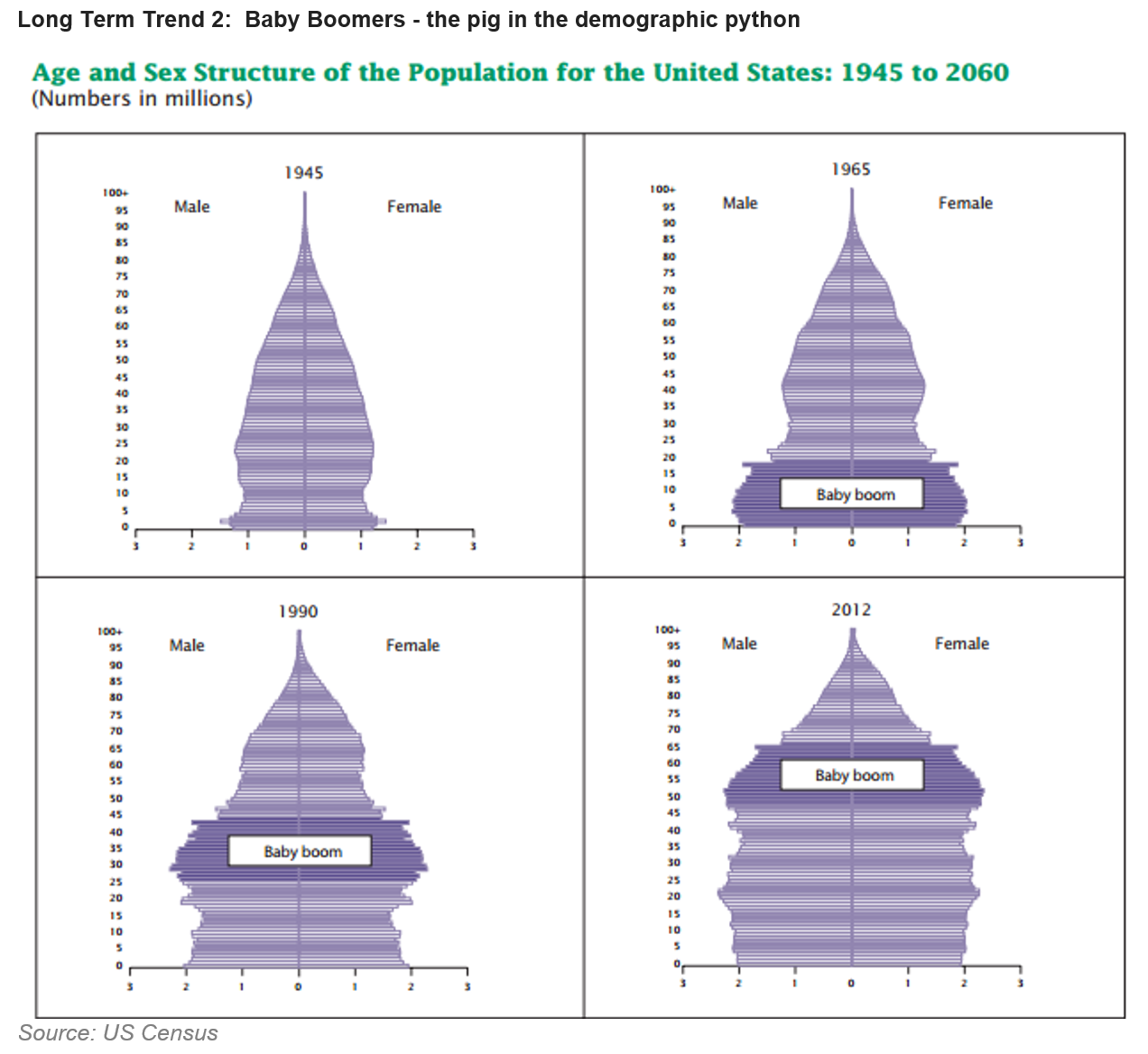

Long Term Trend 2: Baby Boomers – the pig in the demographic python

Following the second world war, most developed countries around the world experienced a baby boom – the charts above show the US experience and many other countries share the same basic structure.

What this has meant is that the proportion of workers in the economy has been growing for the last 40-50 years as this age group went from being dependent (under 18) to workers (18-34) to prime-age workers (34-54). The effect on the productivity and consumption patterns of the economy from this contingent are well documented – one investment theory is that you invest in whatever this age contingent needs next.

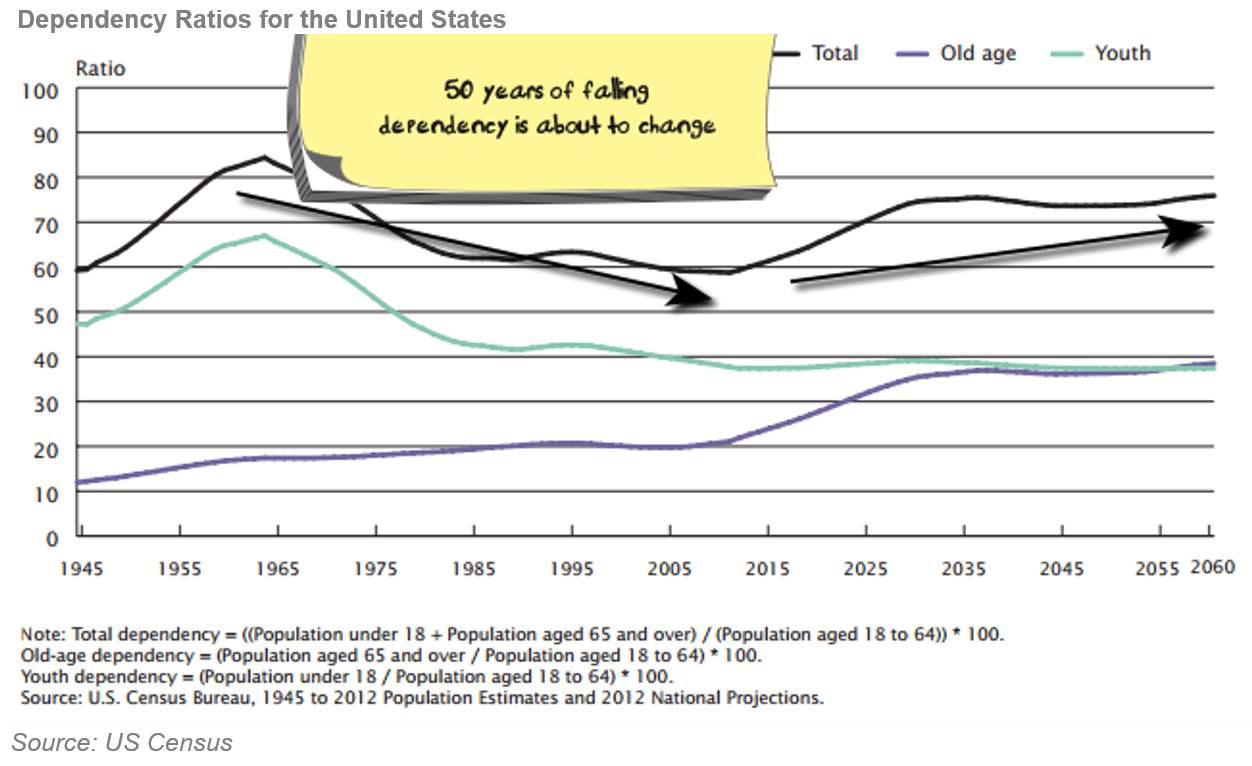

Unfortunately for those of us still working, what they need next is for younger workers to support them in retirement. This means that while we have seen the ratio of workers to dependents rising in most countries for the last 40-50 years, that trend is changing as the boomers retire. The chart below is for the US – the increase in dependency is worse in Europe, Japan, China where population growth is lower.

Dependency Ratios for the United States

I’m not going to get into the pros/cons of population growth debates here, but I will say that there is globally a backlash against immigration. And I’ll highlight Europe and the US in particular where anti-immigration policies are gaining traction. The chart above is based on a relatively high level of immigration. If Trump leads immigration lower, which seems likely, the dependency ratios will rise more swiftly.

Long Term Trend 3: Women in the workforce – Job Done?

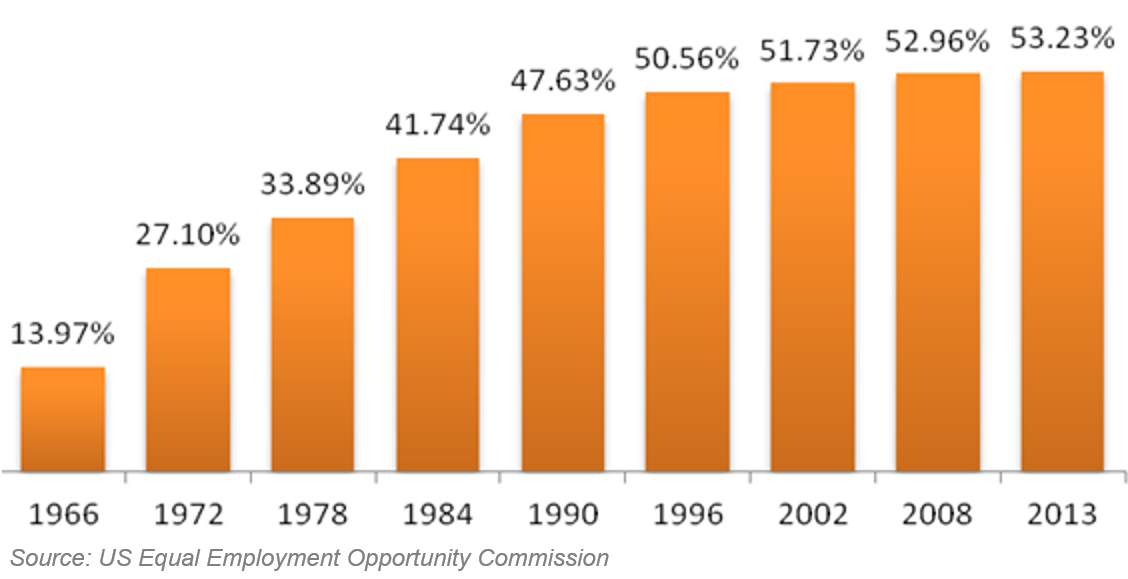

Female participation in the workforce has been a key economic driver for a long time, moving women out of unpaid home duties and into the workforce has yielded numerous economic benefits. The above chart is US based, but again a similar trend in most developed countries exists.

It’s been a classic long-term trend; it can be knocked off-trend by medium-term issues like a recession but on the other side of the recession the trend re-emerges intact.

However, the 50 years of gains have come to an end. While women still face issues about equal pay and the number of women in senior positions, it would appear that (in aggregate) women are not being prevented from working, it is now a question of whether women want to work.

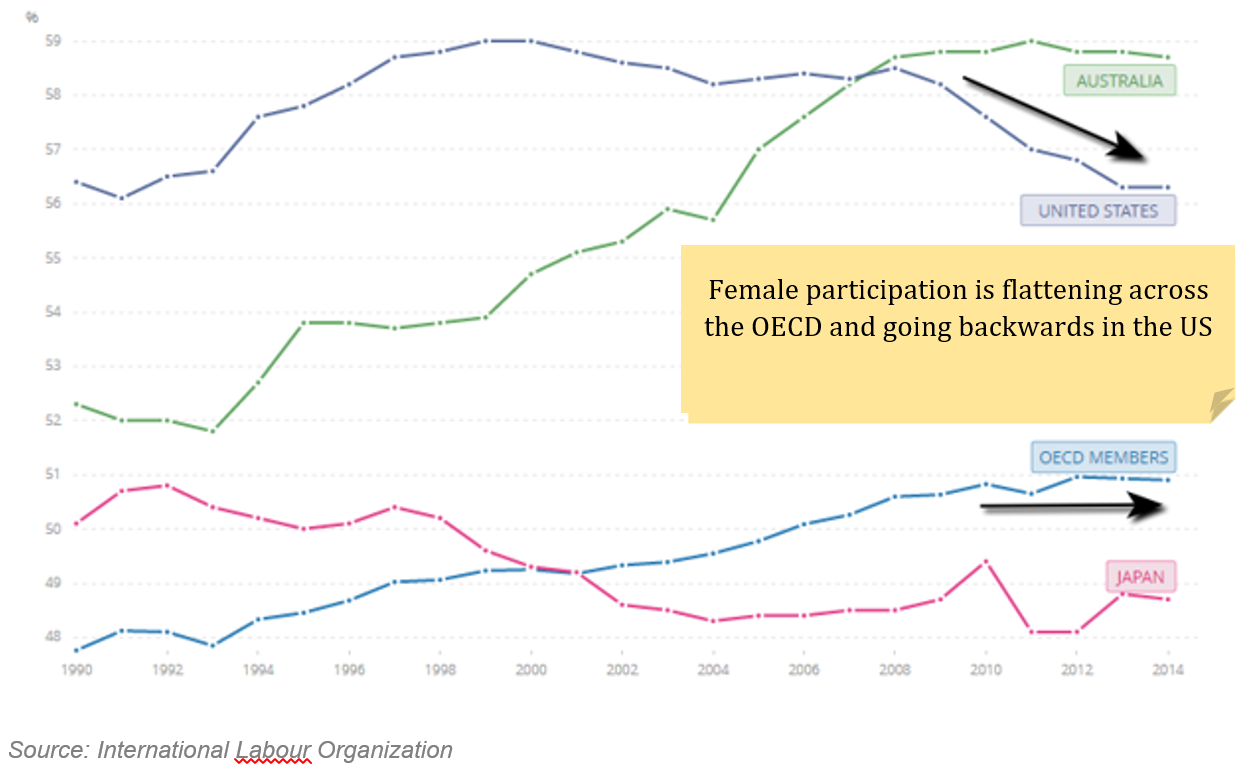

The chart below shows a slightly different statistic over the last 25 years (because I can get comparables across a range of countries):

I do think there are a number of other issues affecting the above chart, primarily that the baby-boomer/ageing effect is overwhelming the increase in participation for younger age groups. However, the effect of increasing female participation does seem to have stalled across most developed markets.

It is also interesting to note Japan as a potential “view of the future” for Europe and possibly the developed world more generally.

Long Term Trend 4: Debt growth

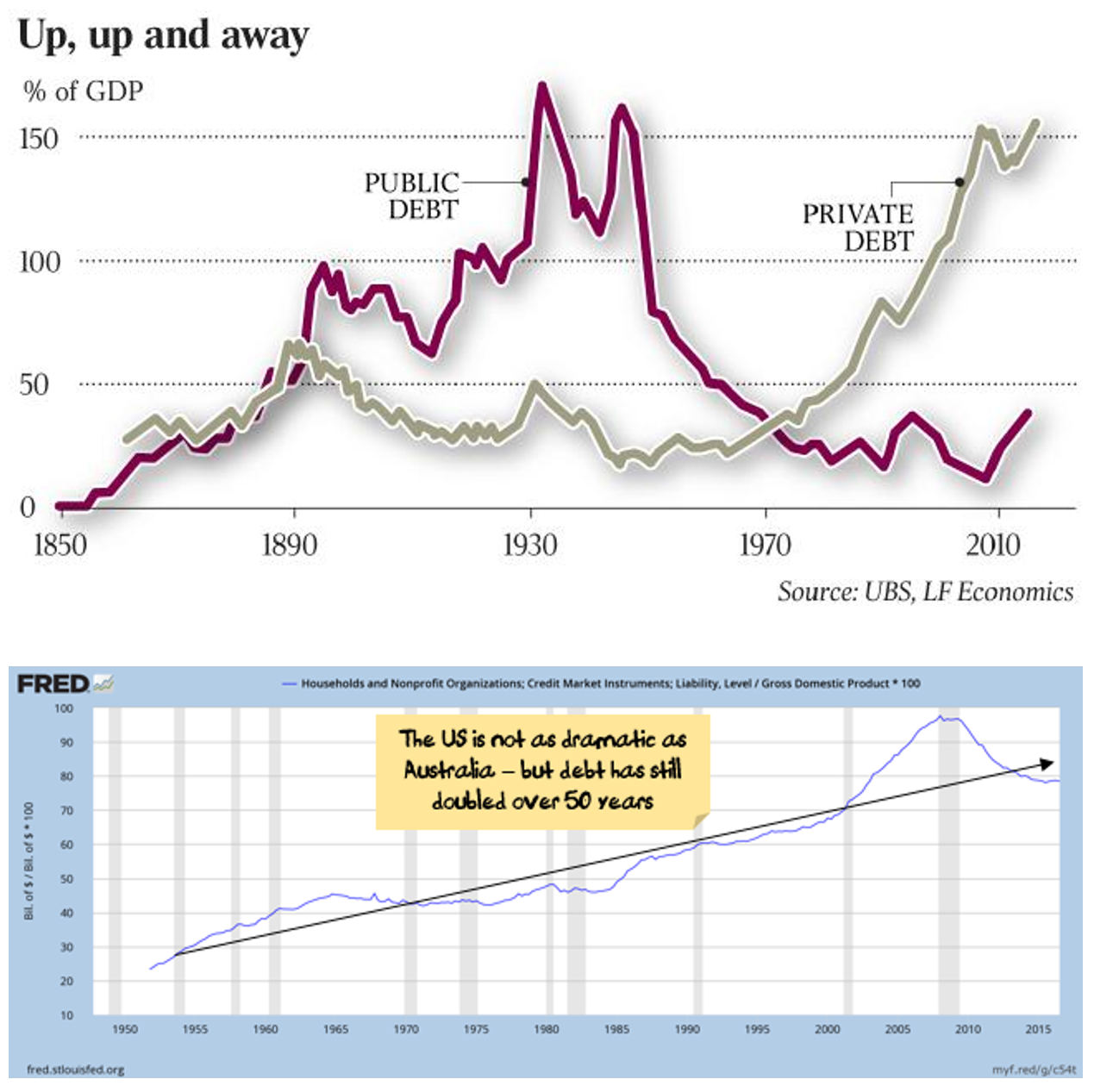

I spoke a little above about the best way to raise demand when a small group of the population (the 1%) are taking the lion’s share of the economic benefits. The way to raise demand is for the 1% to lend the money to the 99% so that they can spend. And that is what has generally happened (from the Australian):

So, when does this end? I’m not sure – we don’t seem close. And the saying “you go broke slowly and then all at once” is probably instructive. There are two key ways to resolve over-indebtedness:

- Inflation: With lots of wage inflation, workers get more money which reduces the real value of their debts. This is relatively painless for most involved, and it is how central banks would like the transition to occur.The reality is that the methods tried to date haven’t created inflation, and Japan is a 20-year example of trying to create inflation but failing.In practice, central banks have lowered interest rates to try to spark inflation, and in doing so they have increased the value of assets which has increased inequality, and we are largely back to square one.The ironic thing is that we know exactly how to create inflation: print money and give it to poor people. Economists generally don’t want this to happen because it usually gets out of control (Zimbabwe, Weimar Germany) and causes hyperinflation. So, what central banks are currently trying to do is create inflation in any way possible without actually printing money. And failing.

- Debt forgiveness/writeoffs: There have been lots of opportunities to do this – basically if you lent money to someone who can’t pay then you lose the money. It’s a great way of transferring assets out of the hands of the rich.Unfortunately what happened instead is that governments everywhere bailed out the banks whenever they stuffed up. The decision was made to “extend and pretend” in high profile over-lending cases like Japan (zombie companies in the 1990s), the US (housing loans in 2008), Europe (Greek & peripheral debt in the last seven years) and China (the housing market in the early 2000’s and probably the housing market plus a range of state-owned entities again in the not-to-distant future).I’m guessing most governments will continue to take a lot of pain over a long period of time rather than let lenders take responsibility for mistakes.

In the short term, what could give us a burst of inflation is if a populist leader was voted in (say in the US) and decided to dramatically increase government debt (say by giving massive tax cuts and/or spending on infrastructure). If Trump this hypothetical leader carefully designed his policies so that the 99% benefited more than the 1%, then we might have a real way out of the major inequality issues. If however Trump this hypothetical leader decided to give most of the benefits to the 1% then what we would get is a short/medium term stimulus that would look like its helping for a few years only to leave everyone in a worse place.

I’m going to come back to this issue in more detail many times over the next few years I suspect.

Long Term Trend 5: Death and taxes – inevitable for humans, but not for companies

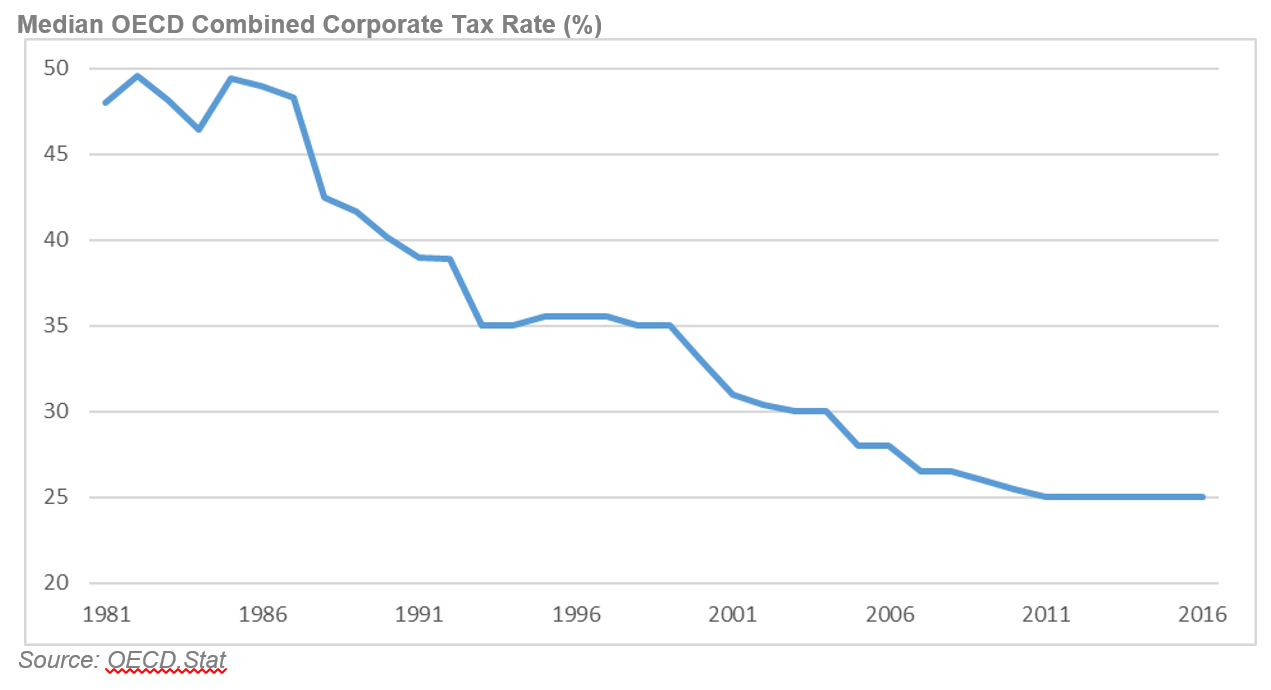

Another long term benefit to the stock market has been the falling company tax rate.

So, as you can see from the above chart, tax rates have basically halved over the last 30 years. Which is a big deal when it comes to earnings – my estimate is that somewhere between a 30% and 40% of real market EPS growth over the last 30 years has come from lower tax rate.

My rough, back of the envelope numbers for earnings growth over that time looks like this:

| Average Annual Real pretax EPS growth | 2.0% |

| + effect of tax cuts | 1.3% |

| + inflation | 2.8% |

| = Real annual EPS Growth | 6.1% |

So, this trend is not looking like ending anytime soon as we have seen the UK cut taxes recently and we are likely to see a huge company tax cut by Trump.

Is there likely to be a backlash at some stage? The moralist in me hopes so. The pragmatist doubts it is coming in the next five years.

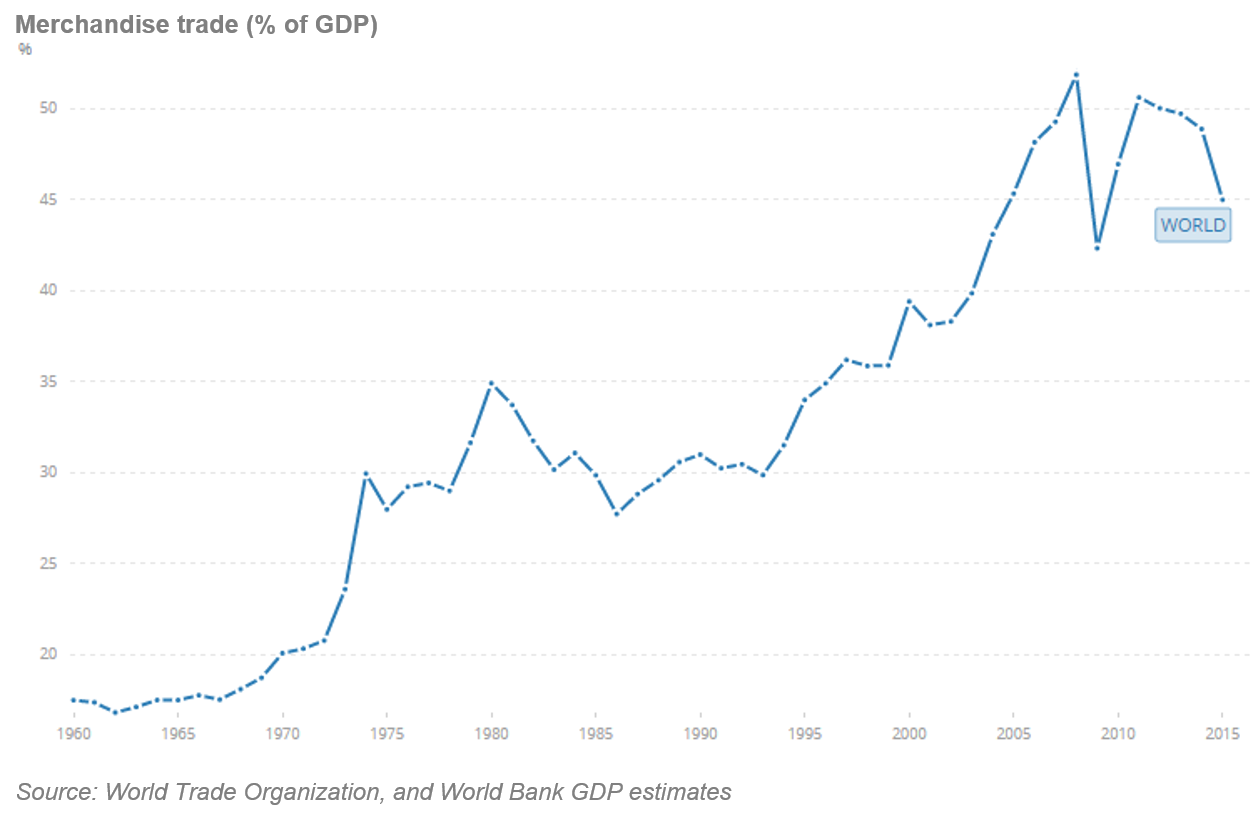

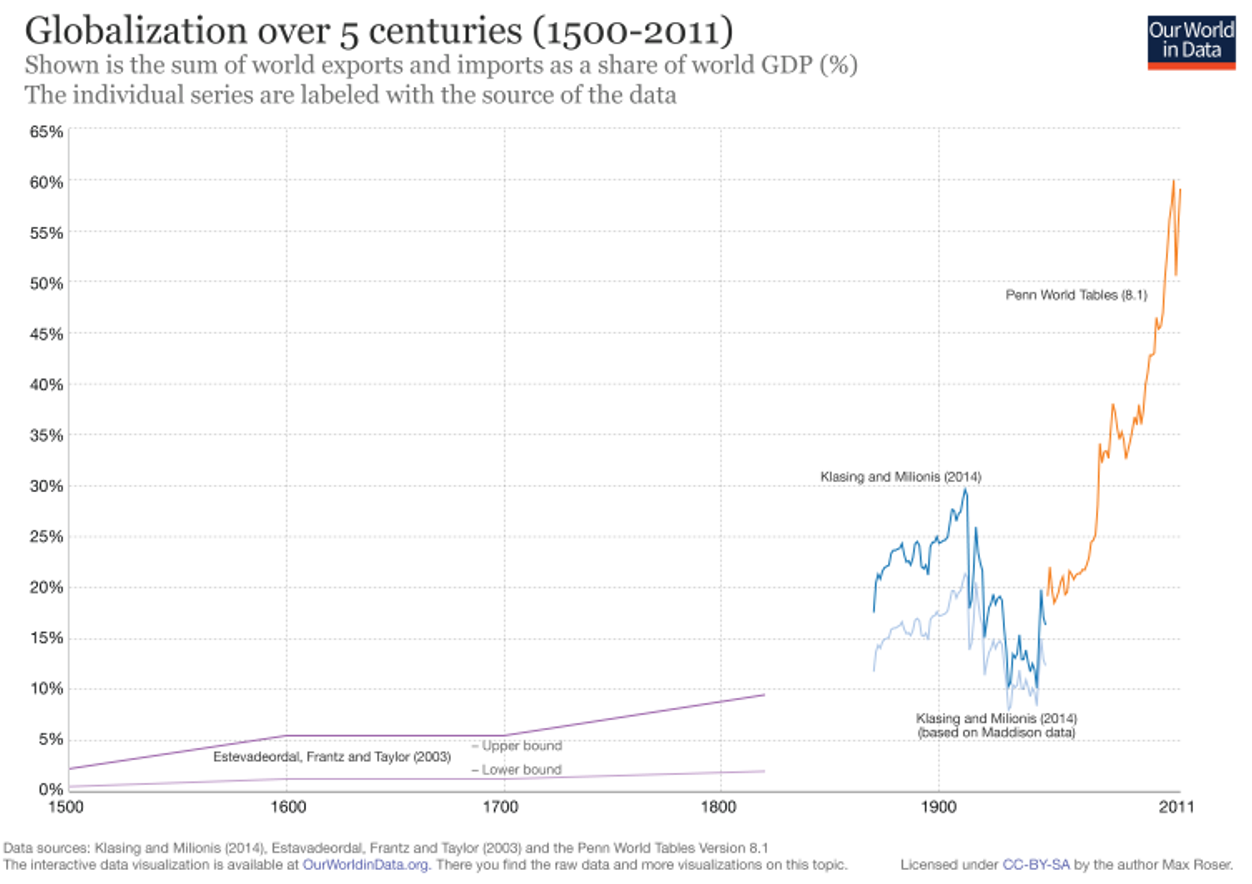

Long Term Trend 6: Increasing global trade

I am a believer in the magic of trade. A buyer and a seller come together, and both leave the transaction thinking that they got the better deal. Comparative advantage, specialisation, relative productivity – it all makes sense in terms of improving global well-being.

Where trade falls down is all about jobs. Like if you had a bunch of states in the US that specialised in manufacturing, and then you outsourced the manufacturing to Mexico and China but didn’t get the manufacturing workers into new jobs, leaving them enraged enough to vote for a reality TV star as president. Or if you sacrificed the bulk of your manufacturing workforce at the altar of the commodity sector and the never-ending Chinese boom, only then to realise that it wasn’t never-ending. Mind you, I guess in the latter case you could just ask them all to be innovative and then it would all work out OK.

For companies in general, and multinationals in particular, growth in trade leads to growth in profits – companies are much better placed than individuals to exploit cost differentials across countries. It’s hard to estimate how much profit growth has come from increased global trade, my guess is that it is significantly greater than zero.

The danger over the next few years comes from the following chart – this shows how far trade fell in the 1930’s when the world turned against trade during the Great Depression.

Now, I don’t know how much of Trump’s anti-trade rhetoric is real and how much is hot air.

With Trump’s tax cuts he has the support of most of the Republican party – I’m reasonably confident they will go through.

With his China/Mexico trade war talk, I have no idea whether it will amount to anything. Republicans are generally are pro-trade, and so there may be difficulties getting a trade war through Congress, especially if Trump’s popularity takes a hit. It is also hard to tell how much of Trump’s rhetoric is “the art of the deal”: take an extreme position and then negotiate back to something more reasonable.

I do however think its safe to say there will not be increased globalisation and the risks are tilted towards less. The risk to investors is that trade wars break out and damage both world growth and company profits.

Bringing it all together

So, the last 40-50 years has seen five key tailwinds: female participation in the workforce, favourable demographics, increasing debt, increasing trade and reducing taxes. These have more than offset the effect of increasing inequality.

Going forward the female participation tailwind looks to have finished. The baby-boomer tailwind is about to (or has already) become a headwind. Trade is no longer a tailwind, it may become a headwind. Increasing debt is still happening, but levels are elevated, and there is probably not much room left on this front. Corporate taxes are still a tailwind. Inequality is still growing – I’m not going to call the end of tax reductions/inequality until we start to see more public backlash. Will Trump’s presidency be the last straw? Often a lurch to the extreme left or extreme right is enough to see a backlash in the opposite direction – but that is 3-4 years away at best.

So, we are at an inflexion point. I believe the long-term trends will be negative, but they are going to be overwhelmed in the next few years by some major medium-term trends – and so we won’t back able to tell how negative the trends are until we emerge from the next boom/bust cycle.

More on that in the next post.