Investment markets are in the eye of the storm. The initial storm danger came as COVID-19 hit, decimating jobs and smashing demand. Governments and central banks ably stepped up to stem the damage, and investment markets calmed. But insolvencies and bankruptcies have only been delayed, not avoided and the employment recovery is unlikely to be quick. The eye of the storm is not as safe as it appears.

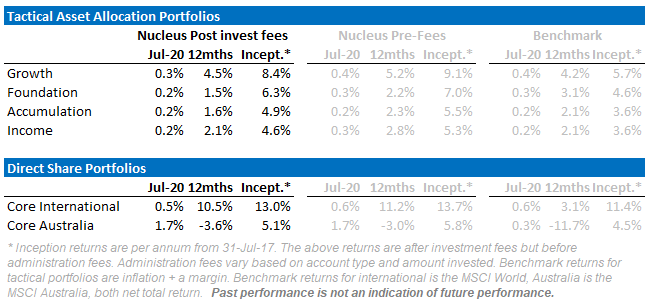

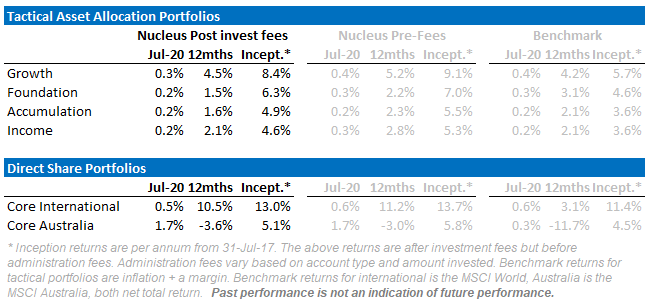

Over July, our direct equities continue to outperform, our Australian fund in particular beat the index by 1.4% over the month on the back of an overweight position in gold. Our tactical funds performed slightly lower than the average superannuation fund over the month, but the annual performance remains significantly higher. Over the month we took profits on a number of our long term bond positions.

And our direct equity portfolios also significantly outperformed their benchmarks:

The disconnect continues

At the risk of sounding like a broken record, the dynamic at the moment is as strange as it has ever been. I have spoken before about the best argument for buying stocks is the ironic case that capitalism is dead, and therefore buy equities. Disconcertingly, there continue to be signs that this is the case.

Governments around the world made significant changes to bankruptcy and property eviction laws.

When the crisis was expected (hoped?) to last for only a few months this was good policy – there is was no sense in shutting down companies due to short term demand issues or kick people out of homes for short term job losses. And the changes have worked:

Which is where the disconnect lies. Australian bankruptcies in the June quarter were down 42%. The US is down around the same. Europe is seeing similar effects. The number of unemployed is 50% higher than the start of the year in most countries. There is clearly a tension that needs to be resolved.

It should be clear now that COVID-19 is not a 3-month “blip” but rather a longer-term structural issue. Now it becomes a question of whether the cure actually turns into the problem.

Some jobs will never return

A Melbourne based specialist delivery company has a niche delivering to hospitals and hotels. Revenues down 75%+. Profits up 50%. Most of the profit increase is JobKeeper. But the owner has also torched middle management and worked out clients are just as happy with larger deliveries less often rather than smaller deliveries more frequently. And so productivity is off the charts. As revenues recover, the middle managers will not be getting their jobs back.

This is just an anecdote from one company, it is not data. But economic history shows a similar effect with businesses across the world. That is what recessions show us – jobs lost take a long time to re-appear. Many older workers will never work again.

Capitalism has bankruptcies for a good reason

Cruel to be kind?

How long can capitalism be suspended for before it becomes a problem?

So there are two competing macroeconomic effects.

- We don’t want bankruptcies to snowball into more job losses, into a housing market crash, into more defaults and so on. So, by delaying the start, it creates a calm spot, the eye of the storm.

- We don’t want the lack of bankruptcies to mean that the over-indebted who aren’t paying their bills start bringing down people who weren’t over-indebted. This is the second half of the storm.

Governments were hoping for a short sharp shutdown and recovery, or a cure or a vaccine. It didn’t happen.

Governments are tempted to pull the first lever again and hope. The issue is that the second grows bigger every day. By pulling the first lever again, if we don’t get a cure or vaccine, then there is now a much larger problem.

If the last ten years have taught us anything, they have taught us that given a choice between:

- taking a little short term pain for a large amount of economic gain or

- taking a little short term gain for a large amount of economic pain

That politicians will take option (b) way more often than more sober observers would prefer.

The rules are rolling off around the globe, my expectation is that this will create at least some sense of normalcy. But there are already countries extending provisions until the end of the year or beyond. Which makes it difficult to assess when the eye of the storm will pass, and the second half will begin.

There is an alternative possibility: that markets are now entirely dependent on central bank support, so economics and fundamentals no longer matter. We have a checklist of a dozen decisions that governments and central banks can make that will eventually suspend capitalism.

A few of the items have already been checked off the list. The more that get implemented, the closer we get to a genuinely new paradigm. But, we do not believe this to be a likely outcome. The steps taken must become increasingly radical: effectively central banks and governments bailing out and propping up most failing businesses, turning the world’s capital markets into a herd of state-owned entities that will ‘kill the village in order to save it’.

Bubbling along

Performance Detail

The charts below show some of the risk characteristics of our international fund over the 12 months:

Asset Allocation

Our portfolios “went to ground” before the crisis hit, selling stocks and investing in bonds/cash/international currencies. All of our funds have a low weight to shares. This is a significant deviation and one that we have not undertaken lightly.

Wrap up

We changed most of our quant models a few months ago to put much less focus on the last 12 months of earnings, or the next year. The focus instead is on a mix of inflation-adjusted historical earnings and the earnings from the second year of earnings. The problem with this is:

- Historical earnings don’t capture growth companies very well.

- Analysts are not very good at forecasting the second year of earnings in the best of times. We are not in the best of times.

Which is an indication of the environment. You have to understand the limits of your models. The key to navigating as we exit the eye of the storm will be to not lose track of the principles of good investment while changing models enough to reflect that times are not normal.

We have a shopping list of high-quality companies that we want to own for our investors at lower prices for the very long term. Which is easier said than done. We picked up a few in March, but the problem with these companies they also bounce back the fastest once panic subsides.

Given a toxic mix of low-interest rates, volatility and expensive markets, investors will need to be significantly more nimble than in the past.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.