In financial jargon, data types range between soft and hard. Soft data consists of surveys and forecasts. Less reliable but usually much more timely. Hard data consists of confirmed results. Hard is much more reliable but arrives after the fact. Successful investment requires interpretation of the soft data – if you wait for the hard data, markets will have already moved.

Right now, there are mixed signals. The soft data mostly screams “beware”. The hard data is mostly benign.

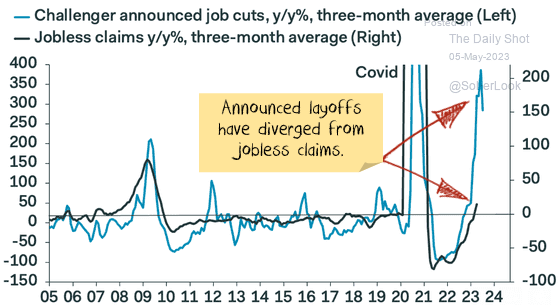

Usually, soft data leads hard data. For example, when it comes to employment:

- First, surveys say businesses are planning to slow hiring.

- A few surveys later, they show hiring slows.

- Then announcements of layoffs.

- Finally, we see the unemployment rate rise.

Sometimes, it is different. The soft data signals a problem, but something intervenes, and the problem doesn’t make it to the hard data. That may be the case this time. But there is such a broad and persuasive set of soft data showing problems that it is difficult to believe the soft data is wrong.

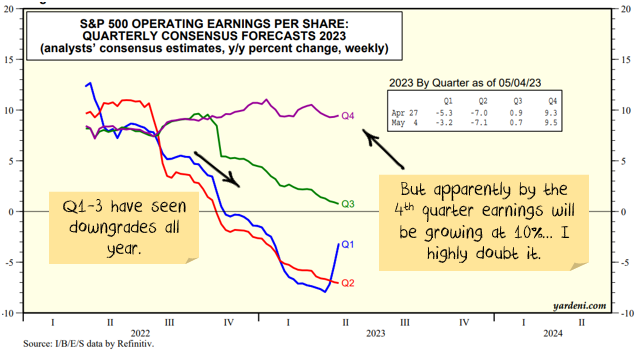

The bond market believes the soft data, it has rate cuts and a recession by the 4th quarter. Equity analyst forecasts do not:

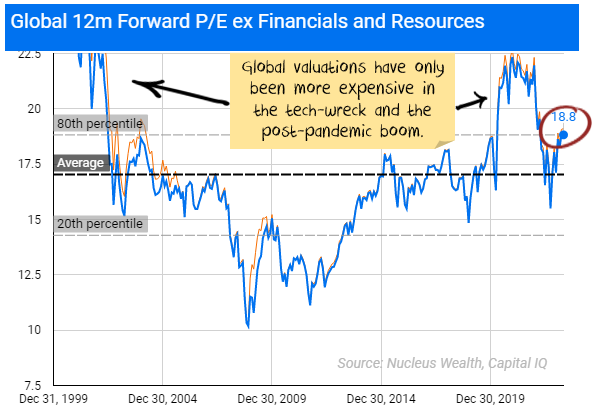

And the stock market definitely has not priced in the soft data:

Credit Crunch

A banking crisis has been playing out over the last few months. I initially thought that, on its own, the banking crisis wouldn’t create major issues. I’m slightly less certain of that this month, as banks continue to fail. Regardless, I’m much more confident that the credit crunch following the banking crisis will create major issues. So, it is a question of “when”, not “if”.

I’m expecting bank funding costs to increase. Deposits to flee the smaller banks. Both have already started.

As a consequence, banks scale back their lending. Interest rates charged are higher. Corporates bear the brunt, the US falls into recession and default rates spike. Inflation is no longer a concern.

Net effect: a mini-banking crisis, followed by a credit crunch, possibly followed by a traditional banking crisis.

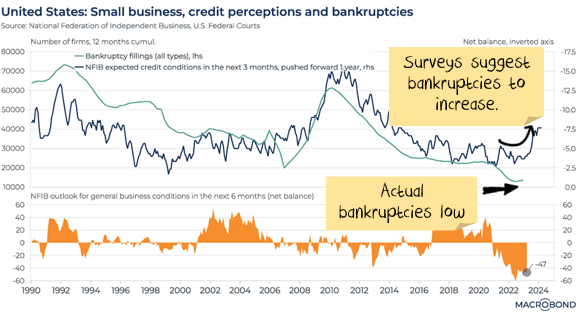

The soft data is pointing in that direction:

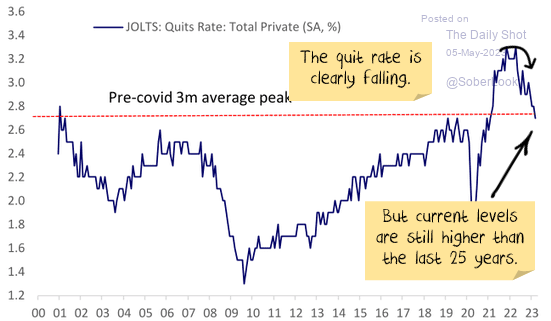

Jobs and inflation are the most lagging indicators.

Some indicators are early warning signs. Employment and the inflation rate are not. They are usually the most lagging indicators, not falling until after the recession has already started. Not rising until after the recovery is already well underway.

There are some divergent indications in both. They are off the extreme highs but are not falling as quickly as leading indicators suggest:

Does this mean that something is different this time? Or is it merely a sign that jobs and inflation are following their typical path and are lagging the cycle? The second explanation still seems the most likely.

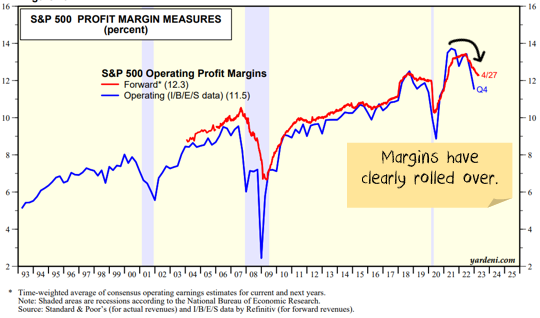

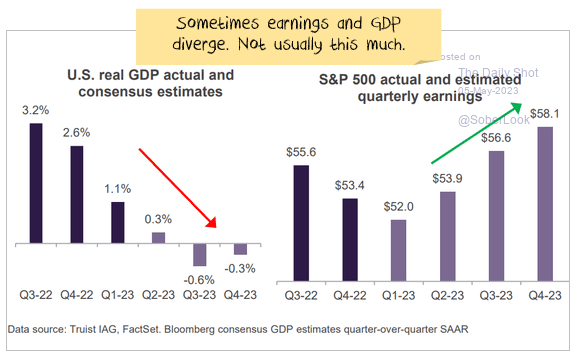

Earnings are still too high.

One of the key features of the last year has been the ability of companies to expand margins, using inflation as a cover to push through price increases. But that is coming to an end.

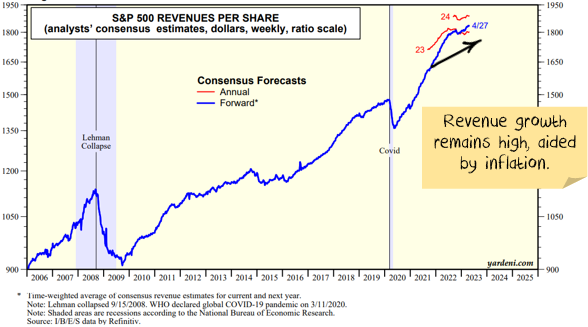

Sales growth remains relatively good, but this is largely a function of inflation:

Analyst forecasts are still too optimistic.

Add in that a host of forward indicators (soft data) are pointing to significant weakness. Capital expenditure intentions, financial conditions, CEO confidence, sector downgrades all point in the same direction. Earnings forecasts are too high.

Is something different this time? Or is it just that analyst forecasts are too optimistic at macro turning points, as they usually are. My money is on the second.

China to the… rescue?

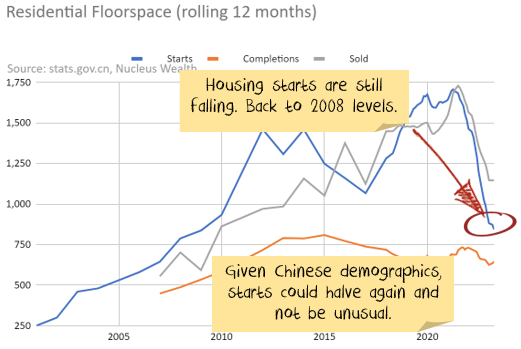

In November, China issued a sweeping directive to rescue its property sector. At face value, it was a major recalibration of its property crackdown.

These settings are hugely important for Australia. Around 30% of the ASX is in mining and energy stocks, and there is a massive exposure to government revenue via high commodity prices.

There are two ways to read the string of announcements:

- China is starting down the “whatever it takes” path. The current policies may not be enough, but they are a sign that China will keep adding more stimulus until the problem is fixed.

- The plan does not change the fundamental demand for new construction. For the most part, you can categorise the elements as either (a) directives to various banks to lend more to developers, mostly focussed on completing existing projects (b) reduced debt constraints or rules on individuals buying houses. The plan is to avert catastrophe rather than return to the old normal.

The stock market assumed the first was true. We suspected the second. It is still early, but the statistics support our view:

This is China’s fourth attempt in the past dozen years to wean itself off its property construction addiction. They lost their nerve on three prior occasions. These announcements were thought to be a sign that China had once again lost its nerve. The policies so far do not support that view.

We took off our underweights to commodities on the Chinese announcements. We went back underweight earlier this year when it became clear the policies are not enough.

Net Effect

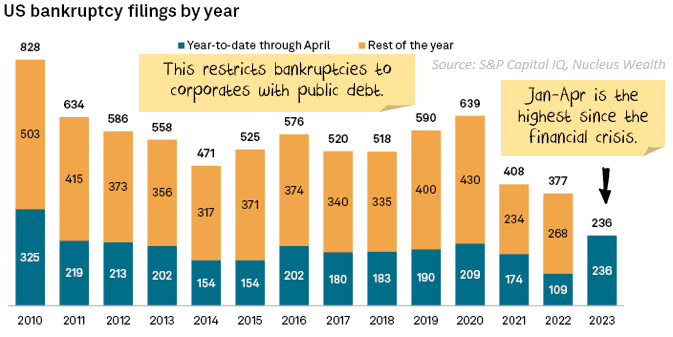

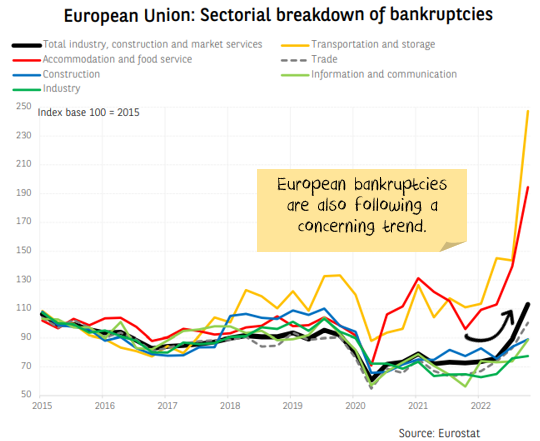

The credit crunch is growing, bankruptcies are climbing, company earnings are sliding lower, and China is not coming to the rescue. Valuations are in the most expensive 20% of historical ranges. None of those factors encourage me to buy more stocks.