How to Make Pre-Tax Concessional Contributions & After-Tax Non-Concessional Contributions to Super Including Catch-up Contributions

In this article, I will run through the different ways of getting money into Superannuation while you are in accumulation phase. Then I will show you some examples so you can really see the benefits.

Boosting your super is an excellent way to save for your retirement in a tax-effective way. What I mean by that is super is a low tax environment and it is usually taxed at a lower rate than your marginal tax rate. More often than not it is a better place to save and invest for your retirement than in your personal name or through other structures.

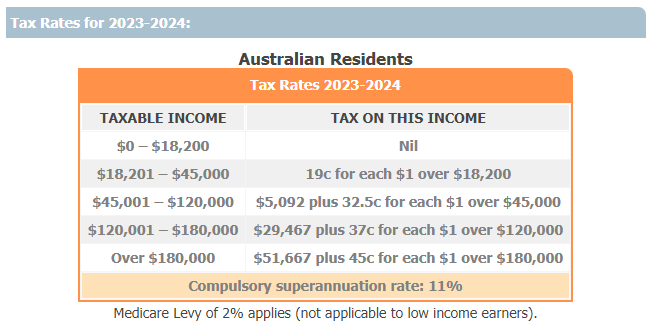

To give you some context, the super tax rate in the accumulation phase is taxed at a maximum of 15% which will be lower than your marginal tax rate if you earn over $18,200 p.a. When you retire and are in pension phase the tax rate is 0%. There is no tax to pay on any earnings, capital gains or withdrawals. It is a completely tax-free environment.

This tax-effective environment means it’s an attractive place to save and invest for the long term and there are lots of concessions and additional opportunities for getting your money into the Super environment also. This article will explore the different ways you can get your money into Super.

Pre-Tax or Concessional Contributions

Concessional Contributions are contributions that are made into your Superfund before tax (ie the amount you contribute reduces your Taxable Income). The Concessional Contribution limit for the 2023/2024 tax year is $27,500.

There are several ways to get your money into Super via concessional contributions and they are all taxed at 15% which is the Super Contributions tax rate. All these contributions count towards your annual cap or limit.

Eligible contributions:

- Employer contributions

- Salary Sacrifice

- Personal Deductible Contributions

Employer contributions

These are the compulsory Super Guarantee (SG) contributions that your employer must pay into your super. Currently, in 2023/24 it is 11%. However, this is indexed to go up to 11.5% on the 1st of July 2024 and will increase to 12% on the 1st of July 2025. It is legislated to stay at that rate.

Salary Sacrifice

This is an arrangement between you and your employer where your employer contributes some of your pre-tax salary into super rather than receiving it as take-home pay. This is in addition to the compulsory SG contributions they make for you. It reduces your taxable income, boosts your super and reduces the overall tax you pay.

Instead of paying tax at your marginal tax rate (plus the Medicare levy of 2%) which can be up to 47% on the highest marginal tax rate, you pay tax at the Super contributions tax rate which is 15%. You benefit from the difference in tax savings. You could be up to 32c better off for each dollar you put into Super if you are on the highest marginal tax rate. The tax savings depend on which tax bracket you are in. However, be careful, not to go over your Concessional Contribution Cap as there are penalties such as Division 293.

Personal Deductible Contributions

These are personal contributions you make to your Superfund where you can claim a tax deduction on your individual tax return if certain criteria are met.

This also reduces your taxable income, boosts your super and reduces the overall tax you pay.

If you have a lump sum you want to contribute into Super you can make a contribution and claim a tax deduction to reduce your taxable income.

There are a few steps to satisfy the eligibility requirements:

- you need to make the contribution, then lodge a form with your Superfund called a ‘Notice of intent to claim or vary a deduction for personal super contributions NAT 71121.

- Your super fund will then send you an acknowledgement and now this will be classified as a Concessional Contribution.

- You have then satisfied all the criteria and can use this acknowledgement to claim the tax deduction when lodging your tax return or give it to your accountant if they file your return on your behalf.

Example 1 – Maximising the Concessional Contribution limit for 2023/24

Salary Sacrifice and Personal deductible contributions work differently in practice but have the same net effect. Below is an example showing the benefits.

Lets say you earn $100,000 p.a. with your employer contributing $11,000 p.a. (11%) on top into your super through the SG employer contribution. Let’s assume you want to maximise your concessional contributions for the year and contribute up to your annual cap of $27,500. You can either salary sacrifice $16,500 split over your pay periods for the year or you make a one-off lump sum personal deductible contribution of $16,500 before the end of the financial year (assuming all the above eligibility requirements have been met)

The income tax payable on your taxable income of $100,000 is $24,967 (including the 2% Medicare levy)

If you contribute $16,500 as a concessional contribution this reduces your taxable income to $83,500 and the income tax payable to $19,274.50. An income tax saving of $5,692.50.

With the $16,500 contribution, you have to pay the super contributions tax of 15% which is $2,475.

Therefore the net amount you have contributed into super after the 15% contributions tax is $14,025 ($16,500 – $2,475) and you have also paid $3,217.50 less tax overall ($5,692.50 – $2,475).

Now your money is in the low tax environment of Super, where it can grow more effectively than investing in your personal name. Plus it is totally tax-free once you retire.

There is a great calculator here to calculate your income tax payable and with differing Super contributions.

Catch-up Contributions

As mentioned the pre-tax concessional contribution limit for this financial year is $27,500. However, if you have not used up your whole cap for this year or previous years starting from 2018/19 you can contribute any unused cap amounts providing your total super balance prior to 30 June is below $500,000. These unused concessional contribution caps are on a rolling 5-year basis and any unused cap amounts will expire after this rolling 5 year period.

To check how much available unused concessional contributions you have available you can check this via the ATO through MyGov (see below for how).

You can do this as a lump sum personal deductible contribution and reduce your taxable income and claim a tax deduction.

This can give you more flexibility around making concessional contributions into super, especially if you have some spare money or come into a lump sum, have broken work patterns or cannot contribute in some years.

Example 2 – Maximising Catch-up Contributions

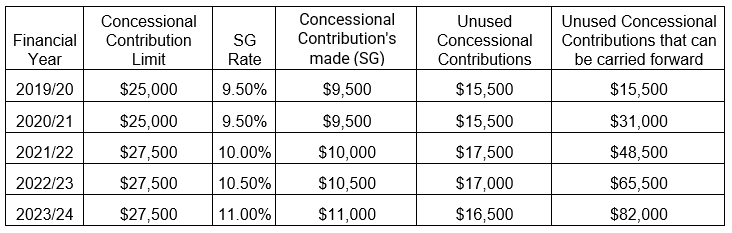

Let’s say you earn $100,000 p.a and your income has been the same since 2018/19 and your super balance is $200,000. You have not made any extra contributions and only your employer SG contributions have counted towards your Concessional Contributions. Lets assume you are part of a couple and you live off your partners income. Your income is a the surplus and you want to put it into Super as a Personal Deductible Contribution. This strategy also works well if you have a large capital gain and want to reduce the amount of tax paid. The below table shows your accrued unused concessional contributions for the last 5 eligible years.

In the 2023/24 tax year, you make a personal deductible contribution of $82,000. This uses up all your unused catch-up contributions since 2019/20 and you claim a tax deduction for this. For this example, we assume you have lodged the Notice of intent, the contribution was received in the 2023/24 tax year and you have received the acknowledgement from your Superannuation fund.

This would reduce your taxable income from $100,000 to $18,000. This would reduce the amount of income tax you pay (including the 2% Medicare levy) from $24,967 (tax payable on $100,000) to $0 (tax payable on $18,000). An income tax saving of $24,967 (including the 2% Medicare levy).

However, we need to account for the super contributions tax of 15% on the $82,000 contribution. This is $12,300.

Therefore the net amount you have contributed into Super after the 15% contributions tax is $69,700 ($82,000 – $12,300). You have paid $12,667 less tax overall ($24,967 – $12,300). Now your money is in the low tax environment of Super for it to grow more effectively compared to investing in your personal name.

As a general rule, the higher your income or the higher your marginal tax rate is, the greater the tax savings are. Therefore this benefits higher-income earners more than individuals on lower marginal tax rates.

In the next financial year (2024/25) your allowable concessional contributions will be $27,500 (provided it is not indexed for this tax year but always check for the latest changes) and you would have no catch-up contributions available. The 5 years that you can accrue catch-up contributions would be reset from 2024/25 going forward for the next 5 financial years.

After-Tax or Non-Concessional Contributions

The non-concessional cap is currently $110,000 p.a. and these are contributions made from your after-tax income. These contributions are not taxed (not subject to the Super contributions tax of 15%) when making the contribution as you have already paid tax on that money.

Additionally, if your total super balance is less than $1.9m you can use the bring-forward provision and do a one-off after-tax contribution of $330,000 and use up 3 years worth of non-concessional contributions in one lump sum. There is a rolling 3 year period under the bring-forward provisions and you will be unable to make any more after-tax contributions for the next 2 tax years until your after-tax contribution cap resets.

There are some age restrictions also so please see the latest information from the ATO and always seek advice from a licensed financial adviser or tax specialist.

How to make Personal Deductible Concessional Contributions or Non-concessional contributions to your Superfund in practice

Your superannuation should have a portal that you can log in to check. For Nucleus Super clients:

1) Log into your Praemium Investor Portal

2) Click on the Accounts tab

3) Scroll all the way to the bottom and find Contribution Options and use BPAY to transfer. The reference numbers displayed are unique to you

4) Personal contributions will be automatically treated as After-Tax Contributions or Non-Concessional Contributions.

5) To allocate these personal contributions as a Pre-tax Concessional Contribution or Personal Deductible Contribution and be eligible to claim a tax deduction; you must lodge a Notice of intent to claim or vary a deduction for personal super contributions form (NAT 71121) and email it to support@praemium.com.au

You will receive an acknowledgement of that notice from Praemium.

You can use this acknowledgement to claim the tax deduction when lodging your tax return or give it to your accountant if they lodge the return on your behalf.

The contributions must be received before 30 June in the year that you want to make the contribution. To make sure it’s received by the Trustee by this date it’s always better to make the payment well before this date.

This ‘Notice of Intent must be lodged by the earliest of: you submitting your tax return for the income year in which the contributions were made; withdrawing or rolling over from the fund; commencing a pension, or before the end of the income year following the year in which the contributions were made.

Please contact your financial adviser or tax adviser for more information on eligibility to claim a deduction.

Final thoughts

You can’t access your Super until you meet a condition of release such as reaching your preservation age and retiring, therefore any contributions you make may be locked up for a long time. There are also progressive minimums you have to withdraw from Super in pension phase so please be aware of this also.

Just a reminder that this is general advice and doesn’t take into account your personal situation. Please be aware that Superannuation is an ever-changing landscape so always seek specific tax advice for your situation or speak to your financial adviser.

Appendix: Where to find your concessional contributions on MyGov

- Go to my.gov.au and login.

- Go to the Australian tax office

3. Select Super -> Information -> Carry forward concessional contributions

4. Select the year and see your contribution:

Note that the information may not be fully up to date and relies on your superannuation funds reporting.

It does show the calculation, but you should also maintain your own records, particularly if you have a self-managed fund or multiple superannuation accounts.