Central banks worldwide, particularly in the US, have promised to tighten financial conditions.

What this means, broadly, is two things:

- Central banks will bring demand down to the reduced supply level, causing a recession if needed.

- Central banks want asset prices lower.

Background

From 2010 until the pandemic, central banks struggled to get enough demand. Inflation was muted. Interest rates spent a decade in the doldrums. Then, the pandemic hit, and the mix of increased spending on goods plus direct government stimulus gave us a boom.

Over the top of this scenario, supply chain problems emerged:

- Lockdowns prevented various components from being produced or reduced capacity.

- The loss of commercial flights, which are also significant carriers of goods, smashed capacity in the logistics market. The primary air routes in and out of China are still a fraction of prior levels.

- Rolling (and continuing) COVID cases among drivers and pilots further reduced capacity.

- As the reduced capacity met increased demand, traffic jams at US ports delayed delivery times even more.

Spending on supply chain efficiency boomed. We expect that supply chains will be significantly more efficient once the traffic jam clears. However, as supply problems were starting to ease, they were hit by two additional events:

- Sanctions on Russia and elevated energy prices following on from the Ukraine war.

- Lockdowns in China disrupting production and supply chains.

Neither of these problems has a short-term fix.

Without a regime change, Russia will likely remain under sanctions for years, regardless of the Ukraine outcome.

China has crafted a narrative of Western ineptitude leading to millions of unnecessary deaths from COVID. However, Chinese vaccines have not been particularly effective, and vaccination rates remain low among the elderly. Until China changes the narrative, it will likely face rolling lockdowns for months.

1. Will a recession be needed?

None of the above problems are solved by higher interest rates.

The response from central banks has been to signal that they will slam on the brakes. The expectation is that central banks will beat demand down to the level of supply. At the same time, governments have hauled on the park brake. We have a record amount of government stimulus being withdrawn from the market.

This all may be the right policy for constraining inflation. Maybe world demand needs to be beaten down to much lower levels. But, it is not a good recipe for investment. And a recession is the likely outcome.

2. Lower asset prices

Part of making financial conditions tighter involves lowering asset prices.

Government bonds are the furthest advanced. Stocks are well into the process. Corporate bonds have started, but have a lot further to go. Houses have stopped rising, but are really only just beginning.

Government bonds

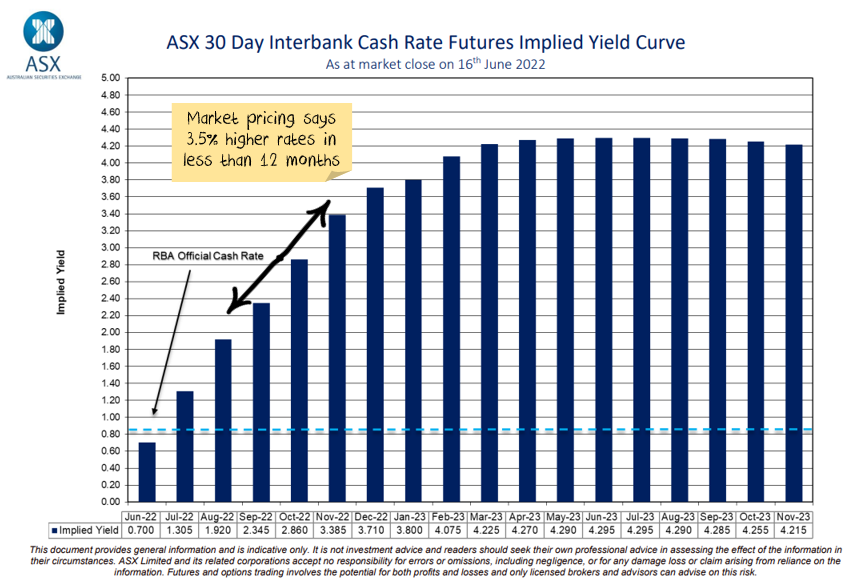

Government bonds have moved to levels far above recent rates. They reflect significantly higher interest rates for a concerted period of time. In Australia, the market is pricing rates of almost 4.3% within 12 months. This is the equivalent of mortgage rates of around 7.5%.

Australia has far more mortgages on variable rates than other countries, particularly the US. Australian consumers are far more indebted than most other countries.

Add in increases in energy costs, I don’t believe the Australian consumer can handle 7.5% mortgage rates. I equate 7.5% mortgage rates with a deep recession in Australia.

This means there are two outcomes:

- Interest rates do not rise as far as the market pricing. So bond yields fall.

- Interest rates rise as far as the market is pricing, which causes a recession. Interest rates are then cut, and bond yields fall.

Can bond yields rise even higher? Yes. But I think we are close to the end game at current levels. i.e. 10y bond yields may go higher in the next few months, but they are most likely headed lower over the next 9-12 months.

Stocks

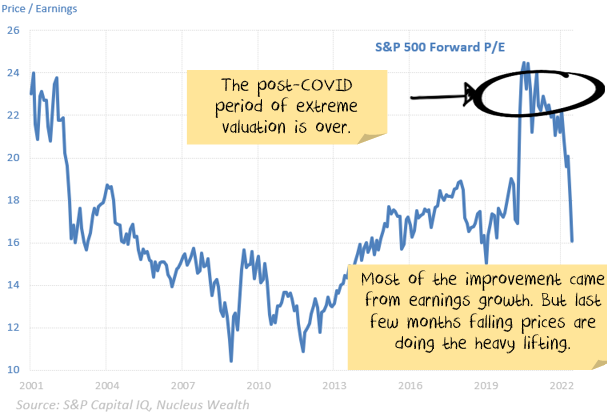

Stock valuations are back to reasonable levels.

Valuation does matter. But earnings growth matters more. In a good year, earnings can easily grow 20% or more, making an expensive market fair value. The danger is that earnings can also fall quite precipitously. And today, in my assessment, that is where the danger is.

At an aggregate level, earnings growth still looks OK. But most of the growth in the last reporting season came from energy and resources. And, effectively, central banks have promised to kill commodity prices to bring down inflation.

Earnings forecasts are still for another 20% combined growth over 2022 and 2023. In the face of a recession, that is heroic. Even if there is not an economic recession, I’m expecting a sharp slow down in profits.

Earnings are more likely to be flat over two years, with risks to the downside. On that basis, stocks would still be at the more expensive end of historical ranges. Heading into a potential recession, that is not where you want valuations to be.

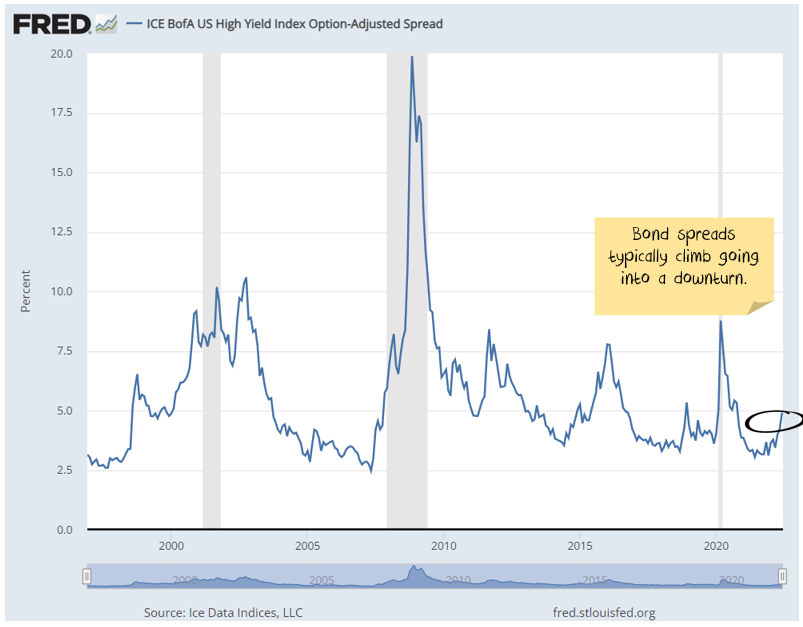

Corporate bonds

The absolute level paid by corporates has risen with bond yields. A better measure looks at the spread that corporates pay over governments.

For the riskier exposures, levels have moved to more normal levels.

For more typical companies, while spreads have risen, they are still low relative to history.

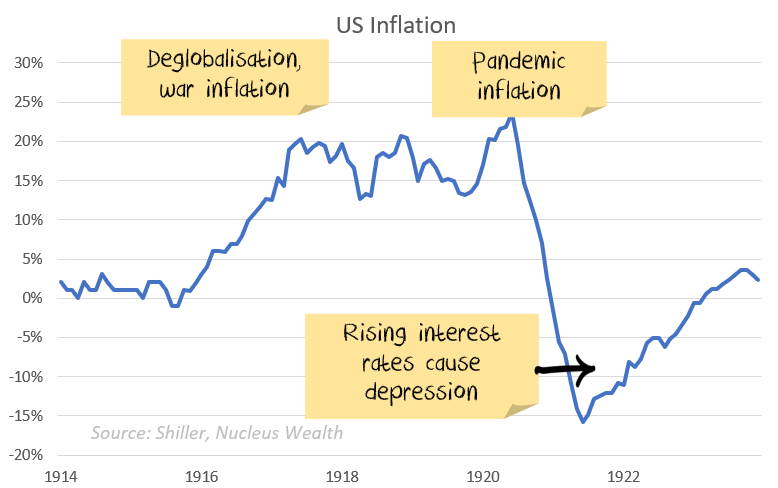

Have we seen this all before?

- Globalised supply chains reversing into more local production due to geopolitical tensions

- A pandemic disrupting supply chains

- A surge in inflation due to supply issues

- Central banks hiking rates into a supply-side shock

Yes, we have. Following World War I, all of the above factors were in place.

By 1920, inflation in the US was running at 15%. The US central bank hiked rates from 3.5% to 5.6% to curb demand. By 1921 the US was in a depression, with inflation of -10%.

The analogy is not exactly the same. But, trying to use interest rates to solve supply chain problems is at the core. There are more similarities than there are differences.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short term effect is probably commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic. In China, however, rolling lockdowns will likely continue for the rest of the year.

- The geopolitical energy crisis in Europe has turned acute and infected Australia. This will subtract from European and Australian growth in the short term, there will be a rush to alternative energy sources in the long term.

- Supply chains have improved a little but have a long way to go.

- Demand is challenging to read and distorted by Omicron. Demand held up far better than prior virus waves.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock in 2022. The question is whether the private economy will be strong enough to withstand it.

- Central banks have made it clear that they will try to solve the Russian induced energy issues and supply chain induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. But China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. Unless they change, this will deflate the commodity market.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for recession this is a buying opportunity. The problem in the short term is that the narrative “high inflation, central banks raising rates = sell bonds” is surging still.

And the mix of higher volatility, leading to deleveraging of risk parity trades, and momentum means yields could yet go higher. We are starting to invest for bond yields to reverse.