I had a fascinating space investment conversation (podcast) today with Dr Andrew Barton, an engineer specialising in space technologies with a long career in both Australia and internationally.

For me, what is incredible is the pace of cost reductions being seen in the sector. Elon Musk’s SpaceX has brought the cost of launching equipment into space down by a factor of ten. And there is a realistic roadmap to bringing it down by another factor of ten.

These changes matter. Twenty years ago, solar power was a novelty. Bring solar costs down by a factor of ten, and suddenly it is transforming the energy sector. The question is, what sectors could be affected by a similar change? What emerging trends should we be watching today.

Note that prices are now low enough that space investment is no longer the exclusive domain of governments.

Some of the key points to listen in for:

- Telecommunication companies should be on the lookout. The Starlink (SpaceX) network is gunning for your remote customers right now. It has plans for your gamers and international video/phone calls. Others are building similar networks, most notably Amazon, which is a long way behind but has big plans.

- Mapping, GPS and weather analysis services are all going private.

- Space tourists are headlined by Jeff Bezos and Richard Branson. For me, tourism still seems a novelty for a long time. Andrew pointed out that tourism is going to be expensive for a while; the skills to launch inanimate things into orbit are not the same as the sub-orbital paths for billionaires.

- There are a host of ancillary services, from refuelling to object mapping to clean-up to ultra-light materials. To re-iterate, the entry of private players and the drop in costs mean there is scope for a range of new services.

- The Sputnik launch in the late 1950s kicked off a US/Russia space race with incredible amounts of money spent in the sector. Andrew discusses what China is working on, and we speculate what might spark a similar race in the 2020s.

- We touched on space manufacturing. Some high-value items look like being worth manufacturing in space rather than on Earth. But it is very early days.

- Moon mining is more likely than asteroid mining in the short term. But it is expected to be for water, fuel and materials to build structures in space. Not to send materials back to Earth.

- Asteroid mining has delivered the corpses of a few companies already. There will undoubtedly be more, as with any new technology. We talk about the rough economics and how long until mining is a reasonable proposition. It is mostly about weight. Gold and platinum at $30-60 million per ton will be profitable long before iron ore at $150 per ton.

Getting Exposure

How can you get exposure? Many of the larger US defence contractors (Boeing, Northrop Grumman, Lockheed Martin) have space divisions. But, space investment is only a part of a very large company. And, they are often not working on some of the cutting edge technology.

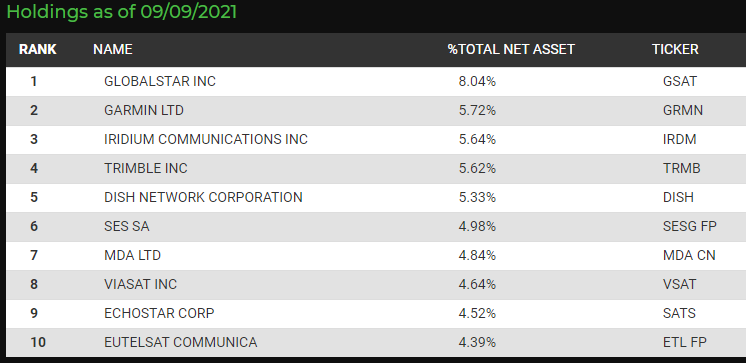

There is a space-focussed US-listed ETF (ticker: UFO) whose holding list might make a good place to start for investors looking for stocks:

Cathy Wood/Ark also has an ETF.

If you are looking for Australian stocks, then be prepared for some red ink on your P&L. Electro Optic Systems (EOS) is the biggest of the crew; Brainchip (BRN), Xtek (XTE) and Kleos Space (KSS) round it out. Keep in mind these are small companies where you need to be comfortable with the product and see a path to profitability.

The profitability of the smaller companies is often dramatically worse than the government-backed defence contractors. It is not the same type of investment. Don’t buy a dream! Make sure that you can see a path to genuine profitability. If there is another space race, you can expect most defence contractors to benefit. That will not be the case for smaller stocks.

Space Investment Wrap up

The net effect is that the sector is undergoing step changes in terms of costs and the entry of private companies. Plus, it is an interesting hedge on the continued souring of US/China relations. If the space sector isn’t at least on your radar, it should be.