One of the recent mega-trends in the healthcare space has been the evolution of a new class of weight-loss drugs that purport to be the magic pill that the pharmaceutical industry has been seeking to address the obesity epidemic. There are obvious implications for the stocks involved. And, there is also the potential for a broader investment impact on society and a range of other sectors.

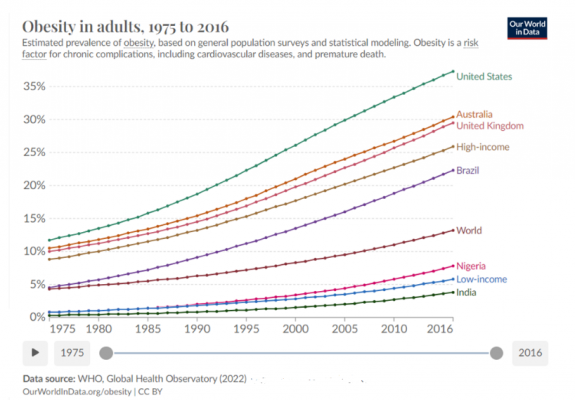

Obesity is a major global social burden.

Measuring how bad is subjective. The World Health Organization ranks it third behind smoking and wars for impact. Other estimates suggest a cost of around 3% of global GDP.

The obesity trend is clearly up across all countries regardless of socio-economic demographics: no country has seen a decline since 1975. The US has gone from 10% of its population in 1975 to over 40% currently and is projected to be over 50% by 2030. Australia and the UK are not far behind. It is primarily a first-world problem.

With this background, stocks targeting obesity drugs make long-term investment sense. We have owned a number of them for years. As with all growth themes, the trick is not overpaying for the stocks involved.

Weight loss options

Until now, weight loss strategies have relied on exercise-diet regimes offering 5-10% weight loss. Extreme cases see invasive gastric surgery that can reduce weight by up to 30%.

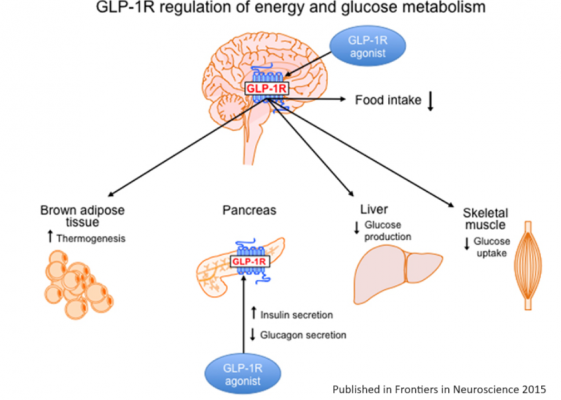

Historically, weight loss drugs have had a spotty record with major side effects. Into this void has emerged a new class of drugs known as the GLP-1 agonists. They were originally investigated for diabetes treatments but, almost accidentally, have become better known for their significant weight-loss ‘side-effect’.

Clinical test results show weight loss of 10-20%+. The advantage of GLP-1 agonists is that they stimulate existing natural pathways and have a multi-factor effect on fat burn, insulin secretion, glucose absorption and appetite suppression.

The last is the most important from an investment perspective. Say we have a safe drug that makes you feel less hungry and eat less. It could have regime-changing impacts on a range of other industries.

Cons of weight loss drugs

The drugs, so far, appear to cause few major side effects. They can be taken weekly, which is better for dosage adherence. Side effects are mainly gastro-intestinal with some potential Pancreatitis and Thyroid cancer implications. They are injectable, which may limit use.

The main downside is the resultant muscle loss with the weight shedding.

The drug’s cost (almost US$1,000/month) and limited coverage by US insurance are also a downside. But both are solvable.

A look at the major weight loss drugs stocks

Companies like Novo Nordisk and Eli Lilly are leading the market in this area. Novo Nordisk has specialised in metabolic disorders for some time. Eli Lilly recently pivoted to concentrate on diabetes treatments as a key growth driver.

Other pharmaceutical players, such as Amgen and Pfizer, are rushing to develop drugs in this space. Still, they are at least five years behind this duopoly.

Danish Novo Nordisk was the first to market with this class of drugs. Currently, two-thirds of Novo’s revenues are generated by GLP-1 (the remainder is primarily Insulin). It is the purer exposure to weight loss drugs.

For US giant Eli Lilly, weight loss drugs are more like a third of revenues. But, given it has only recently launched its weight loss candidates, this will grow. Eli Lilly has a diverse offering of pharmaceuticals targeting other major health areas of Alzheimer’s, Crohn’s disease, and Arthritis and Cancer.

For investors using direct indexing, choosing the weight-loss tilt will get you access to these stocks:

Looking at the metrics

With the release of favourable trial results, the market has woken up to the economic windfall this duopoly now faces and has driven up the share prices to the extent that Novo is now the largest market capitalisation company in the EU, eclipsing the GDP of home country Denmark.

A few years ago, our analysis suggested that both companies looked high quality but relatively expensive with massive potential. Today, the potential looks more likely to be realised, but the stocks are not much more expensive.

Forecasts now suggest earnings will roughly double from 2022 – 2025, and growth beyond that looks strong. Novo is priced around about 26x forward earnings. Eli Lilly is about 15% more expensive.

If that’s all they get from this discovery in terms of earnings growth, then you may argue that both of these stocks are starting to look overpriced.

However, there is potential for expansion of these drugs into many other disease areas. There is a broad range of other ailments where losing weight will be helpful.

Already, GLP-1 are indicating they have the same benefits as key cardiac drugs. The Resmed share price tanked on expectations that these drugs will work for sleep apnea. By 2030, the GLP-1 market could be US$100B+ per year.

If the side effects remain limited and production expands, there is always the potential for broader use.

So, while expensive, we continue to be a holder of the two companies until this story fully unravels. The risk is that some longer-term side effects may hamper its uptake. With more than 10 years of studies, much of (but not all) the threat has been mitigated.

Other healthcare stocks will suffer.

So, companies producing the drugs benefit. But weight loss also sees positive benefits on cardiovascular issues, kidney disease and stroke reduction. And a range of other ailments. So, healthcare stocks targeting those areas will see lower sales.

We have already seen some investor anxiety on sleep apnea players such as Resmed, who have seen recent share price weakness. Perhaps overdone? The key will be to ask how big each market is if you exclude weight-related symptoms.

Alternative weight loss medications/strategies have already taken a hit with Herbalife and bariatric surgery providers such as Medtronic PLC facing lower demand.

Health Insurers may be another big winner.

Most health costs are incurred by a small proportion of people. If obesity rates go from 40% to say 20%, this will have a significant impact on healthcare spending.

Fast Food?

Where to for obesity facilitators? McDonalds, Yum Brands, Dominos, Pepsi, Coca Cola may see slower growth. The drugs will affect the volume consumed by the biggest users. But, maybe some people eat fast food more often if the negative consequences are reduced?

For investors using direct indexing, choosing the fast food screen will cut those stocks out of the index portfolio for you:

Obesity drugs = a productivity boost

Say society needs less food per person and spends less on healthcare. While companies in those sectors may suffer, it sounds like a macroeconomic productivity boost to me. Fewer resources are needed for the same economic output.

If people have more money because they eat less and have fewer health issues, where will they spend?

Will social-focused firms like dating service providers, gyms, and luxury goods see an uptick as people feel better about themselves? But maybe gyms suffer as people trade in exercise for a pill?

It is hard to predict, but what is certain is that where there is change, there will be opportunity.