Stock markets have dislocated from fundamentals. The economic fundamentals are almost as bad as they have ever been. Stock market valuations are almost as expensive as they have ever been. But that hasn’t concerned markets for the past six weeks and, to be frank, it doesn’t look like concerning markets any time soon.

This is presenting you with a rare second chance to sell stocks in the face of the worst economic shock of our lifetime.

For complete disclosure, there is another alternative. That alternative is that markets are now entirely dependent on central bank support, so economics and fundamentals no longer matter. This is a possibility.

It is also an ironic logical progression: Capitalism is dead, therefore buy stocks.

Why has the market risen?

I’m putting the rise down to three main factors:

- Central bank money printing leaving more money in markets.

- Momentum traders, robots and retail traders chasing the bounce higher.

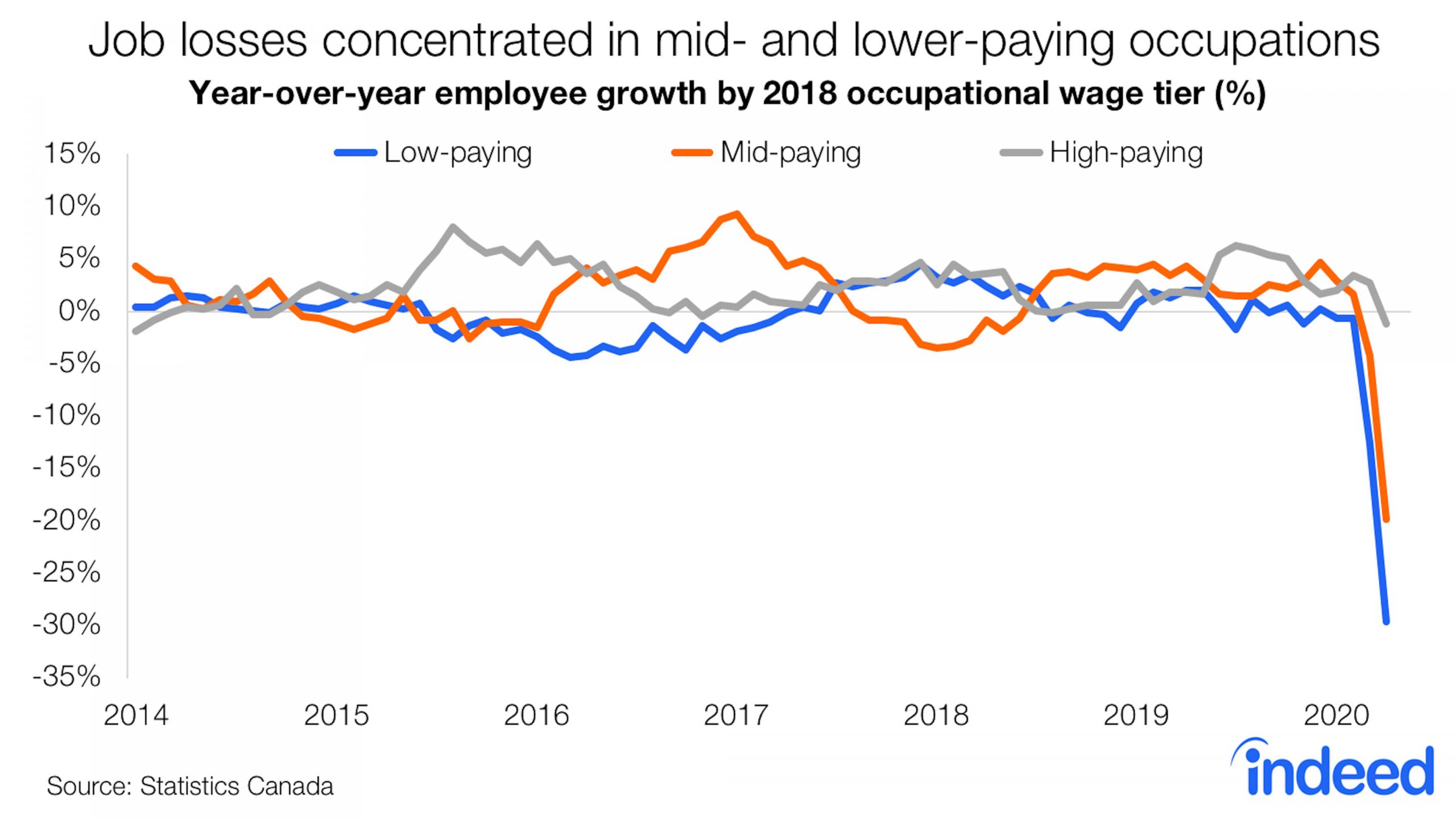

- Inequality getting worse, rich people are more likely to keep their jobs and so are investing more because there are limited opportunities to consume

Could this simply be the “new normal”?

The question is whether weak profits will eventually bring this back to reality. I guess it is possible stockmarkets ignore earnings for 3-5 years until profits recover. But I think it unlikely.

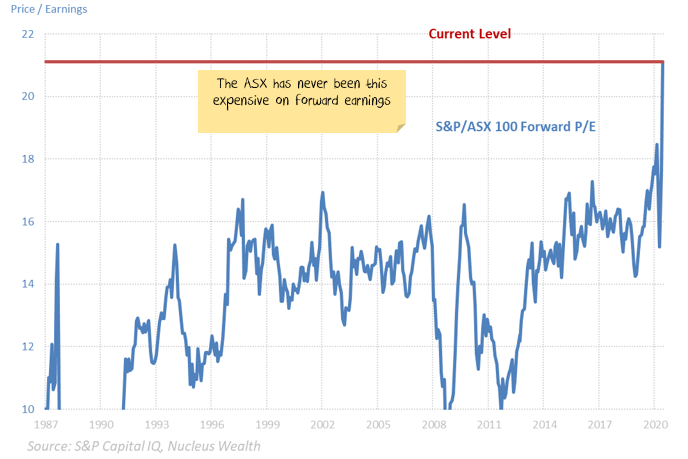

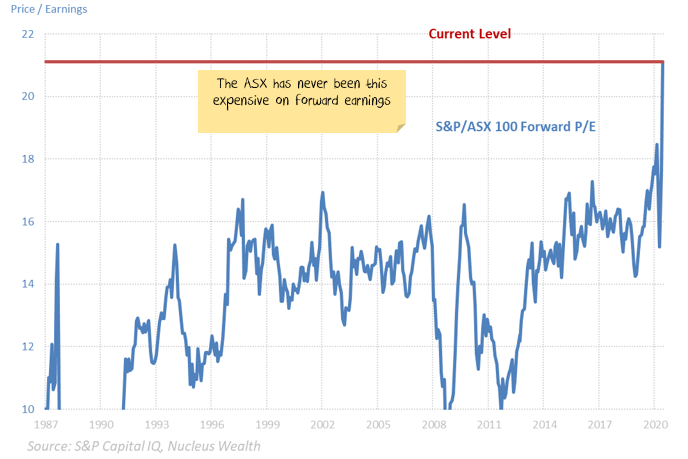

The “stock markets will eventually recover” argument is a favourite argument of the perma-bulls. The underlying logic of this argument is nothing bad ever matters because stock prices will eventually recover. The logic is (mostly) true, but last I checked the ASX 200 was still below 2007 levels – 13 years is a long time for prices to go nowhere if you go all-in at the wrong time. I’m assuming you are still reading because you don’t want to wait that long.

What could bring markets back to reality?

I don’t know. So far the following have failed:

- terrible Q1 earnings and falling outlook

- a failure to control the virus in the US

- rampant virus activity in developing countries

- the likely intensification of the US/China trade war

- widespread rioting in the US

My best guess is a mix of bankruptcies and weak earnings will eventually do it. It might take six months. It might take six minutes.

A Biden win in the US has the potential to shock the market with higher taxes and wages. I expect this will actually be good for profits in the long term, but it might be enough to shock the market back to reality in the short term.

The danger for investors who have a plan to “run with the herd” and then sell when the market turns is that there seem to be a lot of other investors with a similar strategy. And given markets have set records for the speed of both downward and upward movements, you will want to very confident of your ability to get out at the right time.

What about central bank support?

The arguments are:

- Central bank liquidity will overwhelm insolvency risks.

- Government stimulus overwhelms the economic damage.

It is not a particularly nuanced argument. Central banks will buy or fund everything. If our defensive position is wrong, this is probably going to be why.

Dig a little deeper, and the argument is less convincing. Governments and central banks have a choice:

- take more pain earlier and recover faster

- delay the pain and have a much more drawn out recovery

Governments and central banks are opting for the second. Which means investors are going to have a lot longer to wait for company profits to recover.

Can central banks and governments prop up failing large companies?

They can and will.

There is a slight question about how long for. However, the reaction to pretty much every debt crisis since Japan in the 1990s has been to prop up zombie companies. I think the plan is that if you give these companies enough low-interest debt then you can see out your term and leave any problems to your successor.

I expect zombie companies to proliferate. Companies with such enormous debt burdens and low profits that they have little hope of ever paying off the debt. Which means the recovery will take longer.

Can central banks and governments prop up failing small and medium businesses?

These companies make up 50-70% of most economies. They don’t have listed debt that central banks can buy.

It is extremely hard to prop up small businesses. The fraud risks are too high. Take a loan, transfer your assets into your wife’s name, pay your brother-in-law for some fit-out, declare bankruptcy.

The Australian government tried to support small and medium businesses by offering partial loan guarantees for up to $40b of bank lending. The actual amount of credit looks like it will be closer to $4b – i.e. 90% lower than announced.

It is hard to support this part of the economy. I’m yet to see a proposal anywhere which looks workable.

Can central banks and governments continue to pay people not to work?

Yes. The question is how long for. Many governments put in place short term measures to support earnings for displaced workers. Most plans tail off over the next six months.

In most developed countries the virus is now contained enough that hospitals are not over-run. Which means economies are at the stage where the imperative will become finding people new jobs rather than paying them not to do their old jobs.

Will we see governments continue to pay elevated unemployment benefits to displaced workers for years? Possibly, but this once again, this will delay any recovery.

Concern 1: Lack of consumer demand.

Before Covid-19, even though consumers had been growing debt faster than income for years, consumer demand was still weak. Now consumers have lost jobs in record numbers, have been locked at home, face threats of future lockdowns and banks are tightening lending criteria. All the evidence so far suggests that it will be a long time before consumer demand returns.

An often-cited argument is there will be pent up demand from people stuck at home unable to spend money. This is a rich person’s argument:

There will definitely be winners. But the impact of a few winners spending more money will be drowned out by the legion of people with less money. And rich people won’t be able to spend on travel for some time. And there will be winners who decide to save money in case there is a second wave.

Concern 2: Debt Crises

Consumer debt is close to record highs. Corporate debt in the US is at cyclical highs. Add in weak consumer demand and supply shocks. All the conditions are present for a debt crisis.

The best argument is that central banks and governments will “do something” when it becomes an issue. They might. I have no idea what, but it would be hugely expensive and incredibly prone to fraud. Effectively it would be suspending capitalism.

Concern 3: Corporate Earnings and Valuation.

On top of the above problems, I see companies:

- running lower debt levels

- adding more redundancy into systems

- adding more fat into supply chains

- diversifying supply chains away from China.

All of these will reduce earnings even further. And I’m not talking about the one-off impact this year, I’m talking about a long term decrease in earnings potential.

Earnings are cratering. Australian forward valuations have never been this high. US valuations were only higher during the tech wreck.

Upshot

The numbers are messed up at the moment. Growth rates are so large in both directions that they are virtually meaningless. The focus for investors should be on where earnings can get back to over the next few years. And I’m struggling to find anyone with a credible earnings scenario that would justify paying current prices.

I’m betting central banks and governments won’t suspend capitalism forever.

There were a lot of superannuation funds and investors who completely missed the virus coming and rode the stock market all the way down and then most of the way back. They have been gifted a second opportunity to sell. My bet is very few will take the opportunity.

Interested in more? View our webinar on the topic: