- No Fossil Fuels (Worst Offenders)

- No Fossil Fuels (Any)

- No Coal Seam Gas or Fracking

- No Nuclear Power

- No Old Growth Forest Logging

Click get started to see which stocks are excluded in each screen.

Direct indexing lets you personalise passive investments. Instead of sifting through the thousands of ETF options available, you can build what you’re looking for from the ground up. With costs comparable to ETFs, we’re calling this the second generation of ETFs, or ETFs 2.0.

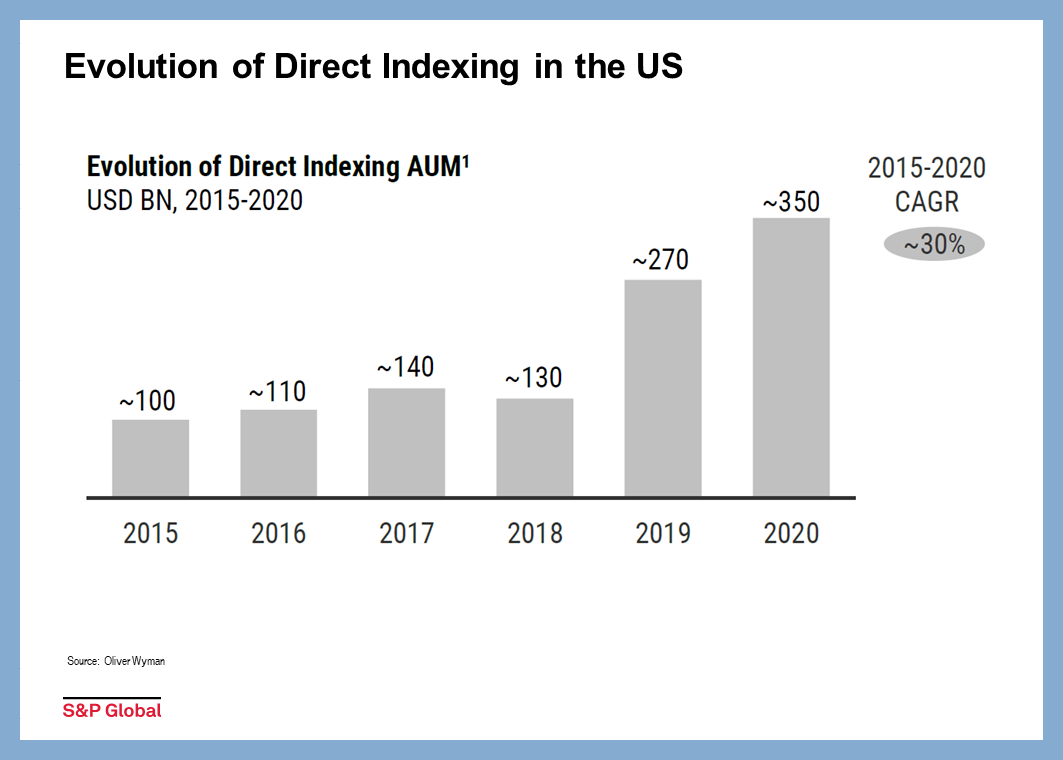

Direct indexing has been available in the U.S. for decades, and its popularity continues to increase as a result of the low costs, portfolio personalisation, tax optimisation and direct exposure the investment structure offers clients.

Choose your investment amount, and then view an estimate of the stocks that will be in your portfolio, including all the stock tilts and exclusions you have selected to personalise your portfolio.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are excluded in each screen.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

Click get started to see which stocks are included in each tilt. Each tilt can also be a stand-alone portfolio.

When it comes to ethical investing, the questions become more nuanced and the answers often depend on the individual.

For example, some people like nuclear power for efficiency and carbon reduction benefits. Other people believe the risks to the environment and contamination are too high.

At Nucleus, we don’t dictate the ethics to investors. You choose from dozens of ethical screens and tilts so that your portfolio reflects your beliefs.

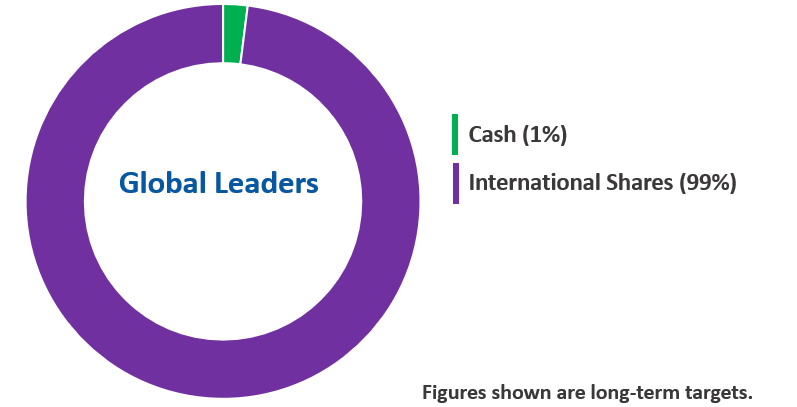

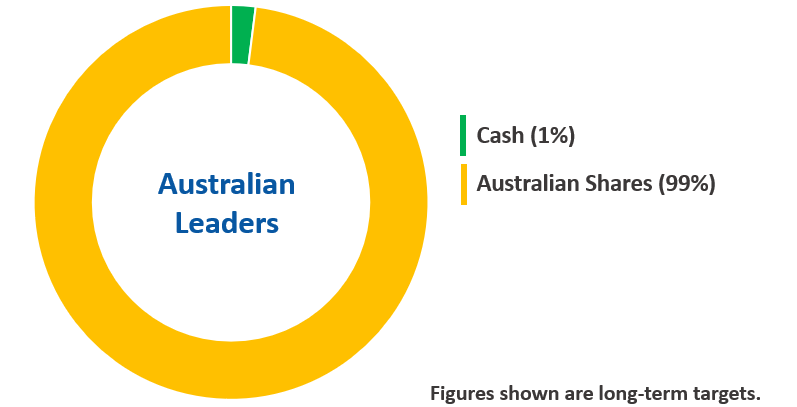

Passively managed investment solutions for those who are happy to receive indexed returns whilst paying lower fees. These portfolios hold only Australian or International shares or ASX listed Bonds, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

A portfolio of the largest global shares by market capitalisation (the number of holdings can be customised by you: between 15 and 75). Ideal for those who wish to manage their own asset portfolio and want to include a lower cost Global Equities exposure Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options. Minimum investment: $10,000 (platform dependent) Benchmark is the S&P Global 100 Index in AUD During periods when small companies outperform larger ones the portfolio may underperform, and vice versa. Portfolio is unhedged so investors are exposed to AUD movements

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here. A portfolio of the largest ASX listed companies' shares (the number of holdings can be customised by you: between 15 and 75).

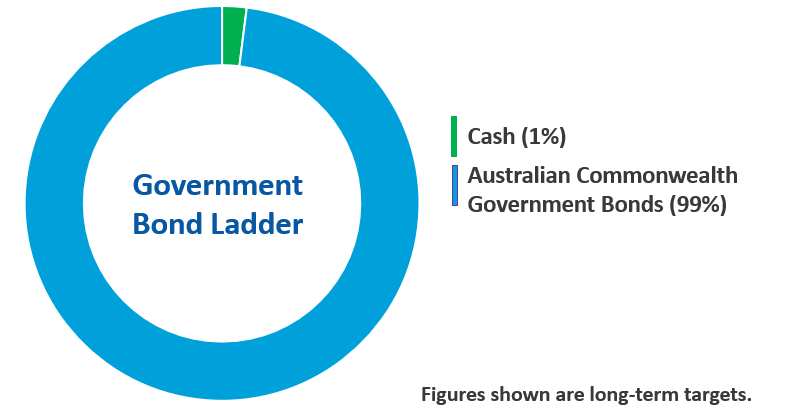

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.17%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here. A portfolio of Australian Commonwealth Government Bonds listed on the ASX. Investment objective: Passively managed portfolio creating a bond ladder using ten to 15 ASX listed Australian Commonwealth Government Bonds of various maturities.

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.11%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 1 January 2021. You can view our full performance reports here. PASSIVE DIRECT INDEXING PORTFOLIOS

Features

Fees

Performance

Features

Fees

Performance

Features

Fees

Performance

Book a complimentary call with one of our financial advisers to discuss your options.

Book A Call Now

Check out our investment resources section to read our latest articles, monthly performance reports, watch our webinars and listen to our Nucleus Investment Insights podcast.

Learn More