The stock market is convinced, maybe rightly, that the US central bank will bail them out if anything goes wrong. In April, the concern was that if inflation got out of hand then the central bank support might be limited. This was enough to see a tumble in stock markets. But in a big-picture sense, it only took them back to where they were a month or two prior. Our stock portfolios performed roughly in line with markets, our tactical portfolios underperformed slightly.

State of inflation

The future of interest rates remains a highly debated topic, especially in the context of Australia's current economic conditions.

Current State of Inflation

Australia has seen a significant drop in inflation from its COVID-19 peak, now hovering around 3.5%. While this is still above the Reserve Bank of Australia's (RBA) target range, it indicates progress along the predicted disinflationary trajectory. Notably, inflation for the December quarter was softer than expected, fueling speculation about potential early interest rate cuts.

Australia vs US inflation

Examining Australian inflation in comparison to the US reveals key differences. Both countries are dealing with high services inflation, but the causes vary. In the US, services inflation is tied to wage growth driven by a structural labor shortage, whereas in Australia, the spike was due to regulatory interventions rather than organic growth. The Australian labor market is experiencing a surge in supply, driven by immigration, which has suppressed wage growth to around 4%.

Australia's housing sector remains a significant inflation driver due to high demand amidst a housing shortage, compounded by rising building costs. This scenario is creating persistent inflationary pressures, particularly in rents, which continue to surge. Education and health services are similarly strained, unable to meet the heightened demand from a growing population. These supply-side constraints are significantly self-inflicted through federal immigration policies.

The net effect is that Australia's inflation is considerably more self-inflicted than the inflation in the US. While this might be thought of as a "good problem" to have, that would assume that the government of the day were going to change the policies that created the problem. That does not seem to be the case.

Central Bank Actions

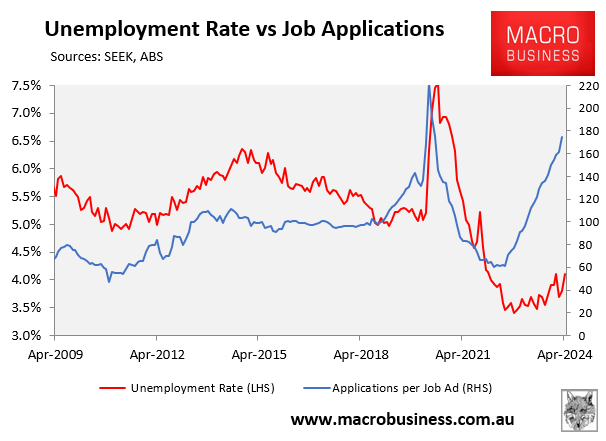

The Australian central bank has adopted a cautious long-term approach, anticipating that bringing inflation back within its target range will take time, possibly until the end of 2025. This extended timeline impacts its stance on neutral interest rates and the measures required to reach its forecast. Currently, the labour market appears looser than official unemployment rates suggest, influenced by a high influx of new workers.

While there are indications of wage growth stagnating and a generally loose labour market, the central bank's conservative stance means they are unlikely to react to single reports but rather focus on broader trends. This conservative approach hints at a stable interest rate environment in the near term, albeit with close monitoring of evolving economic conditions.

Is employment being measured incorrectly?

A range of different analysts have been questioning unemployment statistics globally in recent months. The upshot: private measures have unemployment looking much worse than official numbers right around the globe. Partly this is immigration, and if so then given the rapid immigration, Australia might be understating how poor conditions are:

A more accurate measurement of labour market conditions using real-time data from private surveys could offer better insights than traditional statistics. Central banks worldwide are considering this approach, and it remains to be seen whether the RBA will follow suit.

The immigration debate

The Australian government is now recognising the economic issues stemming from high levels of immigration. Although this shift in perspective is not driven by the Reserve Bank of Australia. Historically, there has been reluctance to discuss the negative economic impacts of immigration, a hesitation rooted in misguided ideology. This has resulted in a policy focus on supply-side solutions rather than addressing demand pressures caused by rapid population growth. Addressing Australia's inflation effectively will require nuanced policy adjustments, particularly in managing immigration and housing policies. However, any debate about immigration often gets mired in accusations of racism, preventing an objective analysis of its economic impacts.

In Australia, government policies designed to boost immigration from countries like India, as a geopolitical strategy to pivot away from China, have led to an unintended surge in population. This influx has now made it necessary to cut back on student visa approvals, the primary pipeline for immigration, indicating that policymakers had not fully anticipated the effects of their decisions. Target immigration levels of 300,000 to 400,000 people were exceeded due to overly generous agreements and policy measures, causing significant economic strain.

This misalignment has led to increased demand pressures, which contribute to rising inflation and stagnant wage growth, eroding living standards. Australia's economic and wage growth lags behind other OECD countries, and this decline is contributing to a broader economic hardship for its citizens, setting the stage for political repercussions in future elections.

Is this now being addressed? In rhetoric, yes. But our view is that while the current measures will bring the total number down, the measures are more likely to be "not enough" rather than "too much".

How high immigration is shaping economics

In response, the government has enacted small tax cuts and fiscal rebates to alleviate energy costs, but these measures are seen as inadequate. The RBA, on the other hand, has maintained its stance on not tightening monetary policy excessively, recognizing the structural and disinflationary pressures within the economy. There is an acknowledgment that addressing these complex issues will involve balancing geopolitical maneuvers with domestic economic realities, a task compounded by the inherent challenges in reversing established immigration policies.

The immediate need is for nuanced, informed policy adjustments that address both inflation and immigration issues without exacerbating the economic pressures on Australian households. We can't see any signs of this occurring.

Investment implications

Investment implications are significant. Bond yields have seen volatility, and the Australian dollar is affected by both China's downturn and the U.S.'s tech boom. The Australian dollar’s stability is challenged by large speculative positions against it and varying economic forces.

In the short term:

In the stock market, fluctuations stem from cycles of market optimism and pessimism influenced by inflation data and Federal Reserve decisions. Major tech firms remain resilient, while other stocks face declines. The market currently grapples with uncertain earnings expectations and a volatile environment, driven by short-term economic cycles and long-term structural changes, especially in technology.

In the medium term:

Looking ahead, AI advancements and new weight-loss drugs could significantly influence labour markets, potentially reducing the structural labour gap in the U.S. and contributing to deflationary pressures. While a soft landing seems probable, the journey through disinflation will be slow and marked by volatility, with a potential deflationary period driven by technological innovation on the horizon.

Asset allocation

After being very expensive for a number of years, stock markets briefly touched off average value before becoming expensive again. However, debt levels are extremely high. Earnings have been going backwards, and seem overly optimistic in 2024.

Markets are supported to a great degree by central banks and governments. Policy error is every investor's number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Energy prices could jump higher, increasing inflation. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might decide again to supercharge property investment.

We are underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

Performance Detail

Core International Performance

The year-to-date rally ended in April with a steady decline over the month seen in all equity markets but especially in the US. The sectors that had run hard year to date had a significant pullback. European stocks outperformed if we ignore currency but the US portfolio was hit by a marked change in sentiment to Intel and the Insurers. Overall Currency proved a minor drag across all markets. We exited some poor performers( Diageo, Bristol Myer Squib increased our Energy exposure this month as Energy prices continue to rise.

.

Core Australia Performance

Australian equities followed the global markets down, growth stocks hit the hardest while miners shined. Early in the month we took some profits on our technology exposures and bought more energy producers, which proved fortuitous timing.

Portfolio Yields

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.

Tags:

Performance

May 18, 2024