Stock markets around the world bounced hard off their Christmas lows to give some respectability to what would have otherwise been another poor month for shares. Being overweight bonds came to the rescue in our tactical portfolios, in particular, our Income and Accumulation funds benefitted finishing up around 1% for the month. The Australian dollar also acted as a shock absorber over the month, falling by 3.6% vs the US dollar which cushioned losses on international holdings.

Over the calendar year, our favoured assets were the best performing – Australian bonds topped the major asset classes, followed by international shares and cash:

Source: Factset, Nucleus Wealth

That preference led to our tactical funds significantly outperforming the median superannuation fund – our Income and Accumulation funds performed 2.7% better than the median, Foundation was 1.7% better and Growth was 1.6% better:

Having said that, it was clearly not a uniform performance over the year – international shares boomed for most of the first 9 months and then busted for the last 3 months. We wound back our exposure to international shares as the year progressed (although not as much as hindsight would have preferred), and so continue to sit on a substantial cash and bond balance. While we added a little to our share exposure when markets fell at the end of 2018, we have been taking profits as share markets have recovered.

For most of 2018, we grappled with the dilemma of how to get enough exposure to the final leg of the bull market while maintaining downside protection in case markets unravelled earlier than expected. We are not expecting much positive news for stocks and so 2019 will be about how to get downside protection.

A resolution to the US/China trade war is one possible positive catalyst, however, we believe the intrinsic issues between China and the US run so deep that any announcement in the next few months is likely to be made to appease the egos of the leaders rather than as a long term solution. If this were to occur, our instinct would be to take further profits on shares and increase our bond/cash holdings further.

For the most part, we expect 2019 to be about avoiding accidents. Brexit, the rise of extremist parties in Europe, slowing growth plus too much debt in China, trade wars, emerging market crises and a slow-motion Australian housing crash will all present their challenges. If every accident is avoided then the stock market could eke out reasonable returns – but our base case is that the best returns are likely early in 2019 before slowing global growth (particularly in China) becomes apparent.

Australian Shares in 2019

Often the worst performing asset class of one year is one of the best in the next year. We are not expecting this to be the case for Australian shares.

The Australian share market starts the year facing a falling housing market, some of the weakest profit growth in the developed world, some of the highest interest rates in the developed world, growth slowing in (key customer) China and one of the most expensive share markets in the world.

The Australian market seems to us to be a one-way bet on China launching another major stimulus package, which will in turn boost demand for Australian iron ore and coal. This is possible, and maybe even likely if conditions get worse in China. However, there are a number of differences this time:

- China has more debt than before. And additional debt is less and less effective at producing growth. Net effect: China needs to incur far more debt than they ever have to produce far less growth. There is a question mark over China’s willingness to do this. We expect China probably will, but that economic conditions will need to worsen markedly before their hand is forced.

- Trade wars. China already runs a significant trade surplus with most countries. With tariffs, trade wars and a slow global economy there is downside risk to Chinese industrial production. i.e. there are other parts of the Chinese economy that will be competing with infrastructure for government stimulus, and these parts of the economy don’t use anywhere near as many Australian commodities.

- China already spending a massive amount on capital expenditure. There is scope for China to grow its infrastructure spending, but the key driver of much of China’s growth is home building which is already running at close to record levels. This limits the growth possible.

With those points in mind, and Australian stocks seemingly already pricing in a China bailout, we are opting to invest elsewhere. All of our portfolios are at, or close to minimum weights for Australian stocks.

2019’s number 1 issue: Chinese growth

First some background:

- China has serious longer-term economic issues that we have discussed on numerous occasions. China is running a Gerschenkron economic growth model, which has been run by many countries in the last 50 years including Russia, Japan, Cuba, South Korea and a number of Latin American countries. This growth model works for countries that have been underinvested. By repressing consumption, these countries can increase savings and investment and then, for a period of time, generate growth that more than makes up for the repressed consumption. When the investment stops generating adequate returns, the debt burden begins to grow and the country needs to change its growth model or go through a debt crisis. China is at the debt accumulation stage where the debt burden needs to grow significantly to maintain growth. This is not an imminent issue but it is clearly unsustainable.

- The problems have been getting worse in recent years. China has made several attempts to rebalance its economy away from capex driven growth. Each time China has slowed sharply enough that the attempts to rebalance have been abandoned.

- Growth is slowing in China despite record home building. There is scope for China to grow its infrastructure spending, but the key driver of much of China’s growth is home building which is already running at elevated levels.

- The US/China trade war is exacerbating the problem. Tariffs get the most headlines but in our view, the concerted and relentless release of hacking stories across multiple countries is likely to be more damaging in the long term as companies in developed markets shift structurally away from incorporating Chinese technology.

- China also has a number of other constraints. Cutting interest rates and reducing the currency might spark capital outflows and further US sanctions.

Question 1: Can a weak stock market prompt Trump to make a trade deal with China?

Yes is the short answer. However, it is unlikely to be an all-encompassing fix to the issues between China and other countries. Cancelling a few tariffs will not solve China’s trade issues and trade is not the only consideration in the growth issues facing China.

Question 2: Does weaker Chinese growth mean a bigger Chinese government spending package is coming, and a weaker global growth outlook mean that it is coming sooner?

Markets are certainly pricing it this way. The iron ore stocks, in particular, have reacted to poor Chinese growth numbers by outperforming rather than underperforming – seemingly pricing in the expectation that China will need major stimulus yet again.

Question 3: Does a weak stock market suggest another “Shanghai accord” is likely?

In 2015 China went through a similar period of weak growth, stock markets declined and the oil price plunged. The situation ended with the US Fed pausing its upgrades and the US dollar stopped rising. The rumour is that a secret deal was made between central banks at a meeting in Shanghai to limit the USD which would give room for China to stimulate its economy.

Given the trade tensions and a US economy growing quickly, this did not look likely 3 months ago. Fast forward to today and a deal is now more possible.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares. We tend to blend these portfolios for clients so that each investor receives an exposure tailored to their own risk and income requirements.

The broad sweep of our asset allocation over the last 18 months was to ride the Trump Boom, winding back on equities as share markets advanced and topping up when they fell but maintaining an underweight position in shares. Now, it is about an appropriate level of protection as the current business cycle draws to a close.

We have positioned our portfolios to be underweight shares (and significantly underweight Australian shares), overweight bonds and overweight cash.

Over / Underweight positions by portfolio

On a calendar 2018 basis, it was the Chip manufacturers that had a huge share price correction in the expectation of falling demand. On a full year basis this thematic also proved true with the exception of Microsoft that bucked the trend of underperforming Technology stocks.

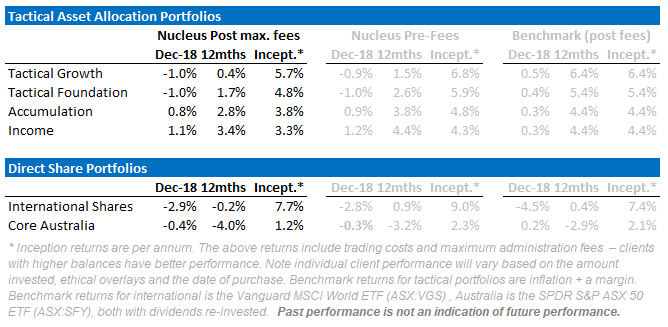

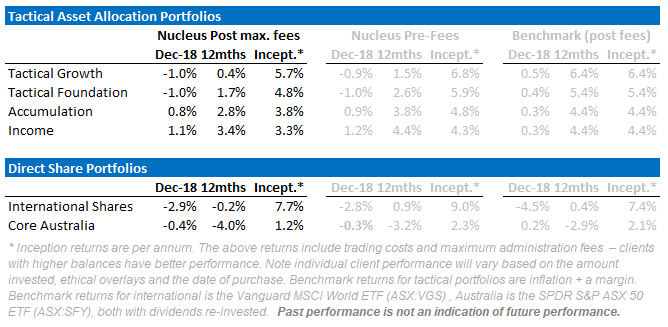

Performance to date

Portfolio performance can be cut a number of different ways. At its most basic level, you should care about the total return. At the next level you should care about the total return relative to some sort of benchmark.

As you dig deeper, you should also be interested how the return was achieved – for example if your fund manager is taking lots of risk but only performing slightly better than the market then you should be concerned. Similarly, if you can get market returns but at a much lower risk then that may be an appropriate trade-off.

Our portfolios to date have been out-performing and taking less risk. The disclaimer is that they have only been running for 18 months, and that is not enough time to make definitive judgements.

For the sake of comparability, we have used the Vanguard MSCI World ETF (ASX:VGS) to compare to our international portfolio – VGS is an index fund investing in the same stocks that we do.

Source: Factset, Nucleus Wealth

When looking at the tactical funds, one of our key measurement criteria is volatility. All of our funds are significantly less volatile than the Australian share market – our income fund is around 80% less volatile, and our foundation fund is about 60% less volatile:

Source: Nucleus Wealth

Epilogue

In summary, our view continues to be that Australian investors should continue to hold minimum weights for Australian shares at this point in the cycle. Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We retain large cash and bond balances to hedge against volatility and in the expectation that capital protection will be important during 2019. If markets continue to be rally then we will likely sell more shares. Our key focus is Chinese growth, gauging the extent of the slow down and the policy response.

Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.