An Australian market boom has emerged over the last two months. After the ASX busted in January, it rose into February, while world markets continued to fall. The US bond yield curve has inverted, signalling recession. But, the Australian bond yield curve is as steep as it has been in decades, signalling boom times ahead.

You might be confused by the central banks in each country. The Australian central bank is cautious, worried the boom may not eventuate. The opposite of what bond markets are saying. The US central bank is hawkish, suggesting they will need to pull hard on the economic reins to slow demand in the face of supply-side problems. The bond market seems to be pricing in that they will do too much.

The market remains volatile. Movements of 2% in either direction have become commonplace.

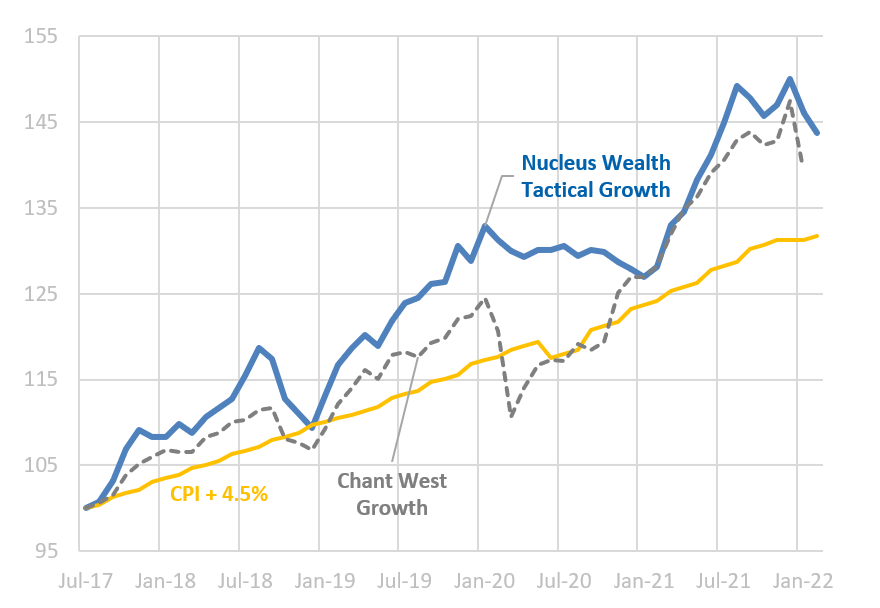

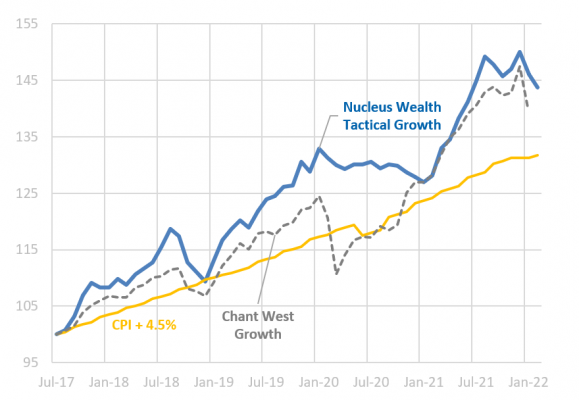

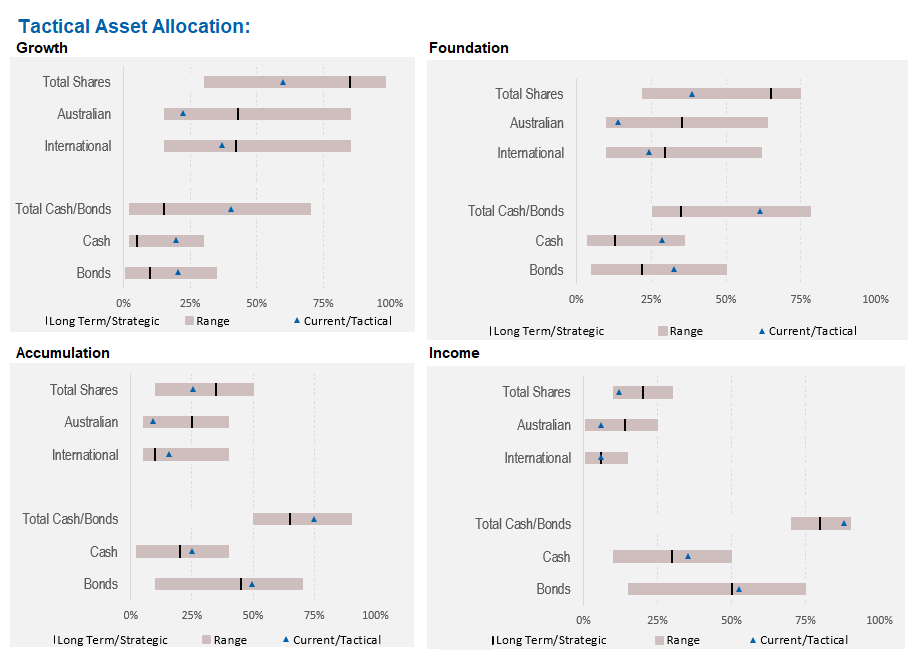

One of the hallmarks of our growth fund to date has been our willingness to reduce risk when we believe the risk/return rewards are not appropriate. Now is one of those times. We are holding over 30% cash and bonds.

Our concern is that central banks are suggesting that they will solve inflation problems, which are largely a result of supply chain issues, by restricting demand. Given the problems that the world has had since the financial crisis, in our view that is not an attractive setup for markets.

We expect international equities to provide some protection from a growth slowdown. While the Aussie dollar is likely to rise if the energy crisis worsens, it is more likely to fall over the medium term. This will hedge the downside under the worst scenarios, whilst still providing some upside in the better ones.

Ukraine presents an issue for inflation

There are two opposing views on inflation at the moment:

- One says that inflation is secular, embedded in the economy, will continue for years. It is the consequence of too much government spending and/or too much monetary stimulus through quantitative easing and low interest rates. Aggressive central banks are needed, raising interest rates to squash inflation before it becomes embedded.

- The other says that the causes of inflation are based on supply chain problems, not excess demand. Under this view, central banks need to be careful that in the taming of inflation they don’t kill the rest of the economy.

A year ago we explained why inflation was going to lift off in 2021 before fading towards the end of the year. We put ourselves in the second camp, the weak supply view.

We were clearly wrong about inflation. However, that does not automatically mean that the first camp is correct.

We were right about supply shortages persisting throughout 2021. Then, a series of events conspired to exacerbate the issue:

- By late 2021, Russian maneuvering around the Nordstream 2 pipeline, plus atypically low European wind power, boosted energy prices. This caused more issues for the supply chain as companies and governments scrambled for cheaper energy.

- Then OMICRON inspired interruptions to manufacturing and transport through the world (ex-China) extended the problem in December and into 2022.

- From there, the Russian invasion of Ukraine and subsequent sanctions continued the supply lockup.

- Now we have China locking down provinces to keep its zero COVID strategy afloat.

I’m not yet ready to declare secular inflation. If we continue to see events disrupt supply chains then we might get there. The series of events keeping supply chains locked up are clearly abnormal, and the profit motive will create more resilient supply chains at some point. The question is whether it takes weeks, months or years to be resolved.

Central banks have a very fine line to walk

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short term is far less clear:

- The sanctions on Russia are unlikely to be lifted anytime soon. The short term effect is probably commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The Omicron variant looks to be resolving in the direction we expected, ripping through economies without too much harm and leaving behind an acceptance that COVID is endemic.

- The geopolitical energy crisis in Europe has turned acute. This will subtract from European growth in the short term, there will be a rush to alternative energy sources in the long term.

- Supply chains have improved a little but are still clogged.

- Demand is challenging to read and distorted by Omicron. Demand held up far better than prior virus waves.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock in 2022. The question is whether the private economy will be strong enough to withstand it.

- Central banks have made it clear that they will try to solve the Russian induced energy issues and supply chain induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. But China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. Unless they change, this will deflate the commodity market.

- Labour markets became more uncertain in January/February as Omicron boomed throughout the world. It will be months before a clear picture emerges.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Asset allocation

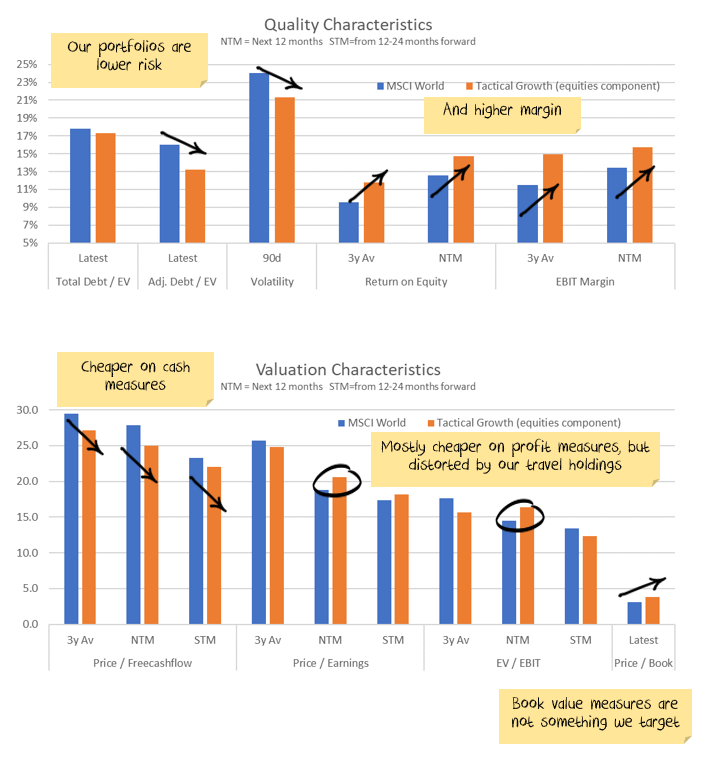

Stock markets are expensive. Debt levels are extremely high. Government/central bank support continues but is slowing. Earnings growth had been really strong but has come to a halt.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Mutations could disrupt supply chains again. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might reverse its tightening on property sectors. Biden may get through additional stimulus, driving increases to minimum wages.

We are significantly underweight Australian shares, with the view that the Australian market will be the one most affected by a slowdown in China:

Australian equities have been a good source of investment performance in recent months. We switched out of them and into international equities and cash. We have largely built the defensive side of the portfolio up, changing out of value winners like resources, banks and cyclical industrials.

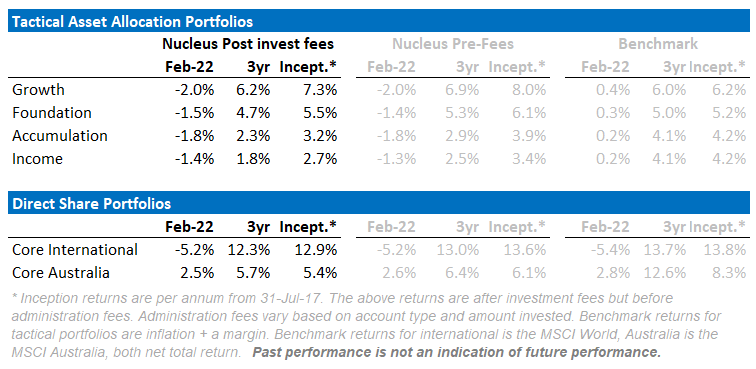

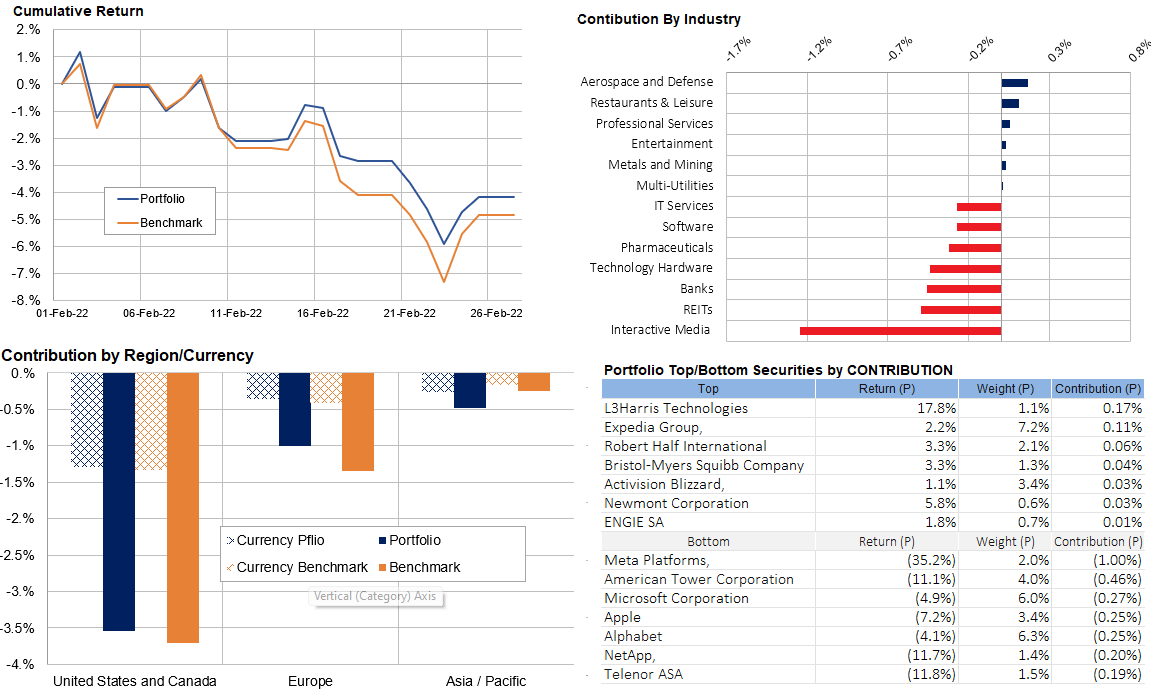

Performance Detail

Core International Performance

There was no avoiding the February market sell-off seen in all overseas equity markets, however, our weighting toward Quality stocks meant the portfolio didn’t suffer as badly as its benchmark.

The sell-off of the AUD, regarded as a risk currency, meant currency headwinds hindered all regions During the month we made no portfolio changes.

Core Australia Performance

Commodity gains boosted the Core Australian portfolio over the month. In early February, we up-weighted defensive and energy stocks as geopolitical concerns increased.

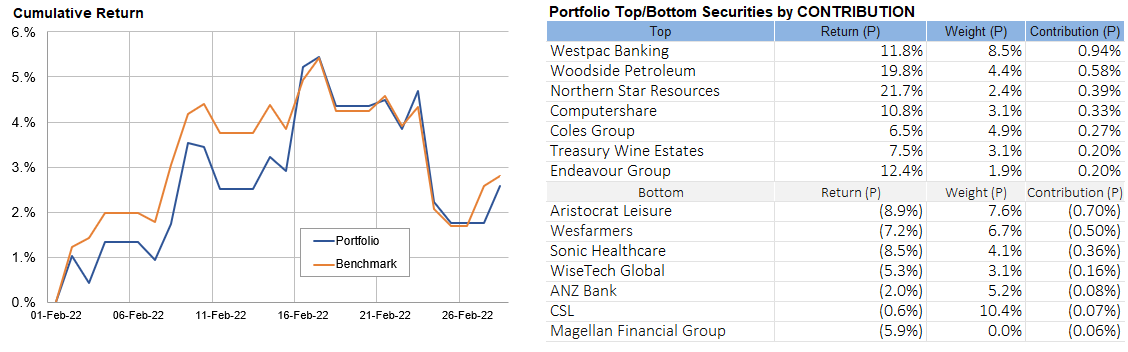

Apologies and note on performance statistics

My apologies for the lateness of the report this month. Our main investment platform is reporting much higher returns for many of our funds in February than what we have shown here. We believe the platform has the performance wrong and we are working with them to correct the official performance numbers. In the meantime, we have published this report with what we believe are the correct ones.

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.