In November, global markets boomed on the back of the Trump election, continuing into December with a Santa rally for the ages. The key question: how much higher can markets go?

Showdown! Valuation vs Fundamentals.

Here is the thing. Sometimes when markets are expensive, it is because there is strong growth coming and markets are anticipating that growth.

It is a showdown: earnings momentum versus valuations:

- Earnings momentum is strong: the last two quarterly reporting seasons have shown improvement after several years of disappointing results. And later year forecasts are excellent, more Trump tax cuts and reduced regulation will probably add at least 10% to earnings.

- Valuations are expensive: But, if you look at them the right way, we are in the 75th-80th percentiles. And, given the potential for a soft landing and an AI capex boom, that might be an appropriate place.

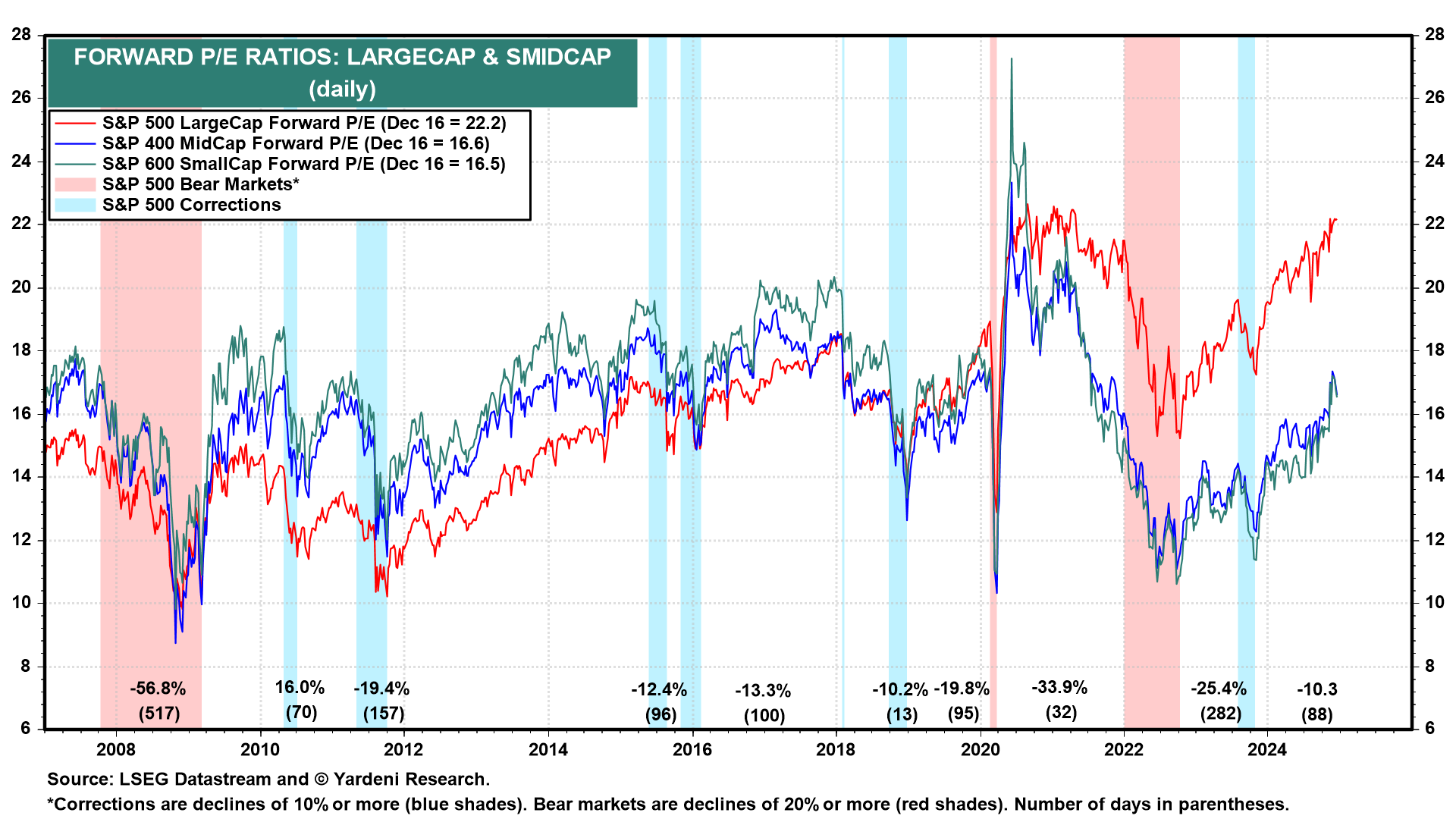

Valuations

Mid-cap and small-cap valuations are high relative to recent years but not excessively so versus the long term. Conversely, large-cap stocks appear more expensive, which skews the market perception since they constitute over 80% of the S&P 500’s weight.

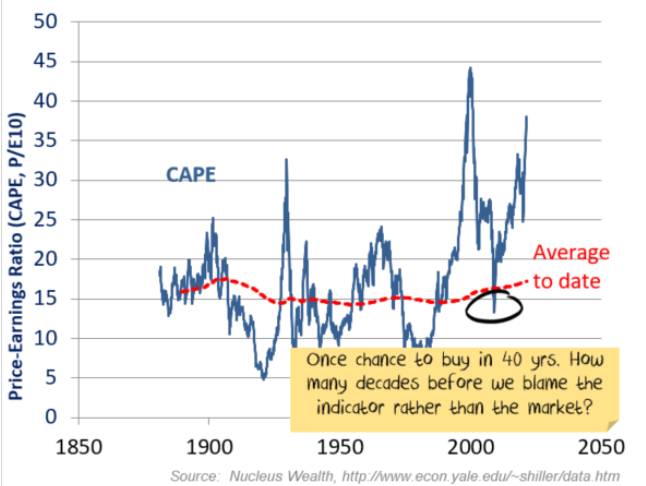

A long-term look at valuation

The Shiller PE is considered by many to be a value investor’s North Star. It looks incredibly expensive at current levels:

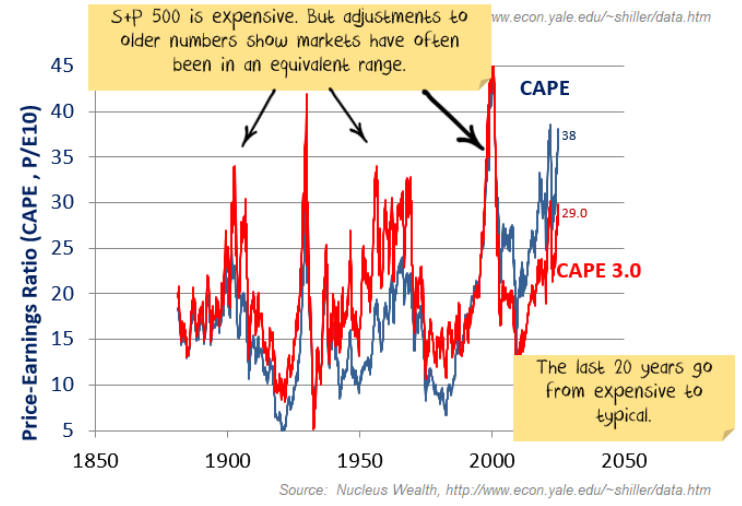

However, I have a lot of issues with how this is constructed. For a deeper discussion see our recent podcast here or blog posts from a few years ago here and here. The short version is that if you adjust for the current tax rate, buybacks and changing accounting standards, you get something more like this:

It still looks expensive, but much less extreme. Markets have been at these valuations many times before.

Valuation vs Growth

The question with large-cap stocks is whether the earnings growth justifies current prices. A useful, though crude, tool to assess this is the price-to-earnings growth ratio. This ratio, calculated by dividing the price-to-earnings ratio by the growth rate, gives insights into market valuation relative to growth expectations.

For instance, if the price-to-earnings is 15(x) and the growth rate is also 15 (%), the ratio will be 1. There are lots of limitations to this ratio. However, the trend can provide historical context. Presently, we’re sitting around 1.25 on this ratio. About middle of the range. It raises the question: Is the growth rate from company earnings enough to justify the recent share price rises?

In two recent podcasts (here and here), we went through a range of other valuation metrics. Net effect? Markets are expensive, but not extreme.

Market Fundamentals

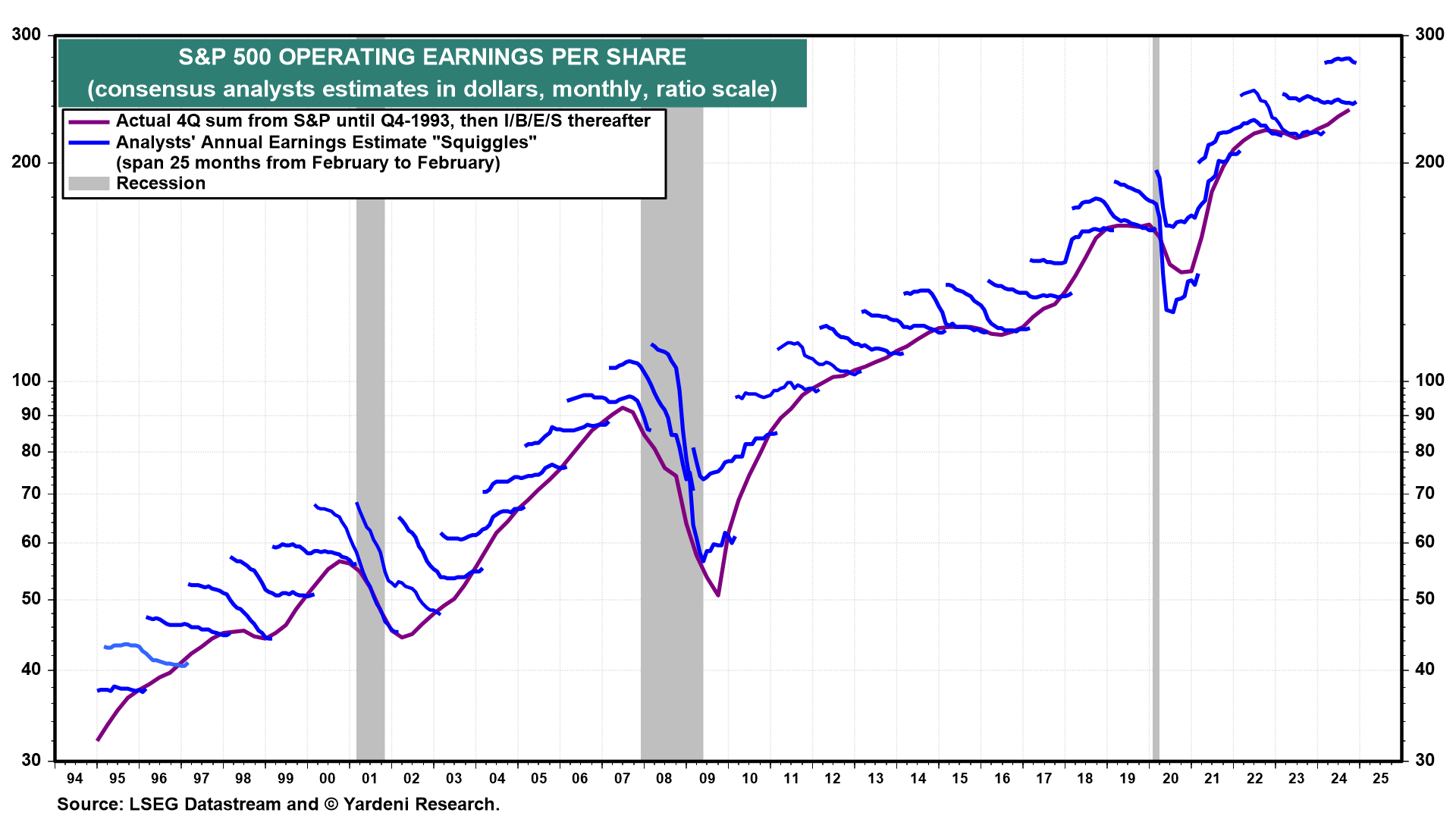

To delve deeper, we must examine the earnings numbers. Below, the purple line shows forward earnings per share, projected 12 months ahead. This rolling number adjusts daily, accounting for more of the next year and less of the current year. The blue lines on the graph indicate initial forecasts compared to where they eventually landed, providing a visual history of earnings estimates.

Focus on the purple. As long as it’s rising, expectations from analysts remain positive. We’re in a phase where this upward trend is evident. Growth is robust compared to the last 30-40 years.

The 2024 numbers have experienced minor downgrades but remained relatively stable, a notable performance compared to recent years. The projections for 2025 show strong growth rates with minimal downgrades.

In our recent podcast (here), we went through the numbers in a lot more detail. Net effect? The fundamentals are good, with few exceptions.

Now, analysts can get earnings wrong. Particularly at turning points. But, there are not many grey clouds on the earnings horizon at the moment.

The long view

Starting with high forecast growth can cushion the effect of downgrades, mitigating concerns about valuations. 15% forecast earnings growth that ends up a 10% is still a good result.

Valuations might appear high, but earnings are strong.

Considering the broader economic context. Say we were at a random historical point with:

- Stocks at the 75-80th percentile (reasonably expensive)

- A potential (probable?) soft economic landing in the US

- Interest rates falling

- Earnings strengthening

- A business-friendly government poised in the US, with tax cuts loaded

That seems like a favourable time to buy stocks.

This is why we maintain significant stock investments. Could things disrupt this outlook? Absolutely. However, until we see fundamental or earnings downgrades, significant market declines seem unlikely. Minor corrections of 5-10% are possible, but a financial crisis-level downturn appears improbable without a major external shock.

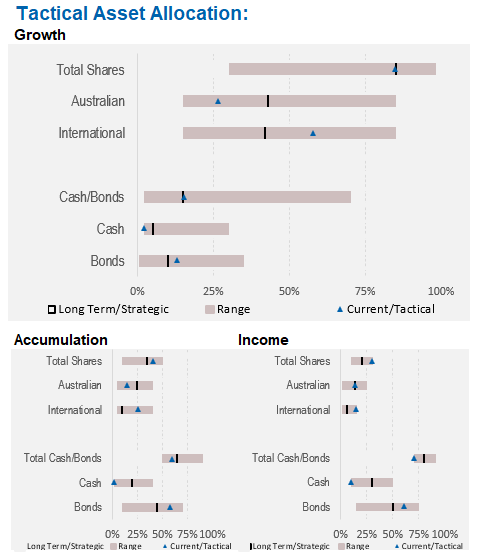

Therefore, we are maintaining our equity weights, focusing on international rather than Australian stocks. This is due to valuation concerns, currency issues, and the structure of the Australian economy, which won’t benefit as much from the AI boom.

Asset allocation

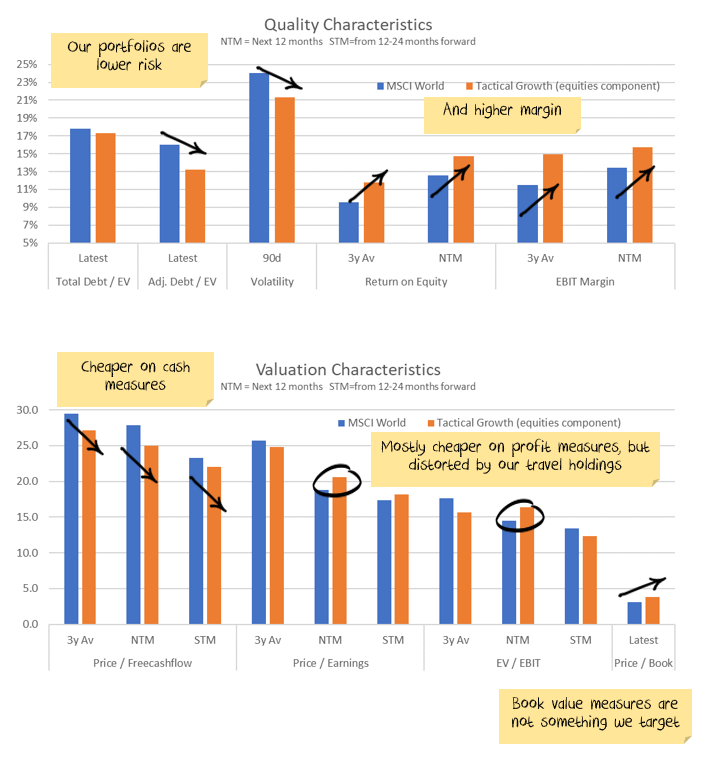

Earnings growth looks to have turned positive. When you add corporate tax cuts and some margin expansion through lighter regulation and a quite expensive US market becomes merely expensive.

We are underweight Australian shares, significantly overweight international shares, with the view that the Australian market is more affected by interest rates and less affected by an AI boom:

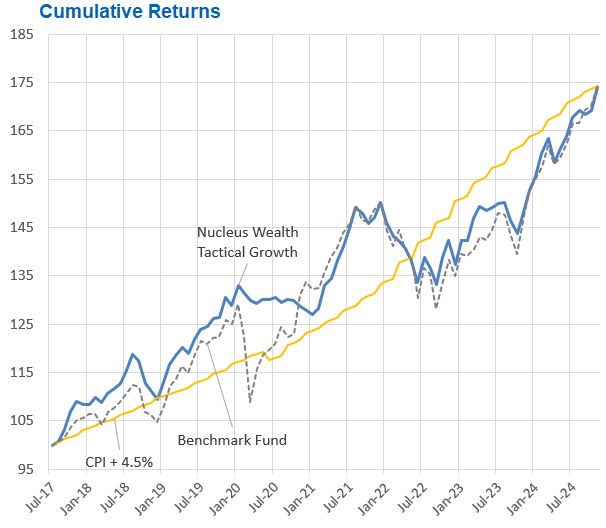

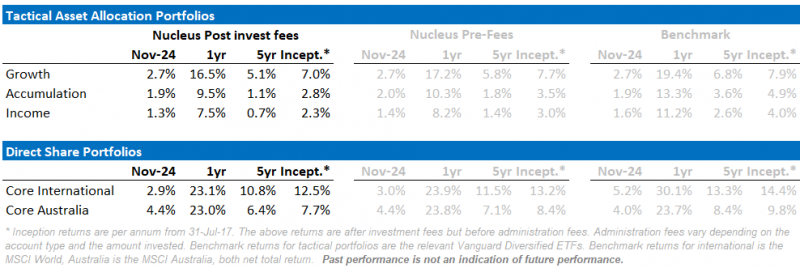

Performance Detail

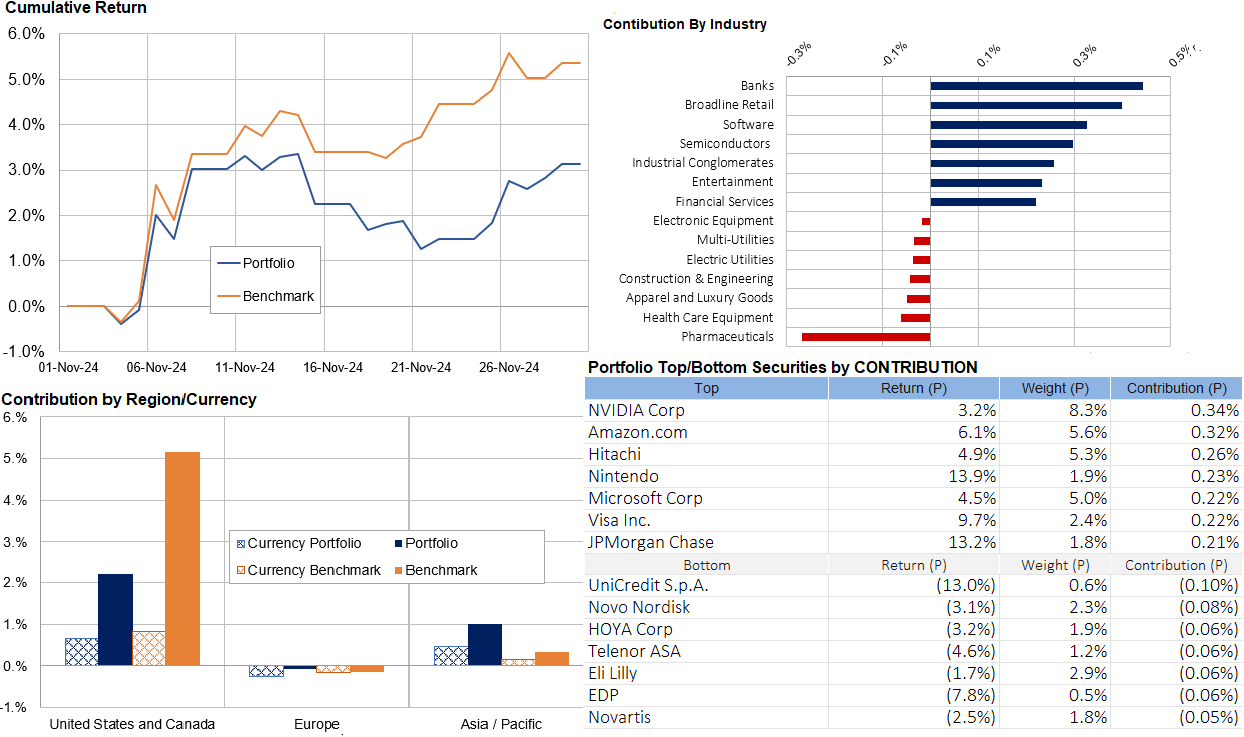

Core International Performance

November saw the Santa rally take off post Trump election. Tech continues to recover with banks leading the way but Tech names well supported, health while defensives continue to suffer. Regionally, we outperformed in Japan (Asia) but underperformed in the US. Currency wasn’t as significant a factor as recent months but the weakening AUD did assist returns. We added Vestas Wind to the portfolio.

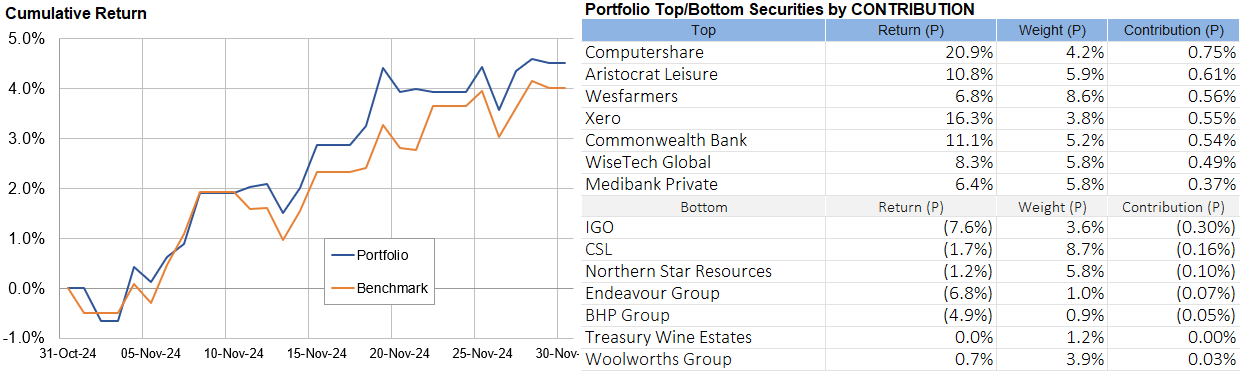

Core Australia Performance

Australian equities marched steadily upwards over the month with miners the main detractors.

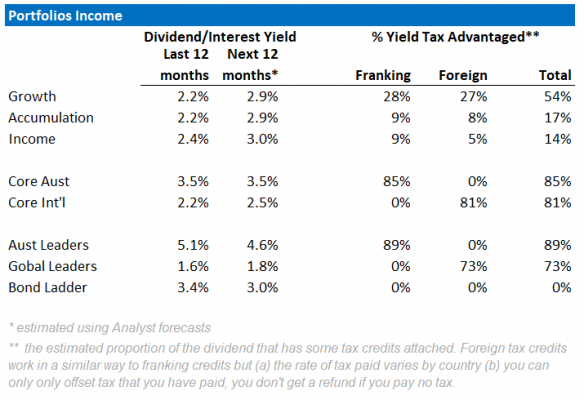

Portfolio Yields

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.