Happy New financial year!

Another financial year rolls by, are you further forward with your finances? Have you done anything differently? Are you still getting the same results? If so, this is an opportunity to reset and to implement small changes for greatly improved results. Given the changes in super, we have a list of 5 things for you to check.

As of the 1st of July, the superannuation guarantee increased from 10.5% to 11%.

Most people got a pay rise as there is more money being contributed into the low-tax environment of Super for your retirement. However, some people may not have and will need to check the wording of their contract. If your contract states a ‘total package’ amount, you may have got an increase in superannuation guarantee but a decrease in your wage or salary to reflect the same total package.

The Super Guarantee rate is legislated to go up by 0.5% on the 1st of July each year until 2025. It will then stay at 12% going forward from that date.

Superannuation guarantee is based on when people are paid, not when the income is earned. Therefore some employee’s pay will cross over between June and July when the rate changes. If you are paid in July for work done in June, the rate of 11% will need to be applied to all ordinary-time earnings done for the work in June.

Checklist item 1: Update salary sacrifice arrangements to avoid additional tax

If you have a salary sacrifice arrangement in place with your employer and you were salary sacrificing up to the concessional contribution cap of $27,500 in the last financial year, you may need to amend the agreement. This could now push you over the threshold if you do not have available catch-up contributions and there will be extra tax to pay.

Super contributions splitting opportunities

Checklist item 2: Are you (a) in a relationship, (b) still working and (c) have uneven superannuation balances? If so, you may be able to take advantage of a number of different strategies.

Did you know you can split your concessional contributions, including catchup contributions and send them to your spouse? This is designed to even up your Super balances. You can split 85% of your yearly $27,500 concessional cap (including any available catch-up contributions) and send them to your spouse. This is essentially all the contributions minus the 15% super contributions tax that gets deducted when the contributions are received in the fund.

Concessional contributions are

- Employer superannuation guarantee contributions

- Salary Sacrifice

- Personal deductible contributions

Eligibility

- You need to be legally married, in a registered relationship or living with a defacto spouse.

- You can split your contributions at any age, but the receiving spouse needs to be under 65 and not retired.

The ATO advises to split your contributions immediately after the tax year in which the contributions were made.

Strategies

If one partner is a higher income earner and their super balance is growing a lot faster than their spouses, there are several benefits for keeping the balances more even, and contribution splitting is a way to do this.

- If both balances are under $500,00 you can both take advantage of the maximum tax savings of catch-up contributions. Here is an article I wrote explaining the benefits with a worked example. You can greatly reduce the amount of tax you pay by making catch-up concessional contributions. As a couple, you can make concessional contributions to whoever is the highest income earner to gain the greatest tax benefit and then split those contributions to the spouse with the lower balance. Or if you are the highest income earner and have surplus savings for the household towards the end of the financial year, you can make a personal deductible contribution to your spouse’s super and even up the balance that way also.

- You may also want to even out your balances so you can both utilise the maximum transfer balance cap into the tax-free pension phase. If a higher income earning spouse maxes out their transfer balance cap balance of $1.9 million and still has $200,00 in the accumulation phase, they will be paying tax at up to 15% on that $200,000. If they had taken advantage of contribution splitting, the $200,000 could be in your spouse’s Super and been able to transfer into pension phase (assuming they are under the $1.9 million transfer balance cap) and pay 0% tax rather than a maximum of 15% tax on that money.

- You could split contributions to a younger member of a couple; this may help the older member reduce their Super balance and potentially qualify for a higher age pension payment due to how the asset test and income test works.

- Conversely, you could also split contributions to an older member of a couple who will be able to get access to their Super sooner. This will mean the couple will get more tax-free money sooner.

To take advantage of Super Splitting, read and fill out this form and email it to support@praemium.com.au

Changing minimum pension drawdowns.

Checklist item 3: Are you in pension phase and making the minimum annual drawdowns?

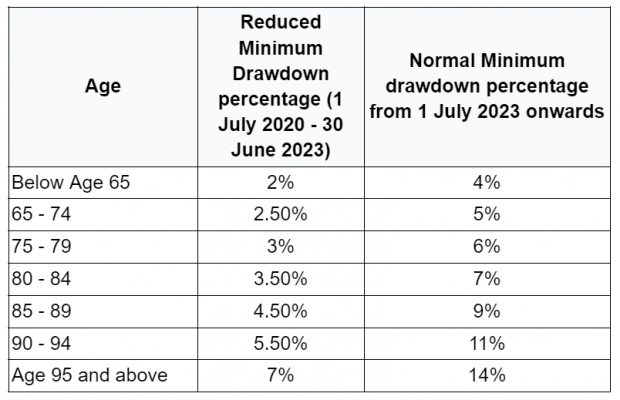

For the last 3 years the government has reduced the minimum required pension payments by 50%. From the 1st of July 2023, it is going back to normal rates. Your minimum pension drawdown is calculated on the 1st of July 2023. This is done by multiplying your total pension balance by the minimum drawdown percentage corresponding to your age. This is an automatic process and there is nothing you need to do regarding this change. See the table below for details

Transfer balance cap increases from $1.7 Million to $1.9 Million.

On the 1st of July 2023, the transfer balance cap was indexed and increased from $1.7 Million to $1.9 million. This is the lifetime total limit you can transfer into pension phase. Your new transfer balance cap will be displayed from the 11th of July in the ATO online via MyGov.

Why does this matter?

This means you can get more money into the tax-free environment of an account based pension account. It is a zero tax environment. There is no tax on any earnings, no tax on any capital gains and no tax on any withdrawals.

Checklist item 4: Are you in pension phase? If so you might be able to transfer more money into a tax-free environment.

If you already have $1.7 million in pension phase, you can now transfer another $200,000 into pension phase. Instead of paying tax at a maximum of 15%; those funds will now be tax-free.

Checklist item 5: Does your superannuation strategy need a checkup? The compounding effect of investment returns are powerful, but so are the compounding effects of getting the tax structure right and making the best use of your contributions. Book in a free consultation here.

If you would like to discuss any of these changes in more detail, please book a free consultation with me as I am always happy to have a chat. If you would like a more personal conversation about investing with Nucleus Wealth, book a free consultation with me as I love talking about investing and the power of compounding.