This is the third in a series of four posts on the contrarian view for inflation, this time dealing with the inventory supercycle.

- Part one: This dealt with inflation today not being the same as inflation in the 1970s.

- Part two: the China inflation problem: Commodity inflation is far more leveraged to Chinese stimulus than developed market stimulus. And the signs are ominous. You can view our podcast on inflation parts 1&2 here

- Part three: This post. I don’t believe we are in a commodity supercycle. But I do think we are in an inventory supercycle. The price signals of today are creating the excess capacity of tomorrow. Our podcast discussing this can be viewed here

- Part four: how to position your investment portfolio for the inflation head fake

To stay updated on the rest of this series and be notified of each part, sign up to receive email updates from us via the form below:

What is an inventory cycle?

The basis of most business cycles has an inventory cycle at the core. The stocking and de-stocking cycles are what typically drive economies both into recession and out of recession.

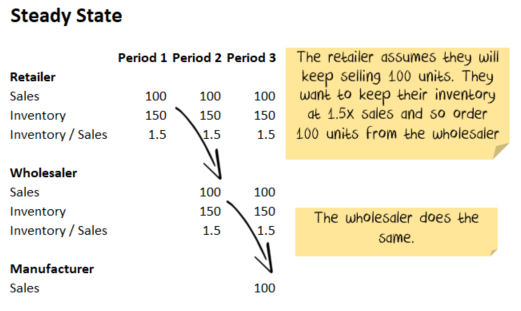

I’m going to start with a grossly simplified illustration. Assume we have:

- a retailer who buys from a wholesaler

- a wholesaler who buys from a manufacturer.

We are looking at the changes from period to period. For some companies, the periods are days. For others, the periods are weeks, months or quarters. Both the retailer and the wholesaler target 1.5x the current period’s sales as inventory.

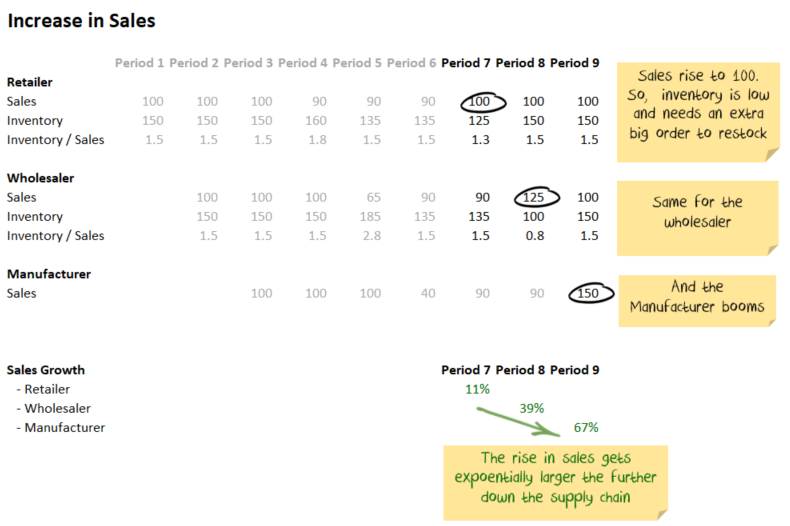

It looks like this:

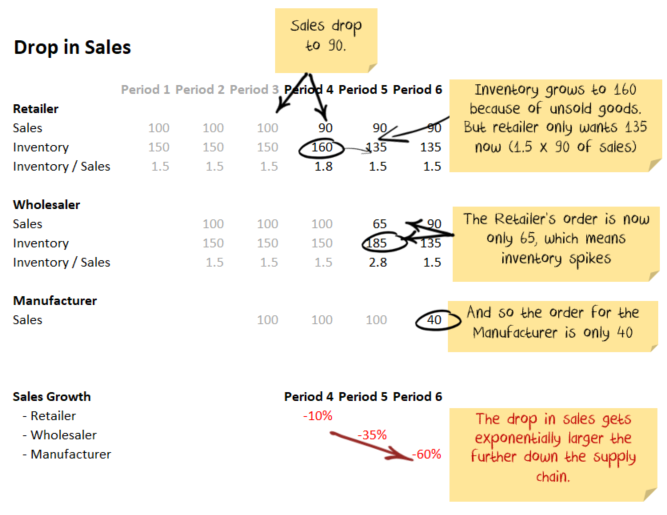

Now let us look at the effect of a drop in demand. Say sales drop 10% for the retailer and then stay at the new level:

As you can see, the effect is more significant the further down the supply chain you go. A 10% fall in sales for the retailer is a 60% fall for the manufacturer. In the initial stages of a recession, this effect worsens the cycle as manufacturers then fire staff/pull back spending.

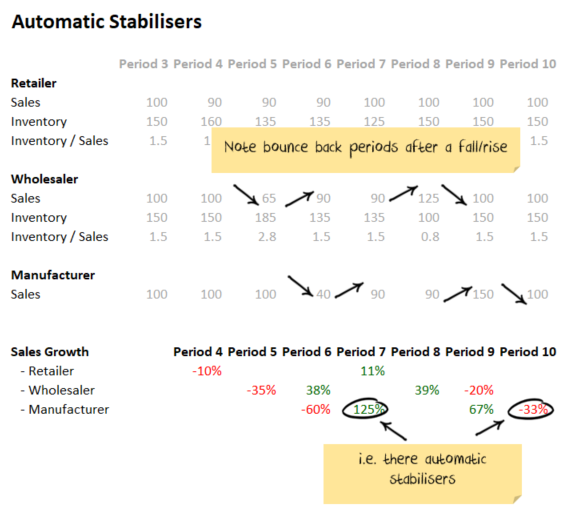

But, it works in the other direction as well. When the cycle turns, the opposite effect kicks in. Now look at retail sales returning to 100:

Because different companies have different periods (e.g. daily/weekly/monthly/quarterly), when you blend them all the overall effect on the economy is not as extreme.

Later in this post, I’ll explain an inventory supercycle.

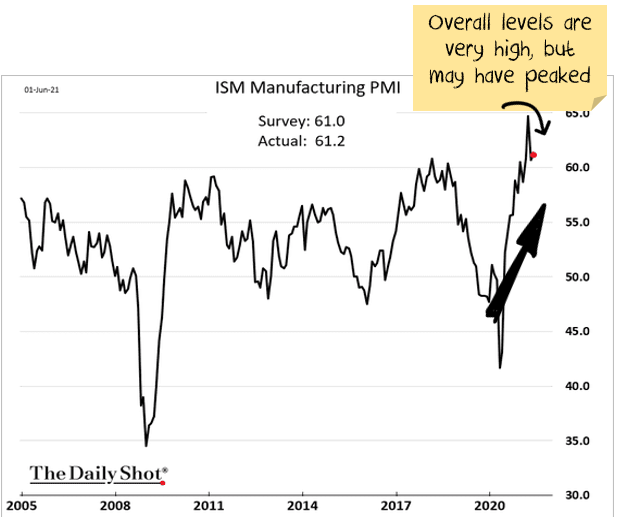

Purchasing manager indexes are booming.

Purchasing manager indexes (often called PMIs) are a survey of businesses. They can give a real-time look at economic conditions, but they can reverse quickly.

The latest reads are overwhelmingly positive, which is why many are worried about inflation:

It isn’t a particularly heroic call to suggest that these conditions won’t continue forever. The big question is, when it will end?

The concern is that price pressures are building. If nothing changes (I believe it will change), then output prices are going to affect inflation:

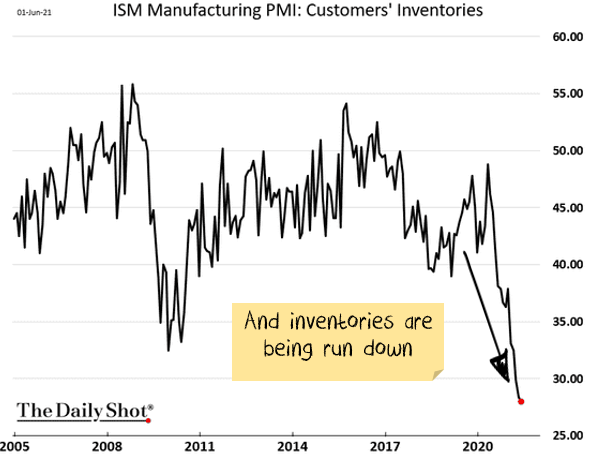

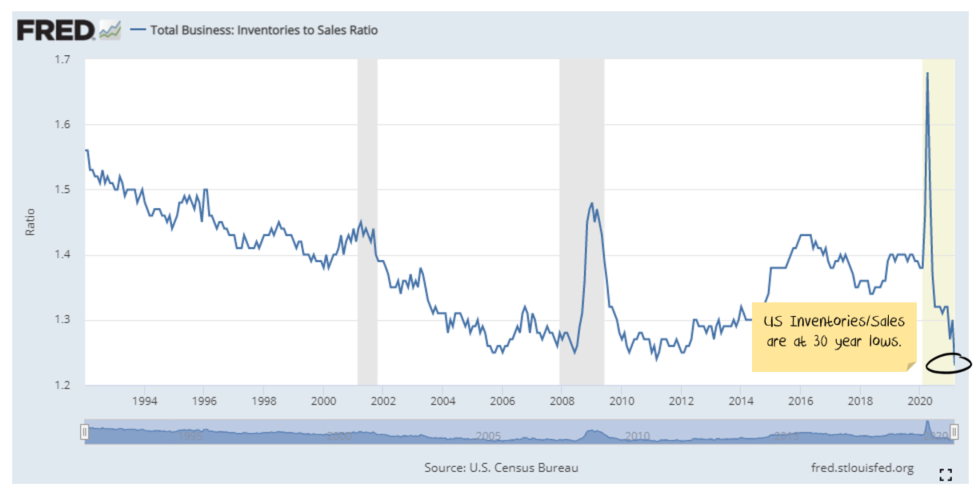

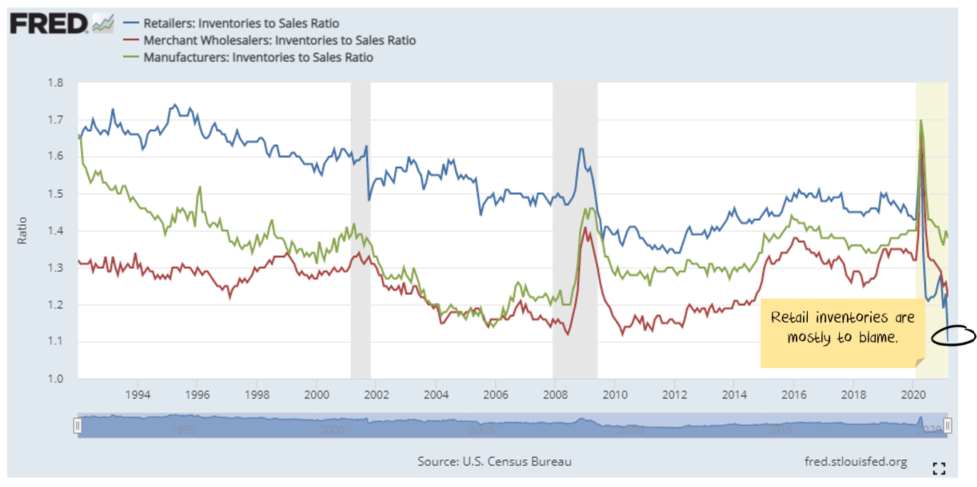

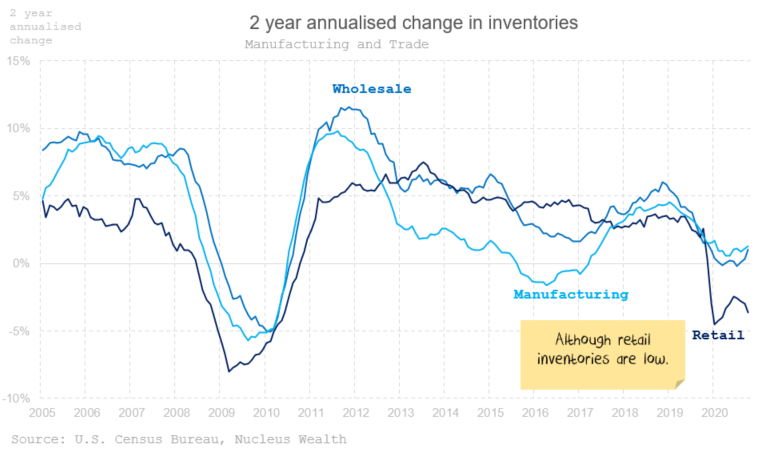

Inventories have been run down.

The Inventory/Sales ratio is very low, leading some to suggest that the restocking cycle is only just beginning.

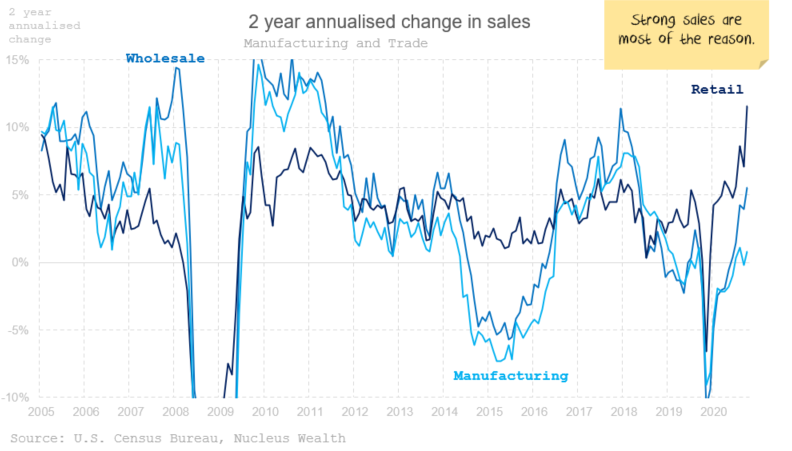

However, when you dig into the numbers, inventories are only slightly low. Most of the change in the ratio is because retail sales are so strong:

Note the above data is from March. Given the usual lags, it is likely that wholesale and manufacturing growth is now booming. Which would agree with the purchasing manager indexes that are more timely.

So, the big question is how sustainable the high sales are.

Other inventory considerations

- Anecdotal evidence of hoarding abounds. Given supply disruptions, businesses likely want greater inventories than before the pandemic.

- A Suez canal blockage in March exacerbated supply issues.

- Worker shortages due to lockdowns/reduced immigration have reduced supply.

Supply chain issues

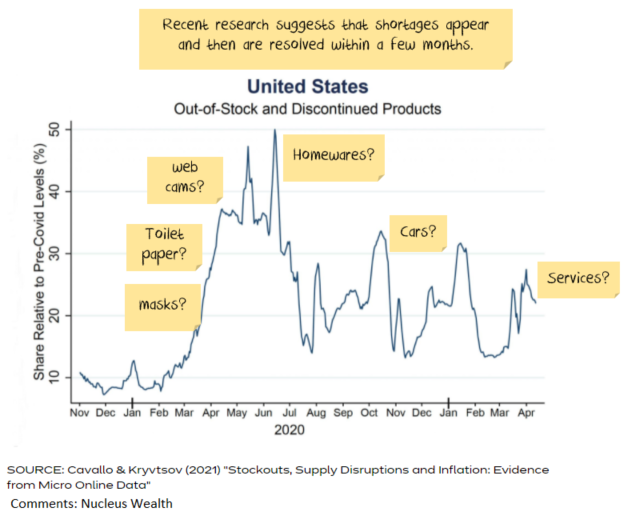

Recent research on shortages during the pandemic shows they came in waves as demand patterns shifted:

My assessment is that changes in demand patterns have driven the shortages, but these have been (generally) quickly resolved.

Mask shortages were resolved by relatively simple production changes. Toilet paper shortages were resolved mostly by time. I don’t believe usage changed much. Instead, consumers wanted to increase their home “inventory” of toilet paper, creating an inventory cycle similar to our description above.

Webcams, laptops, homewares saw shortages as the developed world adapted to work from home. Resolved as production increased.

Some categories, automobiles in particular, haven’t been resolved yet.

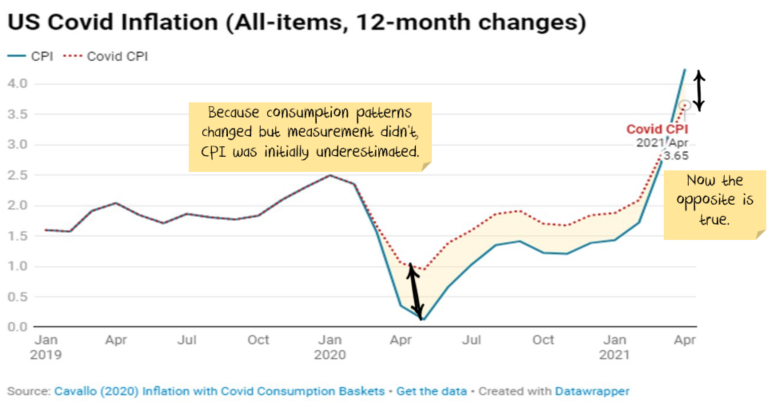

Aside: The author’s view is inflation was understated during the pandemic but is now overstated:

Capacity utilisation still low.

Inflation is likely to become an issue when there is not much spare capacity in the economy. Despite the rise in manufacturing demand, capacity utilisation remains well below pre-pandemic levels:

Total consumption spending is now back to trend.

Note that all of the above is talking about manufacturing. This is where we are seeing the price and inflation pressures.

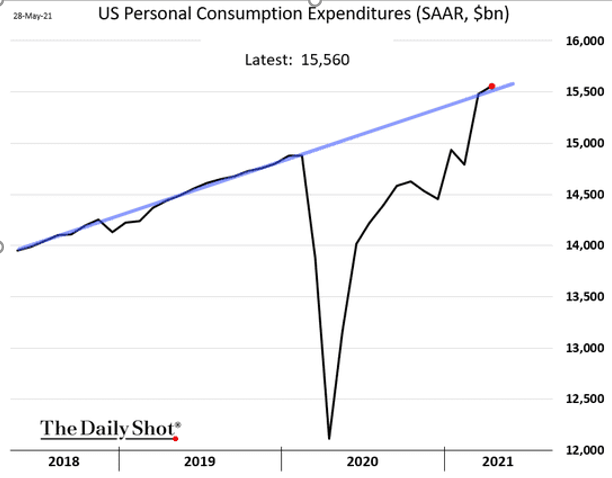

The first reaction of households as unemployment spiked was to save money. Swift government intervention has led to a rapid recovery, and consumers are once again spending. Personal consumption expenditure (which is both services and manufacturing) is now back to trend:

Consumption is also affected by several temporary factors:

- Direct stimulus cheques to consumers

- Additional unemployment benefits

- Indirect government business support

Most of these factors are now fading.

Consumers have been “forced” to spend on goods.

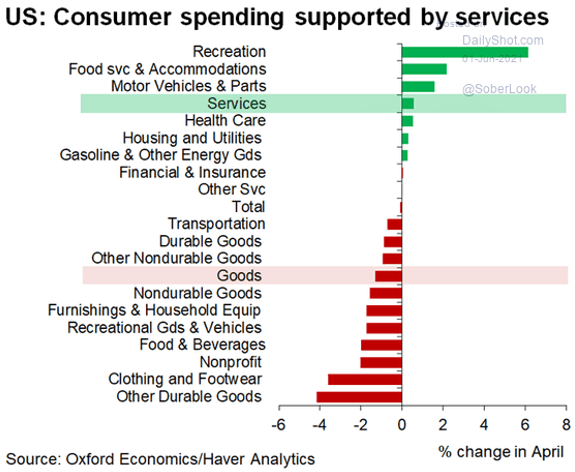

In lockdown, consumers had limited ability to spend money on services as many were closed. Meaning more demand for goods.

As economies gradually re-open, consumers can once again spend money on services like travel or recreation. And early indications are that they are taking that opportunity:

An extraordinary convergence = an inventory supercycle.

All this leads to an inventory super cycle. Demand for goods has been temporarily boosted by:

- Lack of other options as services like travel and recreation were shut.

- Government stimulus, both direct and indirect.

- Pent up demand as consumers who built up savings and are now spending.

- A need for greater inventories from businesses to mitigate against future supply shocks.

Meanwhile, supply has been temporarily constrained by:

- Lockdown constraints on workers.

- Changes in demand. For example, more demand for houses, less for apartments. Manufacturers/suppliers need to change processes.

- The Suez canal blockage.

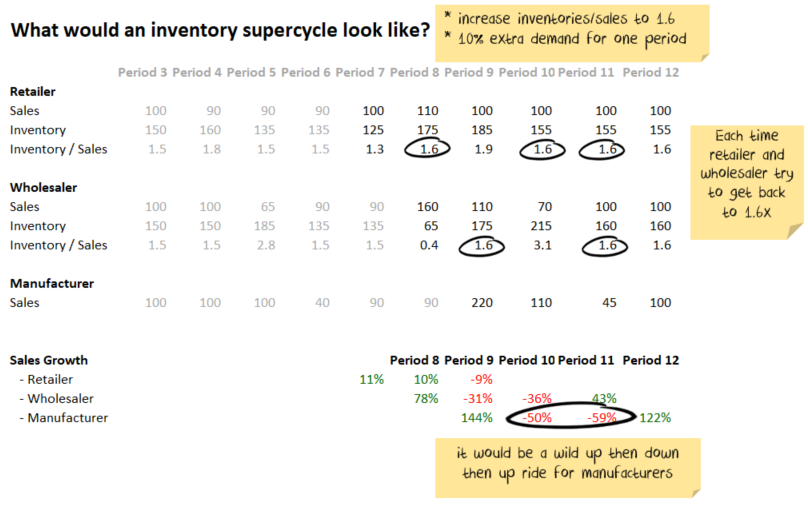

Now, back to our basic model of an inventory cycle. If we are in a supercycle where demand increases and then returns to trend, it would be a wild ride for manufacturers:

Keep in mind this is just an illustrative model. But sales would boom first (where we are today), followed by a crash, followed by another boom.

A capital expenditure boom.

The worst-case scenario for anyone expecting inflation would be:

- A short term inventory boom is mistaken for a lasting economic boom.

- Suppliers spend money to expand production.

- Just as the new production comes online, demand falls back to normal levels.

- Suppliers bid prices lower, trying to fill the new production, creating deflation.

Chart presented without comment:

The most important investment questions

- How much manufacturing demand is:

-

- A typical inventory cycle.

- A genuine new higher level of demand.

- How much retail demand is:

-

- A mix of stimulus cheques, lack of services, pent up savings.

- A genuine new higher level of demand.

- How much are supply shortages:

-

- Pandemic-inspired staffing issues and pandemic-led changes in demand.

- Genuine changes so that factories can no longer produce at pre-pandemic prices.

- Will companies react by:

-

- Not expanding capacity meaningfully, expecting only short term pressures.

- Increasing production to service the higher demand.

If you answered mainly 2’s, then inflation is on the cards. If you answered mainly 1’s like me, then we are at the start of an inventory supercycle.

How long will the inventory supercycle last?

It is hard to tell. A much larger inventory supercycle occurred after the Second World War and lasted 2-3 years. But it was dramatically bigger than what we are looking at today. At that time, factories had to convert from making tanks to cars, combat fatigues to suits and battleships to skyscrapers.

Today is more about either simply restarting production or re-tooling to cater for different preferences post-pandemic. And we are already several months into the process.

My expectation is a much shorter period. I’m expecting somewhere between another month and six months – but it is hard to tell. We need to keep monitoring the data.

———————————————-

Coming next: How to position your investment portfolio.

To stay updated on the rest of this series and be notified of each part, sign up to receive email updates from us via the form below:

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.