ESG investing is a complicated area with many ethical dilemmas and moral decisions to be made.

As the Israel-Hamas conflict has brought to light, companies that manufacture goods for war present one such dilemma. On one hand, listed stocks that manufacture weapons create products that literally kill people. On the other hand, without those manufacturers, countries like Israel could be over-run. Many countries would be left vulnerable if all investment in defence ceased.

Ethical investing is about you

For most funds in the ESG investing space, you have to prescribe to a fund manager’s ESG philosophy. More often than not they just exclude all stocks to do with war, with no nuance. However, this may not be the best approach or one that is right for you.

Nucleus Wealth allows you to tailor your portfolio so it aligns with your ethical values and beliefs and doesn’t have a “one size fits all” approach to ethics.

Nucleus Wealth has a number of categories within each ethical screen to make the decision easier. For example, many choose to exclude the “War Worst Offenders” and “Nuclear Weapons”. This removes companies known to produce nuclear weapons, cluster munitions and landmines but leave the rest of the war stocks in the portfolio that are more aligned with defence. This would mean they own stocks like Boeing, but exclude stocks like Honeywell.

Nucleus Wealth also allows you to include certain stocks and themes based on your ethical preferences and investment outlook. We have a specific tilt towards defence contractors, which adds stocks into your portfolio that are involved in defence.

One of our holdings is L3Harris, a US defence contractor that specializes in surveillance solutions, microwave weaponry, and electronic warfare. We expect it to continue to grow as the West confronts Russia and the Israel-Hamas conflict escalates. For some investors, they don’t want to own L3Harris, regardless of the outlook. For others, it is an acceptable investment. We can understand and accommodate both points of view.

Let me be clear, I am not promoting investing in war. However, I am raising the point that not all manufacturers of weapons are part of an evil industrial-military complex and you should choose what to include and what to exclude in your portfolio. Unfortunately, war is still an aspect of life and excluding every defence stock and making funding more difficult for this industry is not going to solve the problem.

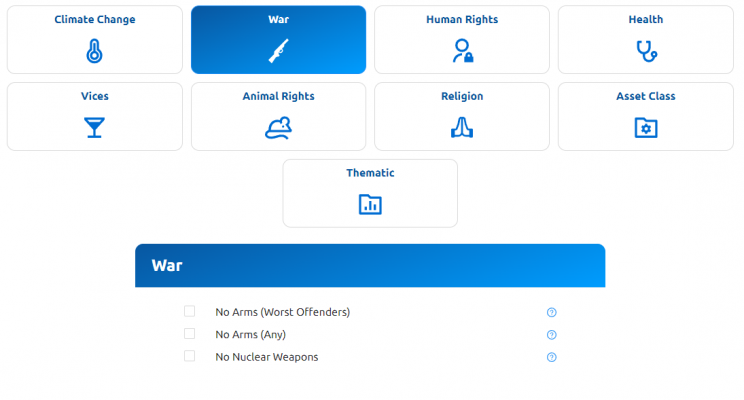

Nucleus Wealth’s ethical screens (exclude) regarding War

No Arms – Worst Offenders. This removes companies that are known to produce cluster munitions and landmines

No Arms – Any. This removes companies that are known to directly produce weapons or ammunition

No Nuclear weapons. This removes companies that are known to be involved in the production of nuclear weapons

Nucleus Wealth’s ethical tilts (include) towards War

Defence contractors – This is a rules based approach to choosing defence contractor stocks. These are companies that are involved in the manufacturing of weaponry. We target 8 of the largest stocks globally, provided that they are listed in a developed market.

The problem with many ethical funds

The problem with many ethical funds is that they treat the world as black or white, with nothing in between.

It is easy to take the moral high ground of an ESG manager and exclude everything to do with War but often there is more to the situation as discussed.

We have had a number of investors that have repositioned and included a tilt towards defence contractors in their portfolios as they see this as a growth area.

Nucleus Wealth has many investors who want to exclude gambling but include tobacco. And many that want the exact opposite. Others want to exclude oil and coal stocks but do want to own fast food companies. The majority of ethical funds don’t give you these options or the ability to customise your portfolio to align to your preferences. Many questionable sectors are either all in or are all out. We think investors deserve better options and deserve to choose how their money is invested.

Nucleus Wealth’s unique offering

We have around 100 ethical, sector and asset class screens and tilts that allow you to customise your portfolio based on your values and beliefs. We are always innovating and we have the flexibility to create specific custom screens also. Our screens can be utilised across all of our active and passive portfolios and see our investment options page so you can view all our different offerings that you can apply the numerous screens too. Log into our no-obligation onboarding portal to see more detailed information about each of our screens.

If you would like to discuss investing, any of these ethical issues or the screens and tilts available you can book a call with me here. I am always happy to chat and explain things in more detail.