How big can artificial intelligence be in the long term?

In the longer term, the sky is the limit. The best analogy is likely the introduction of the internet or the personal computer into workplaces. Artificial intelligence will allow more to be done with fewer workers in a vast array of industries.

This means higher growth, maybe 0.5-1.0% earnings/GDP more over the course of a decade or more. That is a significant economic factor. The question is how much to pay for it now.

How big can artificial intelligence be in the short term?

I look at this in a number of ways below. Each time, I struggle to find more than a few hundred billion in spending.

Significant? Absolutely.

Enough to rescue a $100 trillion dollar economy from the effects of higher interest rates? I’m a lot more skeptical.

Also, a lot of this spending could be classified as “stay in business” capital expenditure. Say you don’t spend money on artificial intelligence, but your competitors do. If your competitors can then lay off staff and lower costs, you might no longer be able to compete. Net effect of this type of spending is that companies lower costs, but also lower sales. It is good for society as companies can do more with fewer resources. But for individual companies, profits don’t change much.

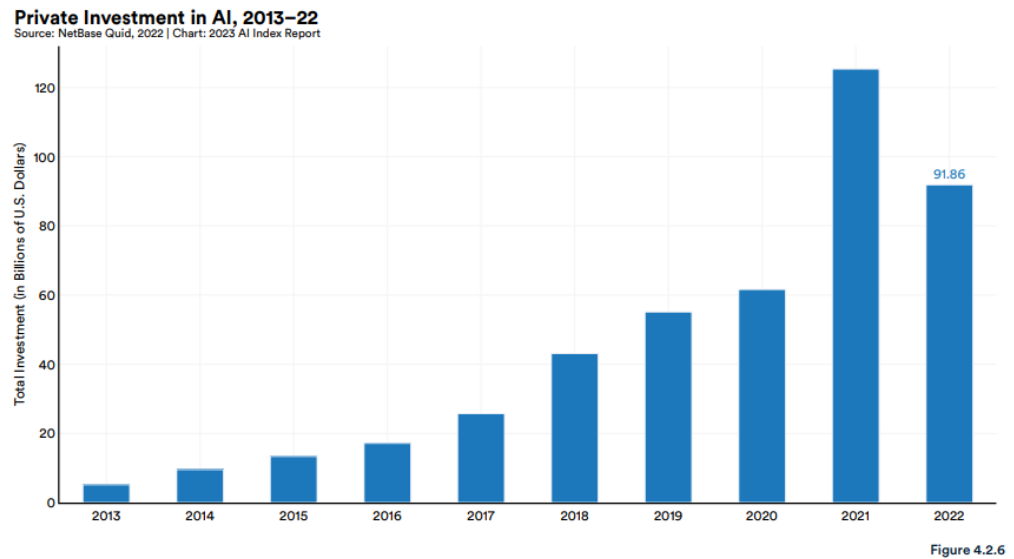

Private investment in artificial intelligence

I’m using NetBase data for this:

It is hard to know how accurate this data is. It seems credible, but my guess is that over the next few years there are going to be lots of job title changes to make it sound like there is some involvement in artificial intelligence. So, some of the extra “spending” is going to be bullshit. I stop calling my offsider an analyst and start calling them a data scientist. I rename a statistician to a machine learning specialist. They get a salary bump, and I get to tell my shareholders what a good job we are doing. I’m not spending any more, I’m just re-classifying.

Secondly, the NetBase AI investment data fell by 30% in 2022. The most likely explanation is that there were a lot of SPACs and venture capitalists raising money in 2021. And then that disappeared into 2022. If NVIDIA is any guide, a lot of this money will be back in 2023.

Then we need to take out any spending by China. Chinese companies are banned from using the most advanced US technology and so for listed companies, China is unlikely to be a significant source of sales. If we average 20221/22, take out China then we are starting with a market size of about $100 billion. Let’s be aggressive. Say this can go to $300b in short order.

So we are talking about an extra $200b in spending on artificial intelligence.

Keep in mind also that AI is very compute intensive up front, but applying the model is much simpler. It is similiar to calculating a regression. The hard work is creating the formula, say y = 1.3 + 2.1x. Once you have the formula, calculating y from a given x is much simpler.

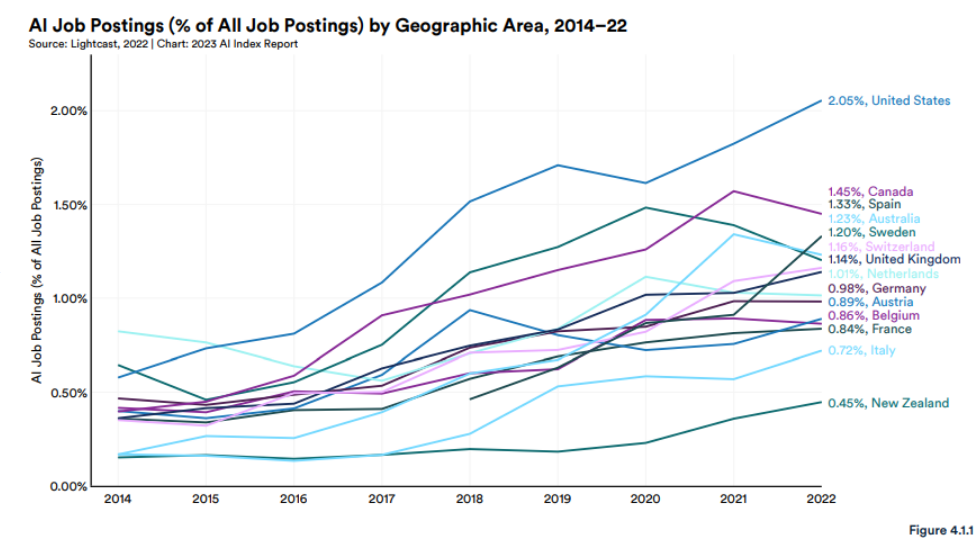

The issue I have is that most of the money is going to go on staff. My estimate is that you are probably spend around 70-90% of money on salaries and other expenses, vs 10-30% on running tests. This same report suggests already that 2% of job ads in the US are for roles that could involve AI:

Sometimes assuming most of the spend will be on salaries will be the wrong assumption. If you need to ingest the entire internet for your model, then you will need to spend tens of millions on processing. On the other hand, Goldman Sachs just patented an AI model to interpret whether communications from the Federal Reserve are hawkish or dovish. That is a limited dataset. You are probably running that analysis on your own laptop. i.e. spending $0 on (additional) computing power.

My observation is that most companies are going to rely on tools where the bulk of the training has been done by others. Then, they will use that data on their own, much more limited datasets.

So, of the extra $200b, we are talking say $40-50b on computing costs. But that isn’t all going to the chip manufacturers. Deduct the profit margin of data centres, memory, storage, power, data centres, infrastructure staff and equipment. Chip manufacturers might end up with a little more than half, say $25-30b. Great work if you can find it, but hard to see how it moves the needle much of total world profits of $60,000b.

US information technology jobs are not suggesting a spending boom

The most recent data that we have says that US information technology jobs are going backwards still:

Is it possible to have an artificial intelligence boom while employing fewer information technology workers? Seems unlikely.

There probably is a boom coming in spending on artificial intelligence. But, as far as I can tell, companies are very much in the exploration stage. They want to spend money, they just don’t know where yet and are probably going to spend the next 12 months or so trying to work it out.

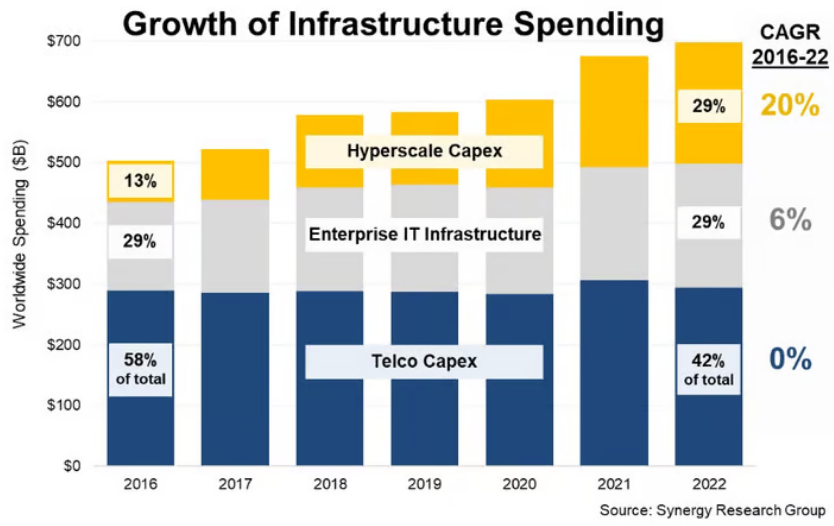

Data centre capex

The other way to attack the market size is to look at existing spend at data centres and scale up from there.

I’m assuming the enterprise IT and telco capex aren’t going to be meaningfully affected. This is mostly about compute, not data transmission.

This means we start with $200 billion on Hyperscale capex per year. Again let us be really, really aggressive. Say capital expenditure goes to $500 billion in short order i.e. 150% higher at +$300 billion.

Of this spend, 50-60% goes to data centres. Say $175 billion.

Data centres make 30%+ margins. And I’m guessing if there was a doubling of demand the margins would be higher. Ignore that though, say we still have $125 billion to spend.

Of that spend, 55-60% goes on servers, and the rest on power, networking, staff, infrastructure, rent etc. So, $75 billion to spend on servers.

So, again there are significant gains for the companies within the sector. But, the spending is just not that large relative to the size of the economy. Further, the biggest impacts are going to be on Microsoft, Google and Amazon, all of which are extremely large companies. The effect on those companies will be positive, especially for Amazon, but won’t be transformational.

AI company investment options

Keep in mind for most of the companies below, AI is a subset of what they do, not the main game. Yet.

There are effectively four layers to consider:

Software providers:

These companies produce the software that others will use. I suspect these will end up a bit like browsers on the internet, largely free to consumers. Effectively paid for from advertising or lock-in to cloud services. Likely to be some (expensive) high-end models provided to big companies for private use.

The only real players currently are Alphabet (Google) and OpenAI (unlisted, partly owned by Microsoft). There are hundreds of companies trying to sell add-ons or alternative products.

Cloud Infrastructure:

The infrastructure needed to run the advanced models is quite specialised. It makes sense to rent the equipment rather than buy your own in most cases. Which means lots more money spent on cloud computing providers.

The big players are Alphabet (Google), Amazon and Microsoft.

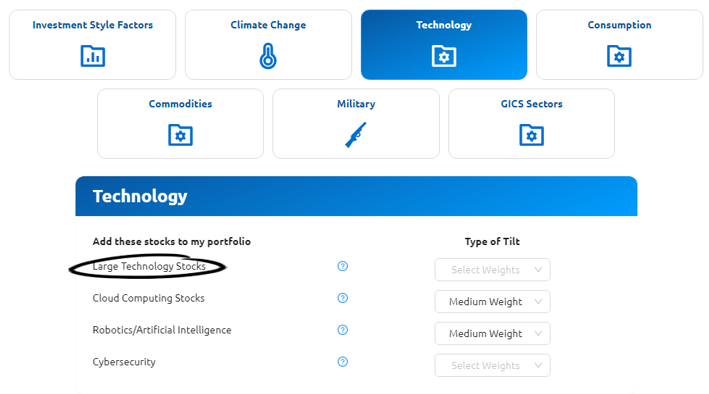

For Nucleus Wealth clients – choose a Cloud Computing as a “tilt” to your portfolio to get an additional weight to a basket of these stocks:

Processing:

The hardware, software and networking to run AI models. This is where NVIDIA dominates. It operates across all elements, as does Google. Amazon is having a go at the hardware, likewise AMD. In the system and networking, Broadcom shouldn’t be overlooked. In the software (supplying libraries that AI models will use), Google, NVIDIA and OpenAI are the main players.

For Nucleus Wealth clients – choose large technology stocks as a “tilt” to your portfolio to get an additional weight to a basket of these stocks:

Then there are the indirect beneficiaries. TSMC and GlobalFoundries are the obvious winners, as is ASML who supply high end equipment that makes the equipment. The memory chip companies, Micron, SK Hynix, Samsung will likely benefit. More so if there are lots of lower end machines sold rather than a small number of supercomputers.

Consultants:

Not really a major thing just yet. But it is coming. IBM, Accenture, Cognizant, Capgemini and others will gladly take the money of those who are late to the party and need to put “AI” in their next annual report or press release.

Upshot of the effect on markets

Artificial intelligence will undoubtedly make the world more efficient. It is likely to increase profits. Will it bail out company profits in the next year? I highly, highly doubt it.