Jobs continue to defy naysayers

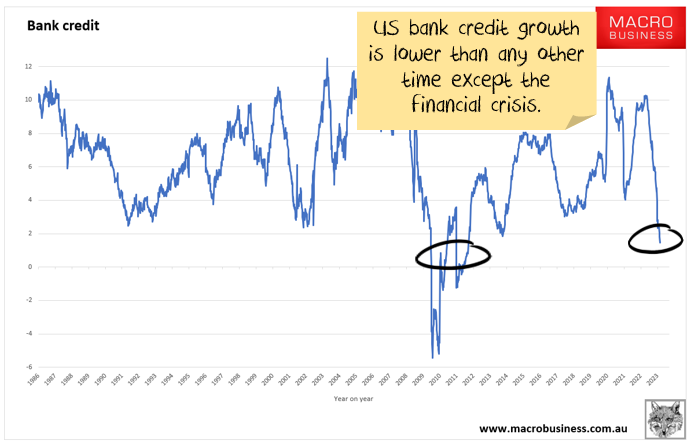

There are a lot of signs that a recession is coming. Bankruptcies are back with a vengeance. Most of the suite of raw materials and commodities have plunged in price. Transport costs are down more than half. Credit growth is running at 20-year lows. Forward surveys are at recessionary levels.

There are two signs, though, that a recession is not here. First, inflation is high, albeit falling. Second, and more importantly, jobs and wages remain strong. And that is where the hopes of the soft landing camp lie. It is all about jobs and wages.

Jobs data

We do need to highlight that data on jobs are a lagging indicator. When an economy enters recession, jobs are usually the last indicator to start falling. Companies tend to cut back on all manner of other discretionary expenditures and plans before finally laying people off.

Globally the story is strong wage growth in most major economies. Australian wage growth is lukewarm, but the central bank is talking like it is hot. Japan and China have weak wage growth. Employment growth is holding up in most countries.

The question is whether continued strength in the jobs market will mean that the economies can plow through the effect of higher interest rates.

Jobs data is not all sunshine and roses. You can paint some “glass half empty” stats:

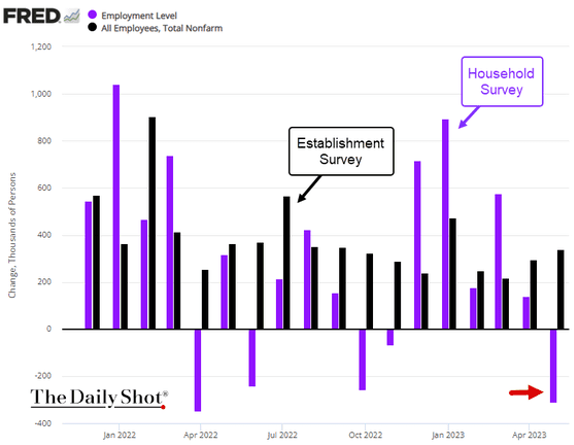

In the US, household survey of jobs looks much worse than the business survey

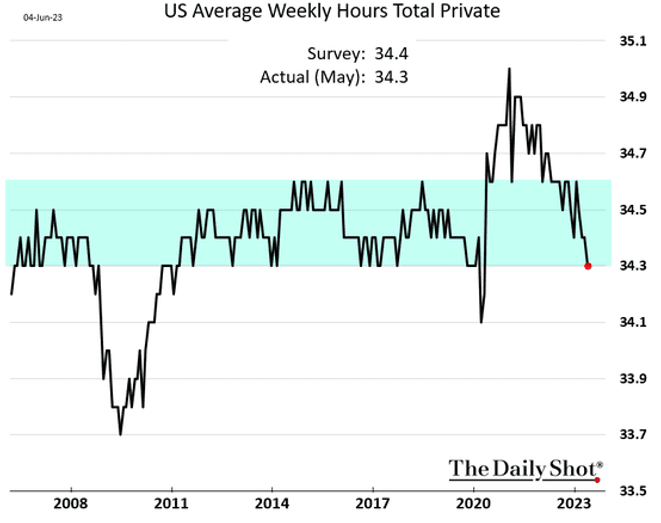

Announced layoffs are high. The number of hours worked is at the lower bound of prior ranges:

Australian job ads are down 20%+ on last year. Many other markets are showing similar trends. This is what I would expect to see in a typical cycle, the forward jobs indicators turn down, and then jobs follow a few months later.

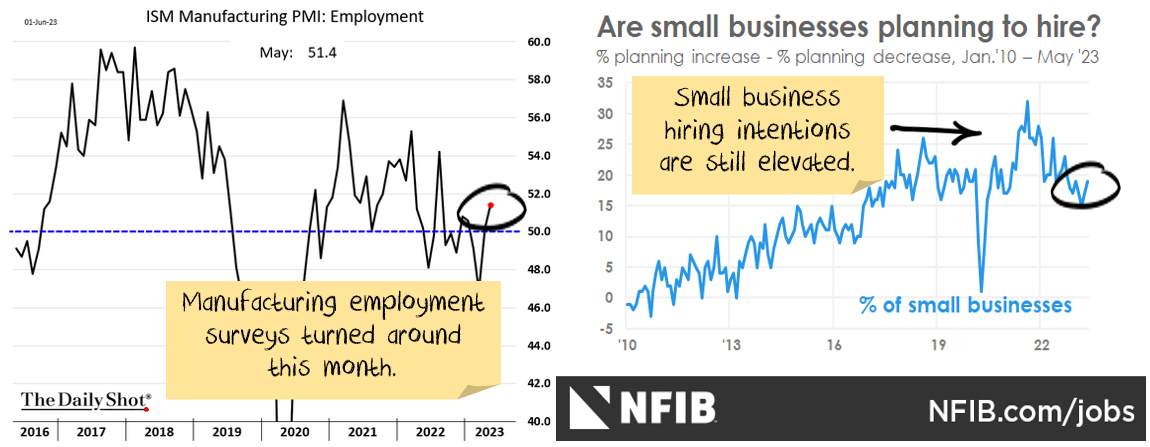

Then again, there are some “glass half full” signs as well that jobs might stay strong:

Is something different this time? Or is it merely a sign that jobs and inflation are following their typical path and are lagging the cycle? The second explanation still seems the most likely.

Is the Reserve Bank of Australia boxed in by immigration and energy?

Australia is running record levels of immigration. Governor Lowe made the point in recent testimony that this is contributing to inflation as infrastructure and housing can’t keep up.

What he didn’t explicitly connect is that interest rates work best to cool demand. Australia is suffering from supply-side issues in two ways:

- Immigration will keep wage growth down as the supply of labour booms.

- Immigration creates demand for housing, but supply in housing is not flexible and will take years to catch up.

Then, energy prices in eastern Australia remain incredibly high by world standards. Whatever policies the government are suggesting it will put in, they aren’t working.

Raising interest rates does not fix either problem. Except if rates rise so high that something in the Australian economy breaks. Which seems to be the plan at the moment.

I’ll write more on this soon.

Could the forward indicators be wrong?

Sometimes, it is different. The forward indicators signal a problem, but something intervenes, and the potential problem doesn’t progress into an actual problem.

The latest market hope centres around artificial intelligence stocks. The short version is that a nascent boom is going to drive spending and productivity to offset the higher interest rates. I have two problems with this view:

- A productivity boom will come. But there simply isn’t enough time. The improvements will occur over a decade, not six months.

- It is simply not big enough. Total global spend on artificial intelligence last year was around USD 100 billion. About 0.25% of GDP. If that tripled overnight, you are still only adding 0.5% to GDP growth.

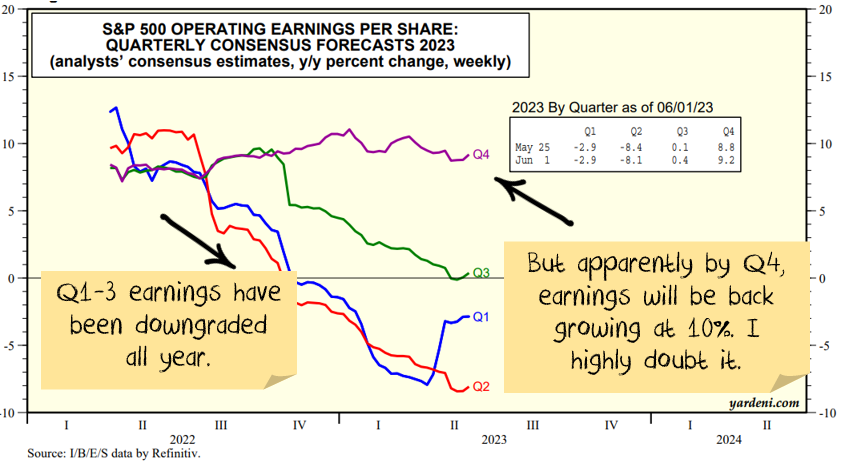

The bond market believes the forward indicators, it has a recession by the end of the year. Equity analyst forecasts do not:

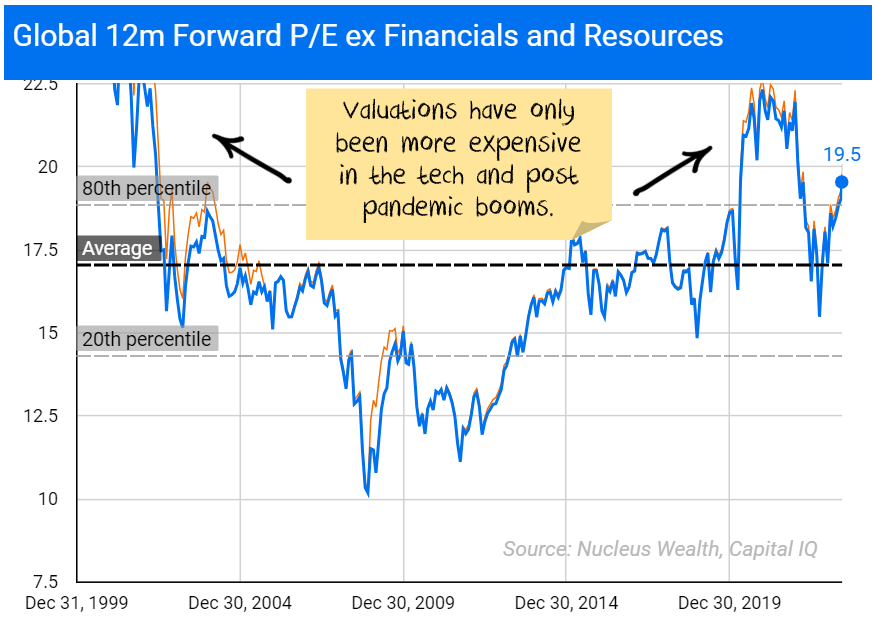

And the stock market is priced for a boom, not a bust:

Credit Crunch

A banking crisis has been playing out over the last few months. I’m still not expecting the banking crisis to create major issues. But, I am expecting the credit crunch following the banking crisis to create major issues. So, it is a question of “when”, not “if”.

I’m expecting bank funding costs to increase. Deposits to flee the smaller banks. Both have already started.

As a consequence, banks scale back their lending. Interest rates charged are higher. Corporates bear the brunt, the US falls into recession and default rates spike. Inflation is no longer a concern.

Net effect: a mini-banking crisis, followed by a credit crunch, possibly followed by a traditional banking crisis.

The forward data continues to indicate economies are in the early stages of a credit crunch:

Earnings are still too high.

One of the key features of the last year has been the ability of companies to expand margins, using inflation as a cover to push through price increases. But that is coming to an end.

Sales growth remains relatively good, but this is largely a function of inflation:

Analyst forecasts are still too optimistic.

Add in that a host of forward indicators (soft data) are pointing to significant weakness. Capital expenditure intentions, financial conditions, CEO confidence, sector downgrades all point in the same direction. Earnings forecasts are too high.

Is something different this time? Or is it just that analyst forecasts are too optimistic at macro turning points, as they usually are. My money is on the second.

China finally holding its nerve?

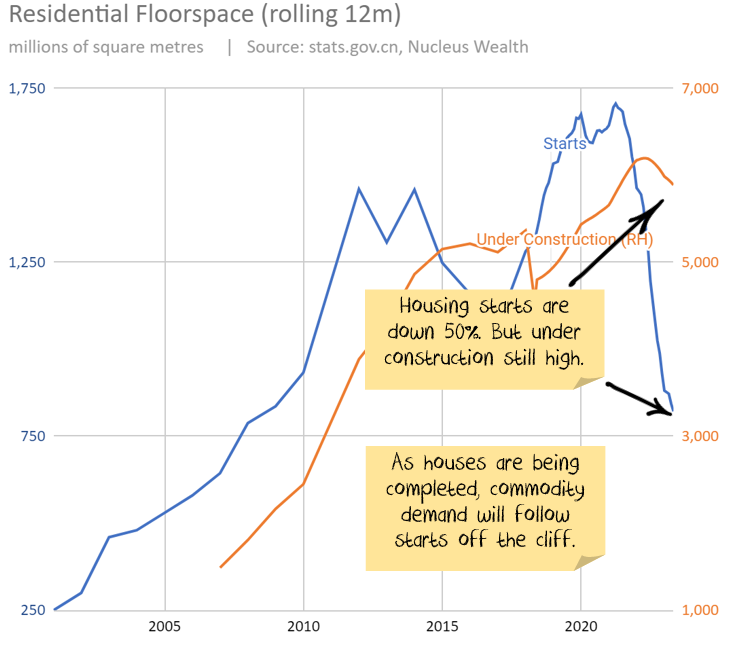

China is in the middle of its fourth attempt in the past dozen years to wean itself off its property construction addiction. They lost their nerve on three prior occasions.

In November, China issued a sweeping directive to rescue its property sector. At face value, it was a major recalibration of its property crackdown. We did not interpret the announcements as a resumption of the property building boom. In fact, for the most part, you can categorise the elements as either (a) directives to various banks to lend more to developers, mostly focussed on completing existing projects (b) reduced debt constraints or rules on individuals buying houses.

The plan is to avert catastrophe rather than return to the old normal.

China’s housing starts are down 50% on prior years. But, because apartments take a long time to complete, the amount under construction has only fallen slightly:

The reduction in new housing starts will eventually flow through to construction. And, given the immense size of the Chinese house-building bubble in recent years, starts would need to halve again to get down to levels that are consistent with other economies.

China is not coming to the rescue through housing and infrastructure. Stimulus, if it comes, is much more likely to be focused on renewable energy and semiconductors. Particularly as the US expands the number of advanced chips that China has been cut off from.

Australia was a major beneficiary of Chinese construction through commodities. That is not the case for semiconductors.

Net Effect

The credit crunch is growing, bankruptcies are climbing, company earnings are sliding lower, and China is not coming to the rescue.

Valuations are in the most expensive 20% of historical ranges. None of those factors encourage me to buy more stocks.

Jobs are the lone bright spot. They are usually the last domino to fall, so it is not atypical at this point in the cycle to see jobs yet to weaken. But the continued strength of jobs and wages is the one factor that bears could prove bears wrong.