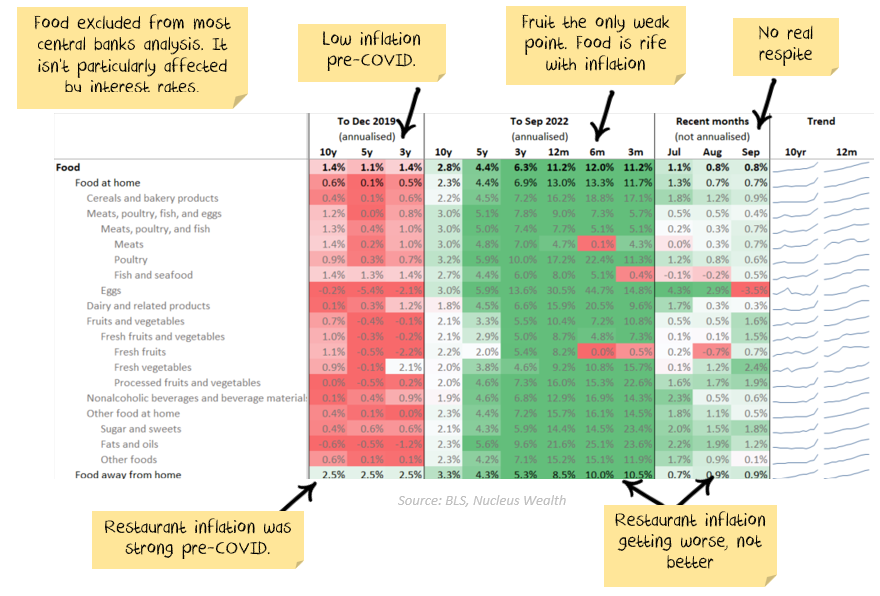

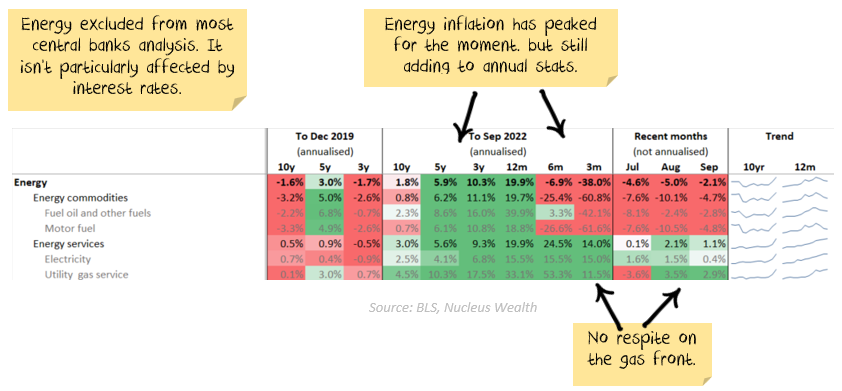

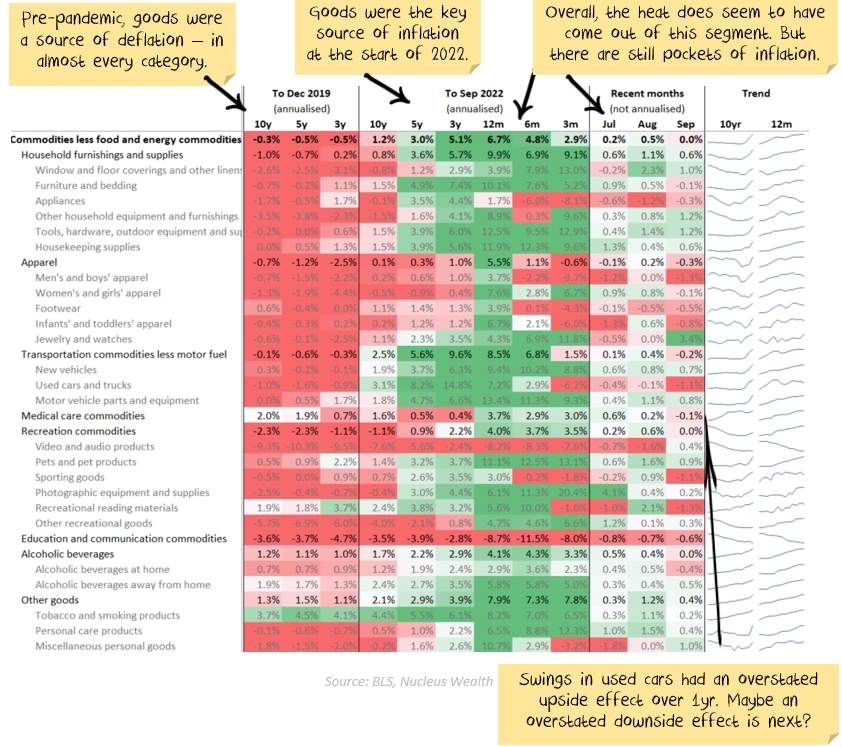

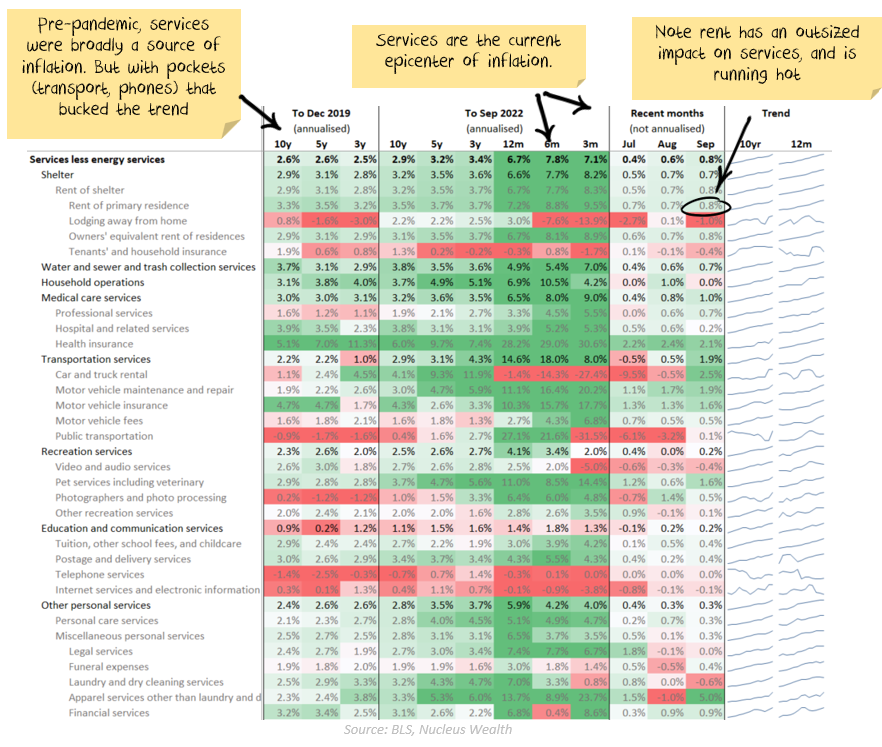

US inflation came in hot overnight. It is worth noting that while there are some positive signs for goods, services inflation is getting worse. See the tables below:

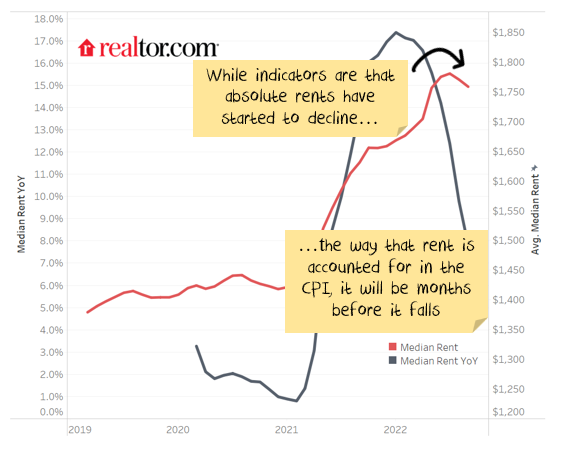

Given some technicalities in calculating rent inflation, services inflation is unlikely to decline quickly.

How should we look at inflation reversion?

There are two ways to consider reversion:

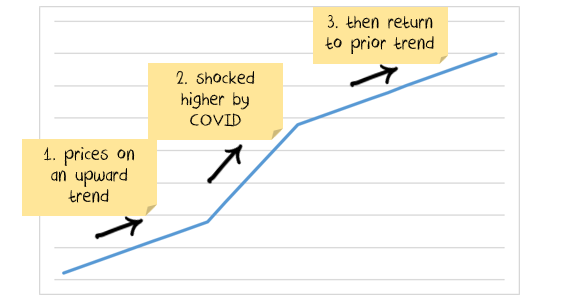

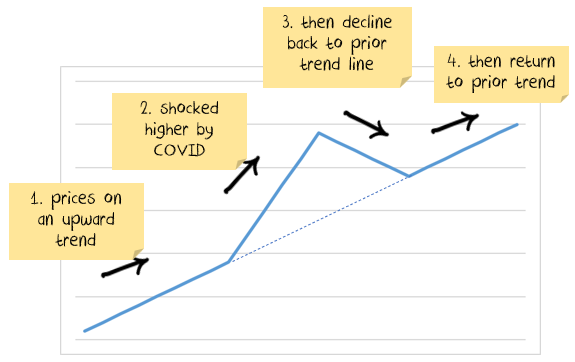

1. While central banks will force inflation back to 2%, prices will remain structurally higher.

2. Prices have been temporarily shocked, but will return to the prior trend

Goods are probably more likely to be in the second category, services more likely to be in the first. Given the Ukraine war, gas prices are likely to be in the first category. Oil is more transportable, and so probably has a chance for either.

The shape of future inflation or deflation depends on how many things you think will fit into each profile.

Going forward

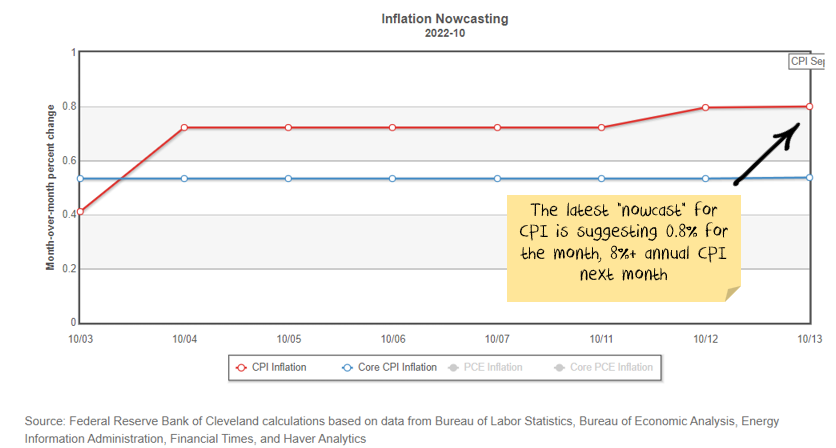

The nowcast from the Cleveland Fed is for another 8%+ print next month.

The way the maths are at the moment, annual inflation is going to remain high for some time. Say you were expecting imminent deflation in many categories. If the US started printing -0.7% per month inflation every month from November, annualised inflation would still be above 2% until March 2023.

So choose your path. My expectation is that central banks want to jump up and down a few times on the corpse of inflation to make sure that it is truly dead before reversing course. With that in mind, I’m expecting very low inflation or deflation by mid-2023. But, even with that expectation, the headline annual inflation figure will stay high for at least six months. Which is just another reason why central banks are less likely to ease up on inflation any time soon.