Empowering you to achieve

your financial goals

Your wealth, your way, professionally managed.

Empowering you to achieve your financial goals

Your wealth, your way, professionally managed.

Investment Insights you can count on

Nucleus Investment Insights takes a weekly deep dive into current financial, macroeconomic and geopolitical affairs across the globe with a particular focus on the Australian investment implications of these events.

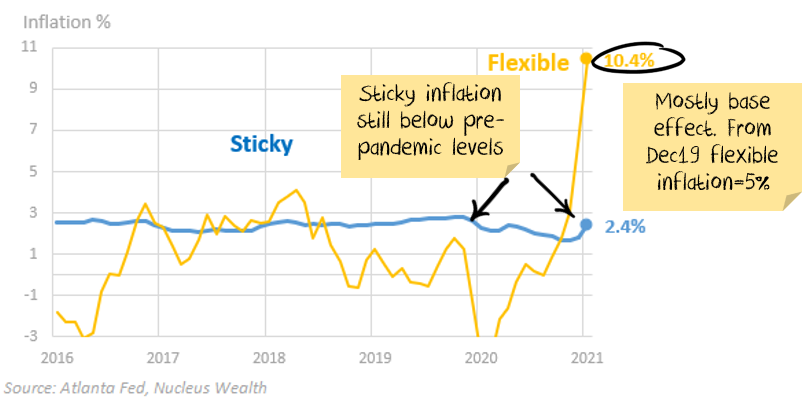

Beware the Inflation snap back

Runaway inflation is the theme du jour. “Protect your portfolio from hyperinflation” scream headlines from investment newsletters.

In this detailed 4 part series, we unpack an alternative scenario for you. Current inflation is supply-chain based, temporary, and the recent price signals might actually create the opposite effect.

Investment Philosophy

Nucleus Wealth’s investment philosophy is that high-quality assets at reasonable prices provide the best investment outcomes for investors.

Studies show that not only do these assets provide higher returns over time, but the path is also much smoother. This is because the lowest quality and most expensive assets will often rise the most during bull markets and then fall the most during bear markets.

Find out more about how our investment philosophy seeks to exploit the efficient market hypothesis.

How we apply this research to investments

All our content, from podcasts to monthly property reports and articles, forms an integral part of the Nucleus Wealth investment management process. Our Head of Investments, Damien Klassen, often says the discipline required to write an article explaining an investment idea is integral to making sure the investment idea is coherent, logical and as water-tight as possible.

So when you read an article, or listen to a podcast, you’re hearing about your investment straight from the portfolio manager’s mouth.

Nucleus Wealth is about quality investment management, that understands you want an investment personalised to your needs. It’s about outsourcing the investment management, but not losing all the benefits you have from managing your own portfolio.

ACTIVE MULTI-ASSET PORTFOLIOS

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global economic themes and help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

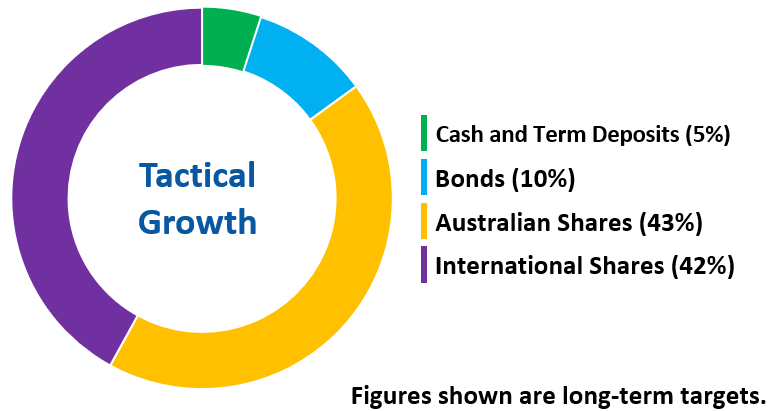

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 98% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 4.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

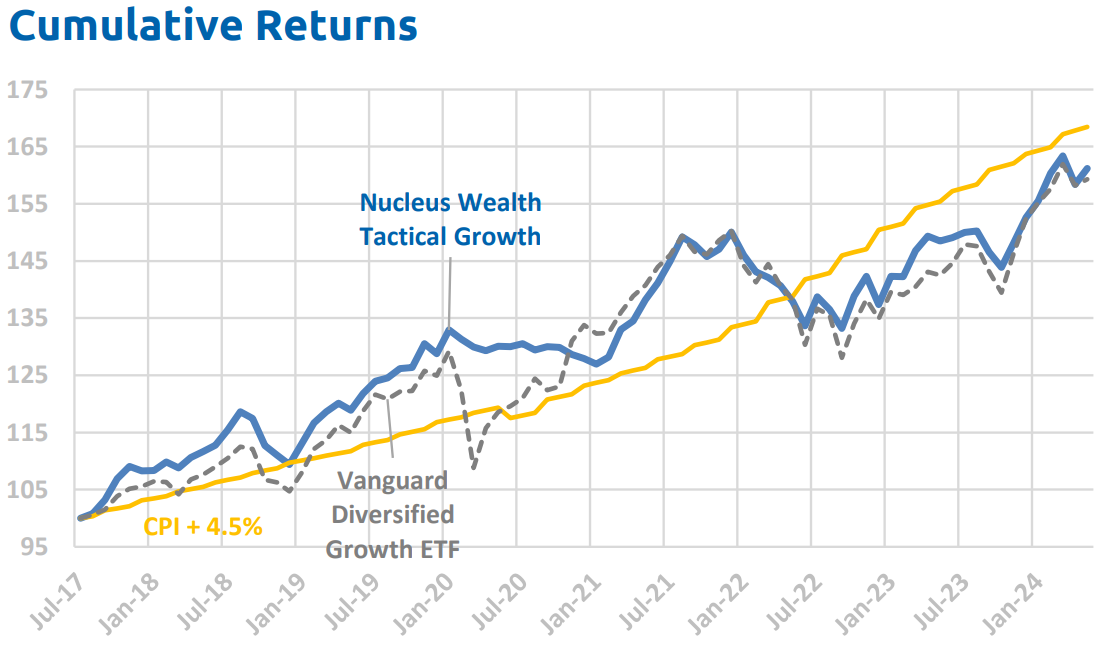

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Features

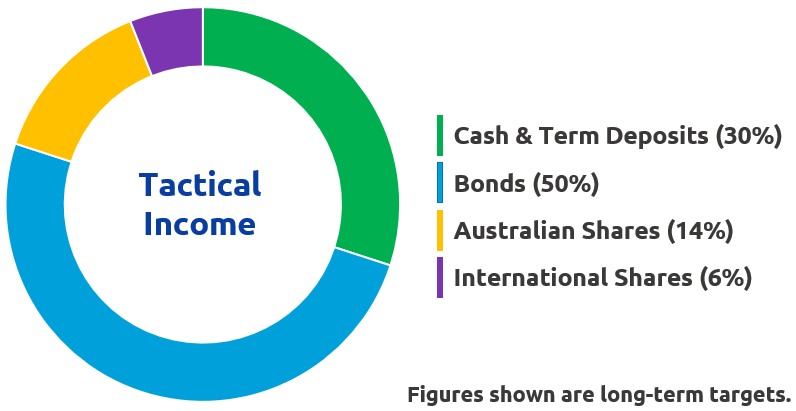

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

ACTIVE MULTI-ASSET PORTFOLIOS

These portfolios feature "Tactical Asset Allocation", meaning the amount of Cash, Bonds and Shares in each portfolio is adjusted by Nucleus Wealth to take advantage of global economic themes and help protect the portfolio during volatile market conditions

Through our onboarding portal you can select any of the portfolios, a blend of several, or receive a recommendation of an appropriate blend for you using our free online advice tool

Features

High growth portfolio for investors who are comfortable with higher levels of volatility and have a longer investment timeframe.

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets.

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio.

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 98% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000.

- Benchmark is Australian Inflation (CPI) + 4.5%.

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

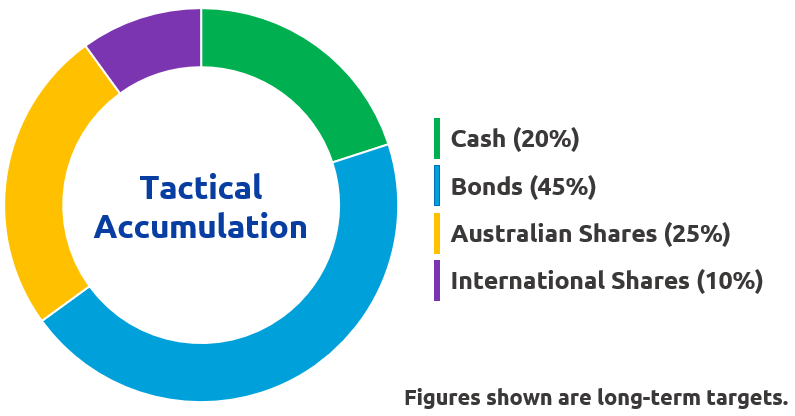

Features

Conservative portfolio for investors who do not have an income requirement

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 50% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

Conservative portfolio for investors who have a preference for income rather than capital gains

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Blend of assets that are tactically managed within the minimum and maximum weighting range of the portfolio ie. max 30% share exposure. Target allocations are shown in the following pie chart

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options

- Minimum Investment is $10,000 (for lower investment balances, please contact us)

- Benchmark is Australian Inflation (CPI) + 2.5%

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

ACTIVE SHARE PORTFOLIOS

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin personalising your portfolio

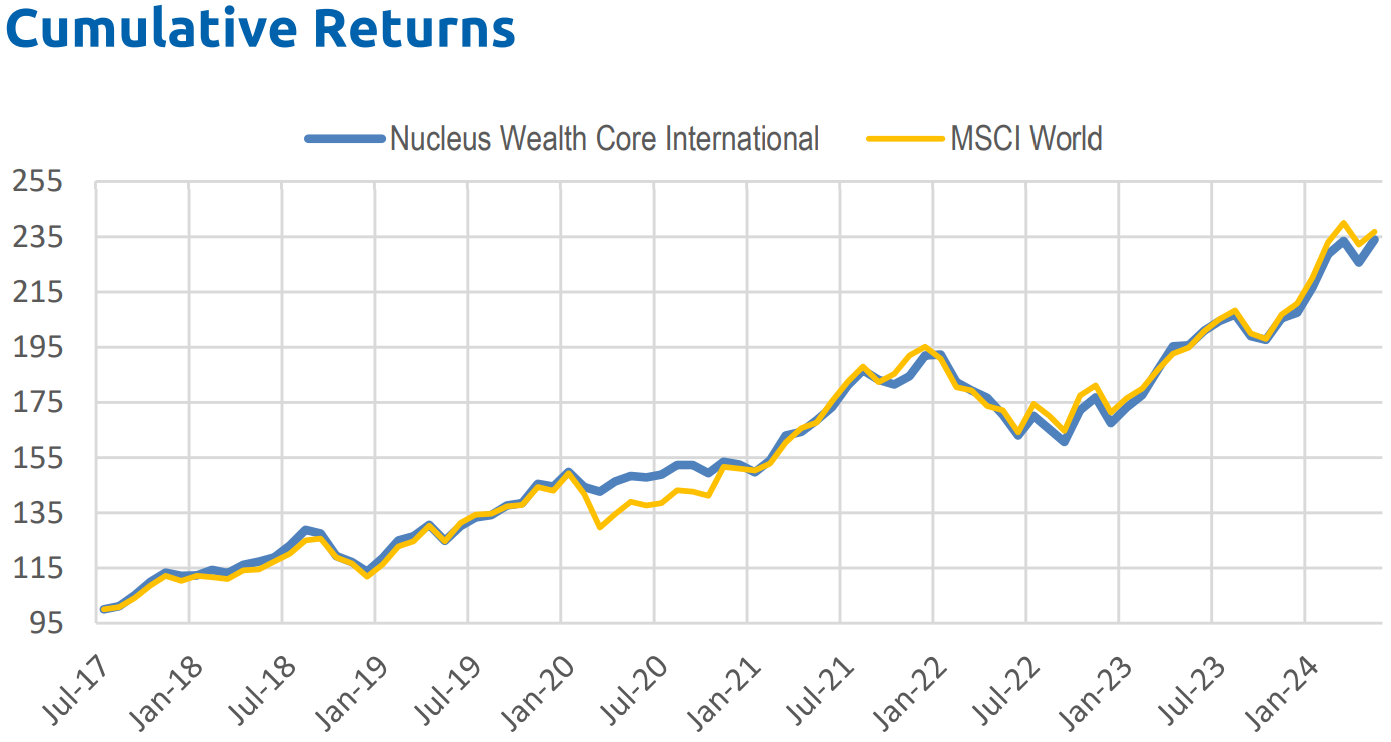

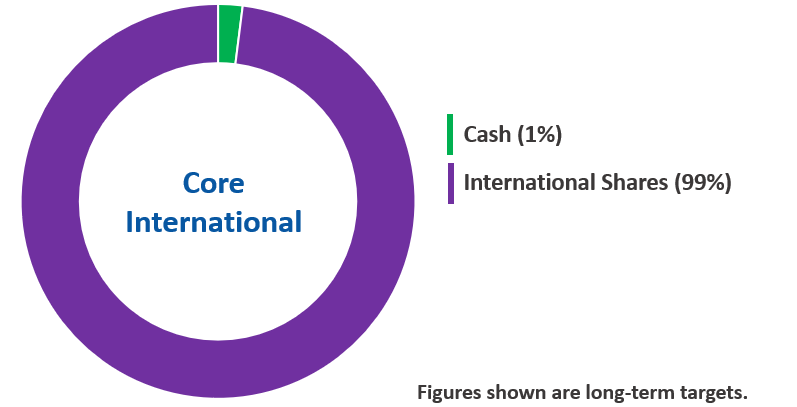

Features

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Personalise with our ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the MSCI World Index

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

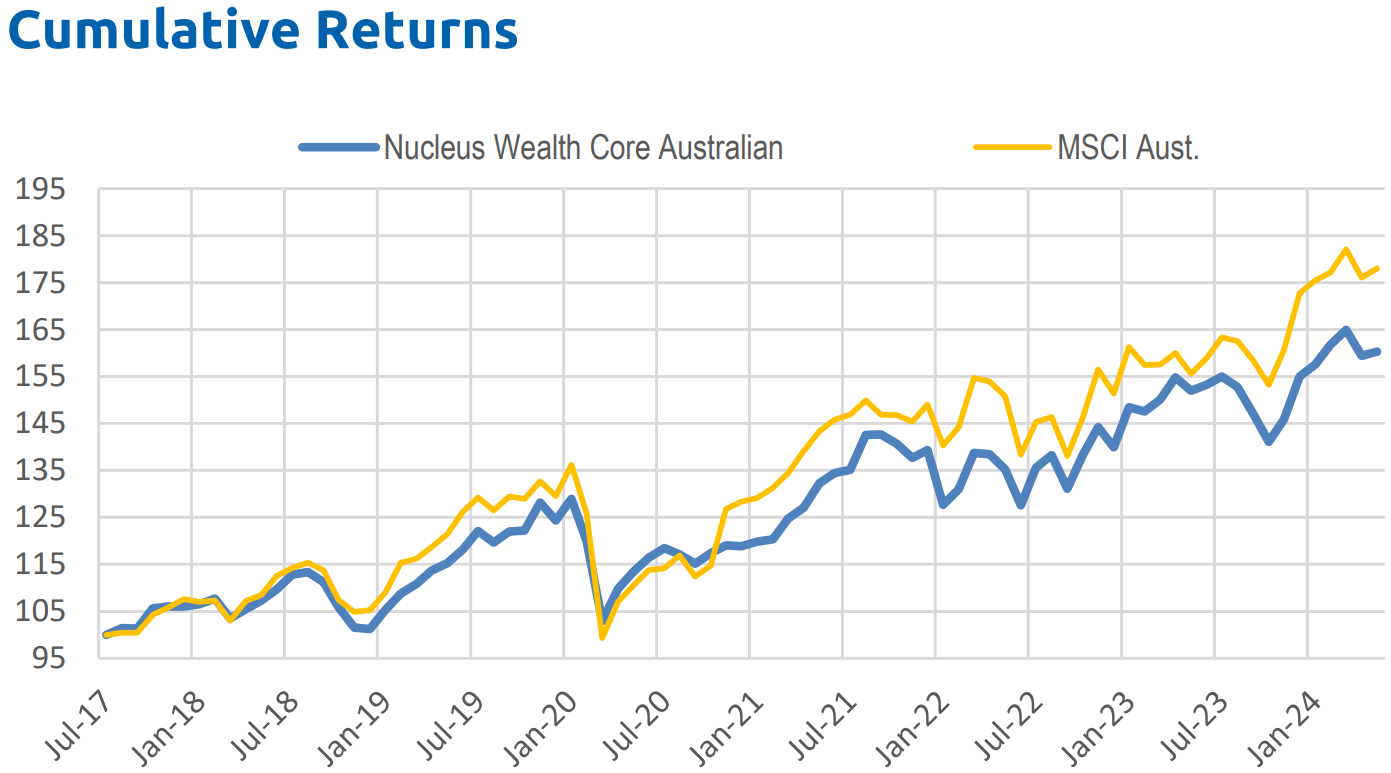

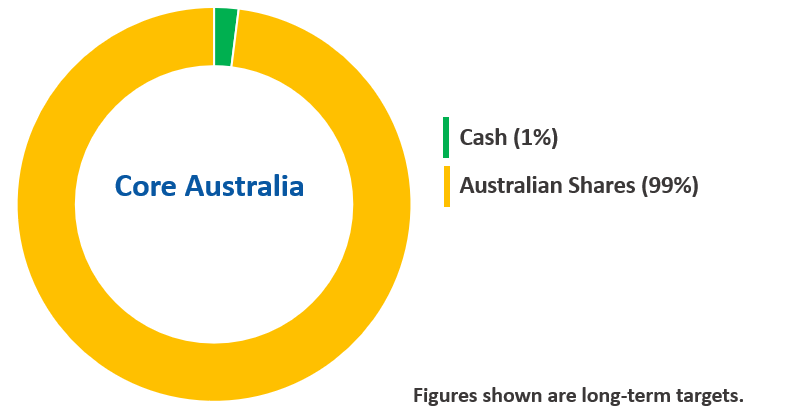

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them

- Personalise with our ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the MSCI Australia index

- View the Target Market Determination for this portfolio

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

ACTIVE SHARE PORTFOLIOS

These portfolios hold only Australian or International shares respectively, and do not feature Tactical Asset Allocation, meaning they are always fully invested and are not ‘de-risked’ at any time. This can mean higher levels of volatility compared with Tactical portfolios.

Through our onboarding portal you can select any of the portfolios or a blend of several, click here to begin customising your portfolio

Features

A portfolio of leading global companies' shares (60-80 holdings)

- Actively Managed, meaning we monitor stock prices and buy or sell accordingly, whilst ensuring a diversified mix of sectors

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the International share component of the portfolio for them

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent)

- Benchmark is the MSCI World Index

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Features

A portfolio of leading Australian companies' shares (20-30 holdings)

- Actively Managed, meaning the portfolio is regularly monitored to seek out opportunities in world markets, whilst ensuring a diversified mix of sectors.

- By using Managed Accounts, every investor has their own individual portfolio, managed by Nucleus Wealth. This means that all dividends, distributions and franking credits are captured within your portfolio.

- Ideal for those who wish to manage their own asset portfolio whilst having Nucleus manage the Australian share component of the portfolio for them.

- Personalise with ethical and investment overlays, allowing you to exclude or include themes from over 100 different options.

- Minimum investment: $10,000 (platform dependent).

- Benchmark is the MSCI Australia index.

- View the Target Market Determination for this portfolio

Performance

Past performance is not an indication of future performance. The above returns are per annum, as of May 31st 2024 and after investment fees (of 0.64%) but before administration fees (variable, available on our client portal and FAQs). Inception returns are per annum from 31 July 2017. You can view our full performance reports here.

Fees

- Our investment management fee is 0.64% of your account balance per annum

- There are additional platform and administration fees which vary with investment size and asset type

- A full break down of all fees is provided during our onboarding process, and before you make a decision.

Why Choose Nucleus Wealth

As Your Wealth Manager?

Bespoke Investments

Tailor your portfolio by blending together investments, applying ethical exclusions and portfolio filters to your investment with Nucleus Wealth.

Built For Transparency

Experience industry-leading transparency allowing you to view your entire investment portfolio in the client portal, outlining your asset weightings, which stocks you own and the investment rationale for them.

Active & Passive Investment Solutions

Offering both actively & passively managed investments, we provide a wealth management solution best suited to your goals & preferences.

Join the hundreds of Australians who are experiencing financial peace of mind

Find out what your personalised investment would look like in 10-20 minutes – free and commitment free.

Join the hundreds of Australians who are experiencing the benefits of our low cost tailored portfolios.

Create your investment portfolio for free in 10 minutes – no commitment required

Get In Touch

Book a complimentary call with one of our financial advisors to discuss your options.

Book A Call Now

Learn More

Check out our investment resources section to read our latest articles, monthly performance reports, watch our webinars and listen to our Nucleus Investment Insights podcast.

Wealth Management Resources