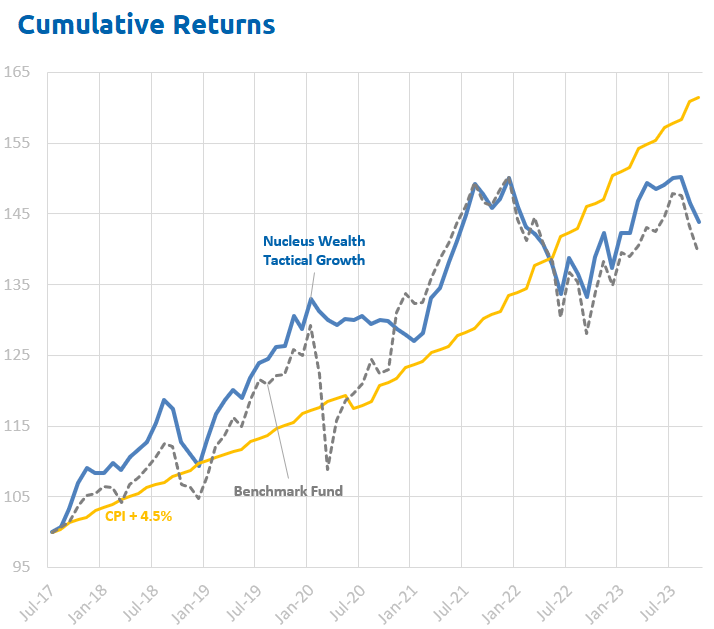

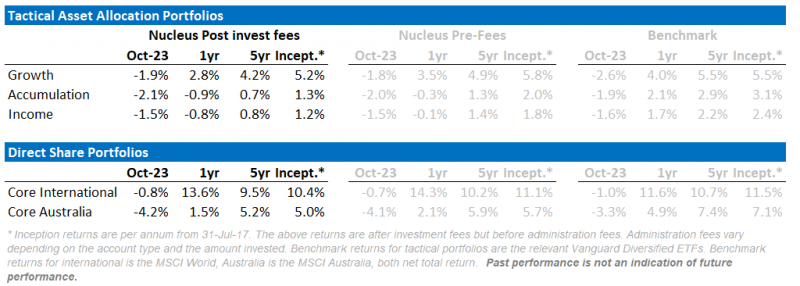

October is known as a month of heightened volatility, and this year it didn’t disappoint. Returns swung from +3.5% to -3% before settling in the red at -1%. This is the third consecutive month of negative stock market returns, and while our tactical portfolios were not exempt, they all performed better than benchmarks given our more defensive positioning.

Looking forward, we expect weak stock markets as the central banks raise rates to slow demand, shrinking company profits.

With that in mind, the key factor to watch in the coming months to tell if we are wrong or right is the change in corporate profitability. The recent reporting season in the US showed some signs of weakening earnings, but not enough to confirm our thesis yet. Earnings forecasts have been drifting lower.

Apologies for the late report this month. It is just a short one as we were making some relatively large changes to stock compositions in our portfolios, I’ll go into more detail in the next performance report.

Some learnings from 2023

2023 reminded us that reflexivity is still a thing. Reflexivity (popularised by George Soros from an investment perspective) refers to the feedback loop between market participants’ perceptions and the market realities they influence.

Stock markets rallying through the second half of the year encouraged:

- consumers through the wealth effect to keep consumption ticking over

- companies to keep investing.

At the margin, markets can shape reality.

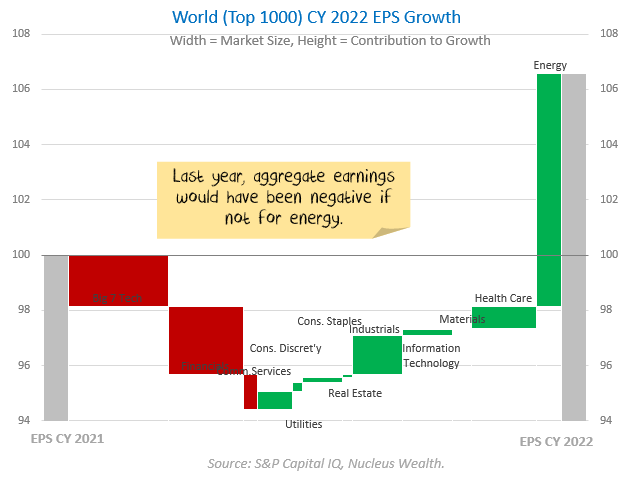

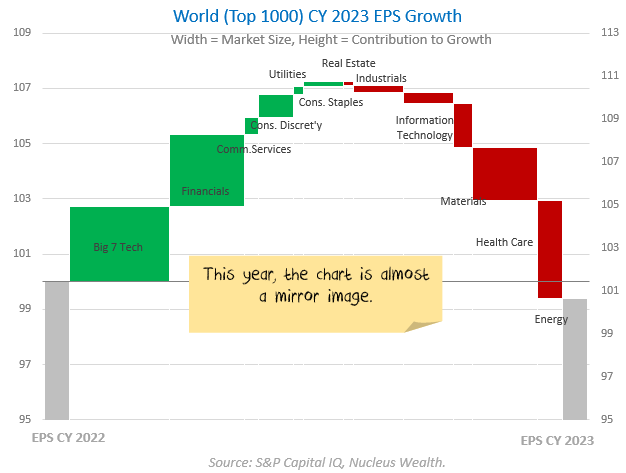

Going into 2024, we need to judge how far earnings expectations will be tempered. 2023 earnings will end up about even with 2022. Cut out the magnificent 7 (Apple, NVIDIA, Microsoft, Tesla, Amazon, Meta (Facebook) and Alphabet (Google) and earnings would be down close to 5%.

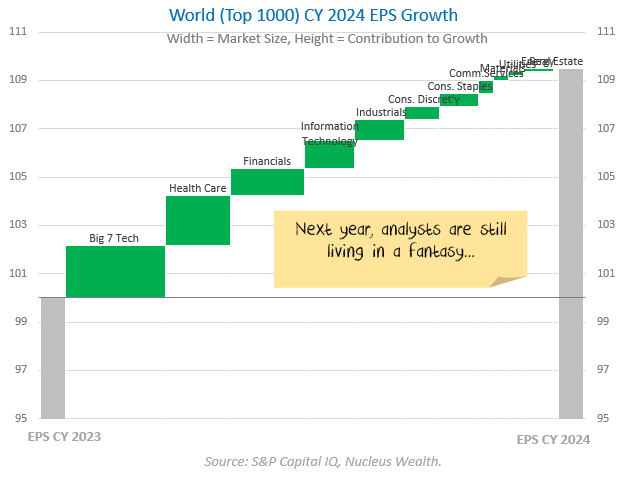

There is close to 25% earnings growth forecast over the next two years, and the market still looks expensive. And central banks are pressing hard on the brake.

If earnings downgrades are gradual, and economies don’t come to a halt, then maybe the stock market can hold up.

The problem is that markets are priced for something close to perfection. This means risks are skewed to the downside if we don’t get perfection.

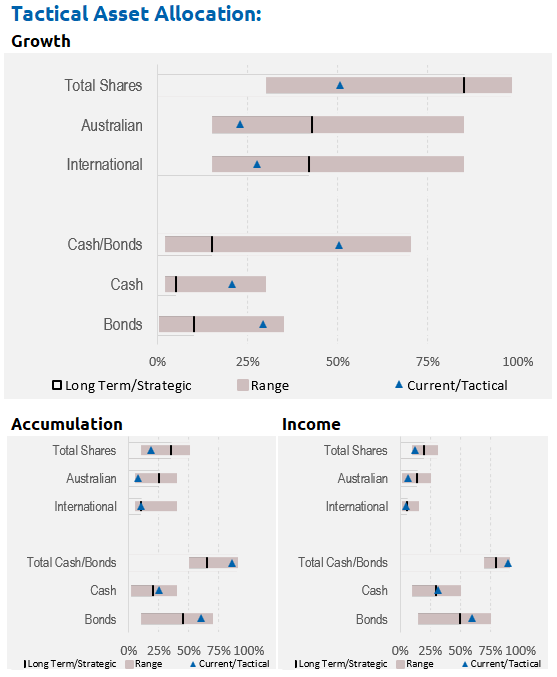

So, on asset allocation, we are definitely looking to hold more in cash and bonds than usual.

Some learnings from the 3Q reporting season

I can’t put my finger on the broad optimism for earnings over the next two years. My impression from company conference calls was that companies expect their own price rises to continue but lower cost pressures. Which has some cognitive dissonance at the macro level: “All my suppliers will have to lower their prices, but I’ll be fine”. This will be true for a few companies, but it can’t be true for everyone.

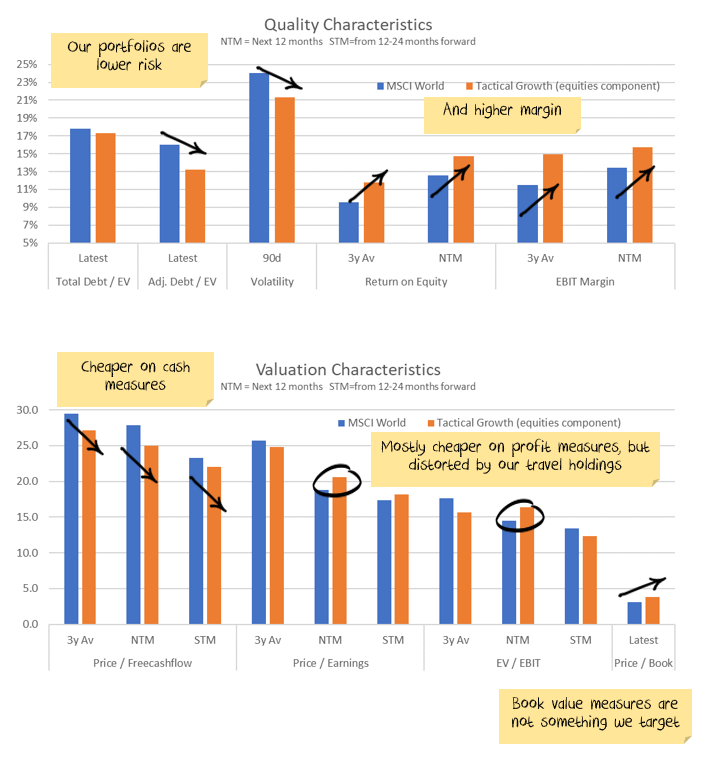

So, we need to look for companies that are going to be more resilient when sales are declining and margins are getting squeezed. Higher quality stocks are the stocks to own in this environment rather than value stocks. Higher quality stocks tend to be more price makers rather than takers. Other sectors in particular where we look for growth to overcome the weaker macro environment are:

- Electrification – more on the service side than electricity production

- Obesity drugs – some breakthroughs here look like they are going to have a significant impact on longevity, health and insurance.

- Onshoring / Robotics – companies that automate or provide services as production is moved out of China

- AI – companies in industries where there are early productivity gains

- Cloud computing – the continued shift online plus extra demand from AI

- Energy – we are interested in companies that will benefit from the gas price gap between the US and Europe falling.

Why hold bonds

Its still OK to buy bonds! Think of a 10 year bond a bit like an option:

- You can lock in 4.5% return for the next ten years if you buy it today.

- If the economy runs into trouble, interest rates would fall. That means the price of the bond will rise.

- You then have the option to sell the bond for a higher price and switch in to equities at (presumably!) lower prices.

So, a government-backed 4.5% return if you hold to maturity. Plus the potential for upside if there is an economic accident.

Are value stocks dead?

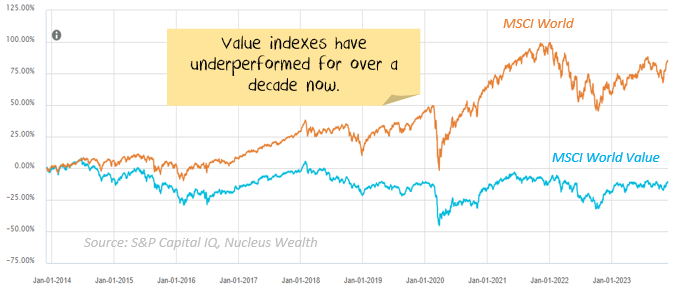

After another poor year, at the tail end of a poor decade, there are some serious questions being asked about value.

I like buying something cheaper. But you need to have another “axis”. I like to use quality, growth is fine as well. What I mean by this is that you don’t want to buy something cheap for the sake of it being cheap.

Think of it like buying a car. If you bought the cheapest car you could find, say <$1,000 you are likely to get a lemon that doesn’t work most of the time. Spend $5,000 more, and you can get a something much, much that might actually work a lot of the time. Another $5,000, and the quality gets better again. But, as you keep spending, the equation flips. Each extra dollar gets you less and less “extra” quality. To get from a 3 series BMW to a 7 series, you probably need to add $50,000 or more. And the change in functionality will be relatively small. Add $500,000 more and the change in quality will not be that significant.

Stocks are the same. You want to buy good quality stocks that are not overpriced. Or stocks that are growing but are at a reasonable price.

The problem with value stocks, is that they tend to have lower-quality earnings. These companies typically can’t expand margins because competitors will take their market share if they try. At specific points of the economic cycle, typically when the economy is running hot, value stocks can finally grow earnings and push through price rises.

The problem is that this is not where we are today. Today the problem is that price rises are getting more difficult, high quality companies will manage to hold onto their price rises, but more commodity-like companies will have to give up their gains as demand slows and competition intensifies. These types of companies tend to be value stocks.

And for all those that claim Warren Buffett is a value investor, look closer. Warren Buffett is always talking about “margin of safety” and “economic moat”. i.e. he buys quality stocks at cheaper prices. He has another “axis” besides value.

Net effect, buy stocks because the quality-to-value or growth-to-value tradeoff looks attractive. Don’t buy companies just because they look cheap.

Investment Outlook

I have some pretty clear ideas about which trends are sustainable and which ones aren’t in the long term. However, the short-term is far less clear:

- The banking crisis is morphing into a credit crunch. This is the number one US issue over the next few months.

- The sanctions on Russia are unlikely to be lifted anytime soon. The short-term effect was commodity shortages. In the longer term, it seems likely that we will see a re-orientation, Russia will supply more to countries like China and India, less to Europe. For some commodities (oil, wheat) this will be easier. For others (gas) it will be extremely difficult.

- The geopolitical energy crisis in Europe has eased on the back of much warmer weather. Australian energy price caps have pushed down energy prices. There will be a rush to alternative energy sources in the mid-term.

- Supply chains continue to improve.

- Governments continue to withdraw (or not replace) stimulus. There will be a fiscal shock into 2024. The question is whether the private economy will be strong enough to withstand it. Leading indicators suggest profits will be lower.

- Central banks have made it clear that they will try to solve the Russian-induced energy issues and supply chain-induced inflation by raising interest rates. The odds of a policy error have increased significantly.

- China still has not bailed out the property sector. Changes so far are not a bailout… but they may morph into one. China is trying to ensure that houses under construction get built, small businesses have access to credit, infrastructure building continues, and failing developers do not crash the economy. China is yet to show any signs of turning back to the old days of debt-driven property developer excesses. If China doesn’t continue to roll out new measures, the commodity market will deflate again.

It is still not the time for intransigence. Events are still moving quickly. But we have positioned the portfolio towards the most likely outcome and are gradually increasing the weights as more data arrives.

Bond yields have risen significantly. If the world heads for a recession this is a buying opportunity. In the short term the narrative “high inflation, central banks raising rates = sell bonds” seems to be coming to an end. Although there may be another last hurrah as the US central bank looks to rein in the stock market optimism.

The mix of higher volatility, leading to deleveraging of risk parity trades and momentum means yields could yet go higher. We are invested for bond yields to reverse.

Asset allocation

After being very expensive for a number of years, stock markets briefly touched off average value before becoming expensive again. However, debt levels are extremely high. Earnings have been going backwards, and seem overly optimistic in 2024.

Markets are supported to a great degree by central banks and governments. Policy error is every investor’s number one risk.

But, any number of other factors could force this off course and see unexpected inflation. Energy prices could jump higher, increasing inflation. Chinese/developed world tensions might rise further, leading to more tariffs. Or, China might decide again to supercharge property investment.

We are significantly underweight Australian shares, and as noted above, overweight bonds, with the view that the Australian market is more quickly affected by rising interest rates and more affected by a global recession:

Performance Detail

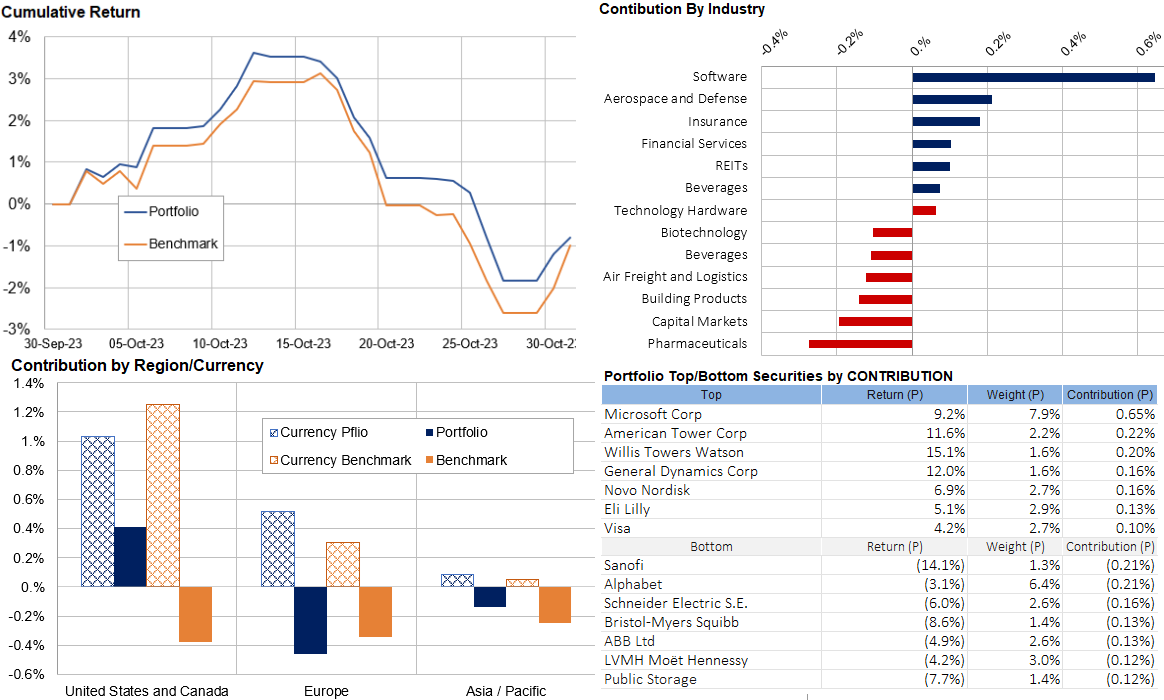

Core International Performance

October indices were down again continuing September’s downward trend which started in August. Our portfolio essentially outperformed the benchmark over the month with US exposures faring better than our European onrd where Luxury and Euro Pharmaceuticals fared particularly badly. Software (ie Microsoft) continues to be a key gainer as do the Obesity drug providers we highlighted recently. Overall the weakening AUD helped retiurns from all markets.

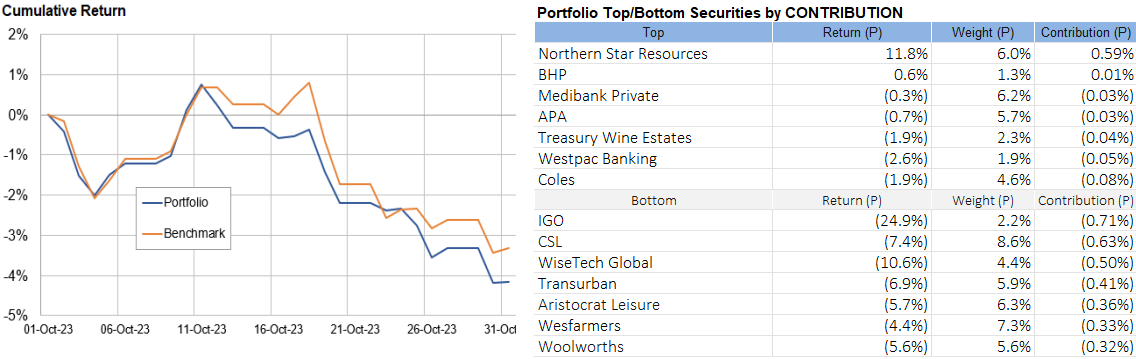

Core Australia Performance

Australian equities performed poorly this month with only gold and Iron ore stocks recording gains.

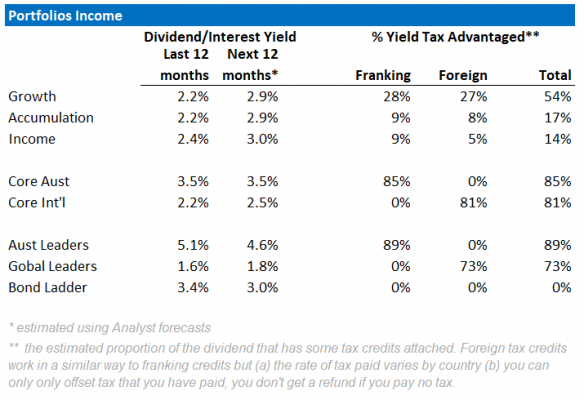

Portfolio Yields

This table shows the income yields of our various portfolios, including their proportion of Franking and Foreign tax paid over the past 12 months.

We also include an estimate of forecast yield (next 12 months), assuming no change in current tactical allocations and stock composition. There is an element of rising yields, as global interest rates rise. Offsetting that however, is the possibility Australian equity yields may fall as commodity-driven mining companies have lower profits to pay out. Our underweight Resource position in Core Australia portfolio should help maintain its yield.