Smart strategies to safeguard income when interest rates dip

International shares have a poor reputation for tax effectiveness. That doesn’t match the reality. Yes, international share dividends are not as good as franked dividends. But they are much better than unfranked dividends or interest from a tax perspective.

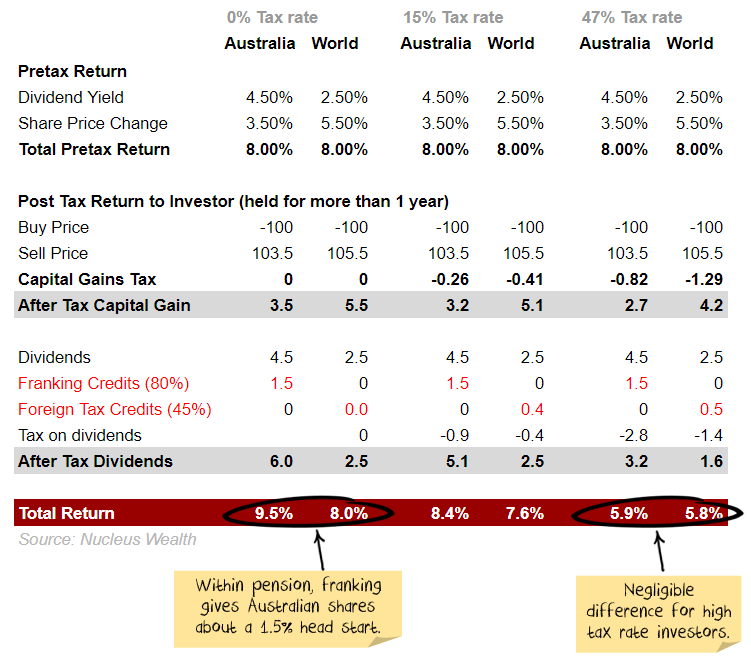

The table below assumes:

- The same investment returns

- In Australia you get a higher dividend return and lower growth

- For international shares you get the opposite

Under that scenario, the tax difference for investors in the top tax bracket is close to nothing:

Don’t ignore foreign tax credits

Foreign tax credits are very similar to franking credits. The main difference is that you can not get paid back for taxes that you didn’t pay in the first place. This puts more complicated limits on the amount you can claim.

Investments in different countries will generate a different amount of foreign tax credits. A reasonable estimate for a diversified portfolio of global shares is somewhere between 30% and 60% of equivalent franking. For example, in the past year, our direct index global portfolios generated dividends the equivalent of being 40% franked (assuming you didn’t have any tilts or screens). Our active portfolios generated income the equivalent of 53% franked return.

The differences are largely very minor

Under current tax laws, if you are on the maximum marginal tax rate, there is no significant difference between the tax position – Australian shares give you a very slightly higher return, but international shares give you better timing as let you defer your tax payment until you sell the shares.

At a 15% marginal tax rate, there is about a 0.8% difference. Again Australian shares give you a higher return, but international shares give you better timing as let you defer your tax payment until you sell the shares.

I would contend that anyone who thinks they can forecast Australian vs International returns to within 1% is having themselves on. Both stock markets and currencies regularly move that amount in a day.

About half the difference in yield is sector allocation

Yes, Australian shares pay a higher yield. But 2/3rds of the difference is merely in the stock selection. If you bought 60% banks and resources in an international portfolio then your yield would be much closer to the Australian yield.

Which is not really a glowing recommendation for the yield on Australian shares. i.e. a big part of the reason you get a higher yield is that you take a huge sector concentration risk in Australia.

Conclusions

Let me start by saying that investing for tax reasons is fraught with danger.

You should always start with investing for returns – tax is (at best) a secondary consideration.

If you expected even a 2% better return from international shares over Australian shares then there is no tax scenario that would make you prefer Australian shares. The tax benefit of franking is the icing. Don’t mistake it for the cake.