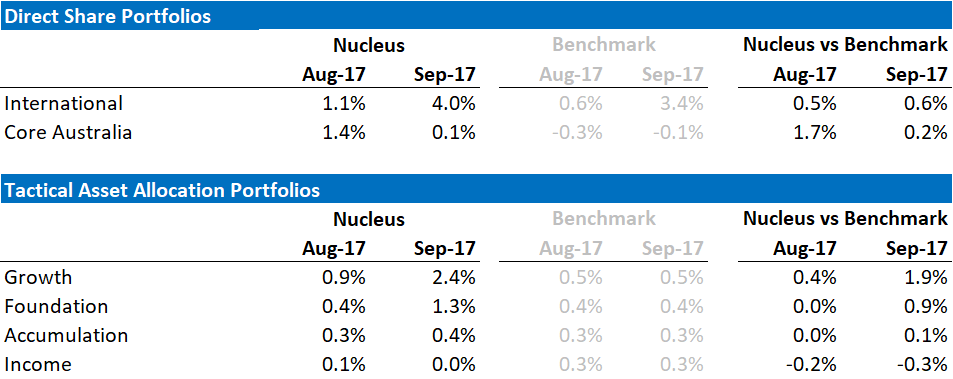

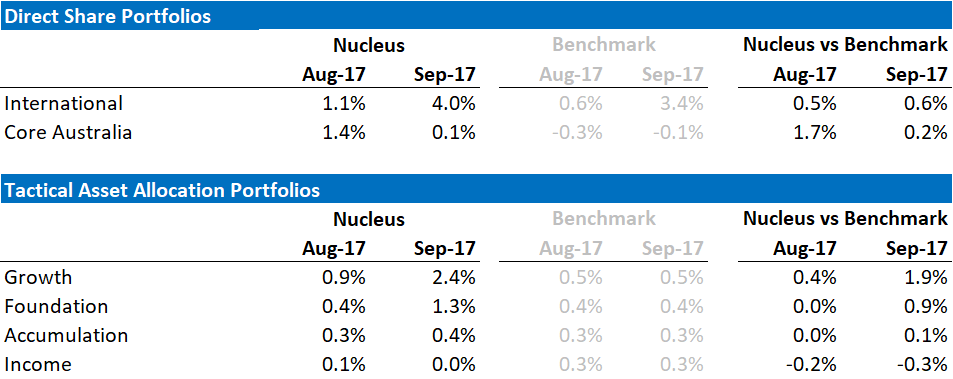

During September the mix of the falling Australian dollar and increasing international equities saw all of our portfolios again outperform their benchmarks except the income portfolio. The international portfolio was the standout, up 4% for the month.

Our overweight to international equities in our Asset Allocation portfolios helped to offset weakness in Australian equities and bonds in our tactical portfolios – more so in the Growth portfolio (which is more aggressively positioned) than the other tactical portfolios:

The returns above include fees and trading costs on a $500,000 portfolio. Note that individual client performance will vary based on the amount invested, ethical overlays and the date of purchase. The benchmark returns do not include fees.

The Way Forward

Last month, I ran through the key themes that are facing our portfolios:

- China: Rebalancing is occurring, the question is how fast Chinese authorities allow it to occur

- Trump: Taxes are the next key decision point, and after failures in healthcare he is looking for a win. We are expecting there to be 2 facets – tax cuts and encouraging companies to bring back cash. Both are USD bullish.

- Europe: Grinding recovery. We are not expecting great things, but note that the number of political risks has reduced in recent months. The major long-term issue is still the significant imbalances between Germany and most of the rest of the Eurozone, but no real flashpoints at the moment.

On China, there was not a lot of news over the month. Activity still seems to be slowing, although the next few months are going to be more difficult to get an accurate read on economic activity as the Communist Party Conference in Beijing has led to the shutting down of a considerable amount of industrial manufacturing, in particular, steel production.

We would expect that some of the strong commodity prices in July/August reflected the bringing forward of production in front of the shutdown. Then, the weakness in September represents the shutdown, which we expect to continue for the next couple of months. Finally, there is likely to be a bounce in Q1 2018 due to “catch-up” production. So, the true trajectory is going to be difficult to ascertain accurately until we are through this period.

Our expectation is that China is going to continue to “glide” lower to try to normalize the capital expenditure to consumption inbalance that we discussed in our last monthly:

It is our view that the Chinese economy will continue to slow over the coming years – Japanese style lost decades, and low inflation/deflation remain more likely than a dramatic bust, which means a grind lower for commodities and the Australian dollar.

There is considerable uncertainty over the timing, the actions following the communist party national congress in October will be key – especially growth in Chinese credit.

Our portfolio positioning on this basis remains:

- considerably underweight Australian stocks from an asset allocation perspective

- underweight resource stocks within equity portfolios

In the US, there was incrementally more information on the Trump taxes, however, there is still little detail to assess.

Our core position is that Trump is trying to engineer a boom. It will not be sustainable and will likely be followed by a bust that leaves the US economy in a worse position but that is a future problem – positioning the portfolio for the boom is the current issue.

The proposed tax cuts are badly targeted by giving most of the benefit to the rich and to companies, trickle down is unlikely to work, the tax cuts are unsustainable, and they are only a short-term “sugar hit” for the US economy, I understand all the negatives. But if it is anywhere near Trump’s promise then it’s going to be such a huge stimulus that you don’t want to stand in the way of it as an investor.

So, we continue to play the boom but keep a sharp eye on the bust.

Our portfolio positioning on this basis remains:

- overweight international stocks from an asset allocation perspective

- overweight stocks with US exposures – subject to valuation. The practical implementation of this has been buying non-US stocks that are exposed to the US.

Asymmetric Risks

When running portfolios that represent core holdings, there is a focus on capital preservation and risk control over chasing returns. Part of the portfolio construction process is an assessment of both the probable path and the potential outcomes – we are looking for investments where when we are right we profit, but if we are wrong the consequences are not significant for the portfolio.

With that in mind, we continue to treat international equities as holding the best risk/return equation. If share markets continue to grind higher then we expect international shares to do better than Australian shares (mainly on the back of a better earnings profile) but when share markets retreat on increased risk we tend to see the Australian dollar also falls which offsets any losses on international stocks.

What this has meant over the last five years is that not only have international stocks significantly outperformed Australian stocks over the past five years but that they have done so with less volatility.

Now, I hasten to add that this is historical and relationships do change. But this is not a relationship that we expect to change over the next few years.

Tactical Asset Allocation Portfolio Positioning

In our tactical portfolios, we own cash, bonds, international shares and Australian shares.

The broad sweep of our asset allocation over the last 12 months was to ride the Trump Boom, switch into Europe in March / April as the US became overvalued and then switch back into the US as the Euro rallied and the USD fell.

We remain underweight shares in aggregate, but that headline view hides the underlying exposure – we are significantly overweight international equities and significantly underweight Australian.

Over / Underweight positions by portfolio

Source: Nucleus Wealth

In early September, our trades involved continuing to switch European stocks for US stocks to take advantage of the rally in both the Euro and European stocks.

International Equities

In our direct international portfolio, markets are expensive, returns look low, and risks are building. So, for the most part putting together our international portfolio, it has been about finding novel ways to get the exposure that we want.

We sold a number of European stocks and bought more US stocks, in particular:

- Robert Half: Exposure to continued US jobs growth and less likely to be affected by the US dollar expense we expect. Robert Half rates highly on our quality measures but is not particularly cheap

- Juniper: This is a play on increased cloud computing and security. Juniper rates well on both value and quality metrics, although we suspect the quality is overstated at present.

- Tyson Foods: Tyson produces processed food, primarily in the US. We have been looking for alternatives to the higher priced utilities and have been putting together groups of consumer staples stocks which we believe (as a group of stocks) give us a similar exposure. Tyson rated well on value measures, but not as well on quality measures.

Country Allocation

Based on growth and relative valuations, we are country agnostic at this point, if the USD keeps falling we will be looking to pick up more US stocks – that is the market where the growth remains the highest but valuations are more expensive.

While “technically” we are underweight the US, many of the stocks we own in other markets have significant exposure to the US. Basically, we are finding stocks listed in the US to be relatively expensive, and so we have been looking to other markets to find stocks that are exposed to the US at a cheaper price. For example, Unilever is a UK listed stock, but Unilever’s actual sales exposure to the UK is only a little over 5% – its biggest markets are actually the US and China. Vestas Wind is listed in Denmark, but the US is its biggest market.

We have been hunting for value in non-Euro European markets in particular.

Industry Allocation

Defensives are expensive. REITs, Utilities, Telcos and Infrastructure are the usual places to look for defensive exposure but (just as the central banks intend) lower risk investors continue to “shuffle up the risk spectrum”, and they have bid the price of traditional defensive sectors to levels that make investment difficult.

So, again we have positioned the portfolio to benefit differently. We are looking for a mix of the more stable industrial, consumer staples and healthcare stocks to get a similar defensive exposure without having to pay the nosebleed prices in the traditional defensive portfolios.

We have been overweight a range of automotive stocks and suppliers. This was largely a value play as most of the sector trades on low multiples over growth concerns. This month saw a range of these stocks benefit on the back of increased demand:

Peugeot (+14%), GM (+12%), Magna (+12%), Linamar (+11%), Eaton (+9%) and Subaru (+6%) all contributed. A lot of this has been hurricane-related replacement of cars (particularly in Houston), which is obviously a one-off gain, but Tesla missing production targets probably also helped.

We will likely lighten our holdings in this sector – it was largely a value play and with the strong performance it is becoming less so.

Our biggest call is underweight energy. In particular oil producers. We have blogged a lot about the oil price, (see this post, in particular) but the thumbnail sketch of the sector is that:

- the short term is not positive for the sector with oversupply and OPEC needing to cut production to try to prop up the oil price.

- the long term is not positive with increasing electrification of cars and falling battery prices limiting the upside

- the mid-term might be good if an undersupply emerges and before electric cars put a dent in oil demand and assuming US shale costs don’t keep falling

Meanwhile, oil stocks are pricing $60-$70 oil prices in perpetuity. The mid-term is going to have to be spectacular to justify current share prices, let alone getting any share price growth.

Having said that, it is a big risk to our portfolio being underweight energy. If there are geo-political ructions, particularly in the Middle East, we would probably underperform. September has seen a significant rise in the oil price, largely on the back of hurricane-related supply constraints, but we remain comfortable with our holding and expect much of this to be a short-term issue.

We are underweight financials – mainly as we can’t find US financials that are cheap enough to justify purchasing. We have been trawling the European banks for value.

We have a reasonable tech / IT exposure. Apple isn’t too expensive, but there are growth concerns – Apple gave up most of its August gains in September and the look like there could be demand issues around its new phone.

There are a number of smaller tech stocks that we own, in particular, a range of semiconductor stocks where we like the growth outlook. It is worth noting that part of the reason for Apple increasing the price of its latest phone is an increase in memory and components. This is a positive for semiconductor stocks more generally, especially if a “feature war” breaks out in the smartphone space. We currently hold a range of stocks that should be helped by this trend (Lam, Applied Materials, Skyworks, and to a lesser extent Cisco).

Click the below for a heatmap of stock performance in September:

Australian Shares

The Australian share market generally continues to struggle. The Australian market fell in August, but our underweights to resources and banks and our overweights to internationally exposed industrials saw the portfolio up 0.1% vs a market that fell 0.1%.

We are underweight both banks and resources, and given the highly concentrated characteristics of the Australian market, we are overweight just about everything else.

We are only just managing to keep a number of the internationally exposed stocks in our portfolio – on a valuation basis Treasury Wines, CSL, Cochlear are all getting expensive after performing well in August.

Over the month we sold half of our Amcor holding, sold Ausnet and bought insurer QBE.

Finding viable replacements for expensive stocks is still the key issue in the Australian portfolio.

Epilogue

In summary, our view continues to be that Australian investors are better off holding international investments at this point in the cycle. The past two months have obviously taken a big step in this direction, with international stocks providing over 5% in just two months. We believe this has a lot further to run, but it is unlikely to move in a straight line.

Our intention is that our portfolio is positioned to take advantage of our key themes but minimise risk in the event that our themes take longer than expected to resolve themselves.

We usually find that big picture macro themes take a long time to resolve themselves in financial markets, but when macro theme resolve themselves they do so quickly – usually too quickly to reposition your portfolio if you are not already invested.

Register your interest now (if you haven’t already): Damien Klassen is Head of Investments at Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.