Since the start of COVID, there has been increased activity in markets from retail investors. This activity has remained elevated, and it signifies the rise of a more active type of ‘investor’ in markets.

ASIC recently released Report 735 about retail investment behaviour. Surprisingly, 44% of investors reported holding cryptocurrency, this was the second most popular investment and a quarter of all people said this was their only investment. Alarmingly only 20% of these crypto investors considered their investment ‘risky or speculative’. ‘Recent investors’ and ‘moderately experienced’ investors were more than twice as likely to hold Crypto than ‘experienced’ investors. Surprisingly, more ‘investors’ held cryptocurrency than international shares; only 33% of investors held international shares compared to 44% holding crypto. Unsurprisingly, 73% of investors held Australian Shares.

Firstly, I want to make a distinction between an investor and a speculator; I believe ASIC has miscategorised the ‘recent investors’ and ‘moderately experienced investors’ as investors when they are more likely speculators. An investor is a person or entity who commits capital with the expectation of achieving a profit. A speculator is a person or entity who commits capital in the hope of achieving a profit. The key difference here is that speculators are operating out of hope, and investors are operating based on fundamental principles of investing with more certainty of return.

The report showed that half of all investors surveyed (predominantly recent and moderate investors) agreed that ‘I’ve invested in things because I don’t want to miss out’ and over one-third agreed that ‘I’ve invested in things because my friends were doing so’. This behaviour is indicative of hope and speculation; categorising these people as investors is a misnomer.

When you follow long-term fundamental investment principles and invest in tangible asset classes like Australian and International shares, there is much more certainty of return over longer time periods. I am not saying you should not speculate. There is absolutely a place for it in a long-term well-diversified portfolio, it should just be a smaller proportion to limit your overall risk, and it should not be your only ‘investment’.

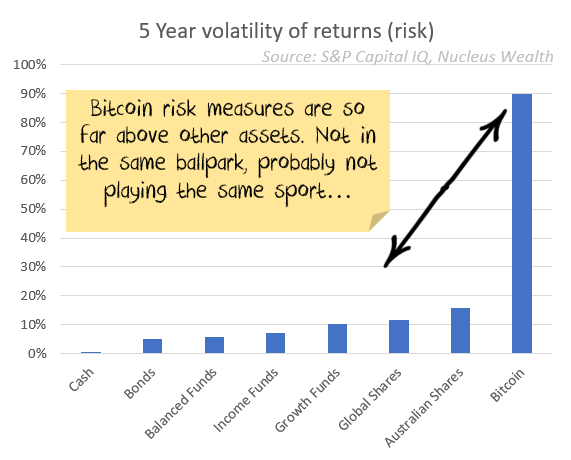

Cryptocurrency is a speculative asset with limited underlying fundamental value, whereas Australian and international shares do have underlying fundamental value. This is because when you invest in shares, you invest in businesses. These produce goods and services and make profits, and that is where the value lies. With speculative assets, you are more reliant on people believing in them and trusting the institutions issuing them, and you generally get more volatility because it is less tangible. There is the potential for higher returns, but this generally comes with a lot more risk of loss.

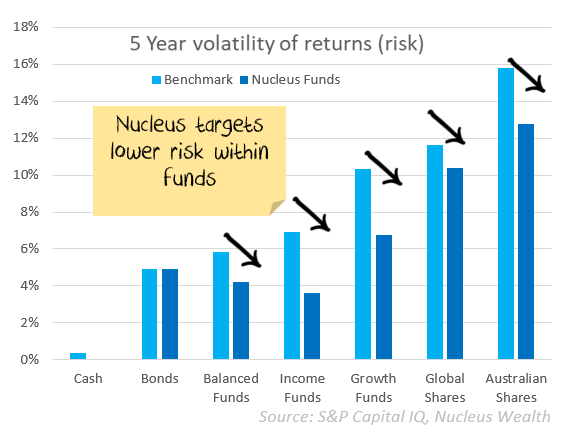

As you can see from the above charts, Bitcoin is off the charts for volatility and the risk of loss is extremely high. Australian shares have been more volatile than Global shares (in Australian dollar terms). This is partly due to the huge exposure to banks and resources, but mostly it is the effect of the currency acting as a shock absorber. Australia is a high-powered commodity currency. When world growth is good, the AUD increases, which limits returns on global shares. When world growth is bad, the AUD falls, cushioning any international losses. You will also notice that with the Nucleus portfolios, they are significantly less volatile than their counterparts with similar returns because we manage the risk.

In my opinion, most portfolios would be more robust by allocating the majority of their investments to the fundamental building blocks of portfolio construction: cash, bonds, Australian and International shares; and keeping the amount allocated to speculative assets small. As the majority of investors already have Australian shares, many investors would benefit from adding international shares to their portfolios. The Australian share market only makes up 2.5% of global stock markets and is heavily concentrated in financials and resources. So by adding international shares to their portfolios, investors will increase their diversification across countries and industries. An example is, the ‘Software & IT Hardware’ industry, which makes up almost 20% of the world, whereas the ASX has less than 1%. Adding international shares can also allow you to own many of the household brand names that you know and likely interact with regularly., eg. Google, Microsoft, Apple, etc.

The returns from international shares have been an excellent place to invest your money over the long term. Nucleus Wealth offers two international portfolios, Core International and Global Leaders, and we have international exposure across all of our tactical portfolios.

If you would like to talk to me about investing rather than speculating or any other aspect of your personal finances, please book a call here.