After a short-squeeze distraction in January, February saw the attention back on fundamentals: corporate earnings, economic data, and interest rates. Global equity markets closed the month with positive returns, despite end-of-month inflation concerns. The rotation to value stocks continued at the expense of growth. The vision of a vaccine driven return-to-normal became more realistic. Our travel holdings, in particular, performed well.

We have positioned our portfolios to contain a lot of value stocks rather than the more expensive growth stocks. For February and March so far, this has been the right exposure. Going forward, there are several big questions facing equity investors.

Do strong earnings offset expensive valuations?

The reporting season was strong. The median company globally saw over 10% growth in the 4th quarter. Earnings forecasts are being revised upwards.

Our generalisation is that companies made substantial cuts to costs at the start of COVID. So, sales do not need to fully recover for profits to exceed 2019 levels. With US and European stimulus continuing, we are expecting profit growth to remain high.

The more important question is how much are you willing to pay for the growth?

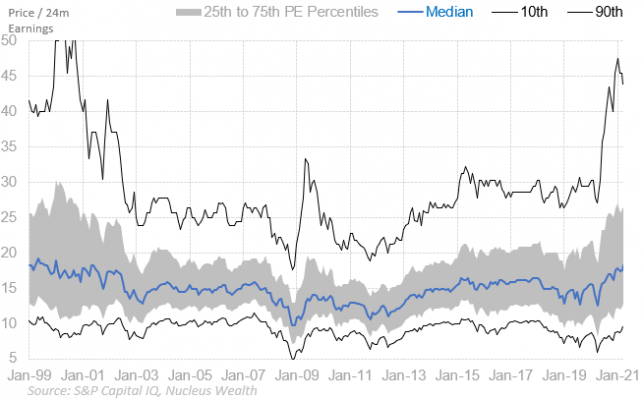

Earnings have been distorted by COVID, so I prefer to look further forward than usual to get a clearer picture of markets. Even if we look at later year earnings (from 12 to 24 months in the future), global stock markets look expensive in aggregate.

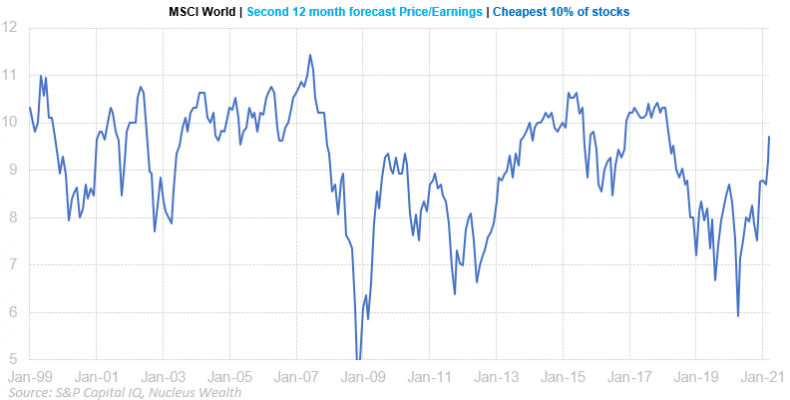

However, that masks the nuances. When you dig into the cheapest stocks, they don’t look historically expensive:

Which means there are still opportunities. But they aren’t in the growth part of the market.

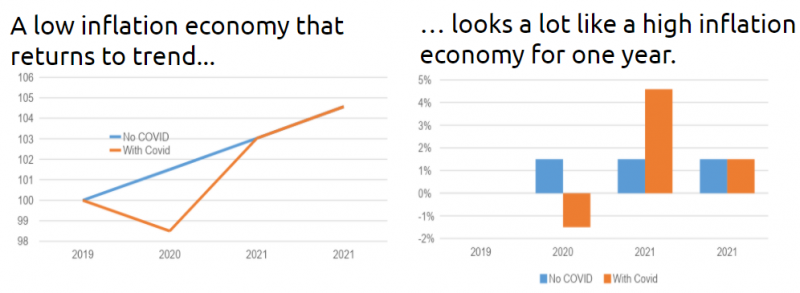

Is there an inflation boom coming?

At the headline level, almost certainly for the short term.

The deflationary forces that existed before COVID are still arrayed against inflation:

- Elevated unemployment meaning low wage growth.

- Low inflation expectations are embedded for consumers and companies. This means workers are less likely to demand pay raises, and companies are less likely to increase prices.

- Technology advances force prices lower.

- Globalisation is leading to a flatter supply curve. i.e. there are likely to be other suppliers in different countries willing to discount, which prevents prices from rising.

- High levels of debt. Paying down substantial debt balances means constrained spending, which means weak demand.

- Increasing inequality. Lower-income households are more likely to spend, higher-income to save. If the rich are getting richer, then savings remain strong, demand remains weak.

The inflationary forces are mostly temporary:

- Shortages from supply chain disruptions and lockdowns. These see product shortages / higher prices for a short time until workers resume/lockdowns end.

- Structural changes in consumption following COVID. As people change habits, product shortages / higher prices result until enough production emerges to satisfy the new demand levels.

- Structural changes in supply chains following COVID. There is a renewed interest in preventing supply chain disruptions. This will likely mean countries encourage domestic production of essential goods, even if they are higher cost. Many industries run just-in-time inventories to save money. To reduce disruptions, many will increase their stock at hand, increasing prices.

- Inventory cycle rebuild. Globally, inventories have decreased during COVID. There will temporarily be greater demand for goods as restocking occurs.

- Government stimulus giving money to people who aren’t working. By giving money to people who aren’t working, you increase demand for goods and services from those who are working. Then, prices rise, and employers hire people to keep up with the increased demand.

- Lower US dollar. The US dollar is almost 10% lower than last year, translating to higher prices on imports.

The most significant risk to our expectation that deflationary forces will win over inflationary forces lies in US politics. The critical factor to watch is infrastructure. If the spending program that emerges is around the mooted size of 2% of GDP for ten years, it will meaningfully affect inflation.

A secondary factor is minimum wages. There will be political hurdles to passing Biden’s preferred $15 target. However, the trajectory is clear. We do not think that minimum wage increases are particularly inflationary, but they will help.

Invest like inflation is coming, be ready to change your mind

The competing factors above lead to two main scenarios:

- Inflation gets the upper hand, bond yields rise, and value stocks perform well. Growth stocks fall, quality stocks underperform.

- Deflation/disinflation resumes after a short inflationary shock. Bond yields fall, bond prices rise. Defensive stocks outperform, as does quality. Value stocks and financials underperform. Growth stocks are more complicated.

I’m expecting the first to occur before morphing into the second. The question is how long this takes.

Without stimulus, we will be back to the second scenario tomorrow.

With the current stimulus, I’m thinking six to twelve months. With two disclaimers:

- the market keeps surprising with how quickly it is incorporating new regimes,

- the more well-targeted stimulus that is added, the longer we will stay in the first scenario.

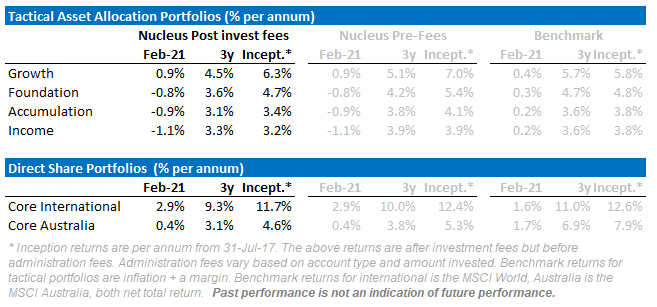

Performance Detail

The market surged in early February, bouncing off late January lows. And then proceeded to trade sideways. The release of increased inflation numbers toward the end of February saw the market sell-off as US Bond yields jumped to 1.6% before retracing.

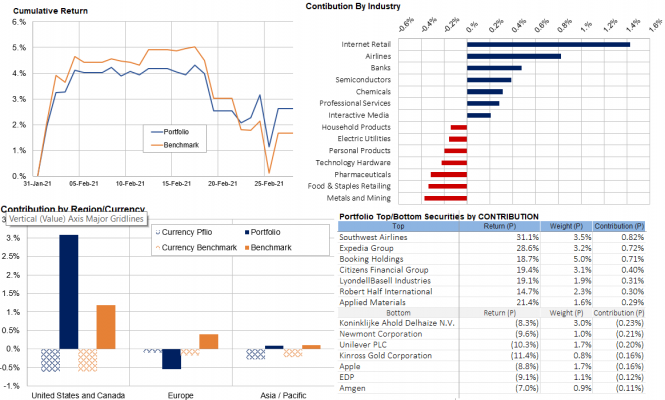

Our portfolios outperformed internationally, but domestically, we lagged the index. Over the month, we increased our weightings to value stocks.

Equity markets ended up, the US S&P 500 up 2.6%, France up 5.6% and Japan’s Nikkei surged 4.7%. Australia lagged, up just 1%. Our international portfolio outperformed the MSCI World index by 1.2%.

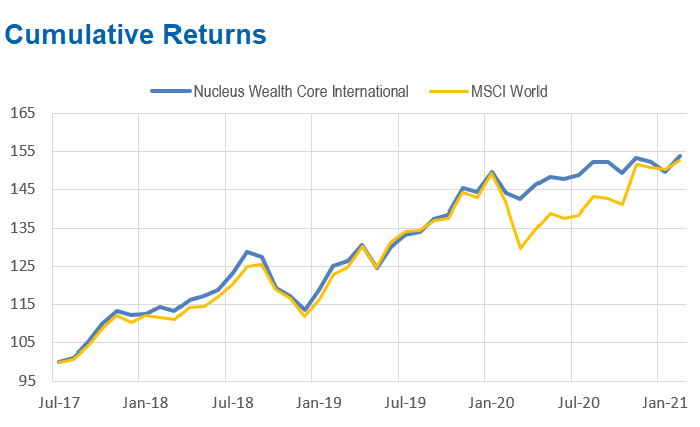

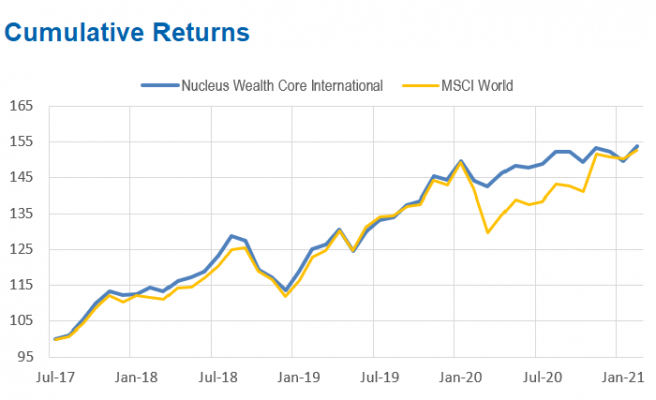

Core International Performance

Our international portfolio saw a 2.9% increase over February, outperforming the MSCI World. Our travel-related stocks bounced hard from the end of January slump. Value-based stocks also rallied. However, our European stocks underperformed hit hard by the end of month inflationary fears. AUD strength vs the USD pegged some of the gains.

During the month, we lightened our gold exposure. We replaced defensive consumer and health stocks (Proctor&Gamble, Atos and CVS Health) with cement stocks that we believe can benefit from the infrastructure stimulus being undertaken worldwide. We also increased our weighting to US banks, taking a position in JPMorgan.

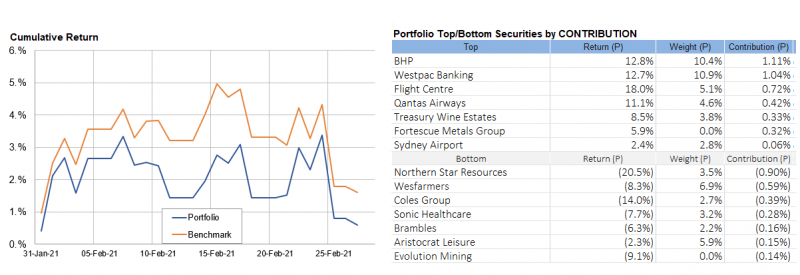

Core Australia Performance

The Core Australian portfolio saw a slight gain over the month but underperformed the index. A strong showing from the travel-related stocks mirrored the International trend. However, US-denominated earners and defensive stocks retreated. Gold stocks were once again a drag.

Six months ago, we halved our gold holding. In hindsight, we should have taken more off. A mixture of improving outlook and the rise of bitcoin have combined to limit the gold price. There is little prospect of that changing in the short term. We reduced our gold weight further.

We continued the value rotation, increasing bank exposure and adding Bluescope Steel.

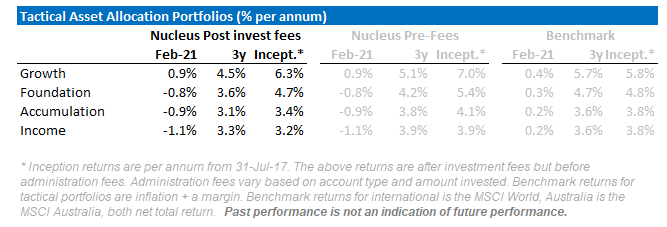

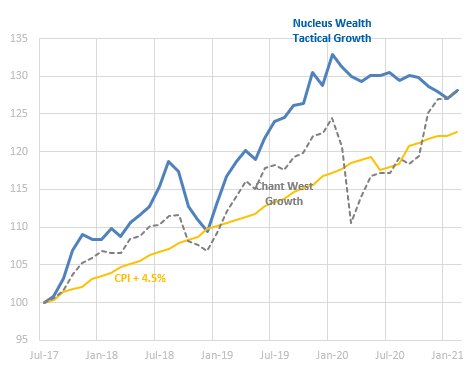

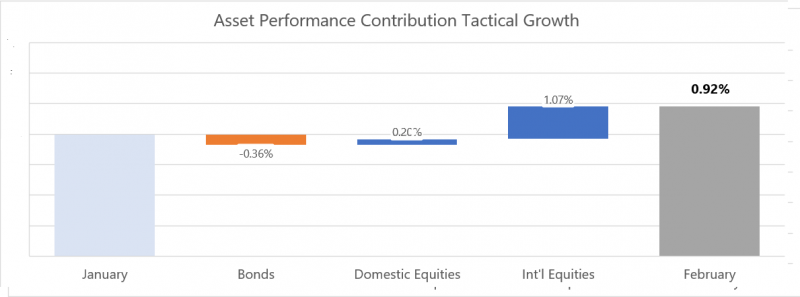

Tactical Fund Performance

The Tactical Growth Waterfall chart below breaks down this return showing International Equities essentially offsetting Bond weakness. Bonds were steady leading up to the expected November rate cut decision.

During the month, we lightened our gold exposure increasing US banks, continued our value rotation and lightened our exposure to long-dated bonds.

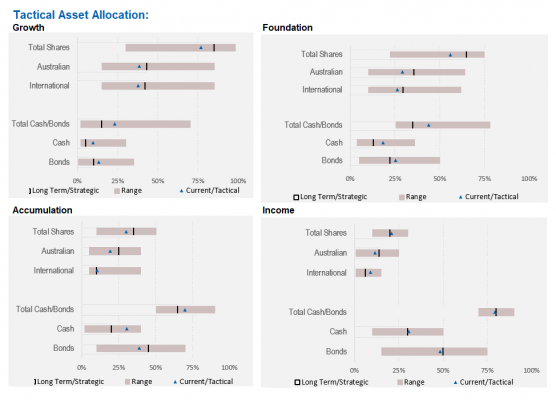

Asset Allocation

Damien Klassen is Head of Investments at Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.